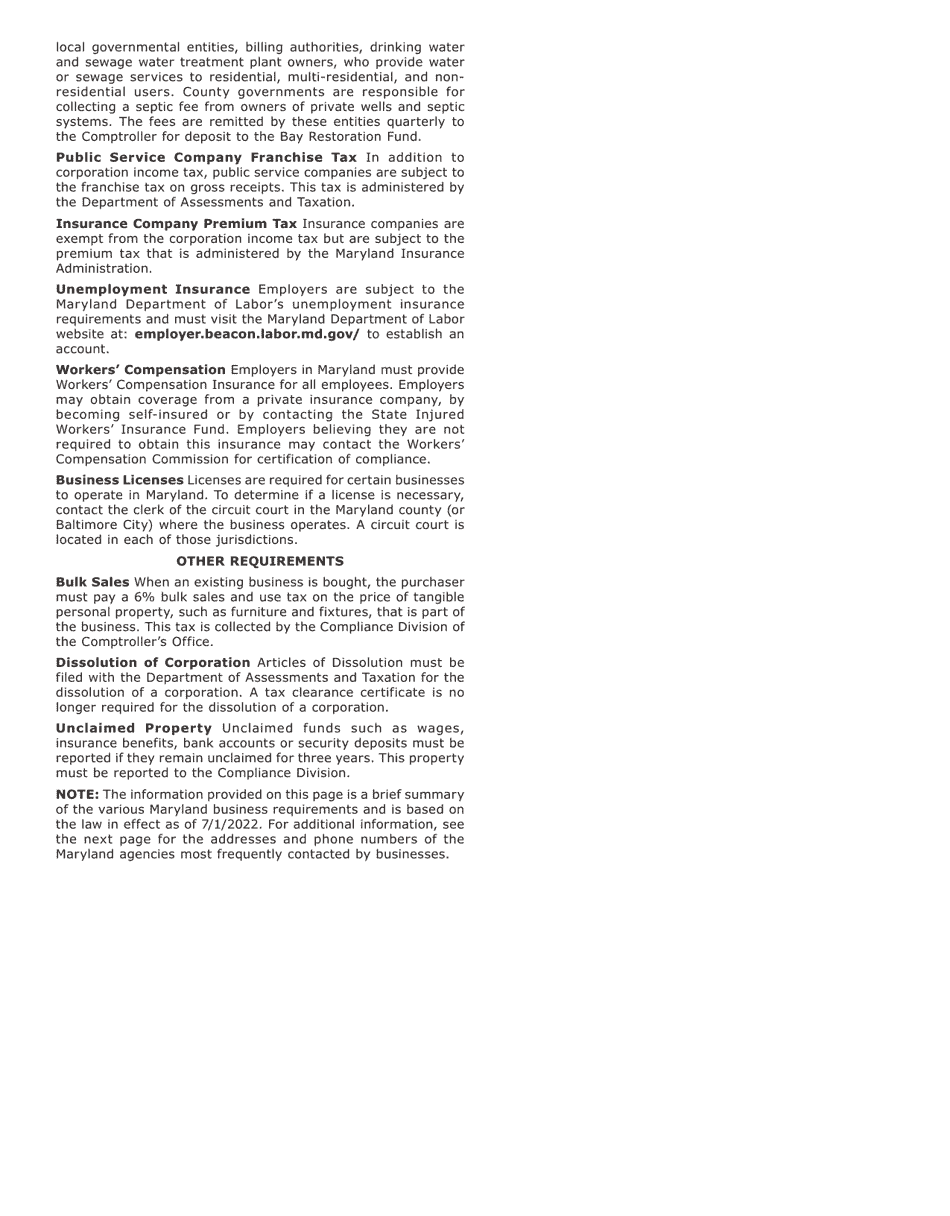

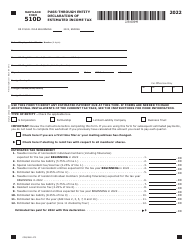

This version of the form is not currently in use and is provided for reference only. Download this version of

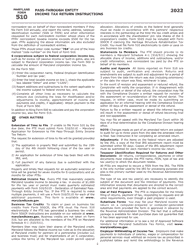

Instructions for Maryland Form 510, COM/RAD-069

for the current year.

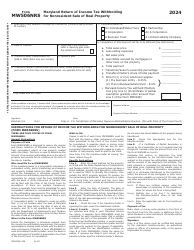

Instructions for Maryland Form 510, COM / RAD-069 Pass-Through Entity Income Tax Return - Maryland

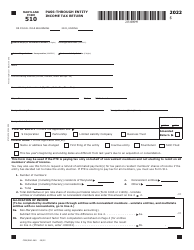

This document contains official instructions for Maryland Form 510 , and Form COM/RAD-069 . Both forms are released and collected by the Maryland Taxes. An up-to-date fillable Maryland Form 510 (COM/RAD-069) is available for download through this link.

FAQ

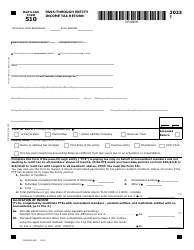

Q: What is Maryland Form 510?

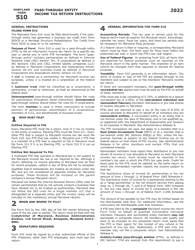

A: Maryland Form 510 is the Pass-Through Entity Income Tax Return for businesses in Maryland.

