This version of the form is not currently in use and is provided for reference only. Download this version of

Form 303

for the current year.

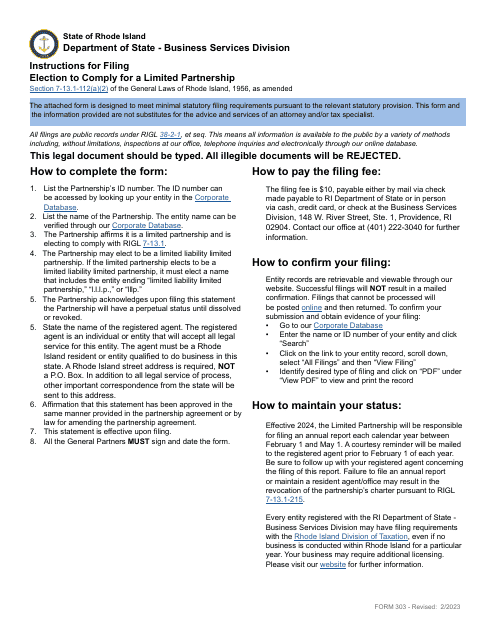

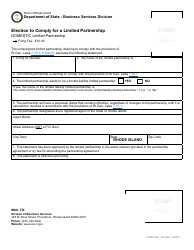

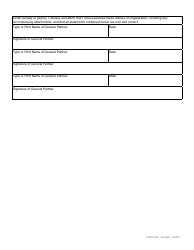

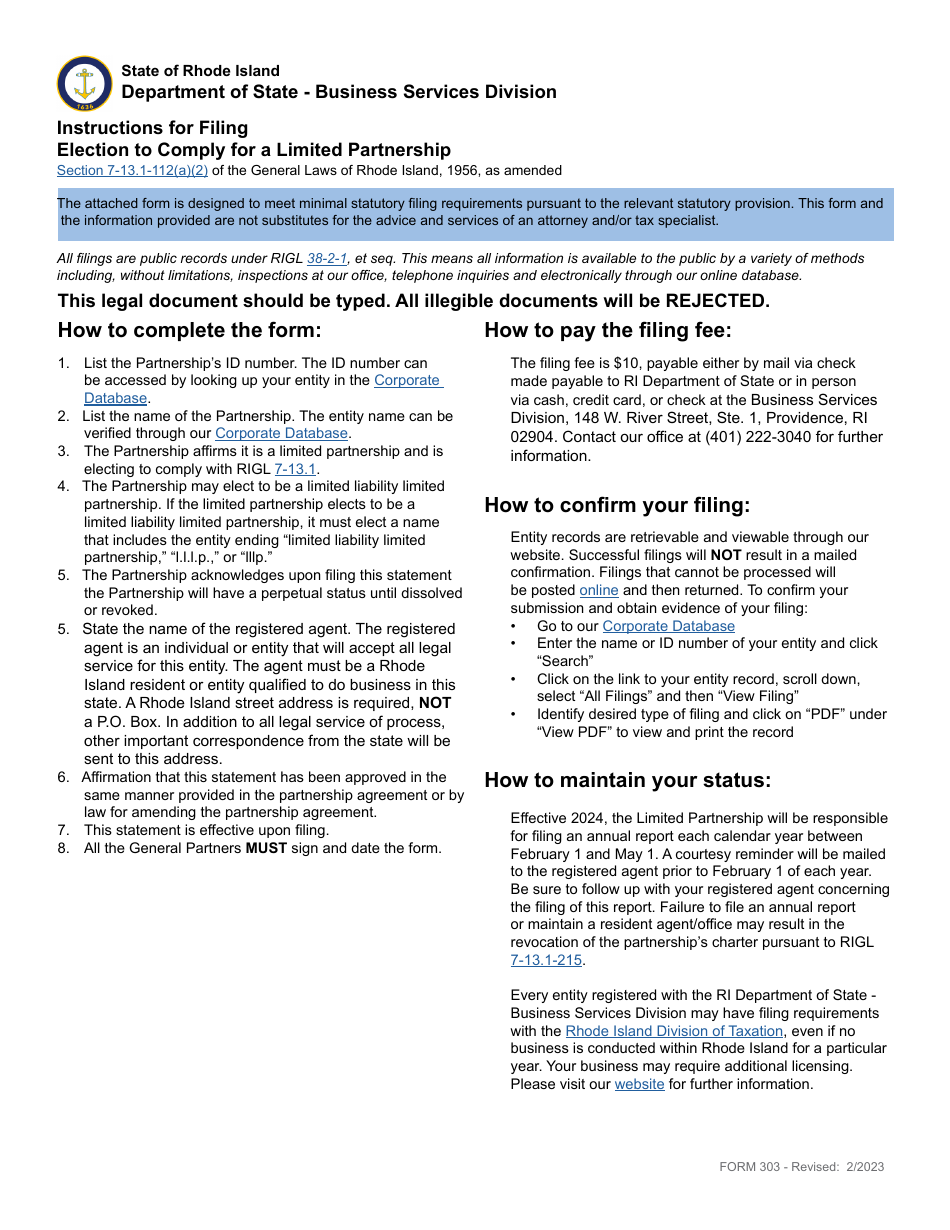

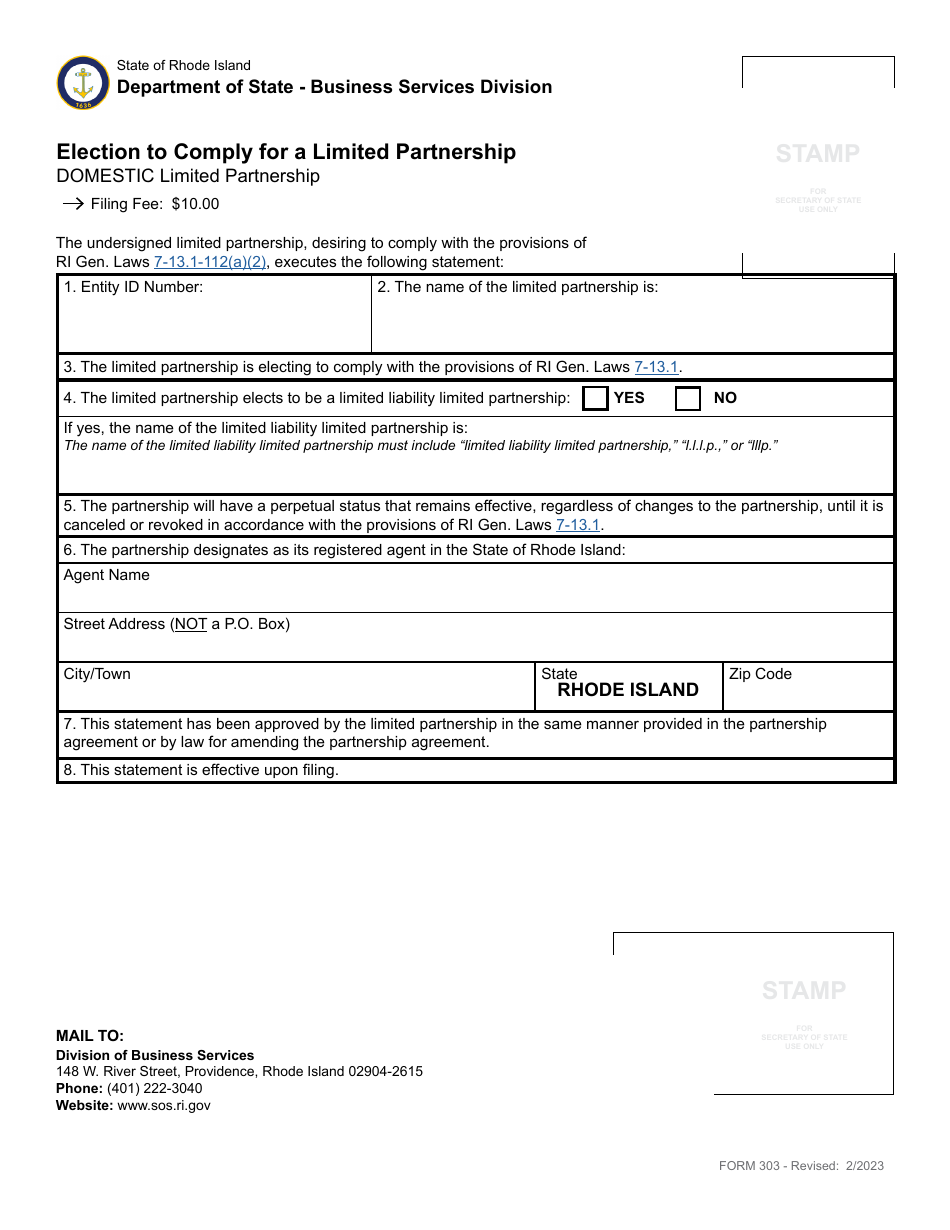

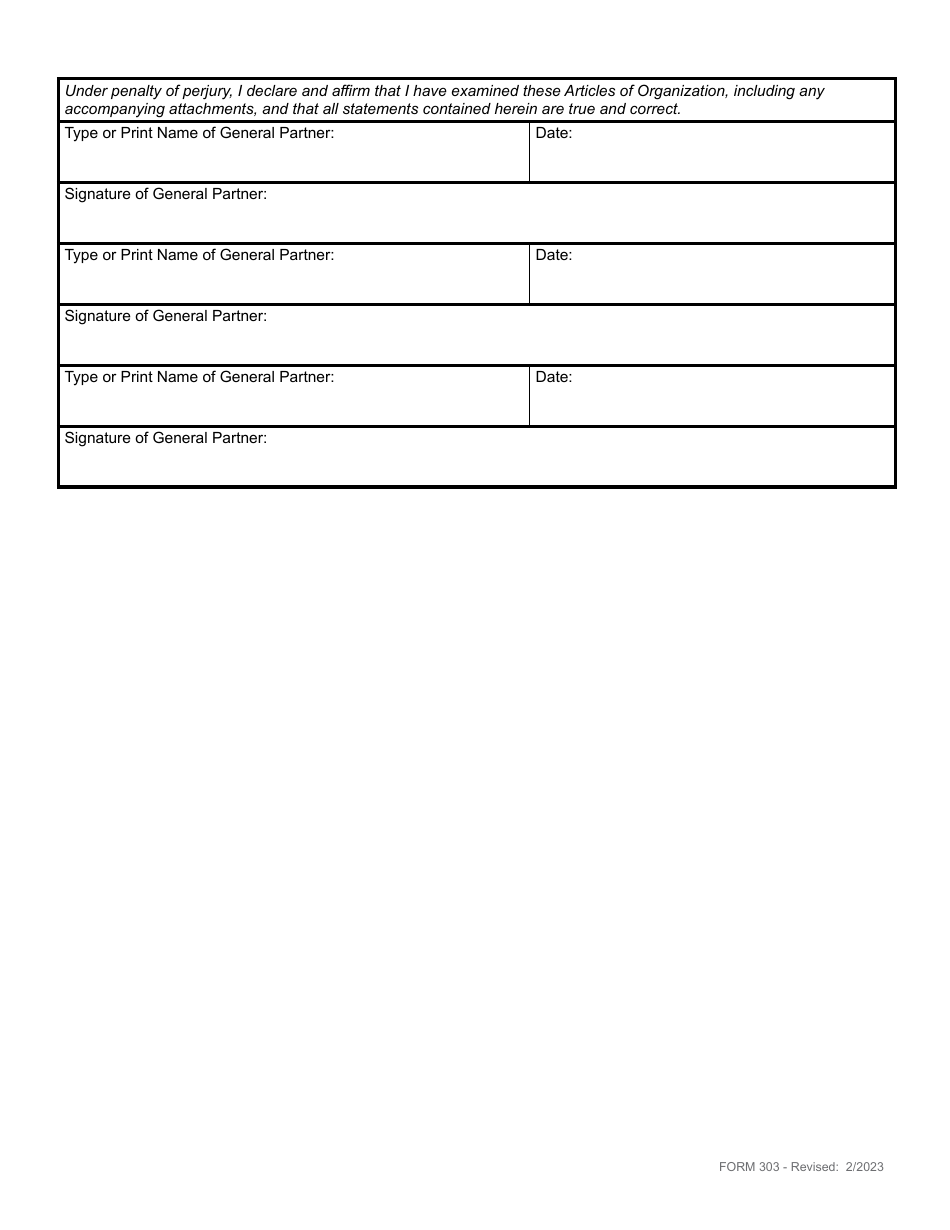

Form 303 Election to Comply for a Limited Partnership - Rhode Island

What Is Form 303?

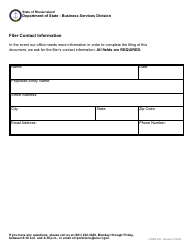

This is a legal form that was released by the Rhode Island Secretary of State - a government authority operating within Rhode Island. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 303?

A: Form 303 is the Election to Comply form for a Limited Partnership in Rhode Island.

Q: What is a Limited Partnership?

A: A Limited Partnership is a type of business structure where there are at least two partners, one general partner and one limited partner.

Q: Who needs to file Form 303?

A: Limited Partnerships in Rhode Island need to file Form 303 to elect to comply with certain provisions of the law.

