This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 1096, 1097, 1098, 1099, 3921, 3922, 5498, W-2G

for the current year.

Instructions for IRS Form 1096, 1097, 1098, 1099, 3921, 3922, 5498, W-2G

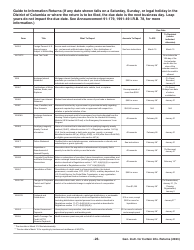

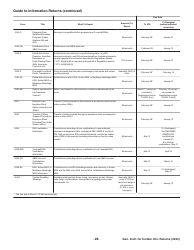

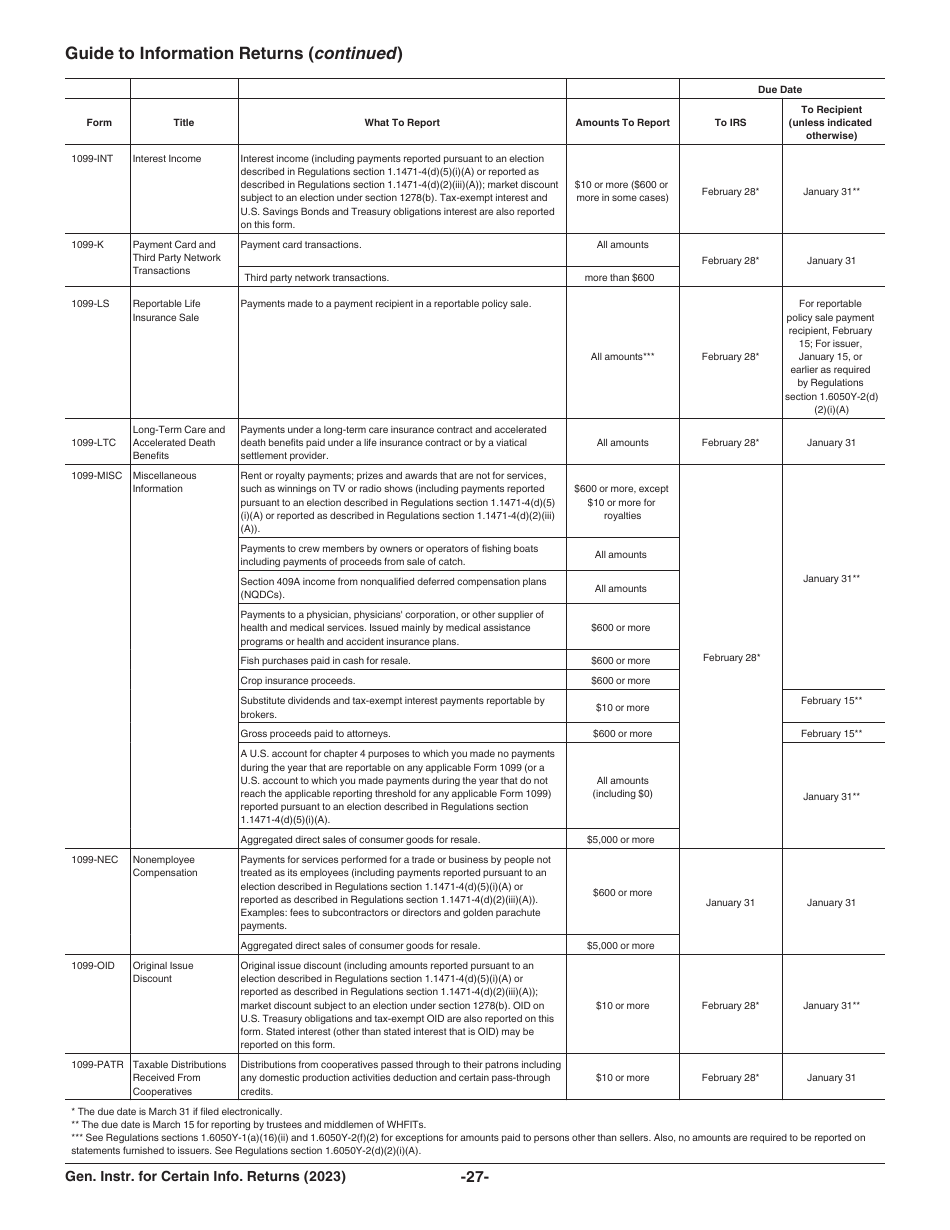

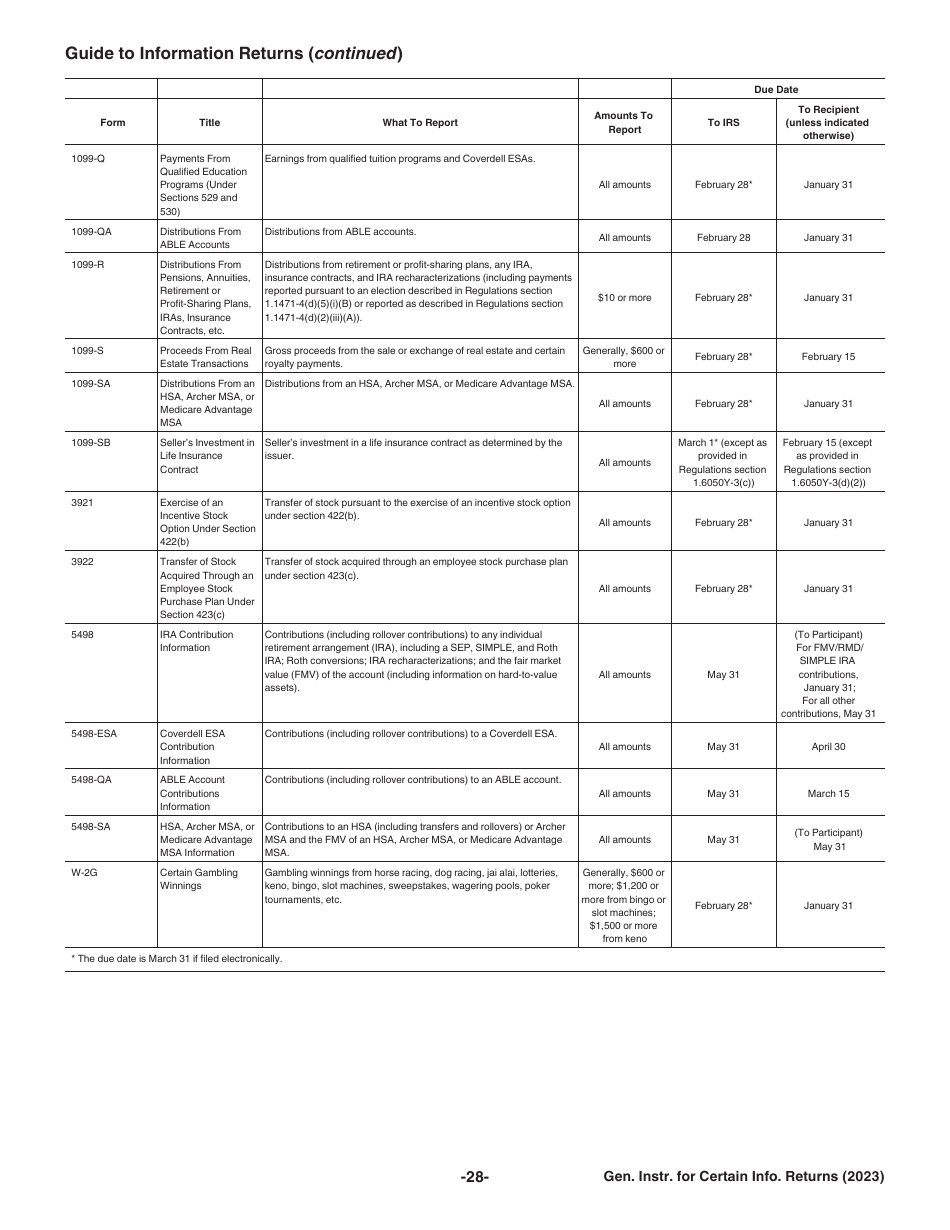

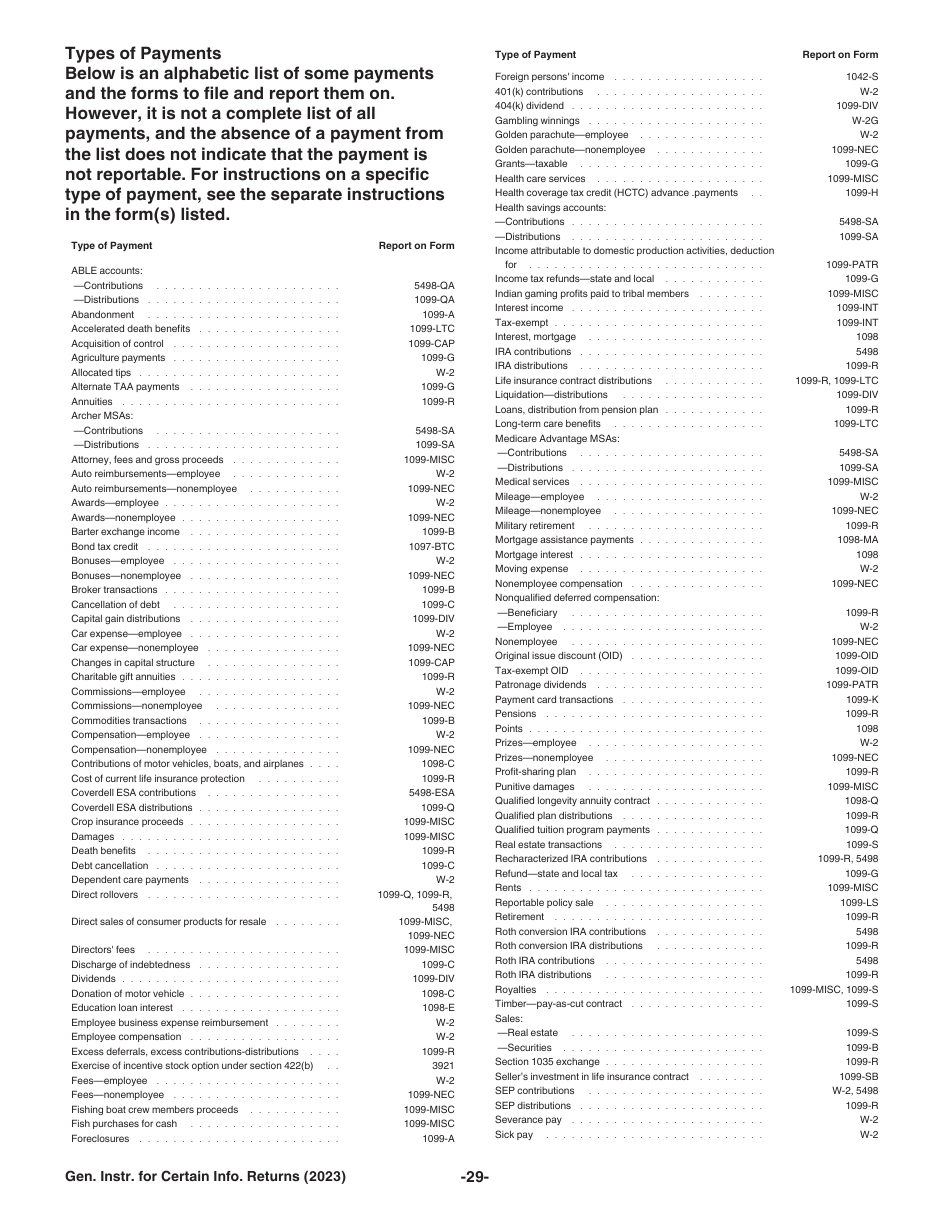

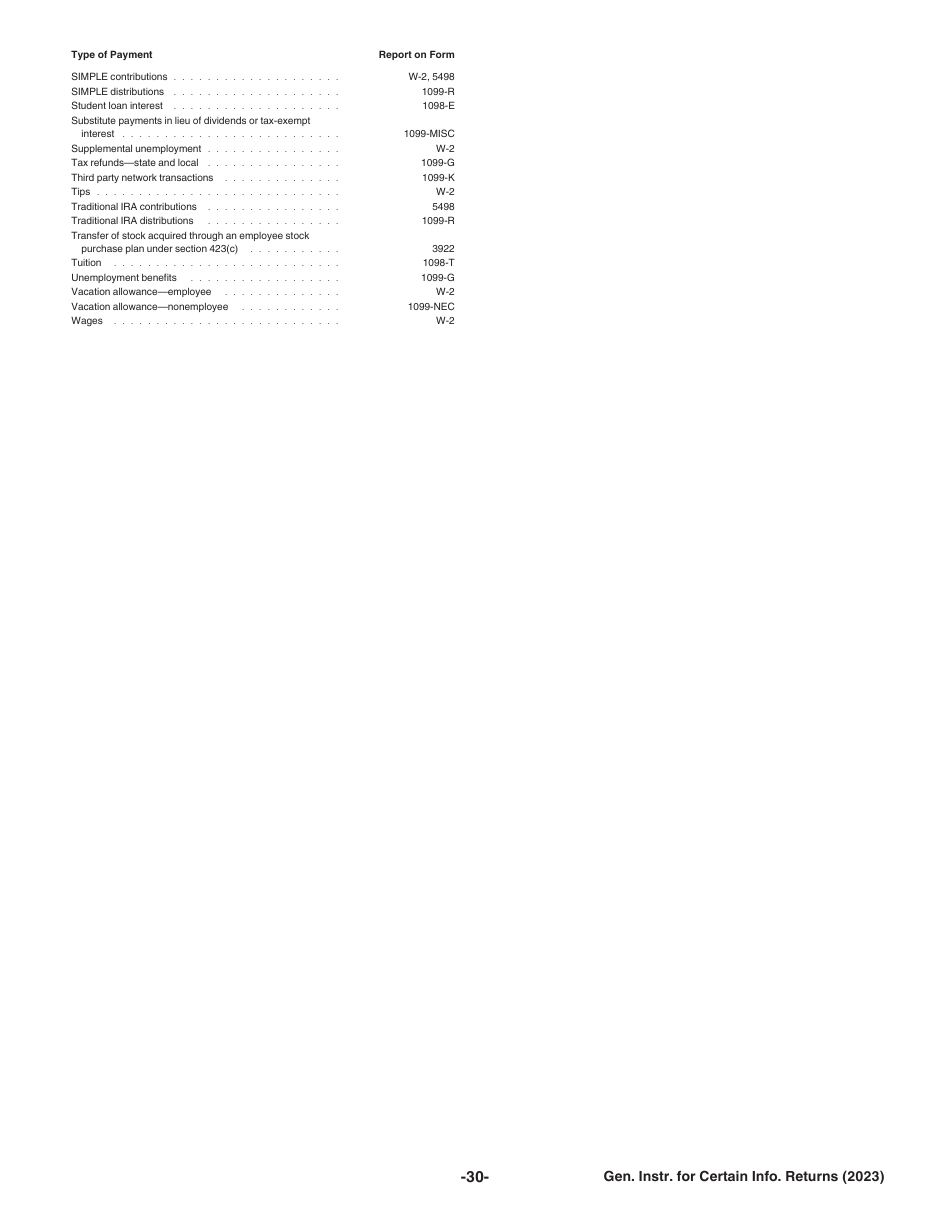

