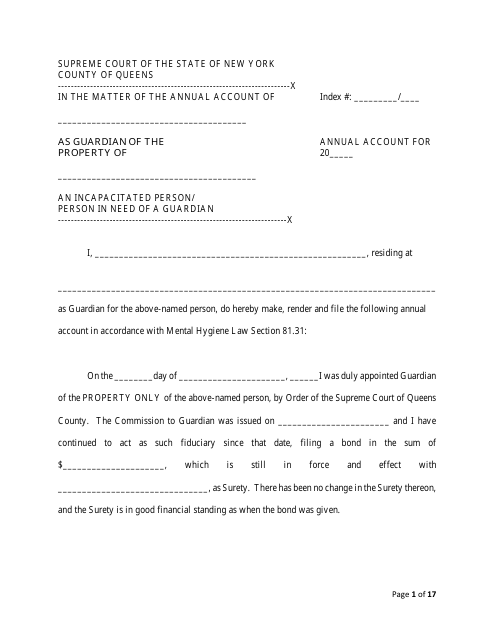

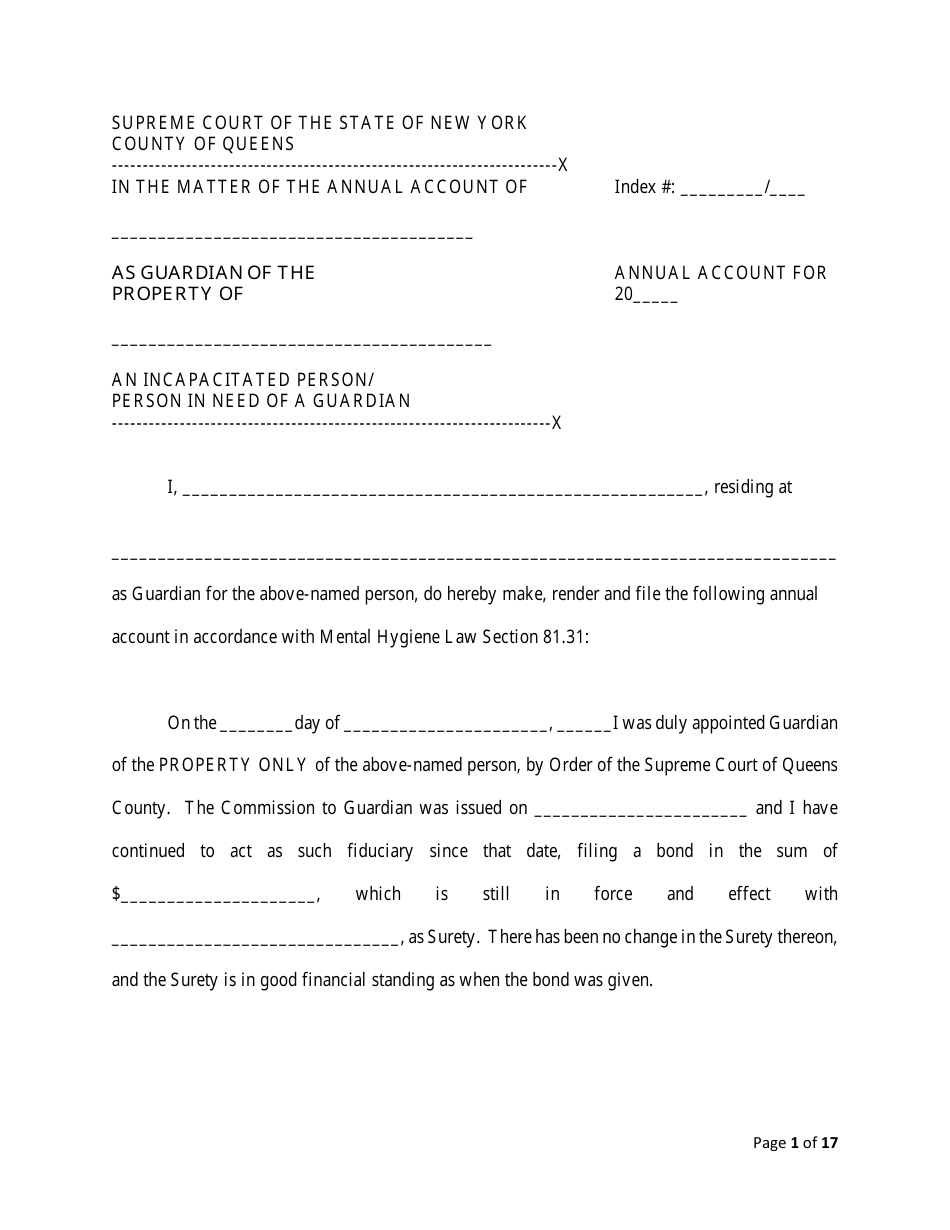

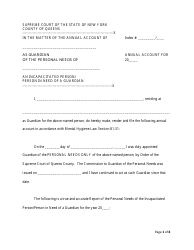

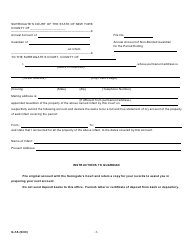

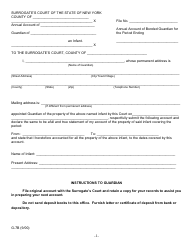

Annual Account - Queens County, New York

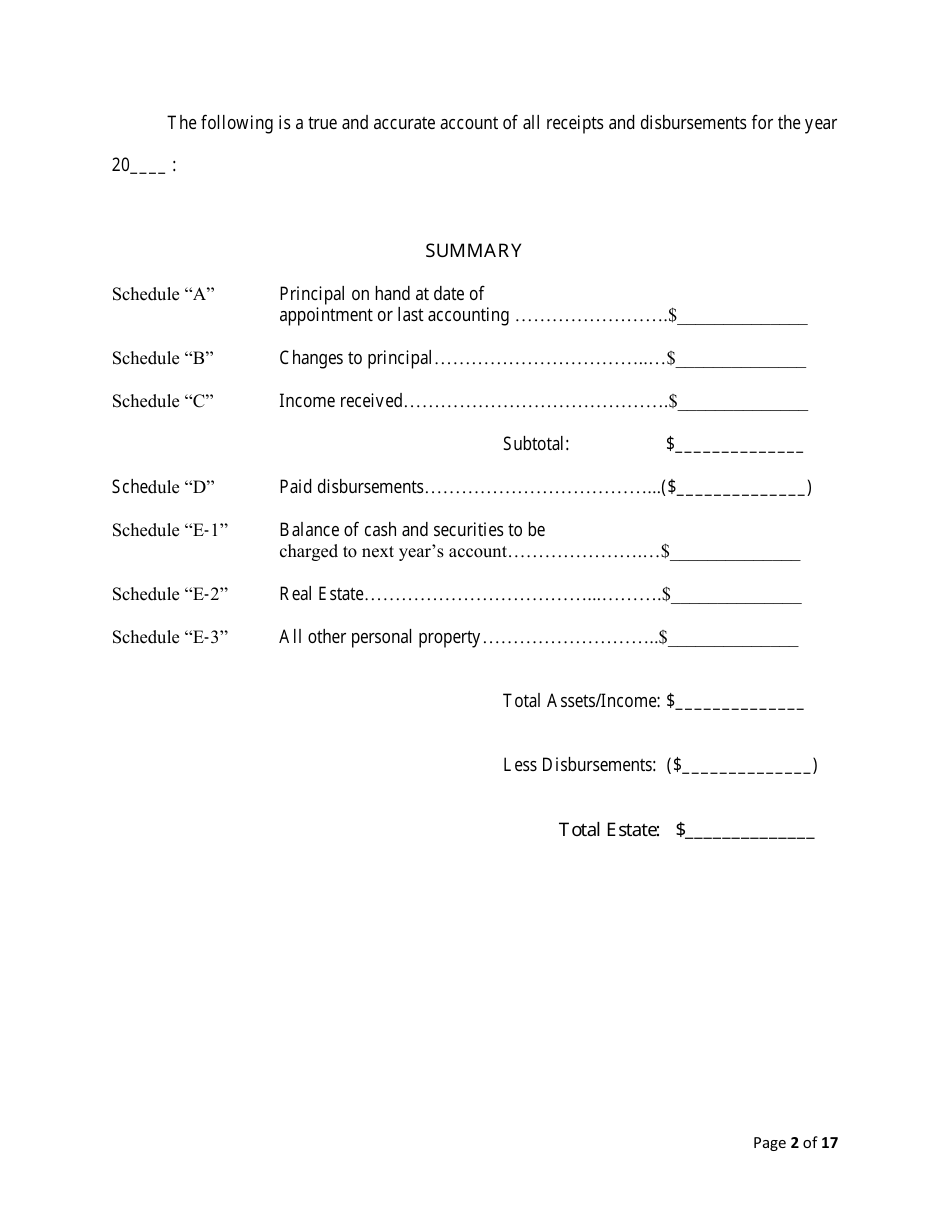

The Annual Account in Queens County, New York is a financial document that is typically filed by the executor or administrator of an estate in probate court. It's used to detail all the financial transactions that have occurred during the administration of the estate.

