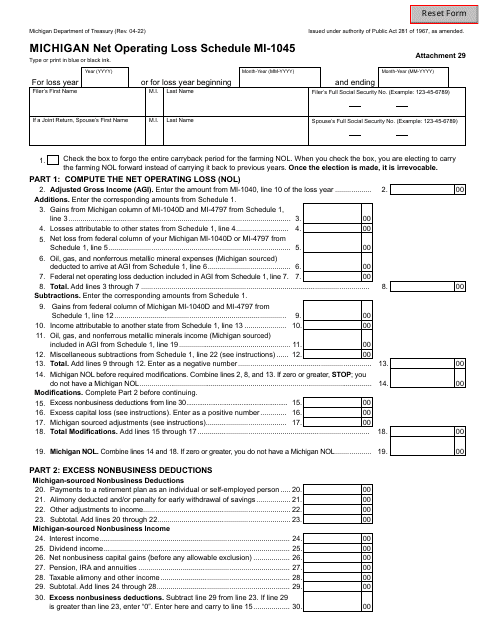

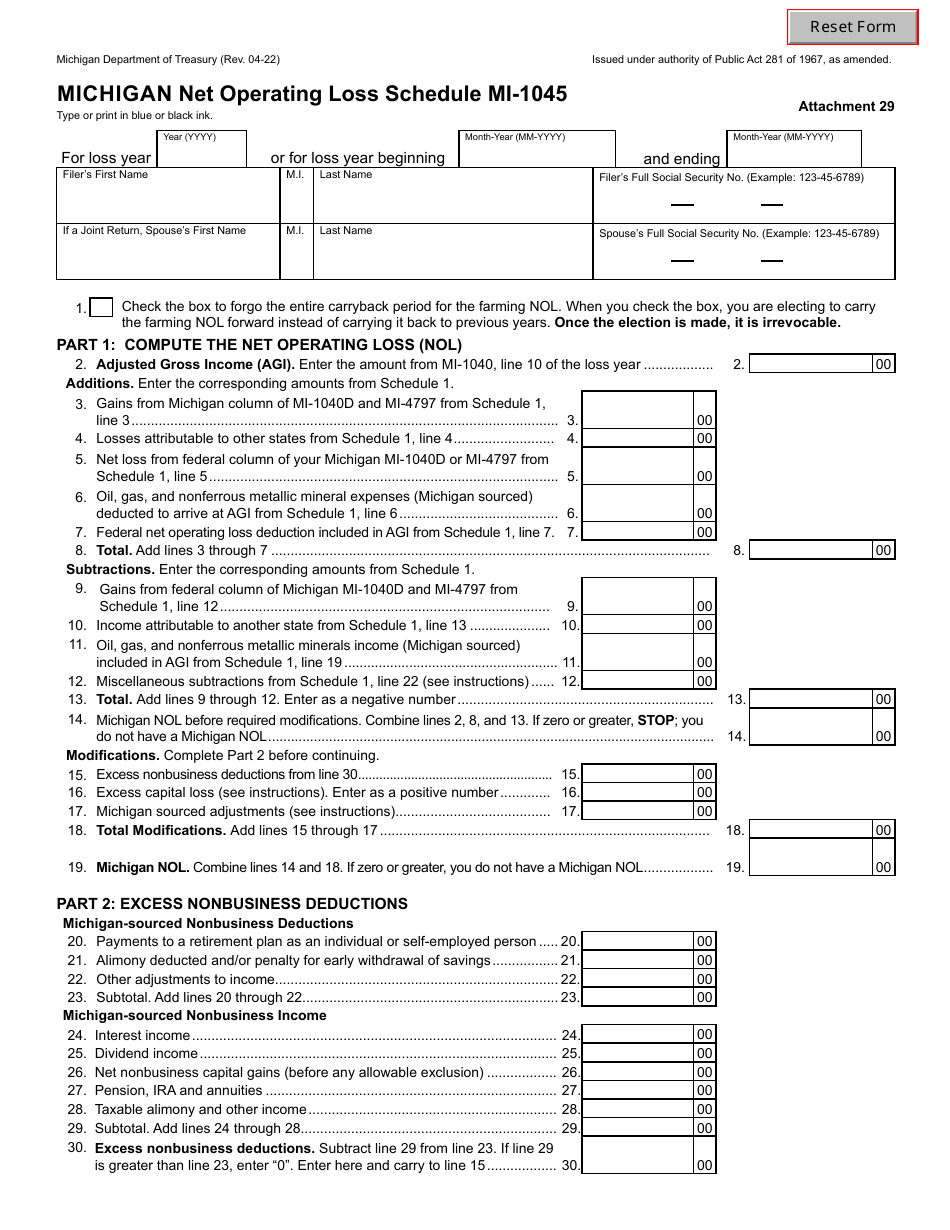

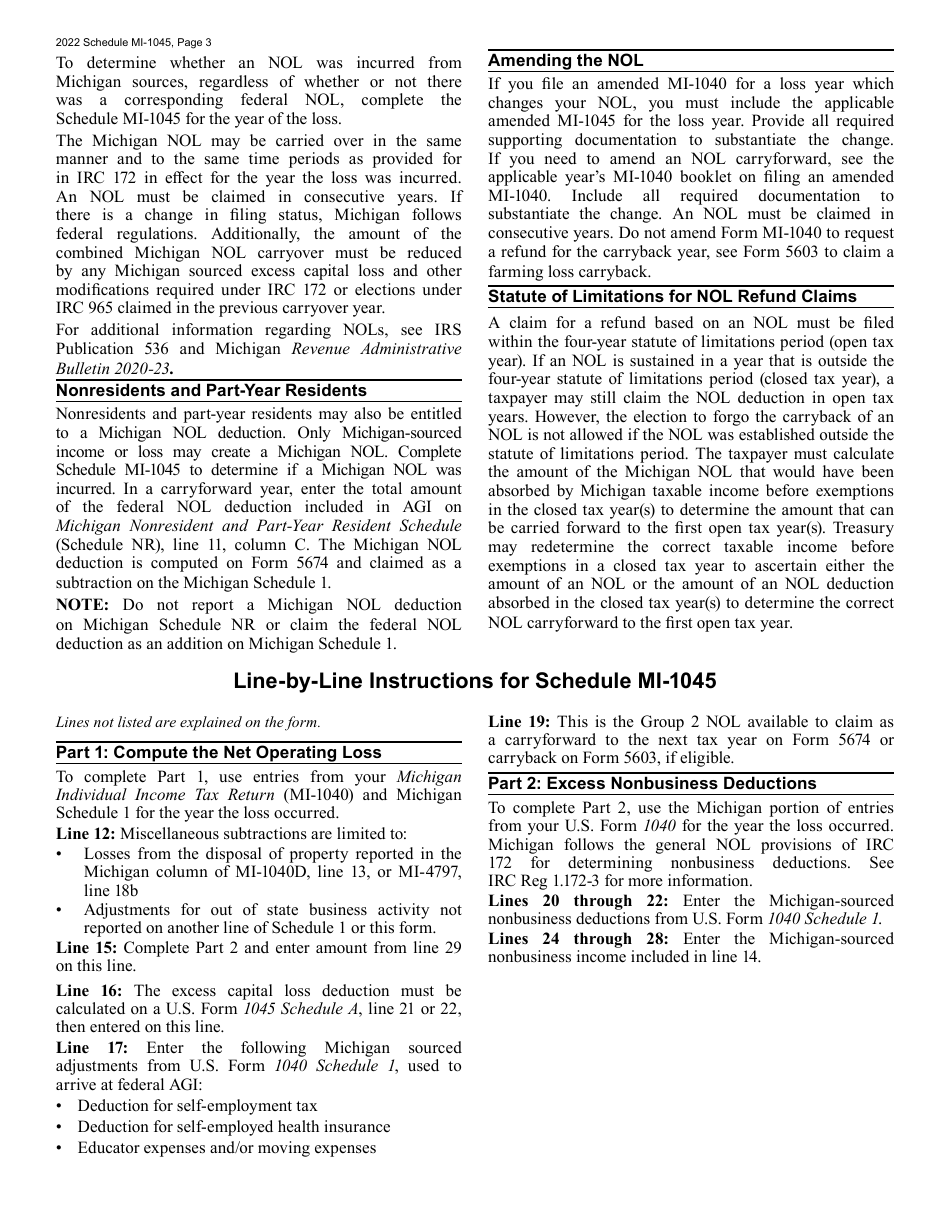

Form MI-1045 Net Operating Loss - Michigan

What Is Form MI-1045?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MI-1045?

