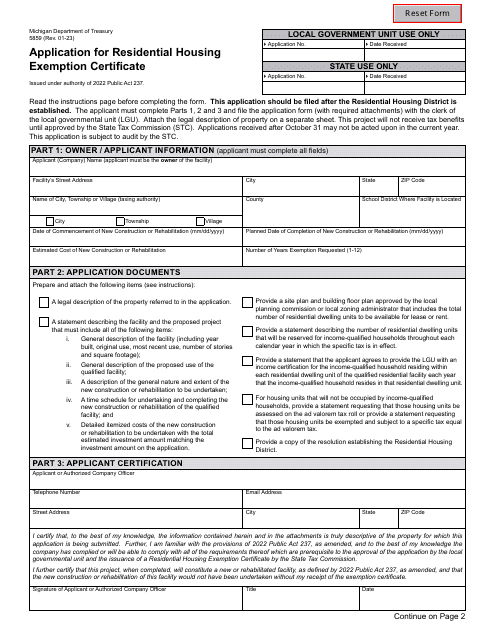

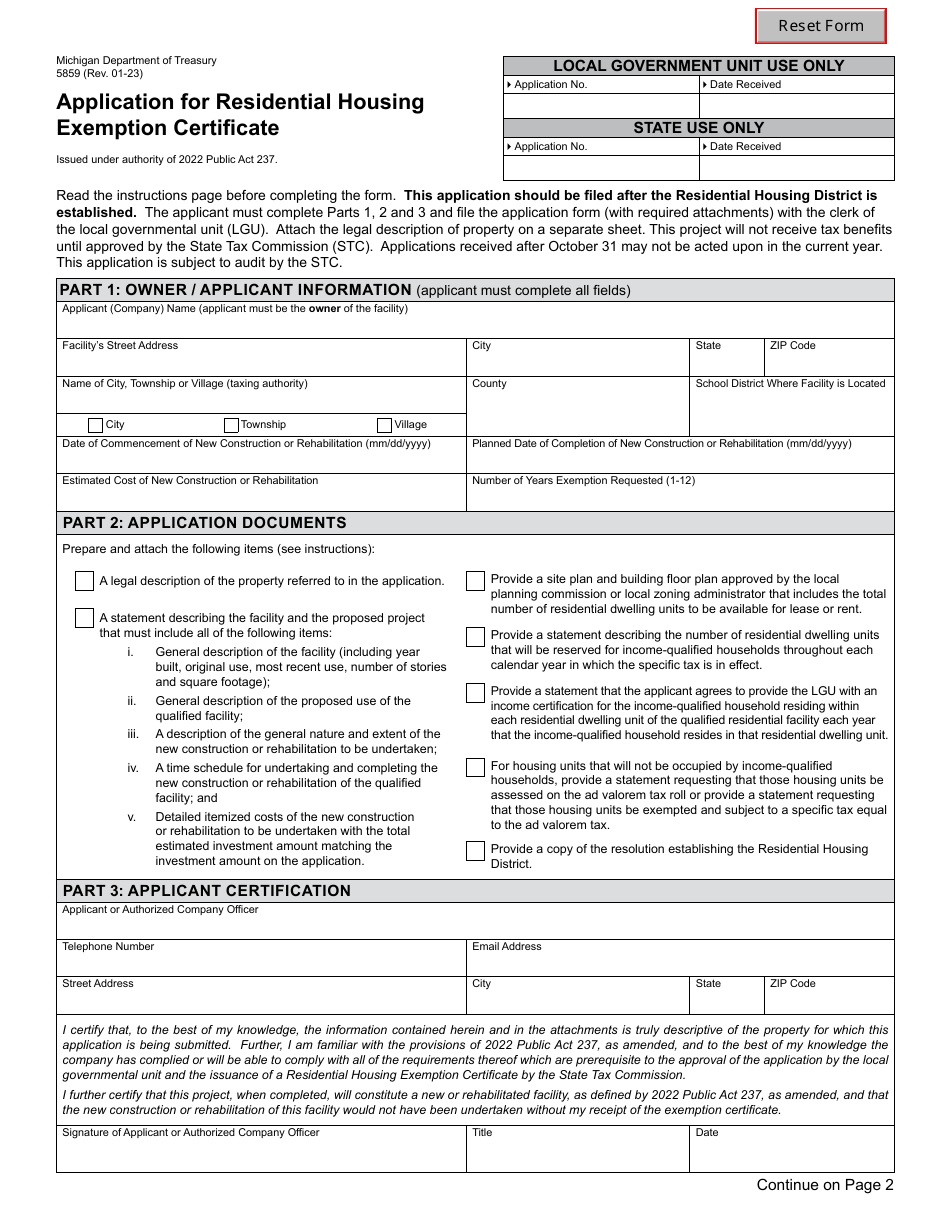

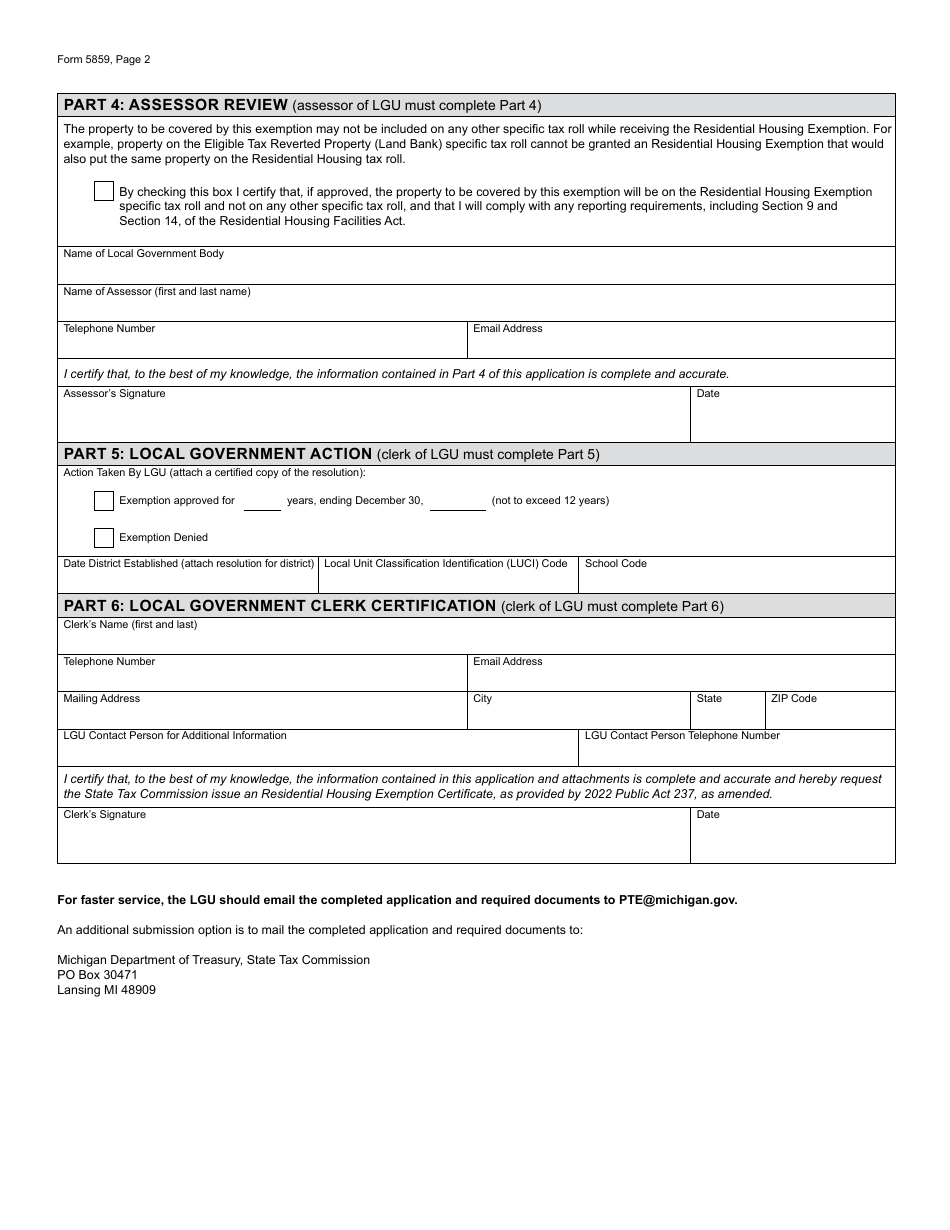

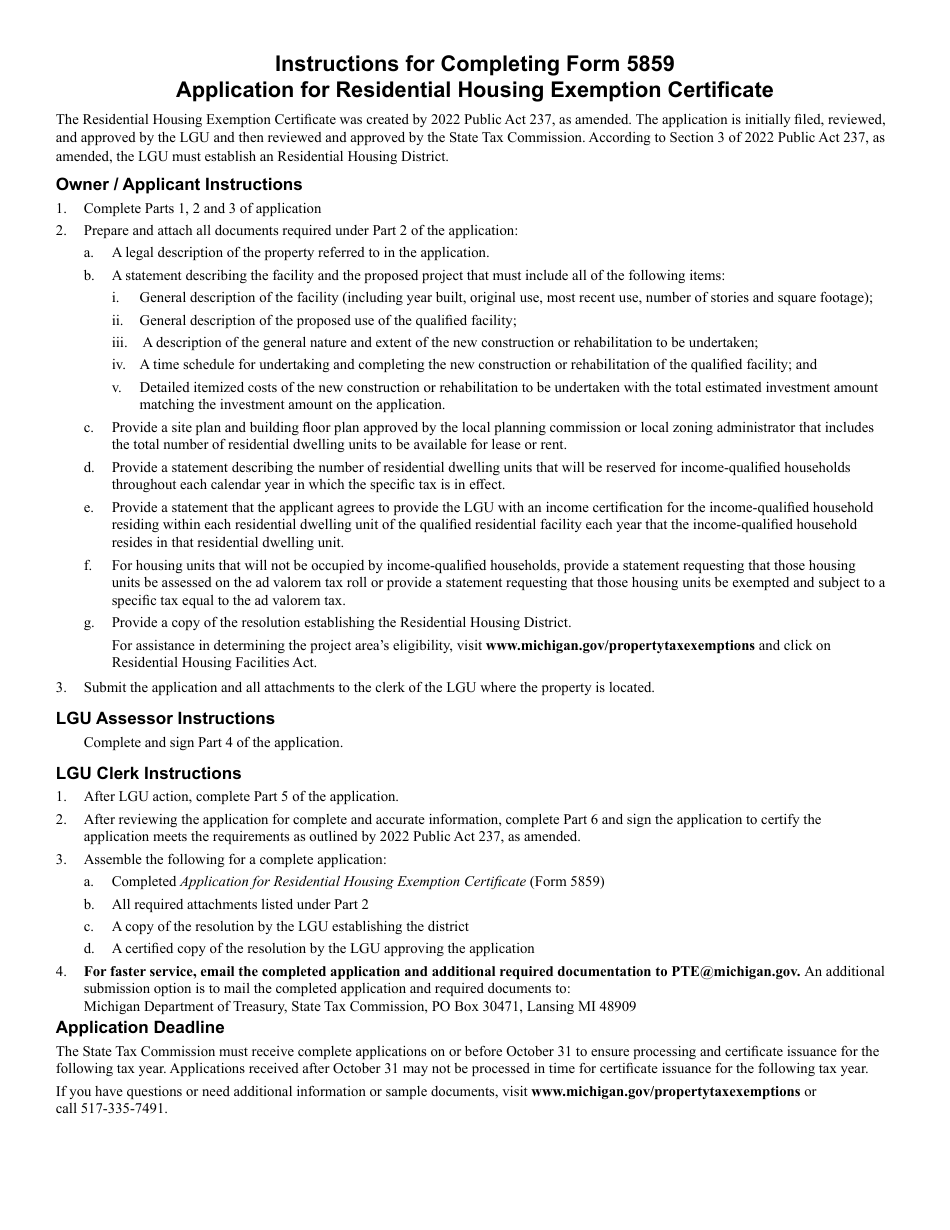

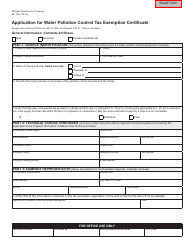

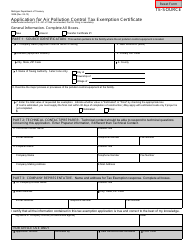

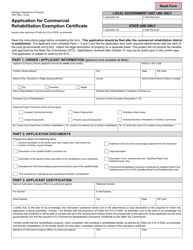

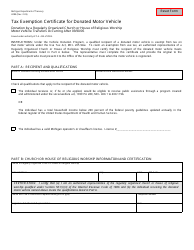

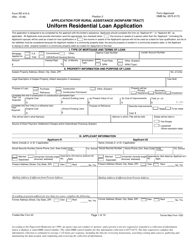

Form 5859 Application for Residential Housing Exemption Certificate - Michigan

What Is Form 5859?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5859?

A: Form 5859 is the Application for Residential Housing Exemption Certificate in Michigan.

Q: Who needs to file Form 5859?

A: Individuals or entities who qualify for a residential housing exemption in Michigan need to file Form 5859.

Q: What is a residential housing exemption?

A: A residential housing exemption is a tax exemption granted to individuals or entities who meet certain criteria for residential property.

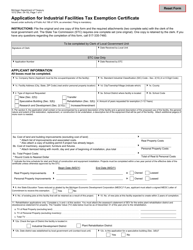

Q: What information do I need to provide on Form 5859?

A: You will need to provide information about the property, your residency status, and other relevant details.

Q: Is there a deadline for filing Form 5859?

A: Yes, the deadline for filing Form 5859 is determined by the local tax office. Check their guidelines for the specific deadline.

Q: What happens after I file Form 5859?

A: After you file Form 5859, the local tax office will review your application and notify you of the status of your residential housing exemption.

Q: Can I appeal if my residential housing exemption is denied?

A: Yes, you can appeal the decision if your residential housing exemption is denied. Follow the instructions provided by the local tax office for the appeals process.

Q: Are there any fees associated with filing Form 5859?

A: There are usually no fees associated with filing Form 5859, but it is best to check the instructions and guidelines provided by the local tax office.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5859 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.