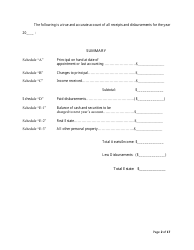

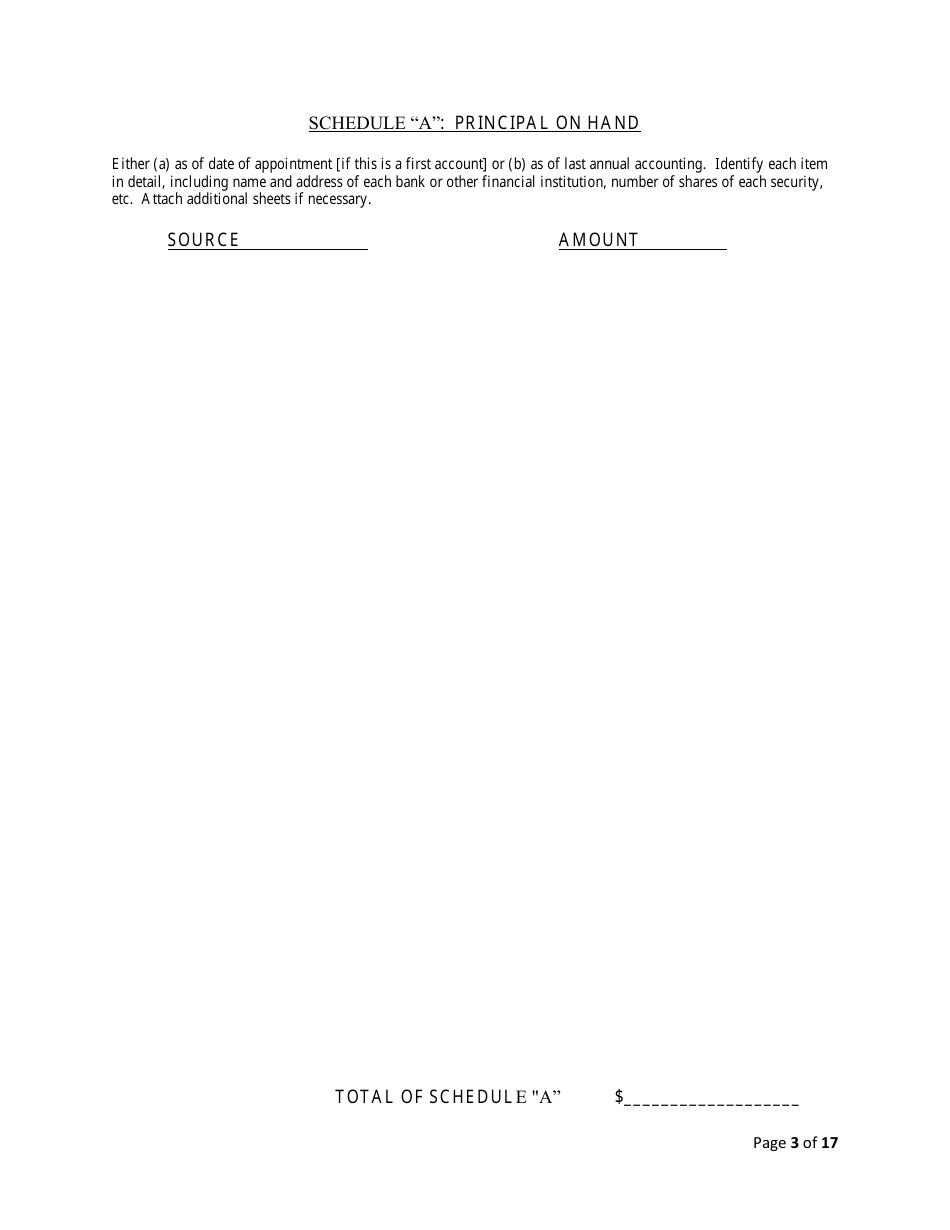

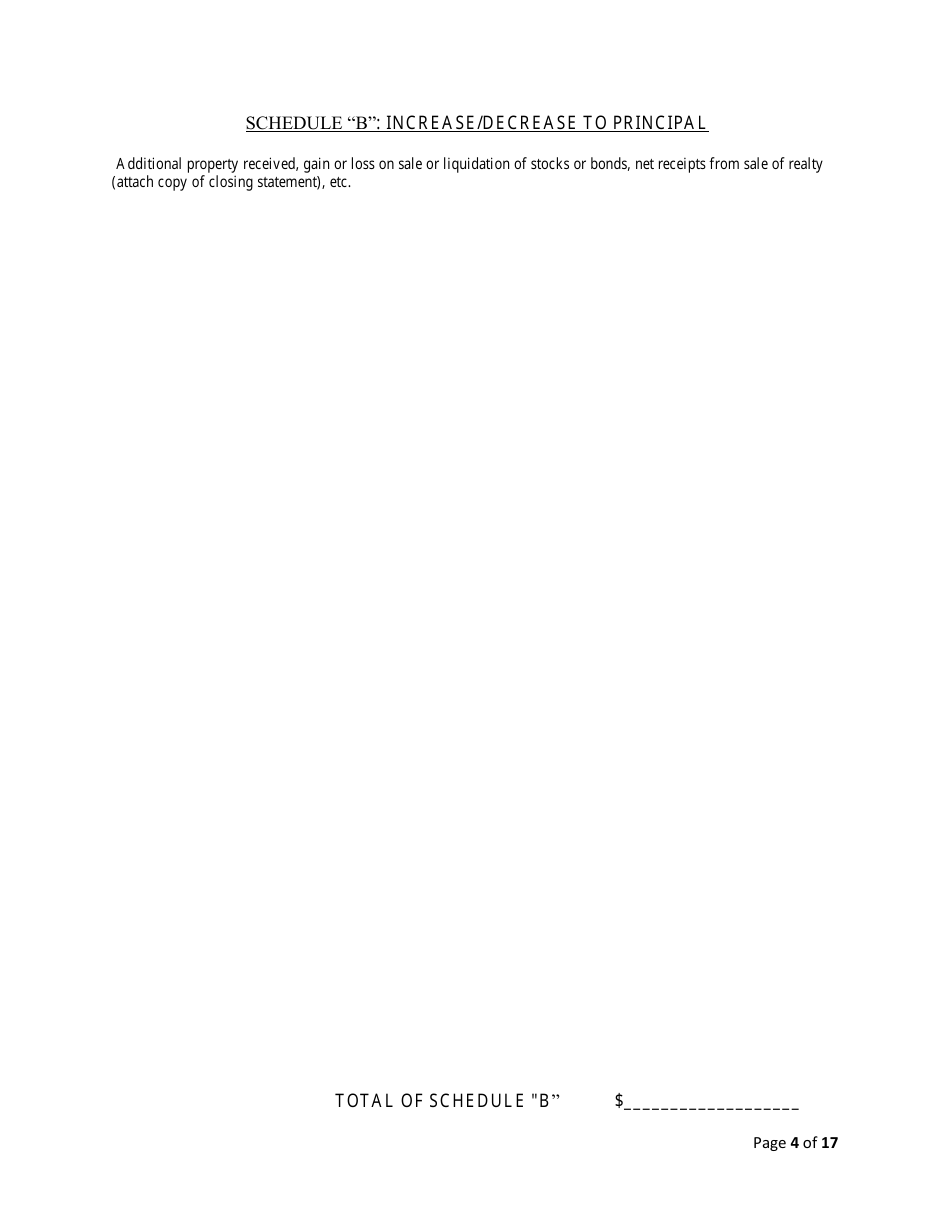

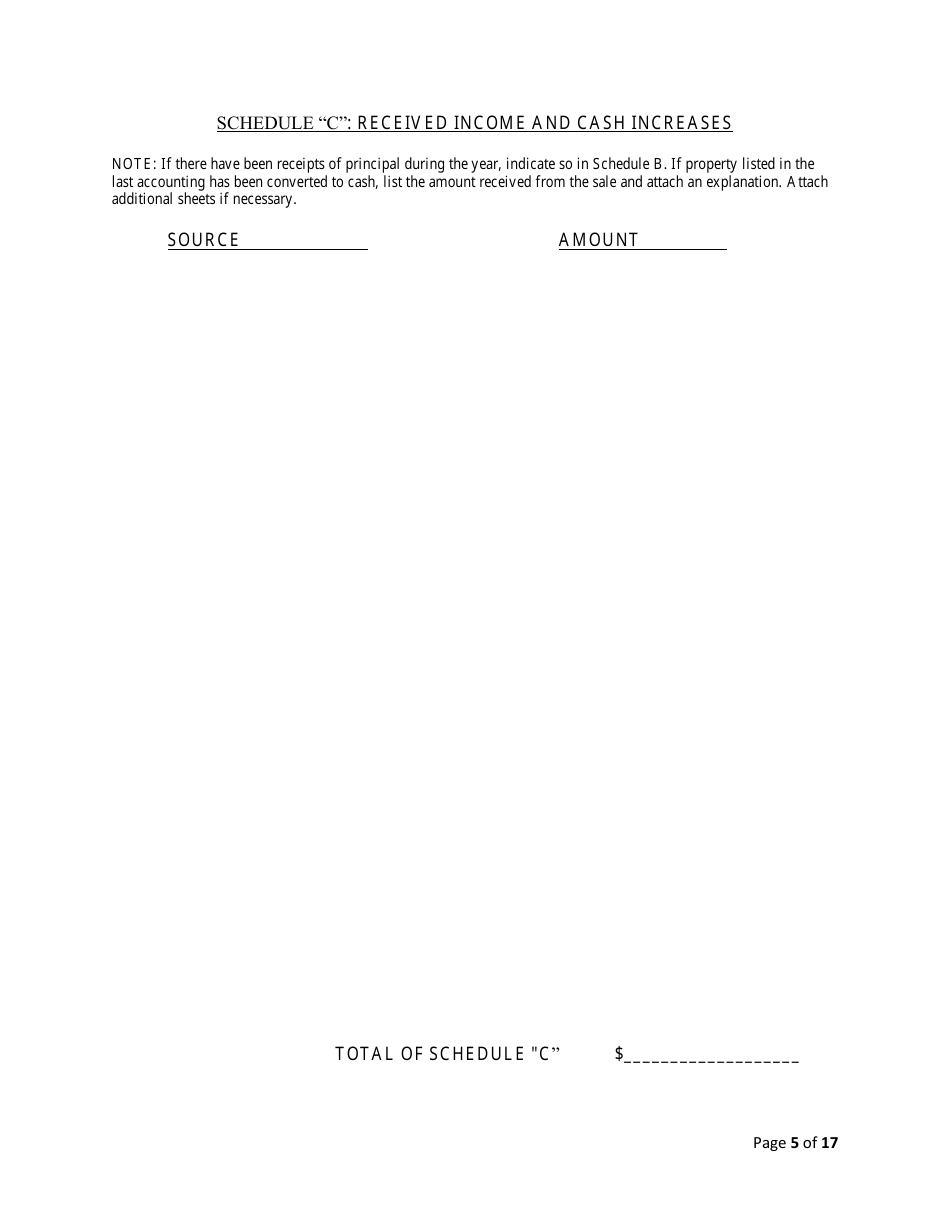

This report includes information such as the assets the estate initially had, any income generated by the estate, expenses incurred like taxes or debts paid, and distributions made to heirs. The annual account is used to ensure the executor or administrator is properly managing the estate according to the decedent's will or according to law if there was no will. Additionally, it assures the court and the beneficiaries that the funds were correctly distributed.

For most estates, an annual account is required until the estate is formally closed with the court. Some exceptions or variations may occur, so it's always good to consult with a legal expert or probate court in Queens County to understand specific requirements.

