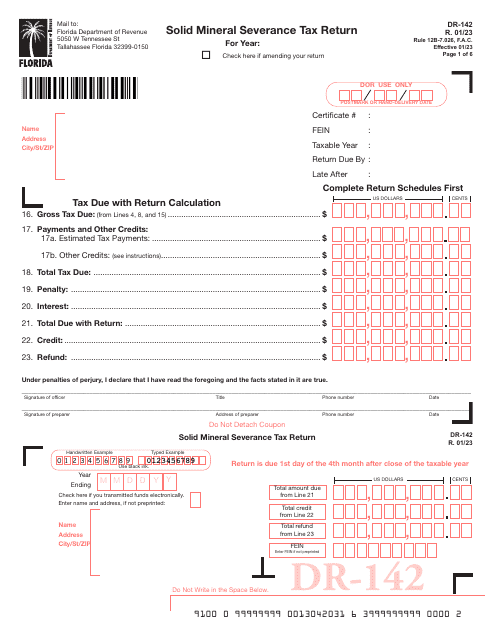

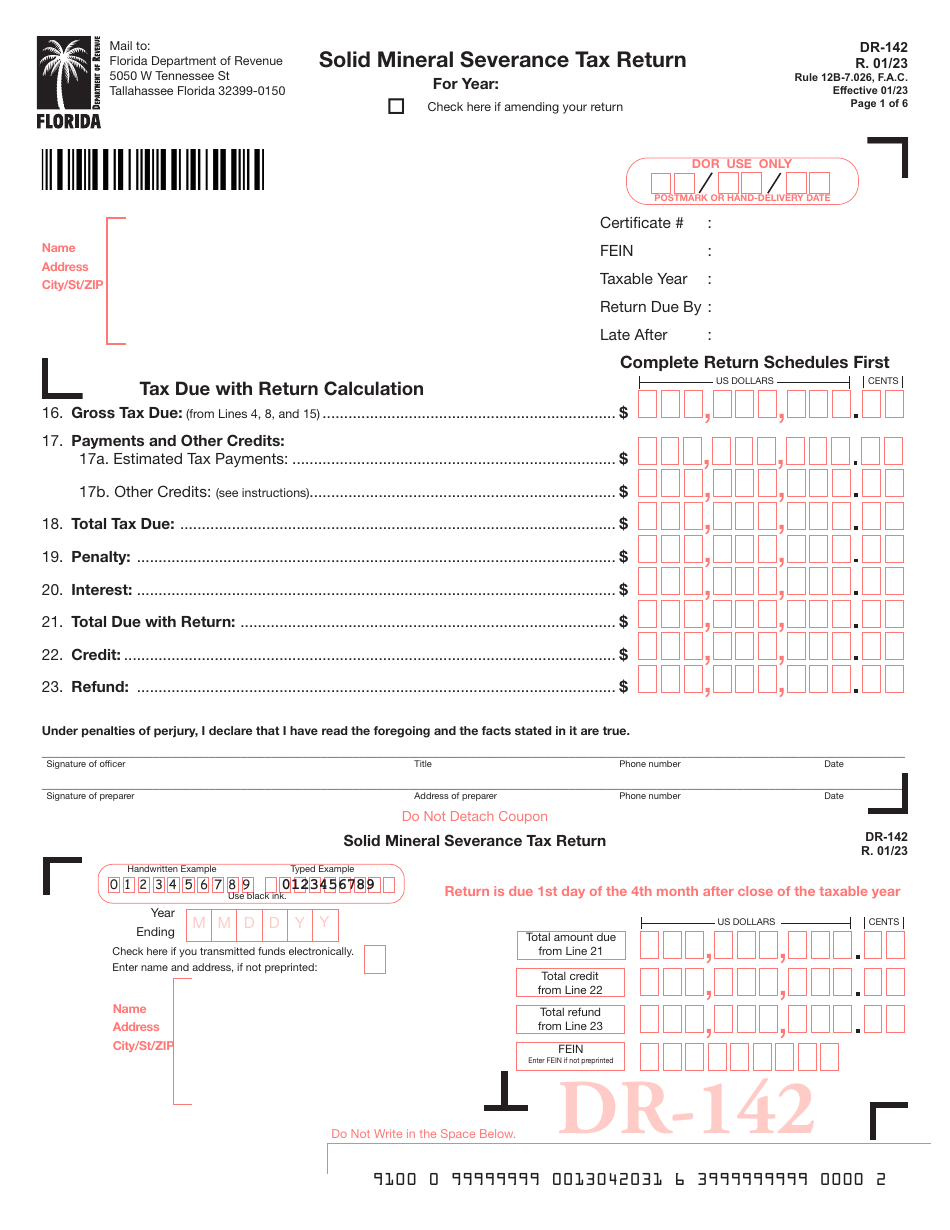

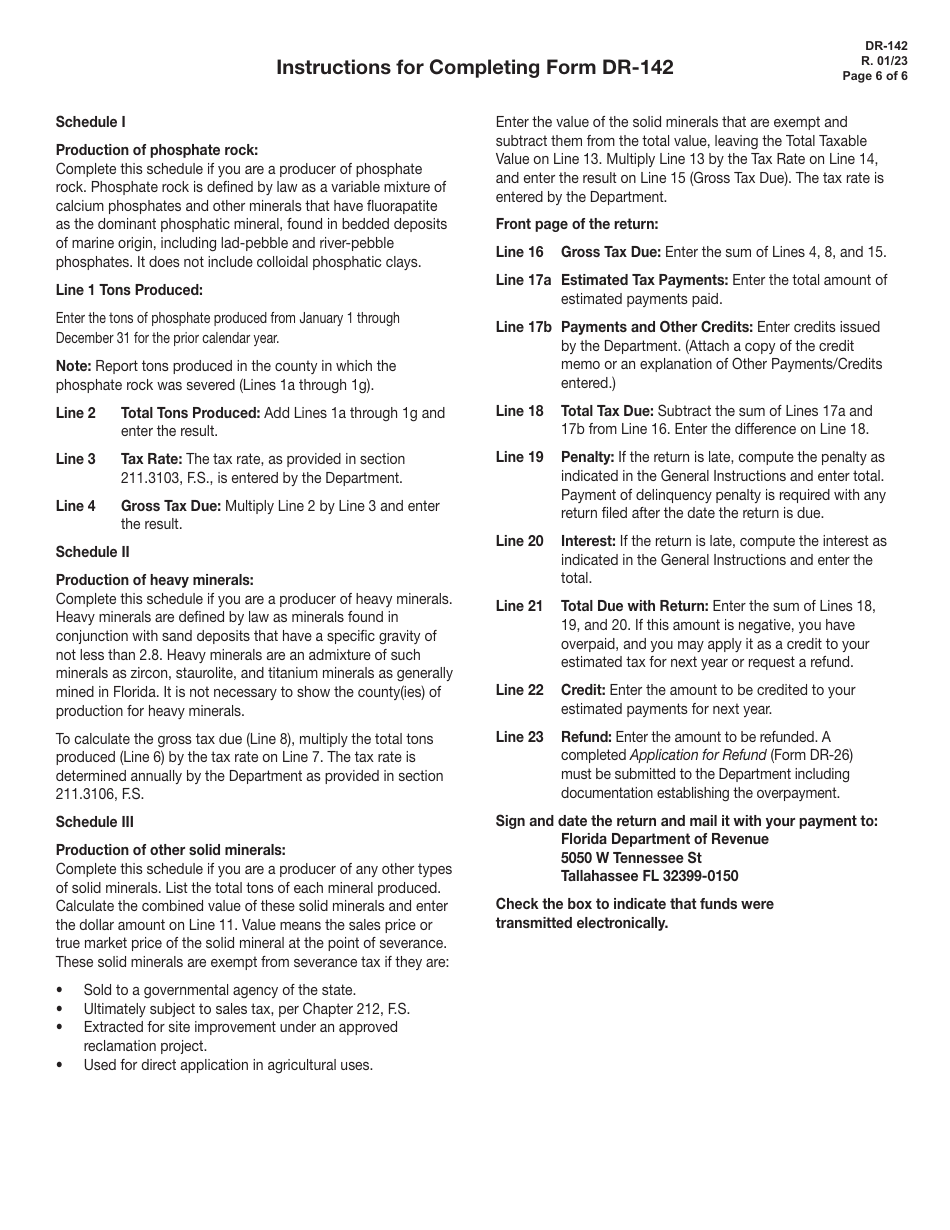

Form DR-142 Solid Mineral Severance Tax Return - Florida

What Is Form DR-142?

This is a legal form that was released by the Florida Department of Revenue - a government authority operating within Florida. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR-142?

