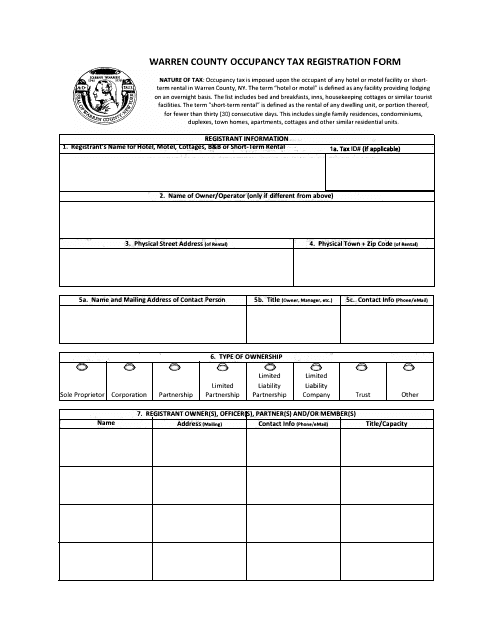

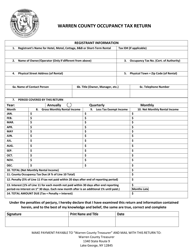

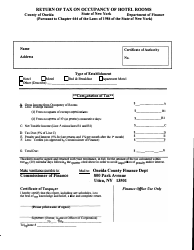

Occupancy Tax Registration Form - Warren County, New York

Occupancy Tax Registration Form is a legal document that was released by the County Treasurer's Office - Warren County, New York - a government authority operating within New York. The form may be used strictly within Warren County.

FAQ

Q: What is the occupancy tax registration form?

A: The occupancy tax registration form is a form used in Warren County, New York to register for and remit occupancy taxes.

Q: Why do I need to fill out the occupancy tax registration form?

A: You need to fill out the occupancy tax registration form if you are renting out lodging accommodations in Warren County, New York.

Q: What is the purpose of the occupancy tax?

A: The occupancy tax is used to fund tourism promotion and development efforts in Warren County, New York.

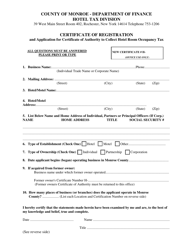

Q: Are there any fees associated with the occupancy tax registration?

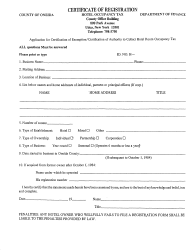

A: Yes, there is a one-time registration fee of $15 for each lodging facility.

Q: Do I need to renew the occupancy tax registration?

A: Yes, the occupancy tax registration needs to be renewed annually by January 31st.

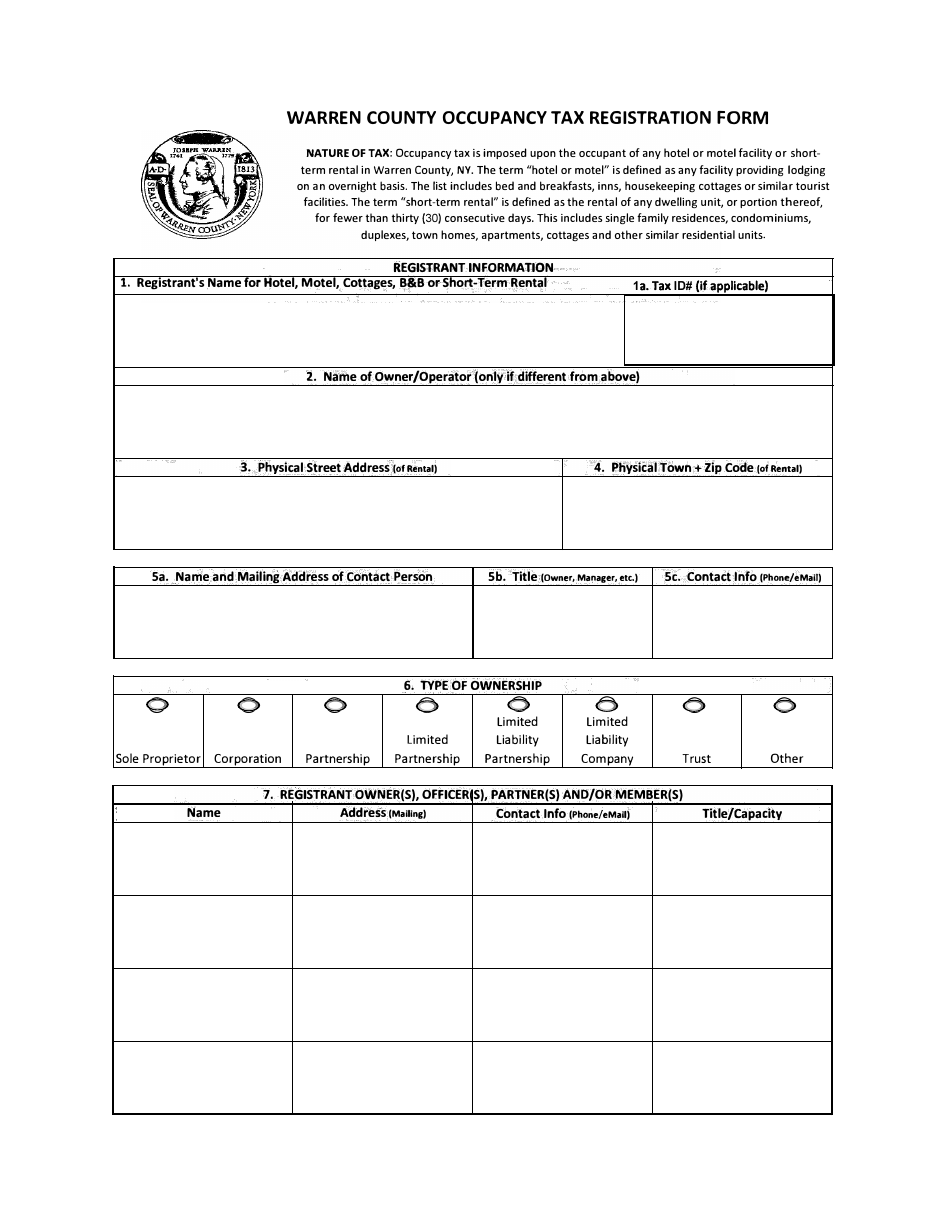

Q: What information do I need to provide on the occupancy tax registration form?

