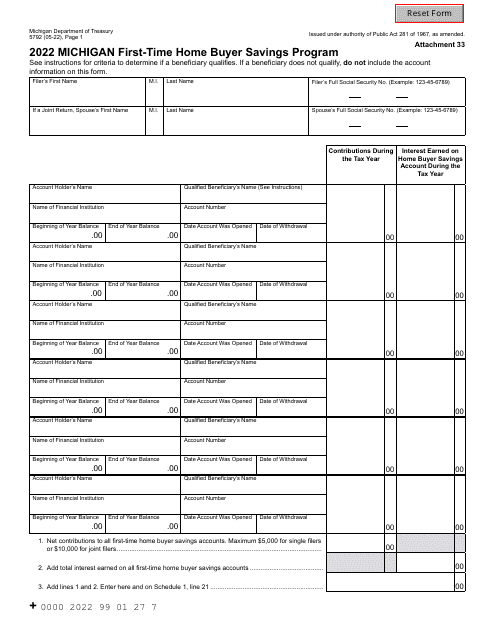

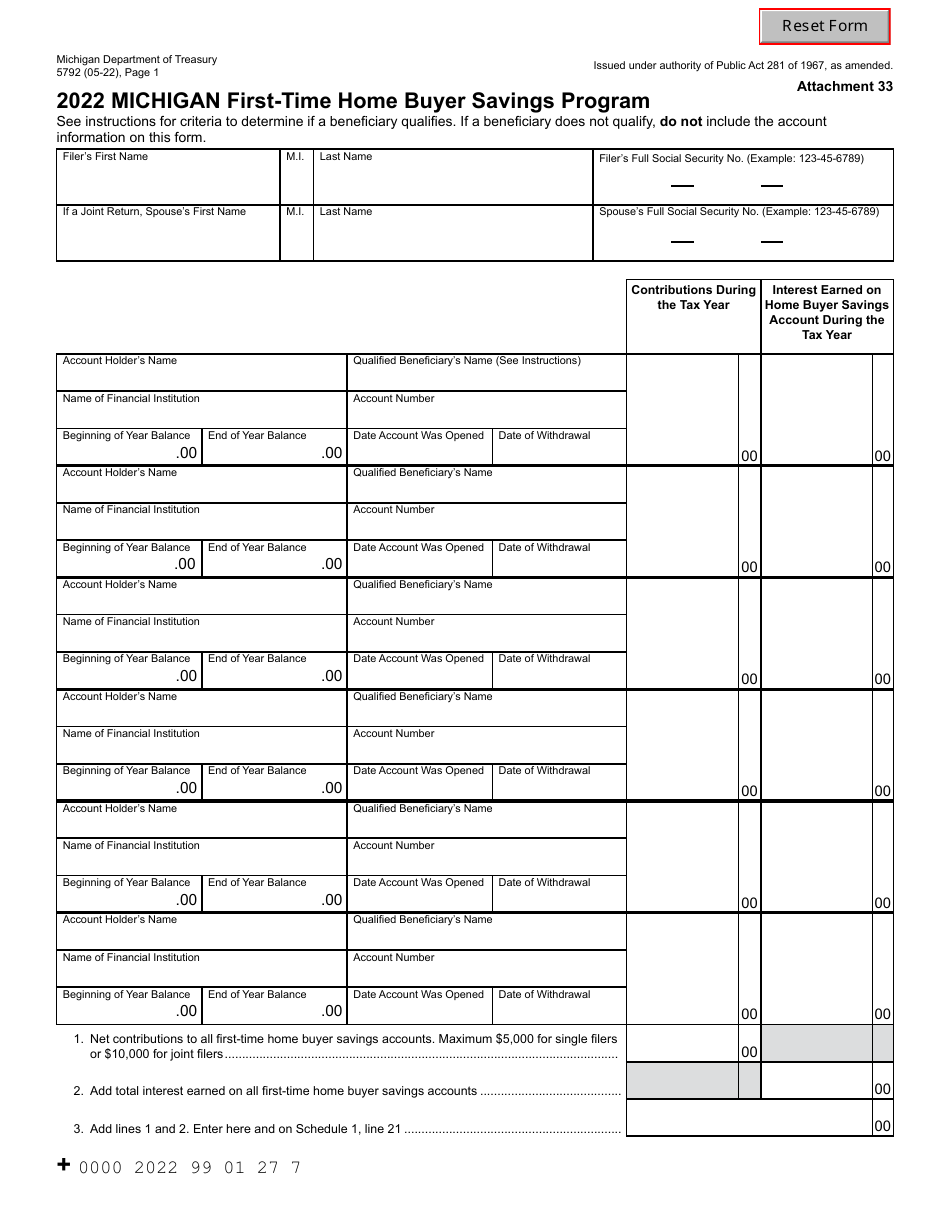

Form 5792 Michigan First-Time Home Buyer Savings Program - Michigan

What Is Form 5792?

