This version of the form is not currently in use and is provided for reference only. Download this version of

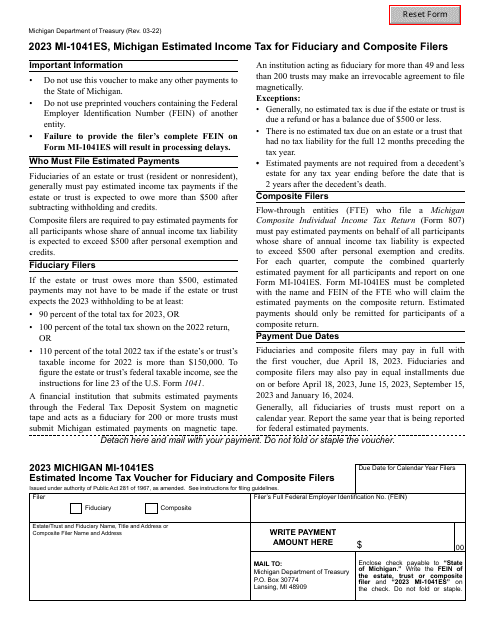

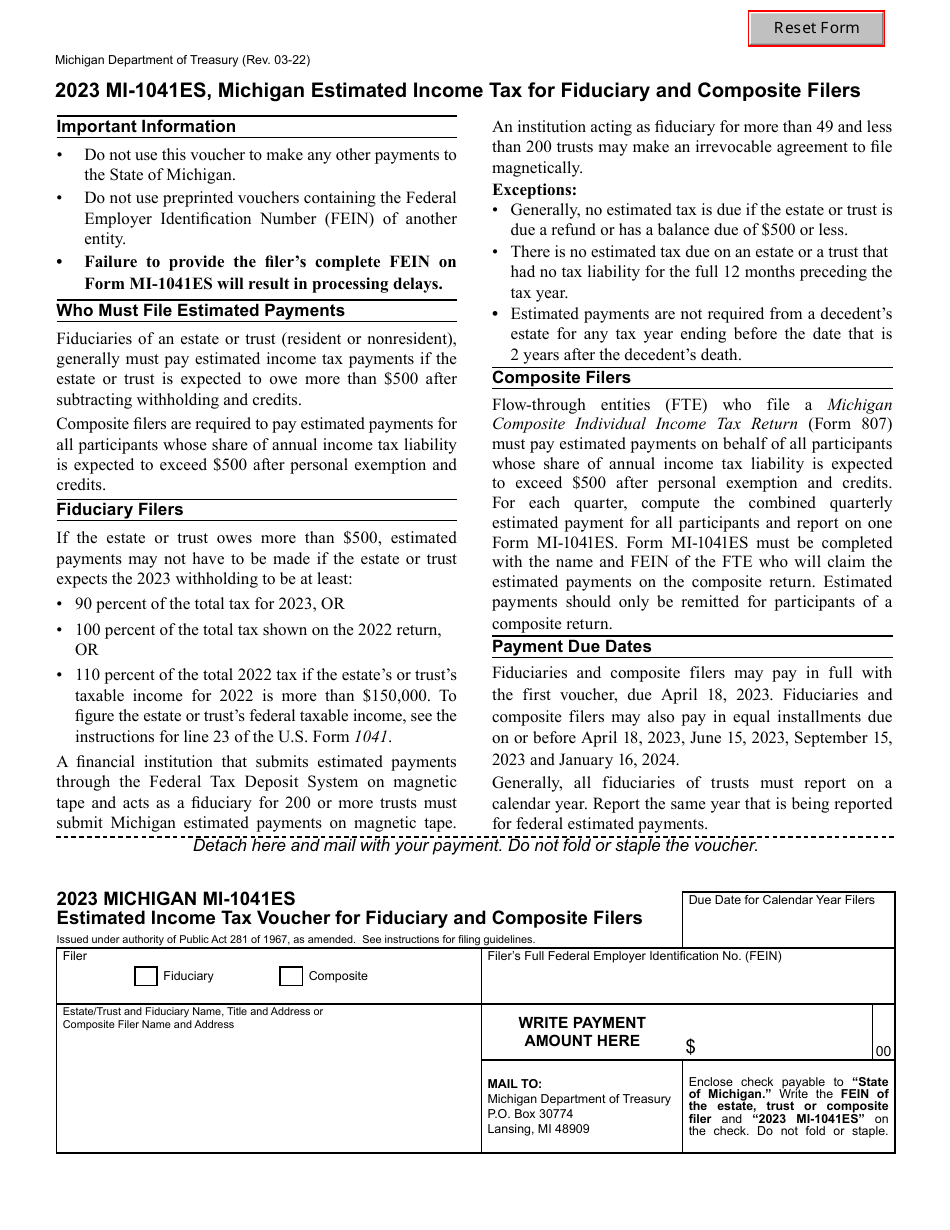

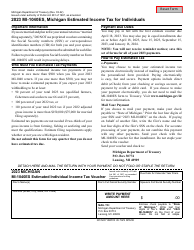

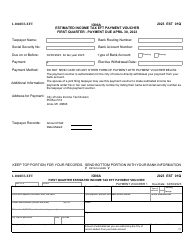

Form MI-1041ES

for the current year.

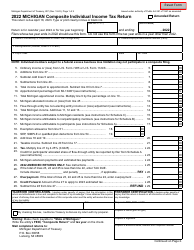

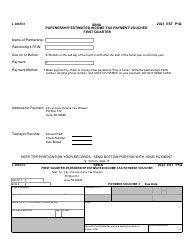

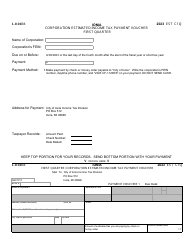

Form MI-1041ES Michigan Estimated Income Tax for Fiduciary and Composite Filers - Michigan

What Is Form MI-1041ES?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MI-1041ES?