A: Form DR-142 is the Solid MineralSeverance Tax Return in Florida.

Q: Who needs to file Form DR-142?

A: Anyone engaged in the severance of solid mineral resources in Florida needs to file Form DR-142.

Q: What is the purpose of Form DR-142?

A: The purpose of Form DR-142 is to report and pay the solid mineral severance tax in Florida.

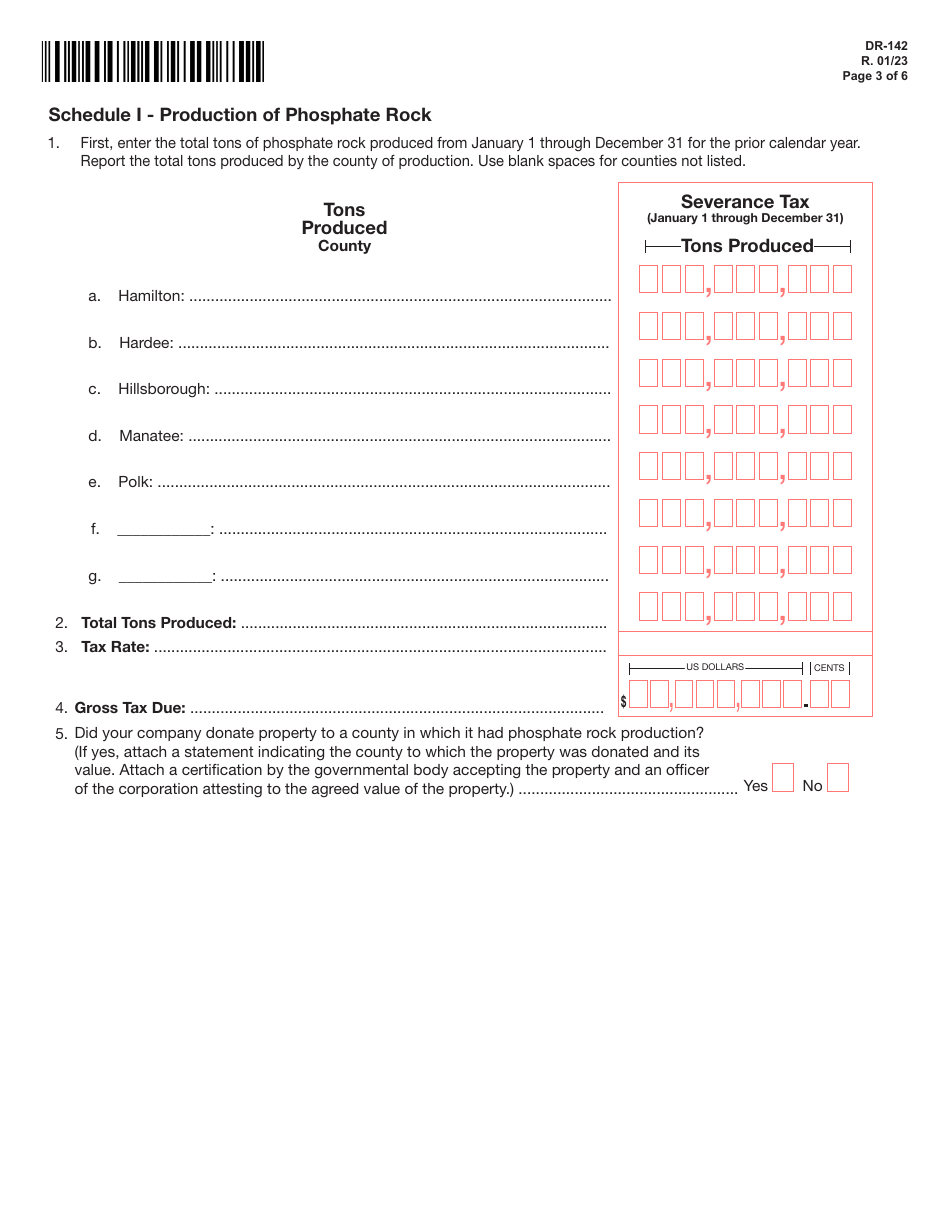

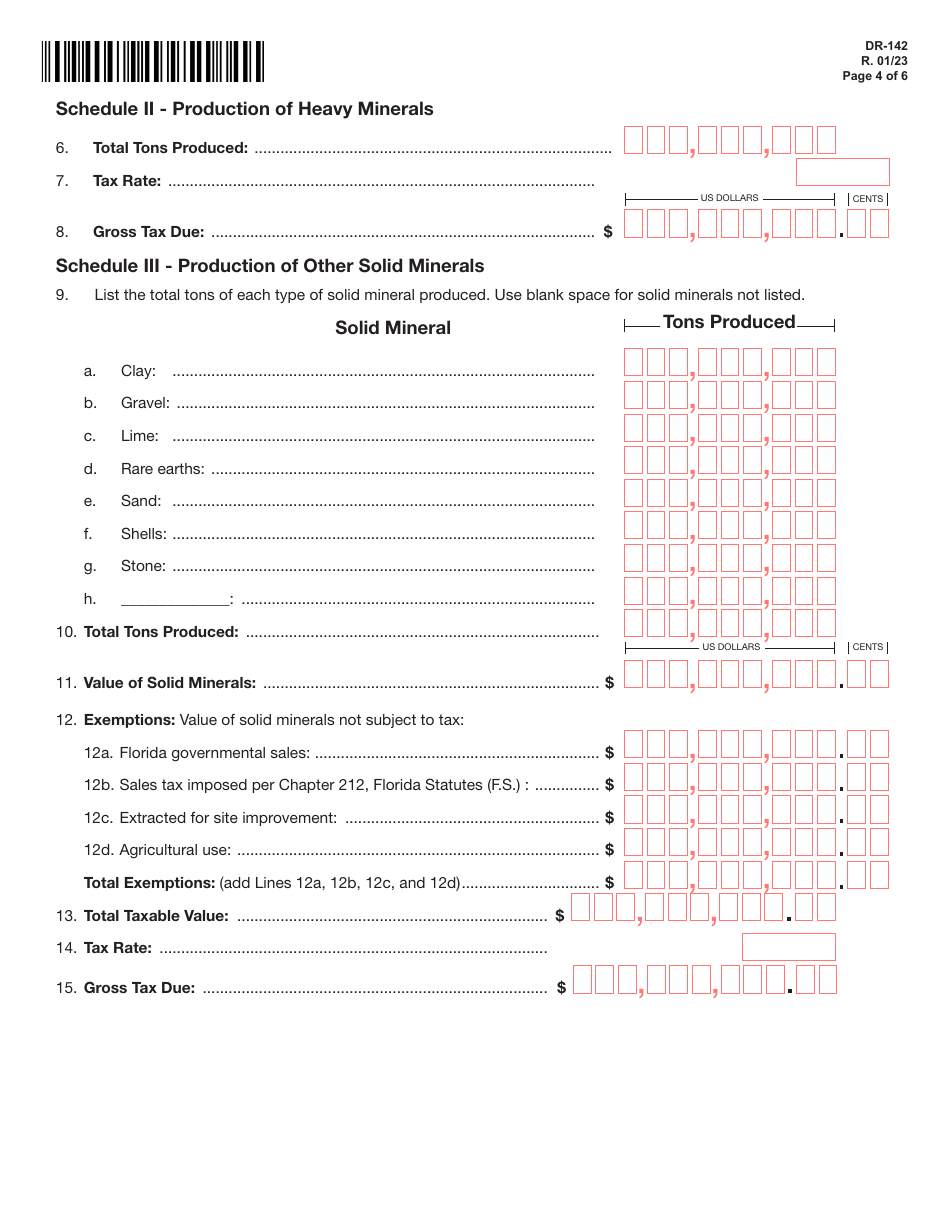

Q: What are solid mineral resources?

A: Solid mineral resources refer to natural deposits of minerals that are mined or extracted, such as limestone, phosphate rock, sand, and gravel.

Q: How often do I need to file Form DR-142?

A: Form DR-142 must be filed on a monthly basis.

Q: What information do I need to complete Form DR-142?

A: You will need to provide information about your business, the type and quantity of solid minerals severed, and the amount of tax due.

Q: Is there a deadline for filing Form DR-142?

A: Yes, Form DR-142 must be filed and the tax paid by the 20th day of the month following the month in which the severance occurred.

Q: What happens if I don't file or pay the solid mineral severance tax?

A: Failure to file or pay the tax may result in penalties and interest charges.

Q: Can I file Form DR-142 electronically?

A: Yes, Form DR-142 can be filed electronically through the Florida Department of Revenue's e-Services portal.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Florida Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR-142 by clicking the link below or browse more documents and templates provided by the Florida Department of Revenue.