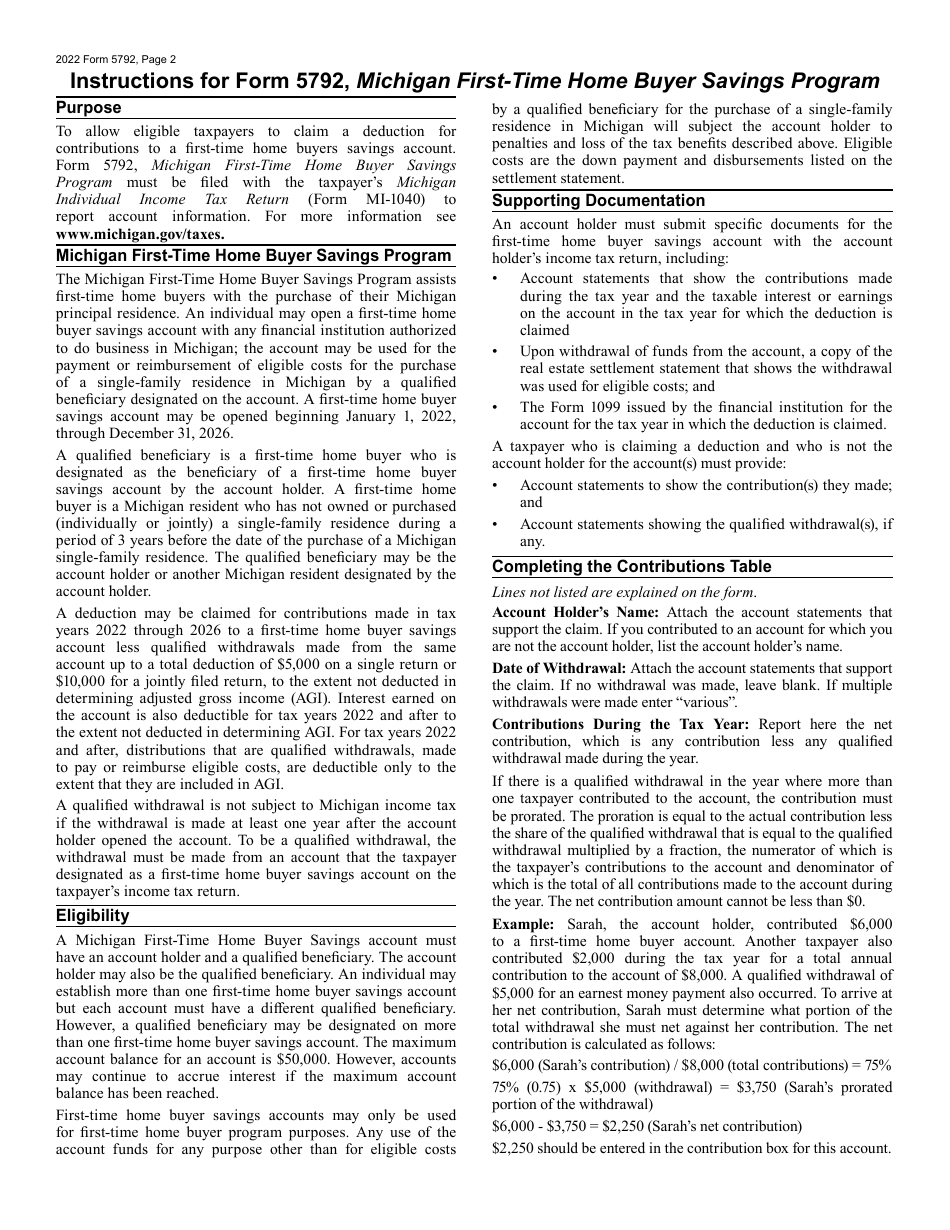

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Michigan First-Time Home Buyer Savings Program?

A: The Michigan First-Time Home Buyer Savings Program is a state program designed to help first-time home buyers save money for their future home purchase.

Q: What are the benefits of the Michigan First-Time Home Buyer Savings Program?

A: The program allows individuals or couples to contribute up to $5,000 per year (or $10,000 for joint filers) to a special savings account, and the contributions are deductible from Michigan taxable income.

Q: Who is eligible for the Michigan First-Time Home Buyer Savings Program?

A: Any individual or couple who is planning to purchase their first home in Michigan is eligible for the program.

Q: Are there any limitations or restrictions on the program?

A: Yes, there are some limitations and restrictions. The funds from the savings account can only be used for the down payment or closing costs of a qualified home purchase in Michigan.

Q: How can someone open a Michigan First-Time Home Buyer Savings Program account?

A: To open an account, individuals or couples can contact a participating financial institution (bank, credit union, or financial adviser) in Michigan.

Q: Is there a deadline to open an account?

A: There is no specific deadline to open an account. However, it is recommended to open the account as early as possible to start saving for a future home purchase.

Q: Can someone contribute more than $5,000 per year to the savings account?

A: No, the maximum annual contribution is $5,000 per individual (or $10,000 for joint filers).

Q: Can the contributions to the savings account be withdrawn without penalty?

A: Yes, the contributions can be withdrawn at any time without penalty. However, if the funds are not used for a qualified home purchase, they must be reported as taxable income in the year of withdrawal.

Q: Is there a limit on how long someone can contribute to the savings account?

A: No, there is no time limit on how long someone can contribute to the savings account. However, the funds must be used for a qualified home purchase within 20 years of opening the account.

Q: Can someone use the savings account funds to purchase a second home?

A: No, the funds can only be used for the purchase of a first home in Michigan.

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5792 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.