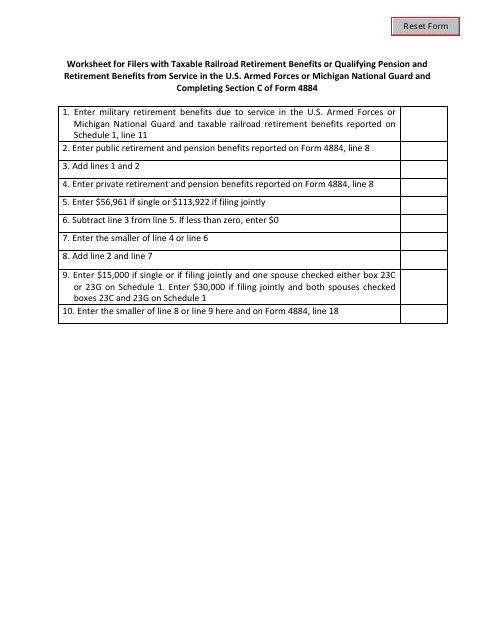

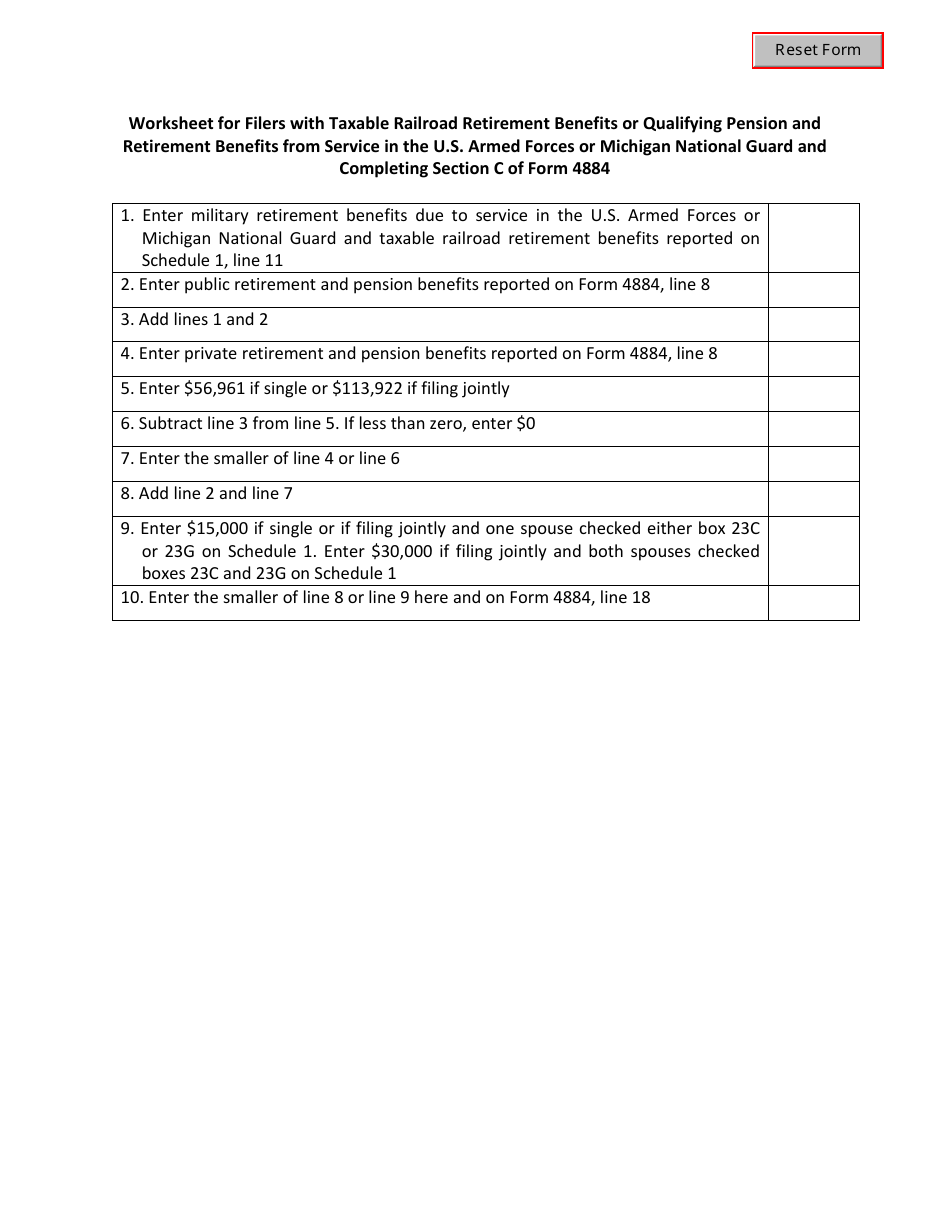

Form 4884 Worksheet for Filers With Taxable Railroad Retirement Benefits or Qualifying Pension and Retirement Benefits From Service in the U.S. Armed Forces or Michigan National Guard and Completing Section C of Form 4884 - Michigan

What Is Form 4884?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4884?

A: Form 4884 is a worksheet for filers with taxable railroad retirement benefits or qualifying pension and retirement benefits from service in the U.S. Armed Forces or Michigan National Guard.

Q: Who should complete Form 4884?

A: Form 4884 should be completed by individuals who have taxable railroad retirement benefits or qualifying pension and retirement benefits from service in the U.S. Armed Forces or Michigan National Guard.

Q: What is the purpose of completing Section C of Form 4884?

A: Completing Section C of Form 4884 allows individuals to calculate the Michigan retirement benefits subtraction.

Q: What is the Michigan retirement benefits subtraction?

A: The Michigan retirement benefits subtraction is a deduction that can reduce a taxpayer's Michigan taxable income.

Q: Are railway retirement benefits taxable?

A: Yes, railway retirement benefits are generally considered taxable income.

Q: What qualifies as qualifying pension and retirement benefits from service in the U.S. Armed Forces?

A: Qualifying pension and retirement benefits from service in the U.S. Armed Forces generally includes pensions, annuities, and survivor benefits received by military retirees.

Q: Can I use Form 4884 if I am not a resident of Michigan?

A: No, Form 4884 is specifically for residents of Michigan.

Q: What is the deadline for filing Form 4884?

A: The deadline for filing Form 4884 is generally the same as the deadline for filing your Michigan income tax return.

Q: Is there a fee for submitting Form 4884?

A: No, there is no fee for submitting Form 4884.

Form Details:

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4884 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.