This version of the form is not currently in use and is provided for reference only. Download this version of

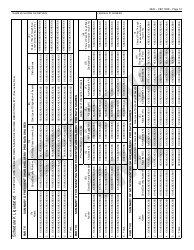

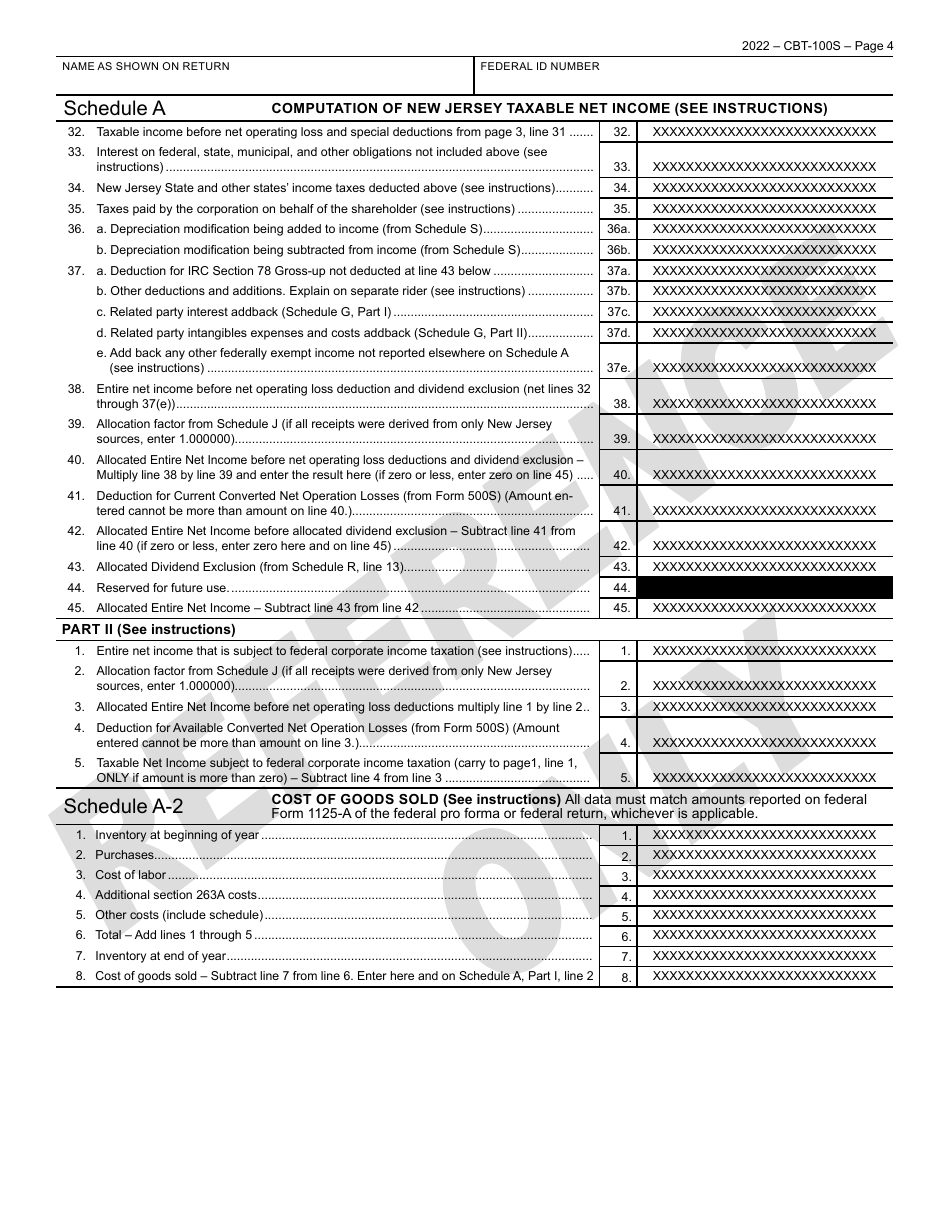