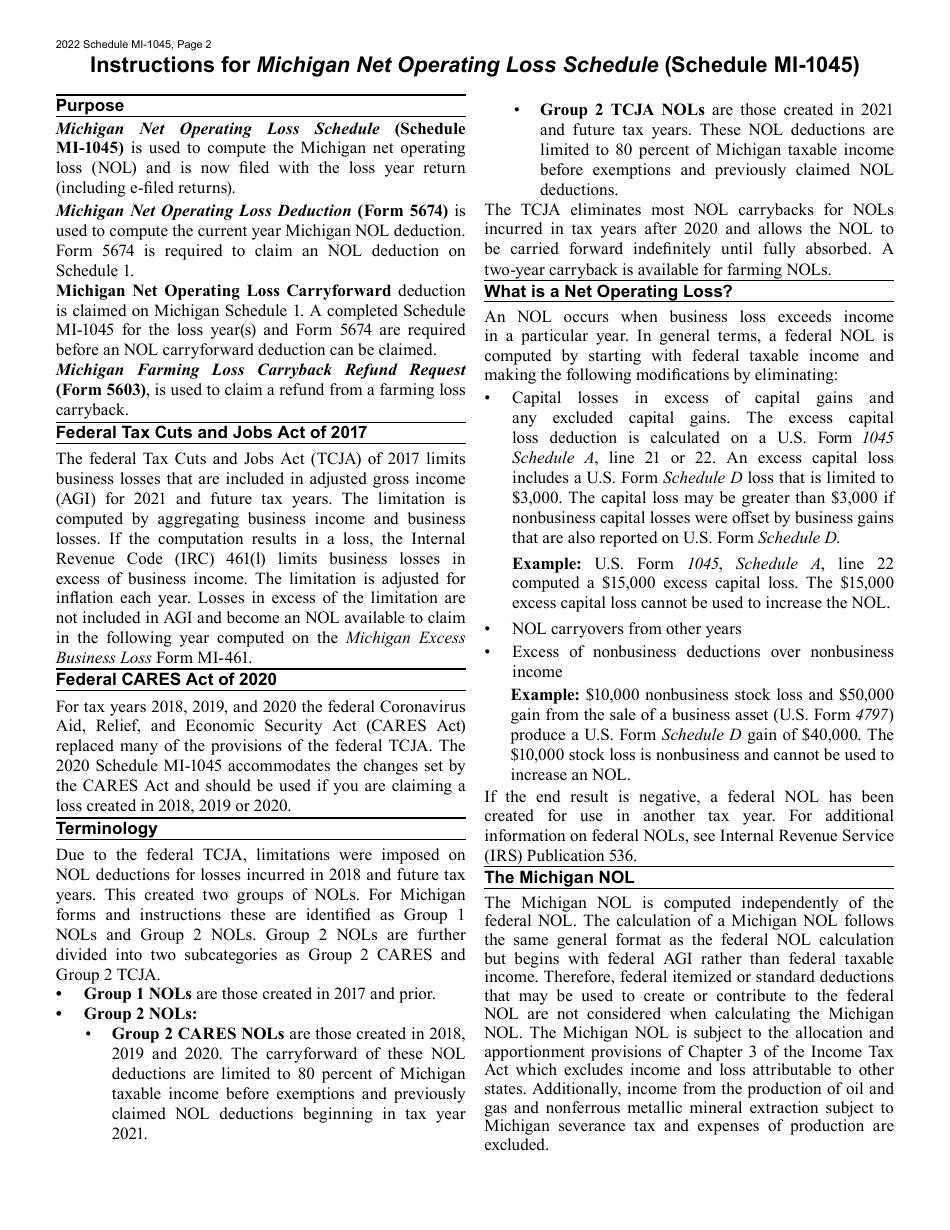

A: Form MI-1045 is the form used in Michigan to calculate and carry forward a net operating loss (NOL).

Q: What is a net operating loss (NOL)?

A: A net operating loss (NOL) occurs when a taxpayer's allowable deductions exceed their taxable income.

Q: Who should file Form MI-1045?

A: Taxpayers in Michigan who have a net operating loss from a previous year and want to carry it forward to future years should file Form MI-1045.

Q: What information do I need to complete Form MI-1045?

A: You will need information from your federal tax return and your Michigan tax return for the year in which the NOL occurred.

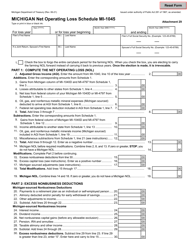

Q: How do I calculate my net operating loss (NOL)?

A: To calculate your NOL, you subtract your allowable deductions from your taxable income.

Q: Can I carry forward my NOL to future years?

A: Yes, you can carry forward your NOL to offset future taxable income for up to 20 years.

Q: When is Form MI-1045 due?

A: Form MI-1045 is due on the same date as your Michigan income tax return, typically April 15th.

Q: Can I e-file Form MI-1045?

A: No, currently the Michigan Department of Treasury does not offer e-filing for Form MI-1045. It must be filed by mail.

Q: Is there a fee for filing Form MI-1045?

A: No, there is no fee for filing Form MI-1045.

Q: What if I need help completing Form MI-1045?

A: If you need assistance completing Form MI-1045, you can contact the Michigan Department of Treasury or consult a tax professional.

Q: Can I amend my Form MI-1045 if I made a mistake?

A: Yes, if you made a mistake on your Form MI-1045, you can file an amended return using Form MI-1040X.

Q: Are there any penalties for not filing Form MI-1045?

A: If you have a net operating loss and do not file Form MI-1045 to carry it forward, you may lose the ability to use the NOL in future years.

Q: Is Form MI-1045 used for federal taxes as well?

A: No, Form MI-1045 is specific to Michigan taxes and cannot be used for federal tax purposes.

