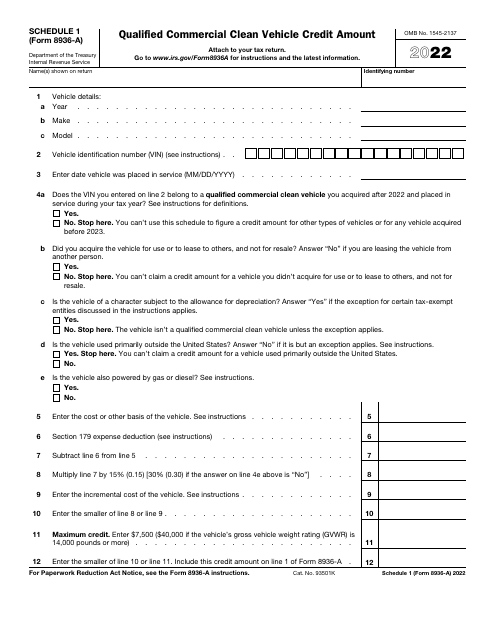

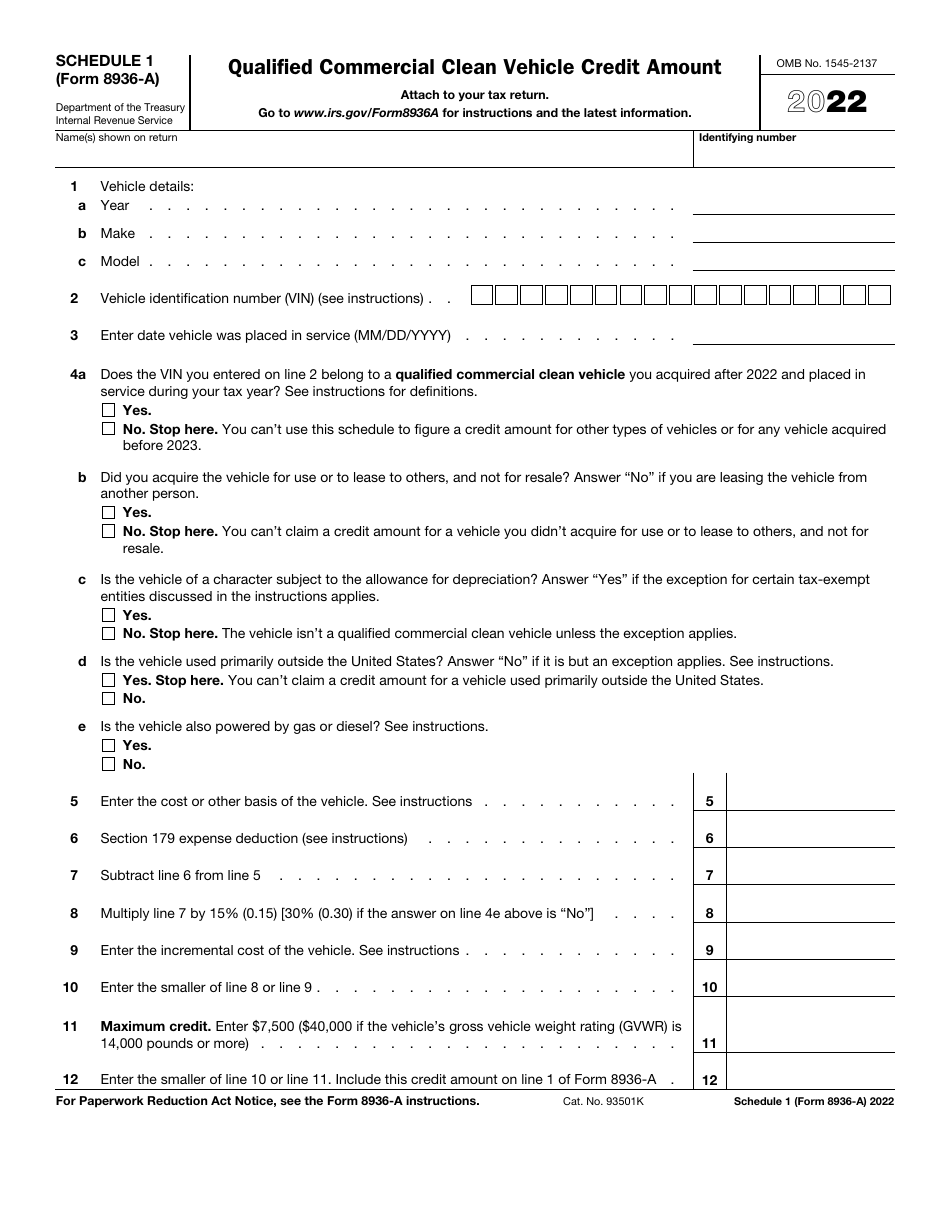

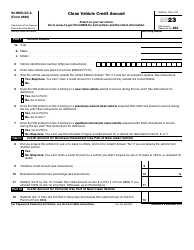

IRS Form 8936-A Schedule 1 Qualified Commercial Clean Vehicle Credit Amount

What Is IRS Form 8936-A Schedule 1?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury. The document is a supplement to IRS Form 8936-A, Qualified Commercial Clean Vehicle Credit. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8936-A?

A: IRS Form 8936-A is a schedule used to calculate the Qualified Commercial Clean Vehicle Credit Amount.

Q: What is the purpose of IRS Form 8936-A?

A: The purpose of IRS Form 8936-A is to determine the credit amount for qualified commercial clean vehicles.

Q: What is the Qualified Commercial Clean Vehicle Credit?

A: The Qualified Commercial Clean Vehicle Credit is a tax credit available for businesses that purchase or lease eligible clean vehicles.

Q: How do I fill out IRS Form 8936-A?

A: To fill out IRS Form 8936-A, you should follow the instructions provided by the IRS and enter the necessary information related to your qualified commercial clean vehicle.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8936-A Schedule 1 through the link below or browse more documents in our library of IRS Forms.