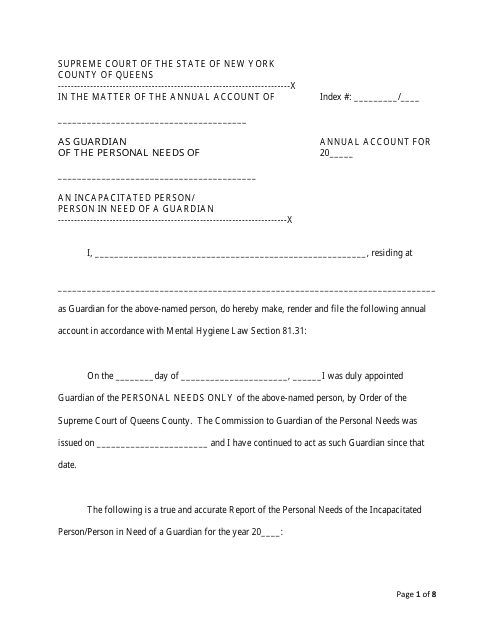

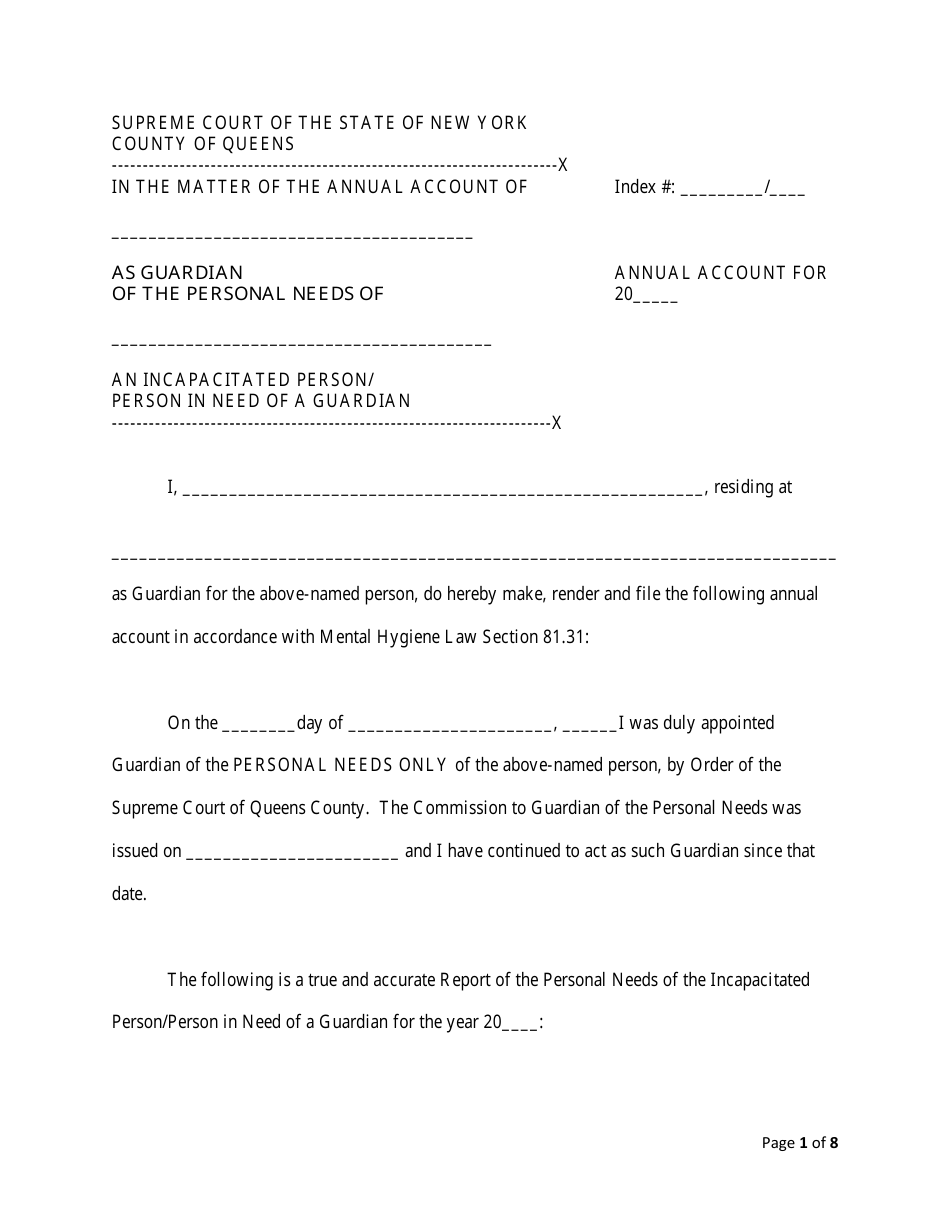

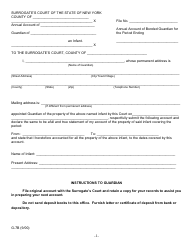

Annual Account - New York

Annual Account is a legal document that was released by the New York Supreme Court - a government authority operating within New York.

FAQ

Q: What is an Annual Account?

A: An Annual Account is a financial document that summarizes the financial transactions and activities of a company or organization for a specific year.

Q: Why is an Annual Account important?

A: An Annual Account provides crucial information about the financial health and performance of a company or organization. It helps stakeholders, such as shareholders, investors, and creditors, assess the company's profitability, liquidity, and solvency.

Q: Who prepares an Annual Account?

A: An Annual Account is typically prepared by accountants or financial professionals who are responsible for maintaining the financial records of a company or organization.

Q: What information is included in an Annual Account?

A: An Annual Account usually includes a balance sheet, income statement, cash flow statement, and notes to the financial statements. It also provides details about the company's assets, liabilities, revenues, expenses, and net income.

Q: Is an Annual Account required by law?

A: In many countries, including the United States, companies are required by law to prepare and file Annual Accounts with government agencies, such as the Securities and Exchange Commission (SEC) or the Internal Revenue Service (IRS).

Form Details:

- The latest edition currently provided by the New York Supreme Court;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York Supreme Court.