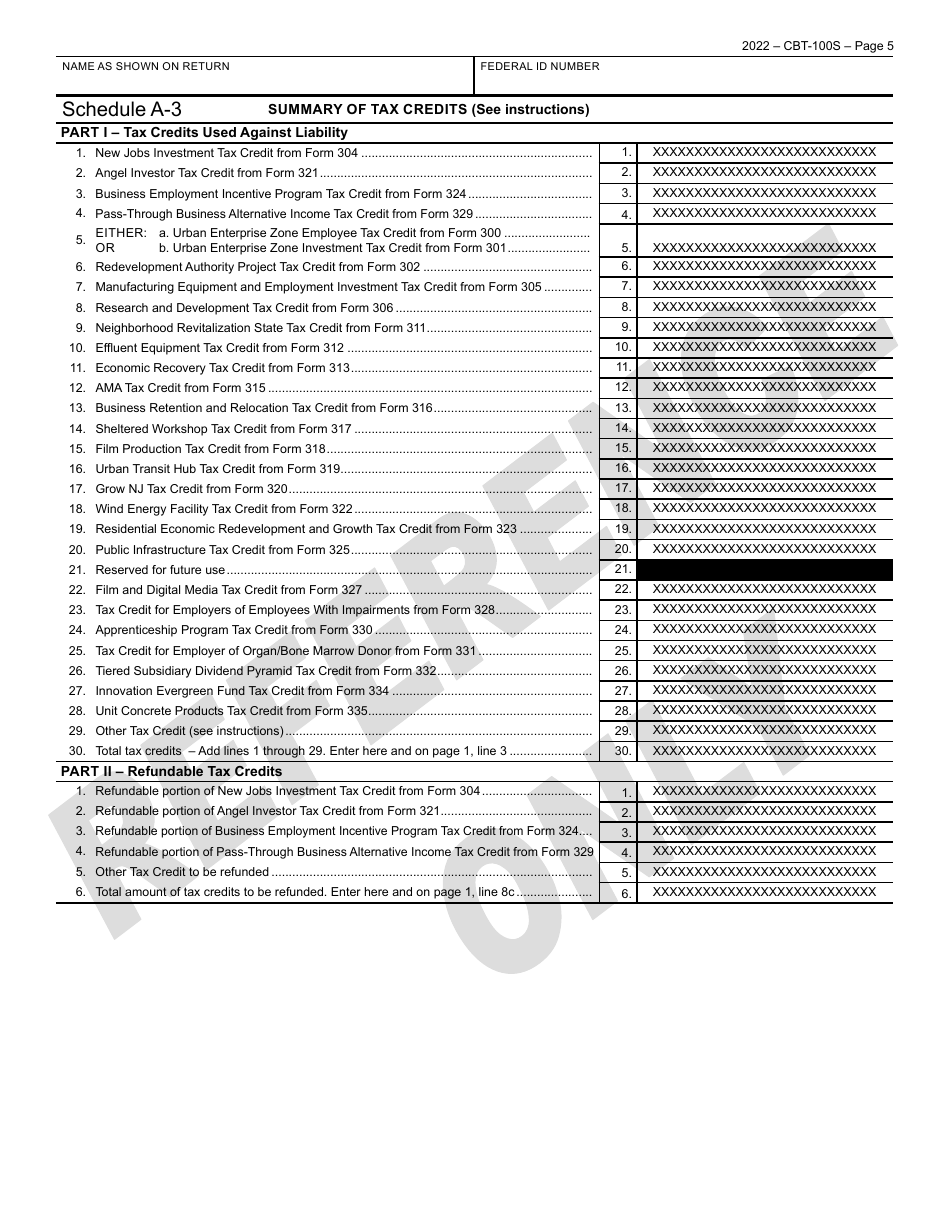

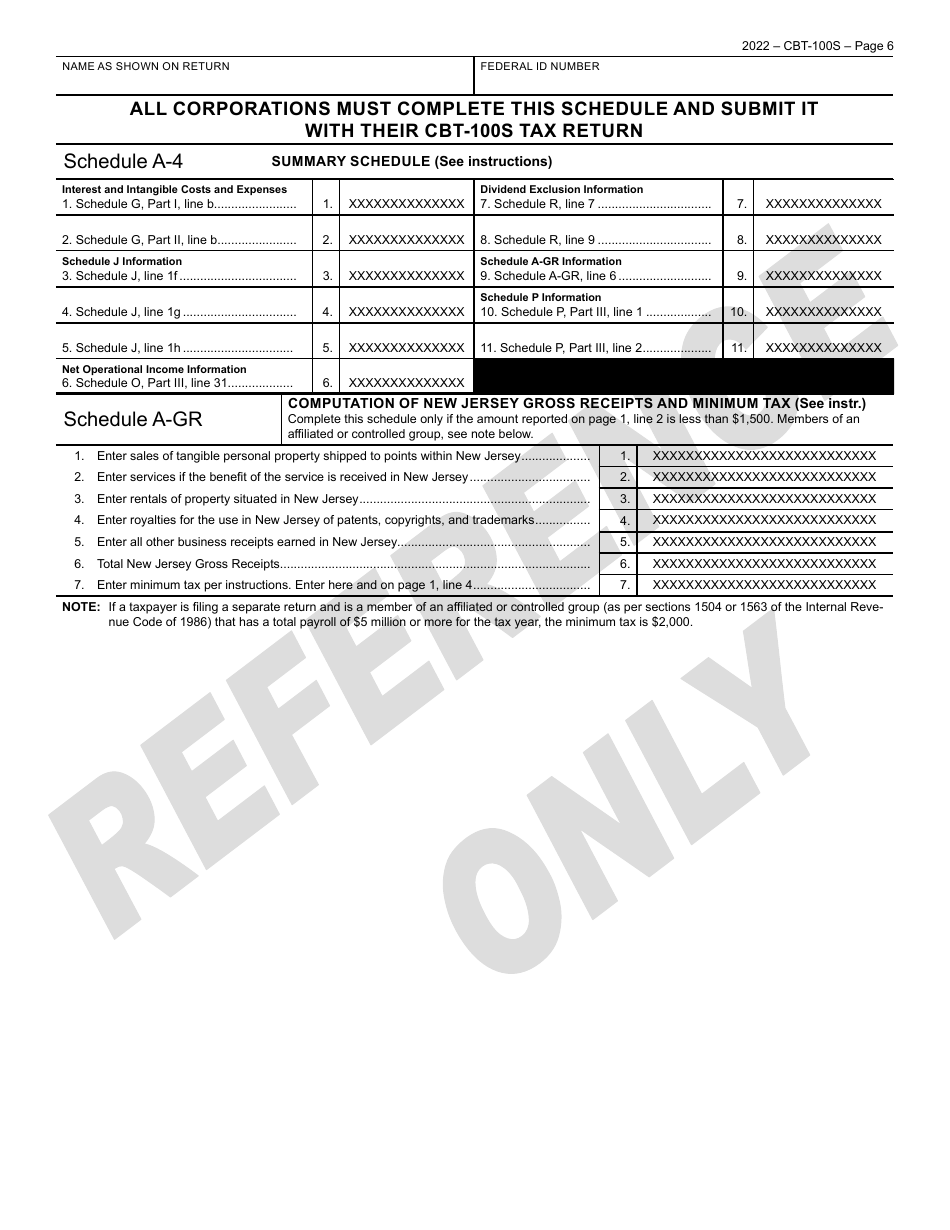