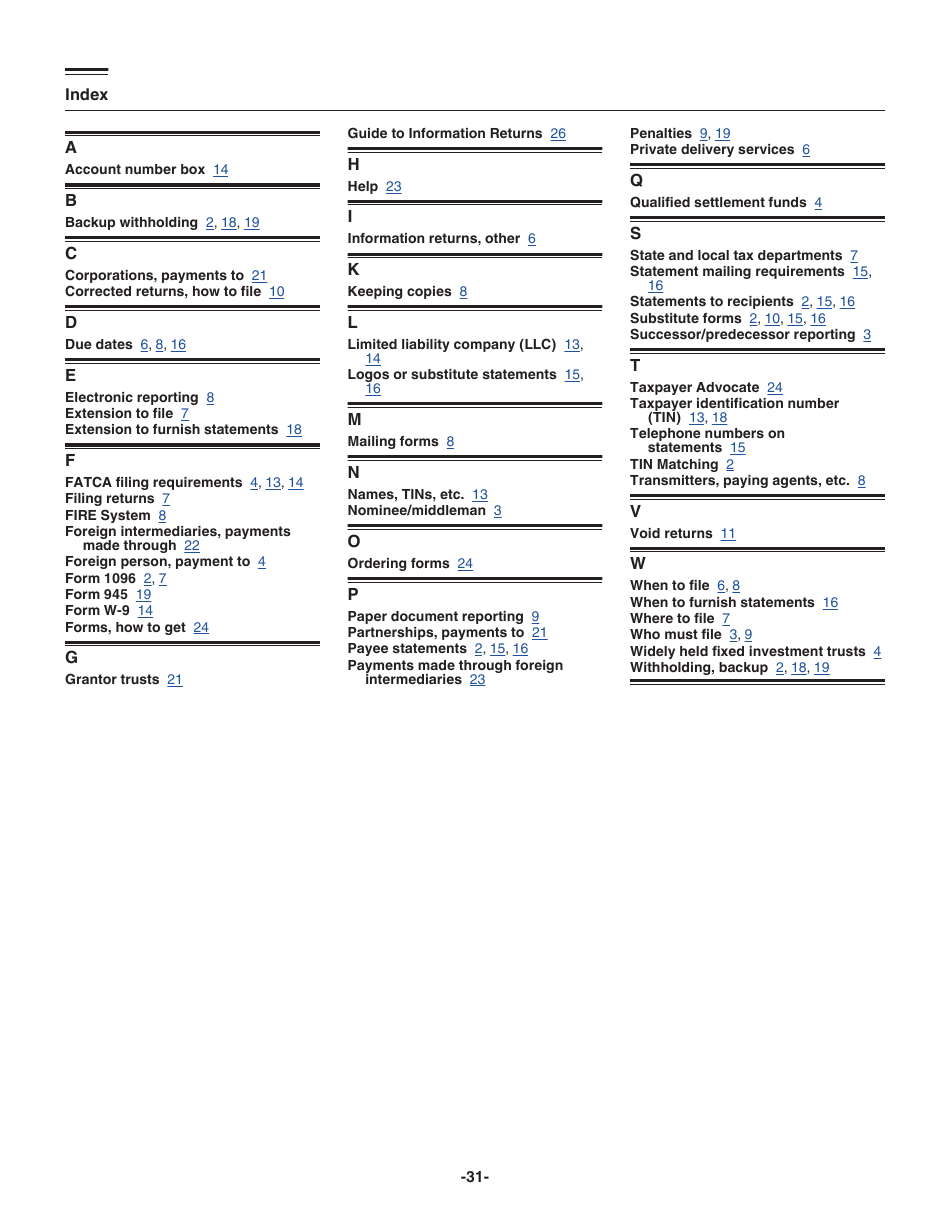

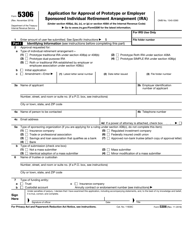

This document contains official instructions for IRS Form 1096 , IRS Form 1097 , IRS Form 1098 , IRS Form 1099 , IRS Form 3921 , IRS Form 3922 , IRS Form 5498 , and IRS Form W-2G . All forms are released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1096 is available for download through this link. The latest available IRS Form 5498 can be downloaded through this link.

FAQ

Q: What is IRS Form 1096?

A: IRS Form 1096 is used to summarize and transmit paper forms that report payments made by a business or individual that are not filed electronically.

Q: What is IRS Form 1097?

A: IRS Form 1097 is used to report certain payments received by banks and other financial institutions.

Q: What is IRS Form 1098?

A: IRS Form 1098 is used to report mortgage interest, student loan interest, and tuition payments received.

Q: What is IRS Form 1099?

A: IRS Form 1099 is used to report various types of income, such as miscellaneous income, interest income, and dividend income.

Q: What is IRS Form 3921?

A: IRS Form 3921 is used to report exercises of incentive stock options.

Q: What is IRS Form 3922?

A: IRS Form 3922 is used to report transfers of stock acquired through an employee stock purchase plan.

Q: What is IRS Form 5498?

A: IRS Form 5498 is used to report contributions made to individual retirement arrangements (IRAs), including traditional, Roth, and SEP IRAs.

Q: What is IRS Form W-2G?

A: IRS Form W-2G is used to report certain gambling winnings and any federal income tax withheld on those winnings.

Instruction Details:

- This 31-page document is available for download in PDF;

- These instructions will be used to file next year's taxes. Choose a previous version to file for the current tax year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.