A: Form MI-1041ES is the Michigan Estimated Income Tax form for fiduciary and composite filers.

Q: Who should file Form MI-1041ES?

A: Form MI-1041ES should be filed by fiduciary and composite filers in Michigan.

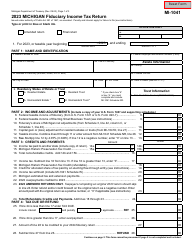

Q: What is a fiduciary filer?

A: A fiduciary filer is an individual or entity responsible for managing the financial affairs of another person or entity, such as an executor or trustee.

Q: What is a composite filer?

A: A composite filer is a nonresident individual who is a beneficiary of a trust or estate in Michigan.

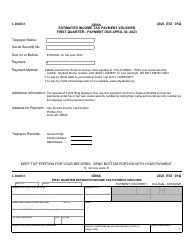

Q: When is Form MI-1041ES due?

A: Form MI-1041ES is typically due on April 15th of the tax year.

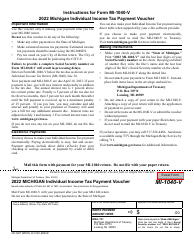

Q: How do I file Form MI-1041ES?

A: Form MI-1041ES can be filed electronically or by mail.

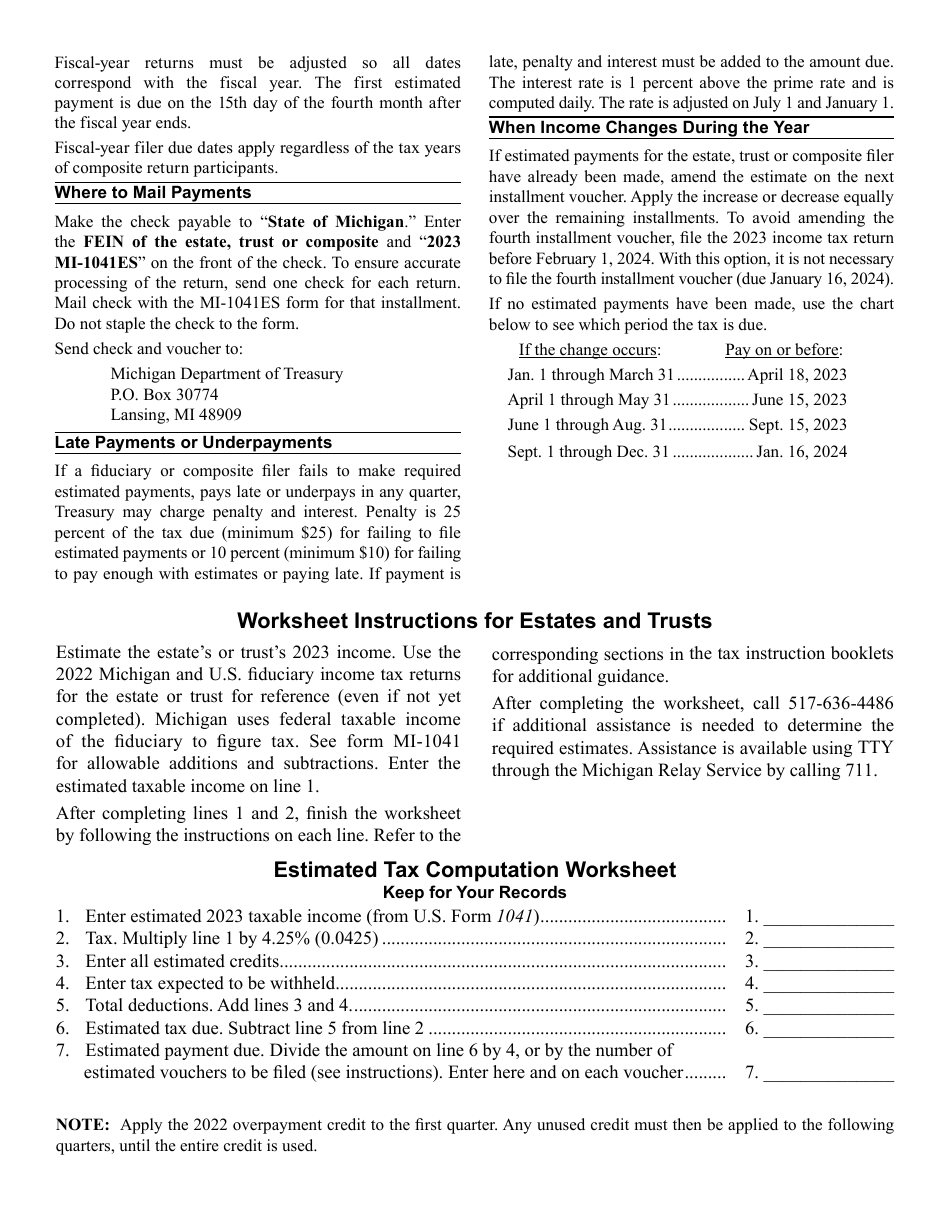

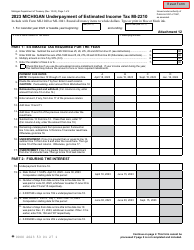

Q: Are there any penalties for late filing of Form MI-1041ES?

A: Yes, there may be penalties for late filing or underpayment of estimated taxes.

Q: Do I need to include payment with Form MI-1041ES?

A: Yes, estimated tax payments should be included with Form MI-1041ES.

Form Details:

- Released on March 1, 2023;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MI-1041ES by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.