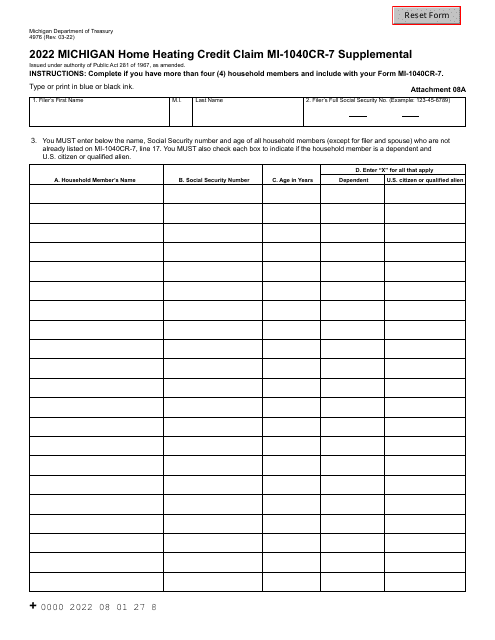

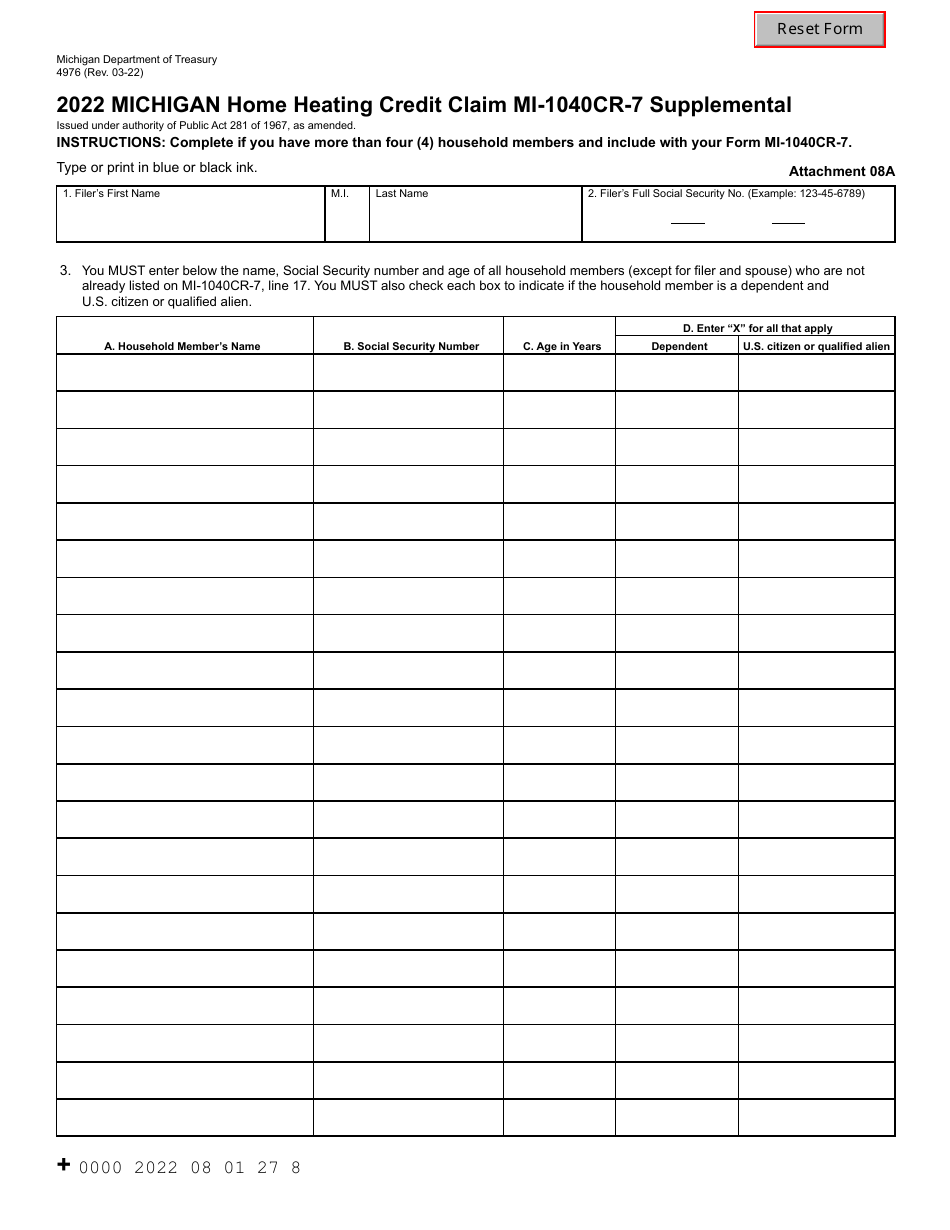

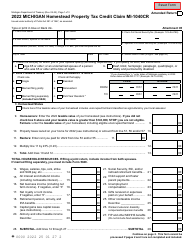

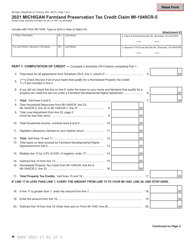

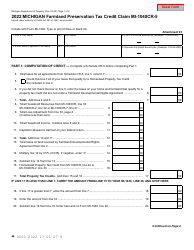

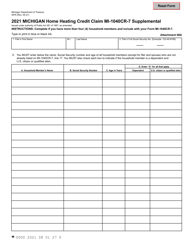

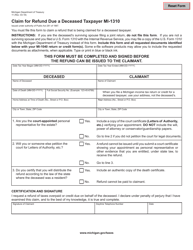

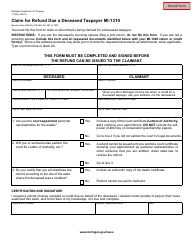

Form MI-1040CR-7 SUPPLEMENTAL (4976) Michigan Home Heating Credit Claim - Michigan

What Is Form MI-1040CR-7 SUPPLEMENTAL (4976)?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

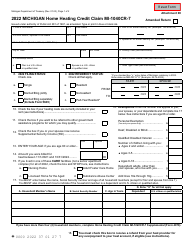

Q: What is the MI-1040CR-7 SUPPLEMENTAL form?

A: The MI-1040CR-7 SUPPLEMENTAL form is used to claim the Michigan Home Heating Credit.

Q: What is the Michigan Home Heating Credit?

A: The Michigan Home Heating Credit is a refundable tax credit that helps eligible residents with the high cost of heating their homes.

Q: Who is eligible to claim the Michigan Home Heating Credit?

A: To be eligible for the Michigan Home Heating Credit, you must meet certain income and residency requirements.

Q: How do I claim the Michigan Home Heating Credit?

A: You can claim the Michigan Home Heating Credit by completing and filing the MI-1040CR-7 SUPPLEMENTAL form with your Michigan income tax return.

Q: Is the Michigan Home Heating Credit refundable?

A: Yes, the Michigan Home Heating Credit is a refundable tax credit, which means you may receive a refund even if you do not owe any income tax.

Form Details:

- Released on March 1, 2022;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MI-1040CR-7 SUPPLEMENTAL (4976) by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.