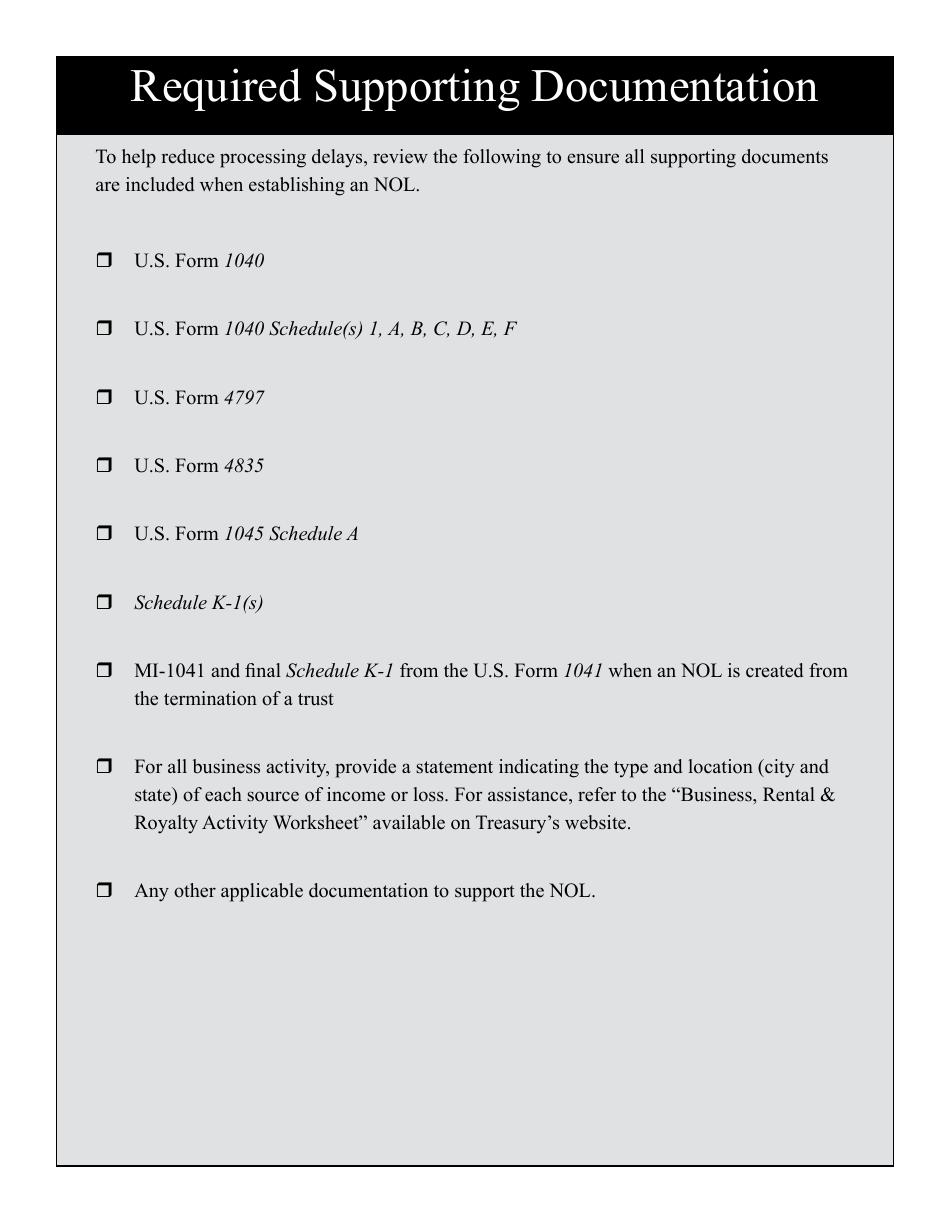

Q: Do I need to include supporting documentation with Form MI-1045?

A: You should keep all supporting documentation for Form MI-1045, but you do not need to send it with your return. However, the Michigan Department of Treasury may request it later.

Q: Can I e-file my Michigan income tax return if I need to file Form MI-1045?

A: Yes, you can e-file your Michigan income tax return even if you need to file Form MI-1045. Only the Form MI-1045 itself must be filed by mail.

Q: What if I have a net operating loss in multiple years? Can I combine them on one Form MI-1045?

A: No, you must file a separate Form MI-1045 for each year in which you have a net operating loss.

Q: Can I file Form MI-1045 if I haven't filed a federal tax return?

A: No, you must have filed a federal tax return for the year of the net operating loss before you can file Form MI-1045.

Q: Can I carry back my net operating loss (NOL) to previous years?

A: No, Michigan does not allow for the carryback of net operating losses. You can only carry them forward.

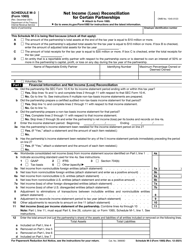

Q: What if my net operating loss (NOL) is from a partnership or S corporation?

A: If your NOL is from a partnership or S corporation, you should consult the instructions for Form MI-1040CR to determine how to report and carry forward the NOL.

Q: Can I use Form MI-1045 for a net operating loss (NOL) from a previous year if I did not live in Michigan at that time?

A: Yes, you can still use Form MI-1045 to carry forward an NOL from a previous year, even if you did not live in Michigan at the time the loss occurred.

Form Details:

- Released on April 1, 2022;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MI-1045 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.