In Queens County, New York, the annual account is generally filed by the financial officer or accountant of a corporation, non-profit, or estate. Legal representatives such as law firms might also manage this filing for their clients. In case of a personal estate, the executor or administrator of the estate files the annual account with the Surrogate's Court. This document includes a detailed report of all transactions that have taken effect during the year, indicating all the money received and paid out.

FAQ

Q: What is the Annual Account for Queens County in New York?

A: Annual account for Queens County in New York typically refers to the yearly financial report presented by the local government. It may include data for income, expenditures, budget reports, tax details and other financial activities of that year.

Q: Are Annual Accounts for Queens County published every year?

A: Yes, Annual Accounts for Queens County, New York, are typically published every year to outline the financial activities for the local government during that fiscal year.

Q: What kind of information can I find in the Annual Account for Queens County?

A: In the Annual Account for Queens County, you can expect to find data related to income, expenditures, tax revenues, budget summary and execution, and more, which provides a clear financial snapshot of the Queens County for that year.

Q: Who prepares the Annual Account for Queens County, New York?

A: The Annual Account for Queens County, New York, is prepared by the Department of Finance, which is responsible for financial reporting and transparency in the county.

Q: Who uses the Annual Account for Queens County, New York?

A: The Annual Account for Queens County, New York, is used by various stakeholders like county officials, regulatory bodies, taxpayers, investors, and financial analysts.

Q: Is the Annual Account for Queens County publicly available?

A: Yes, the Annual Account for Queens County, New York, is a public document and is usually made available for public viewing through the local government's website or at the County Clerk's office.