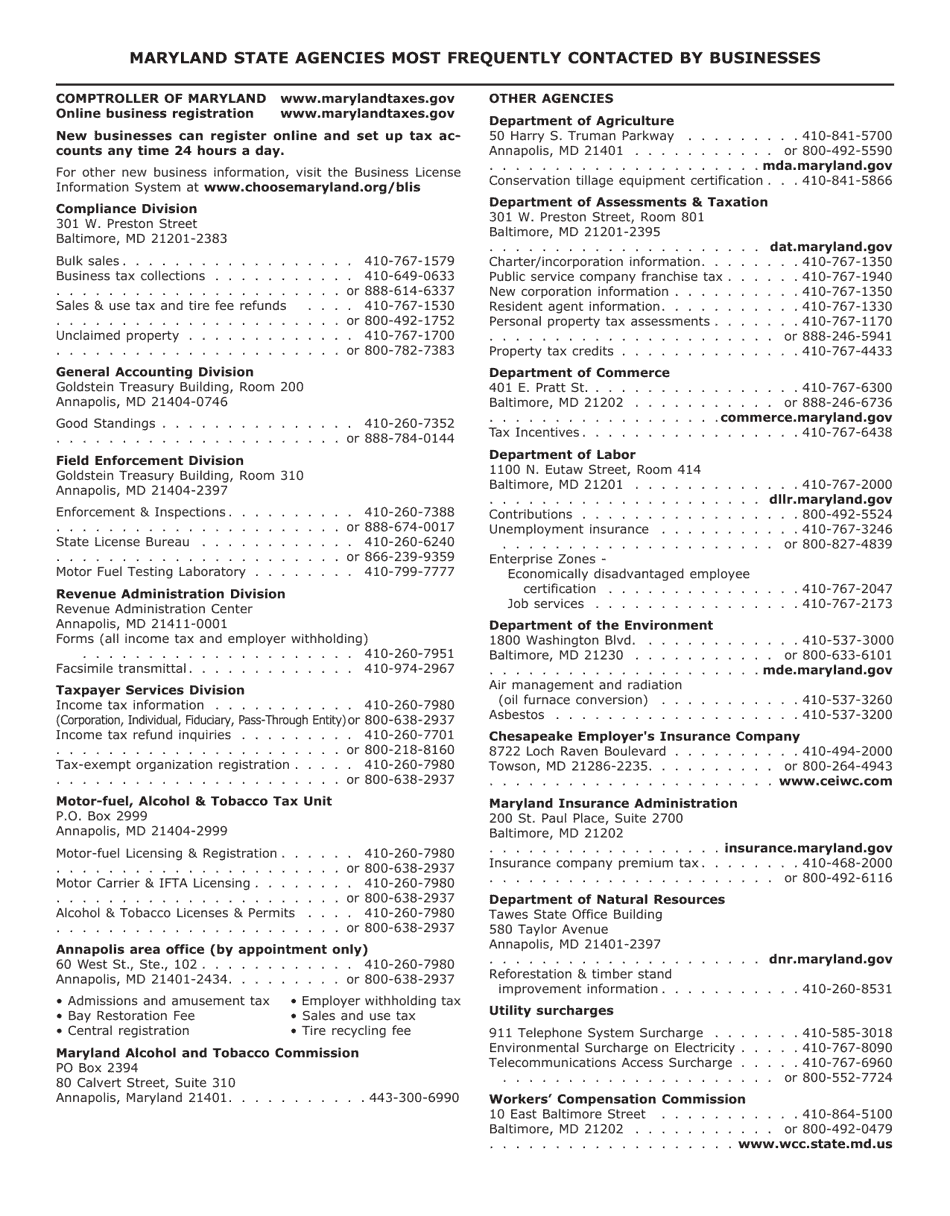

Q: Who needs to file Maryland Form 510?

A: Pass-through entities such as partnerships, limited liability companies (LLCs), and S-corporations that do business in Maryland need to file Form 510.

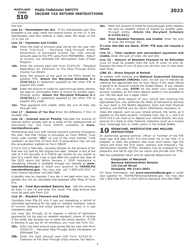

Q: What is the purpose of filing Maryland Form 510?

A: The purpose of filing Form 510 is to report the income, deductions, and credits of the pass-through entity to the state of Maryland.

Q: What information is required to complete Maryland Form 510?

A: To complete Form 510, you will need information about the pass-through entity's income, deductions, credits, and any other relevant financial information.

Q: When is the due date for filing Maryland Form 510?

A: The due date for filing Form 510 is generally April 15th of the year following the tax year.

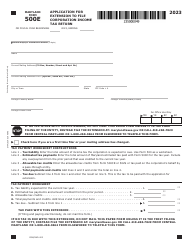

Q: Are there any extensions available for filing Maryland Form 510?

A: Yes, you can request an extension to file Form 510 by filing Maryland Form 502E.

Q: Are there any penalties for late filing of Maryland Form 510?

A: Yes, there are penalties for late filing of Form 510, including interest charges and possible penalty fees.

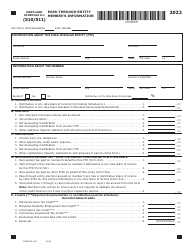

Instruction Details:

- This 12-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Maryland Taxes.