Q: What does Form 303 do?

A: Form 303 allows a Limited Partnership to elect provisions related to liability limitations and other requirements.

Q: When is Form 303 due?

A: Form 303 is due at the time of filing the Limited Partnership's annual report.

Q: What happens if I don't file Form 303?

A: If you don't file Form 303, your Limited Partnership may not be able to benefit from certain liability limitations and other provisions.

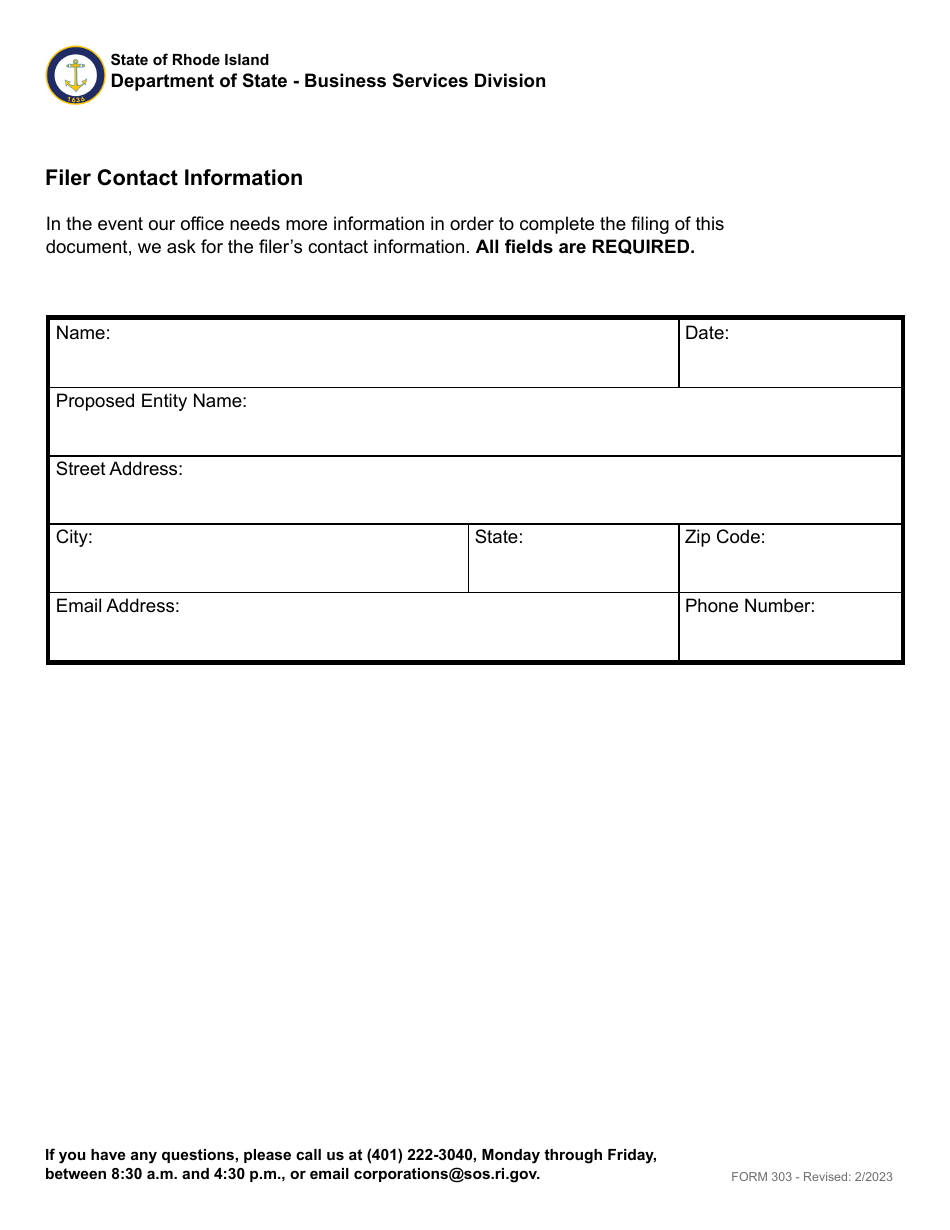

Q: Can I get assistance with filling out Form 303?

A: Yes, you can seek assistance from the Rhode Island Secretary of State's office or consult a legal professional.

Form Details:

- Released on February 1, 2023;

- The latest edition provided by the Rhode Island Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 303 by clicking the link below or browse more documents and templates provided by the Rhode Island Secretary of State.