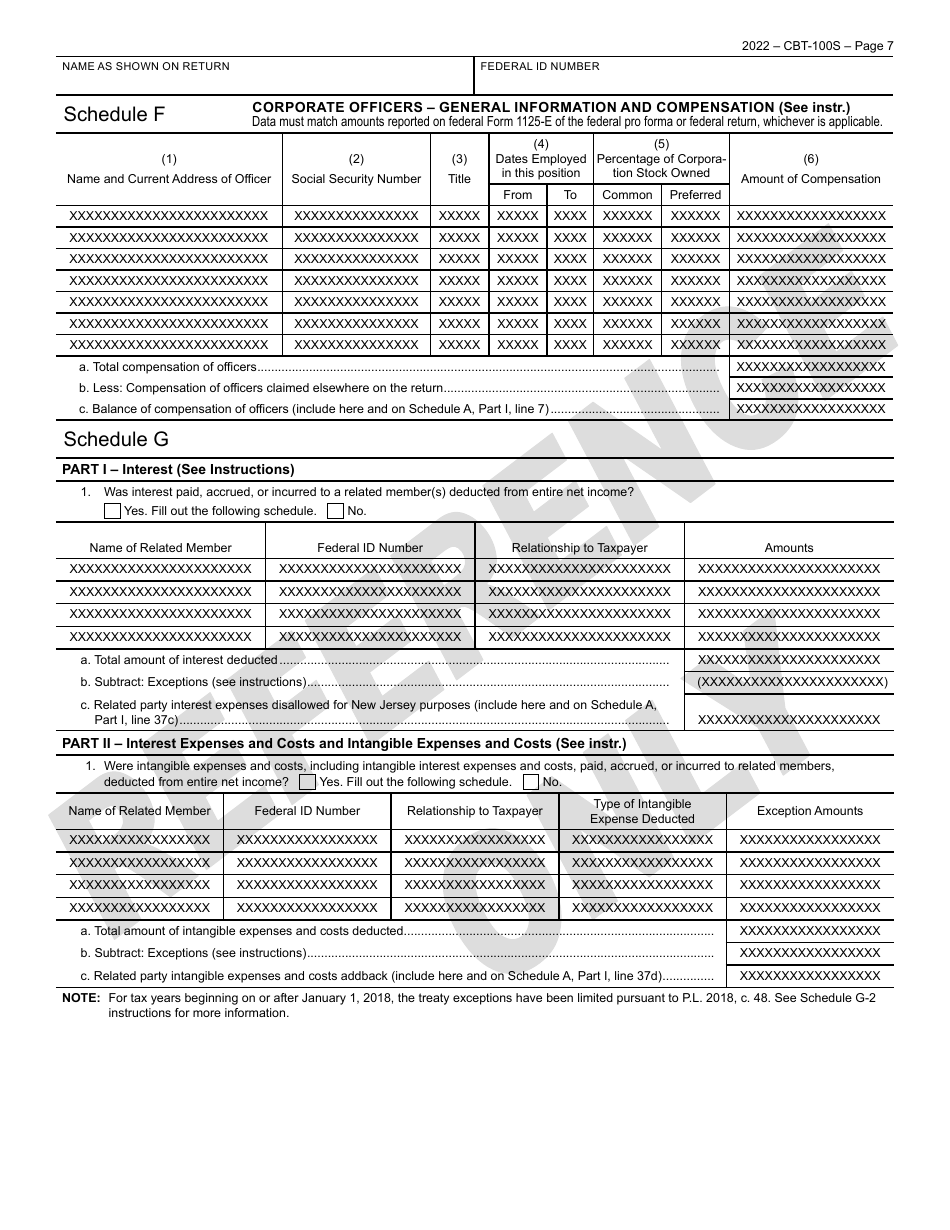

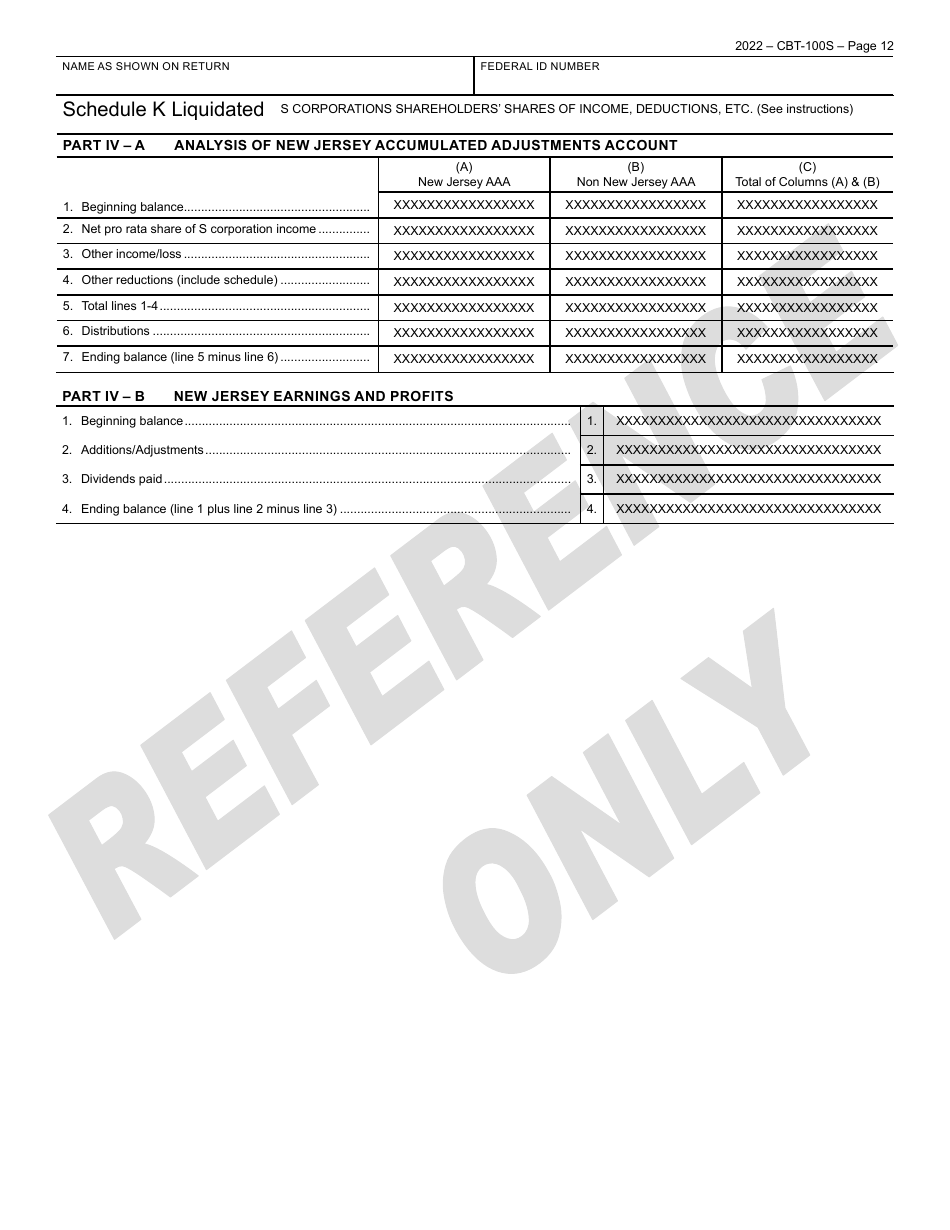