A: You will need to provide information about your lodging facility, including owner's contact information, number of units, and rental rates.

Q: Can I register multiple lodging facilities on the same form?

A: No, you need to submit a separate occupancy tax registration form for each lodging facility.

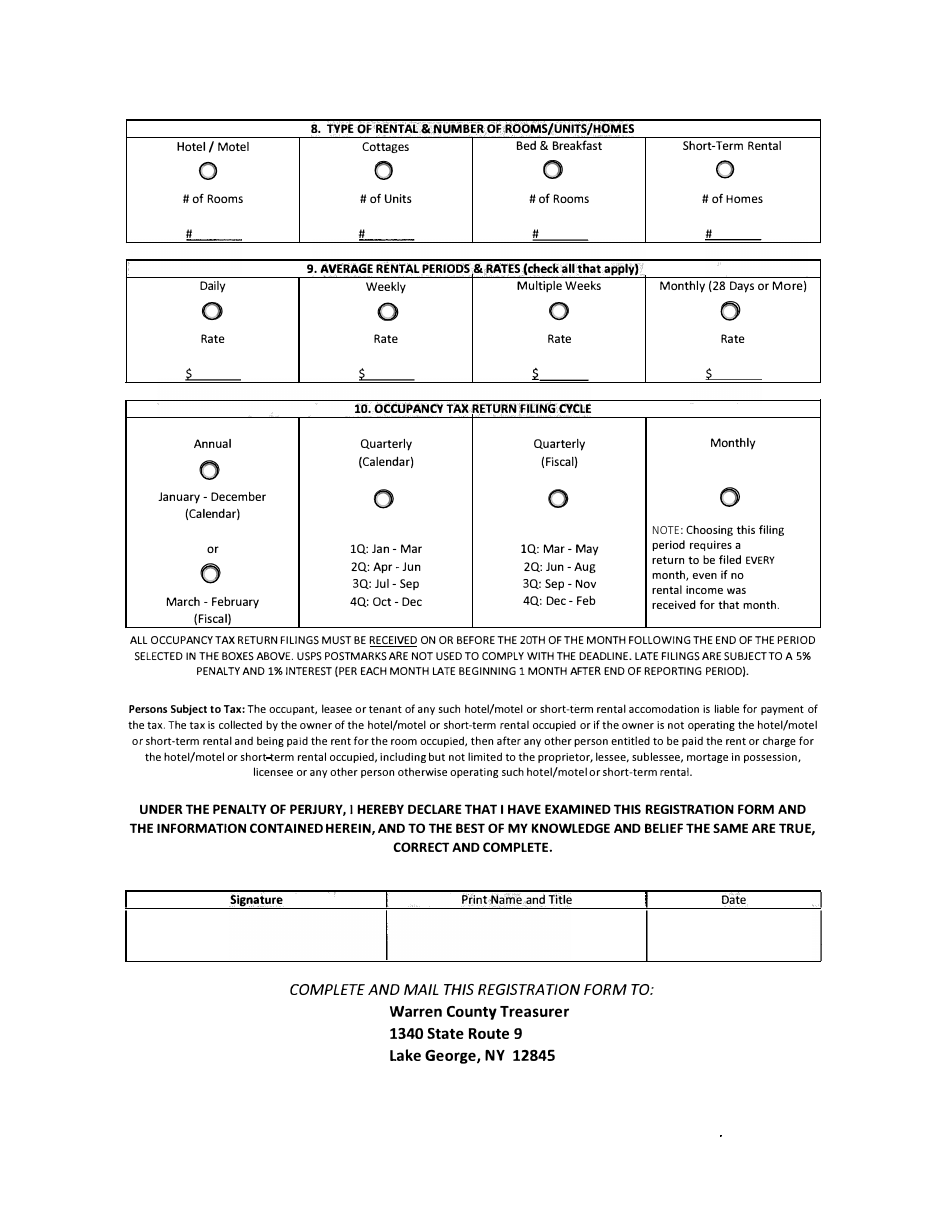

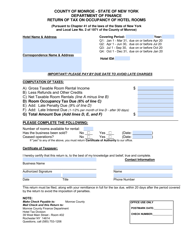

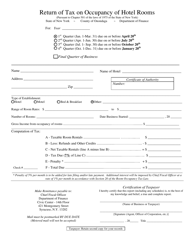

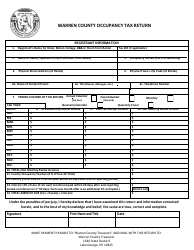

Q: How do I remit the occupancy taxes?

A: You need to remit the occupancy taxes on a quarterly basis using the occupancy tax quarterly return form and submitting it along with the payment.

Q: What happens if I fail to register or remit the occupancy taxes?

A: Failure to register or remit occupancy taxes may result in penalties and fines imposed by Warren County, New York.

Form Details:

- The latest edition currently provided by the County Treasurer's Office - Warren County, New York;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the County Treasurer's Office - Warren County, New York.