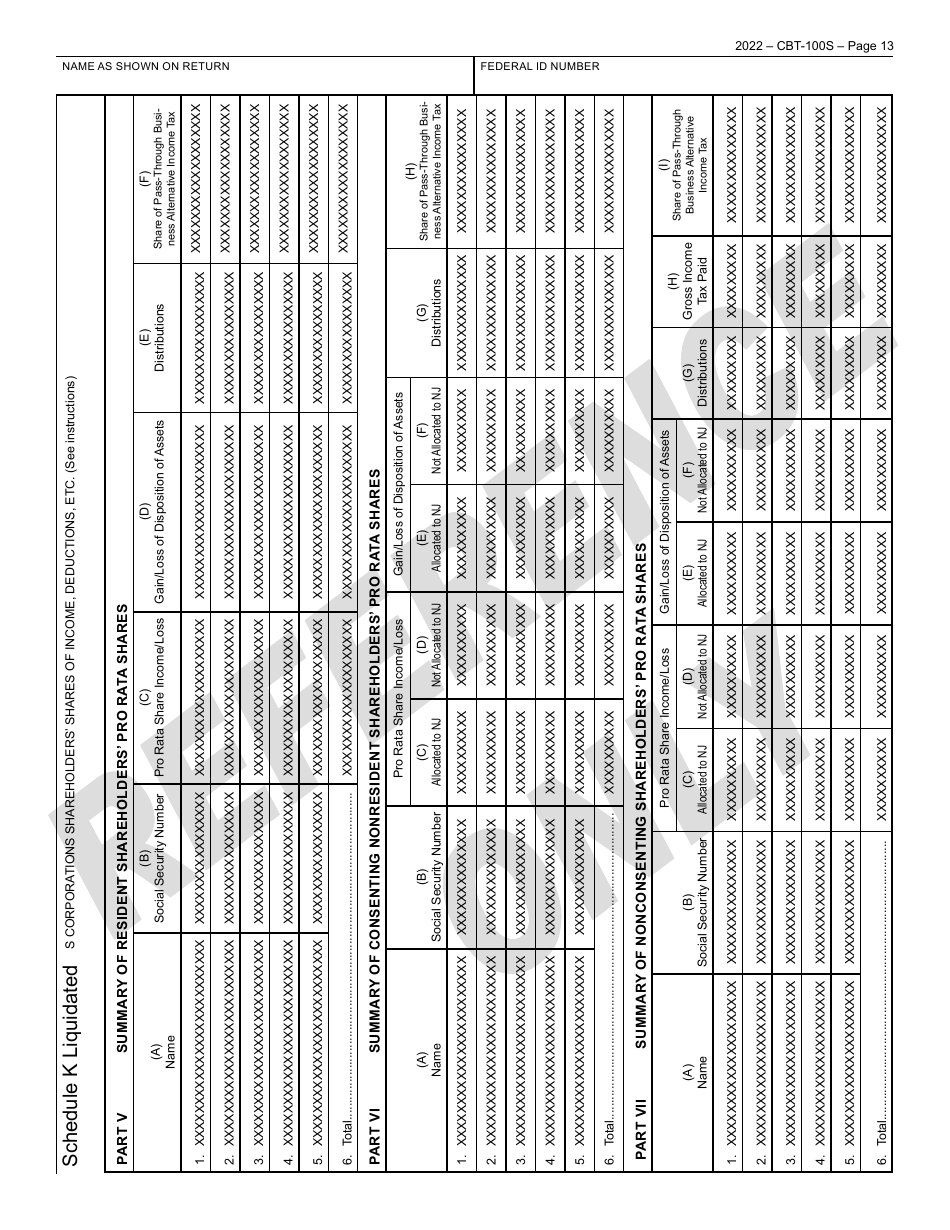

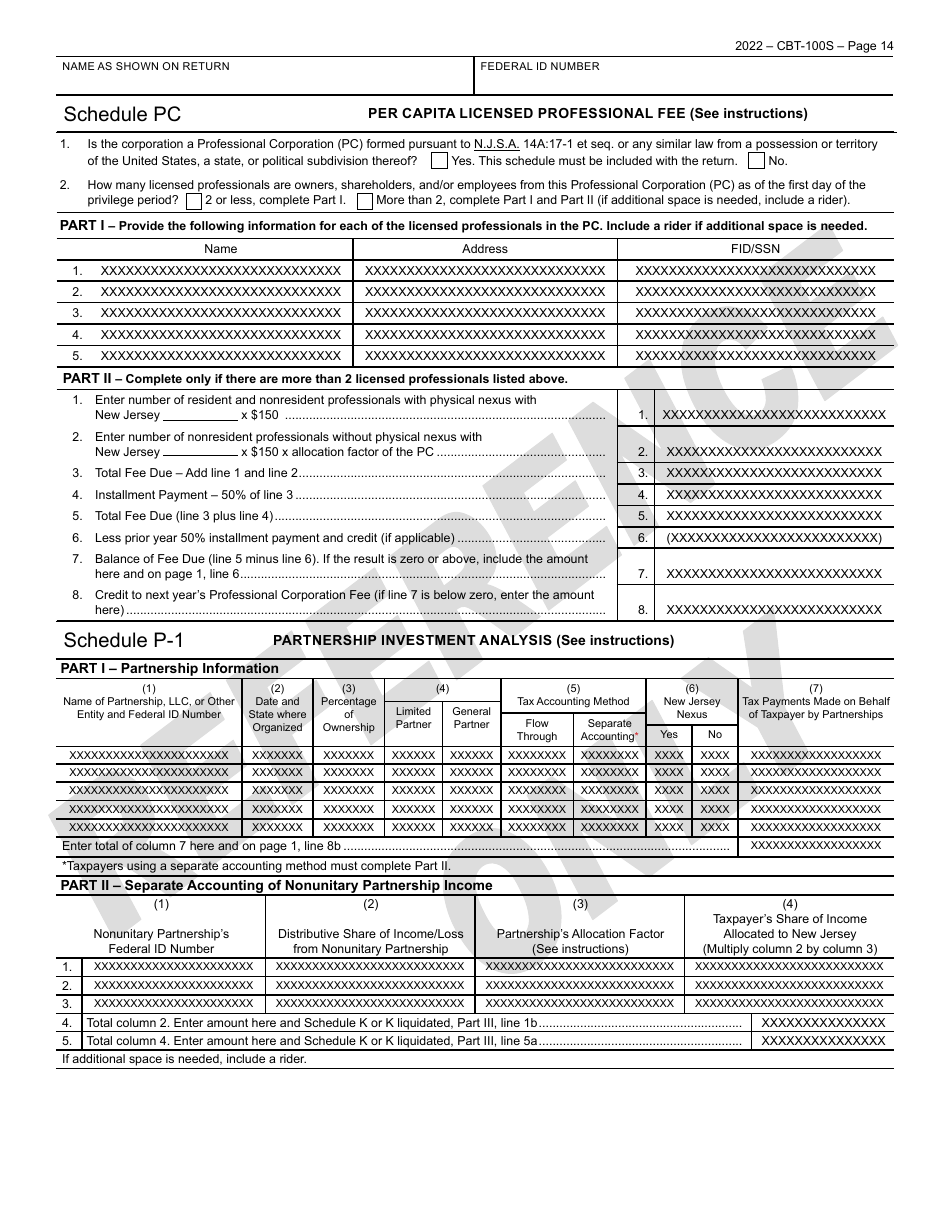

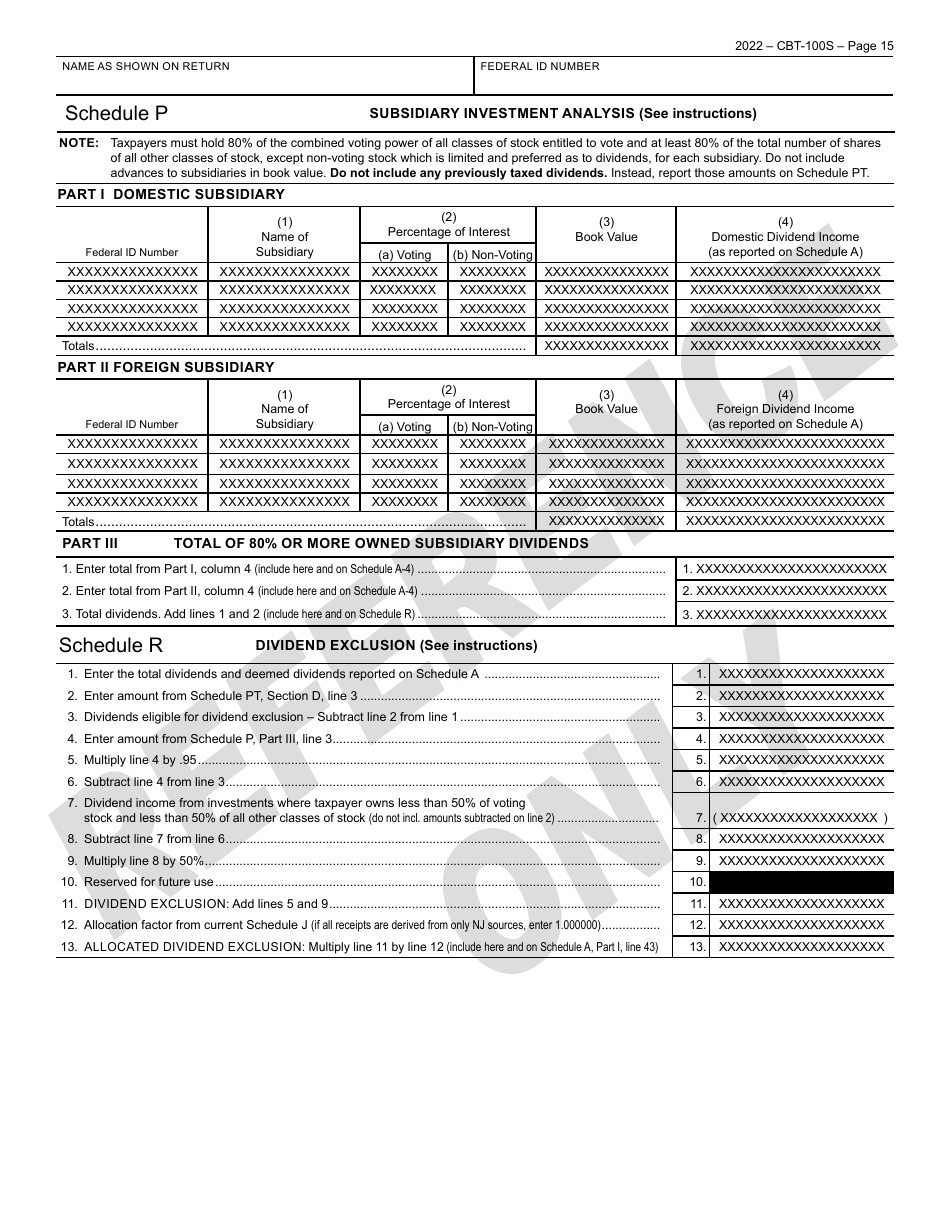

Form CBT-100S

for the current year.

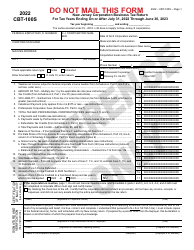

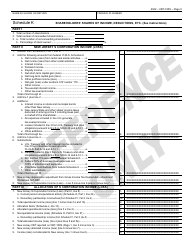

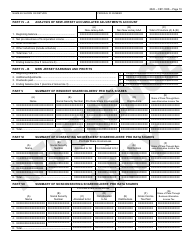

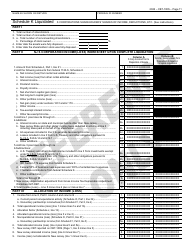

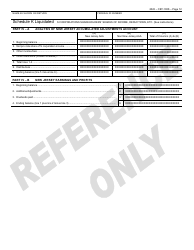

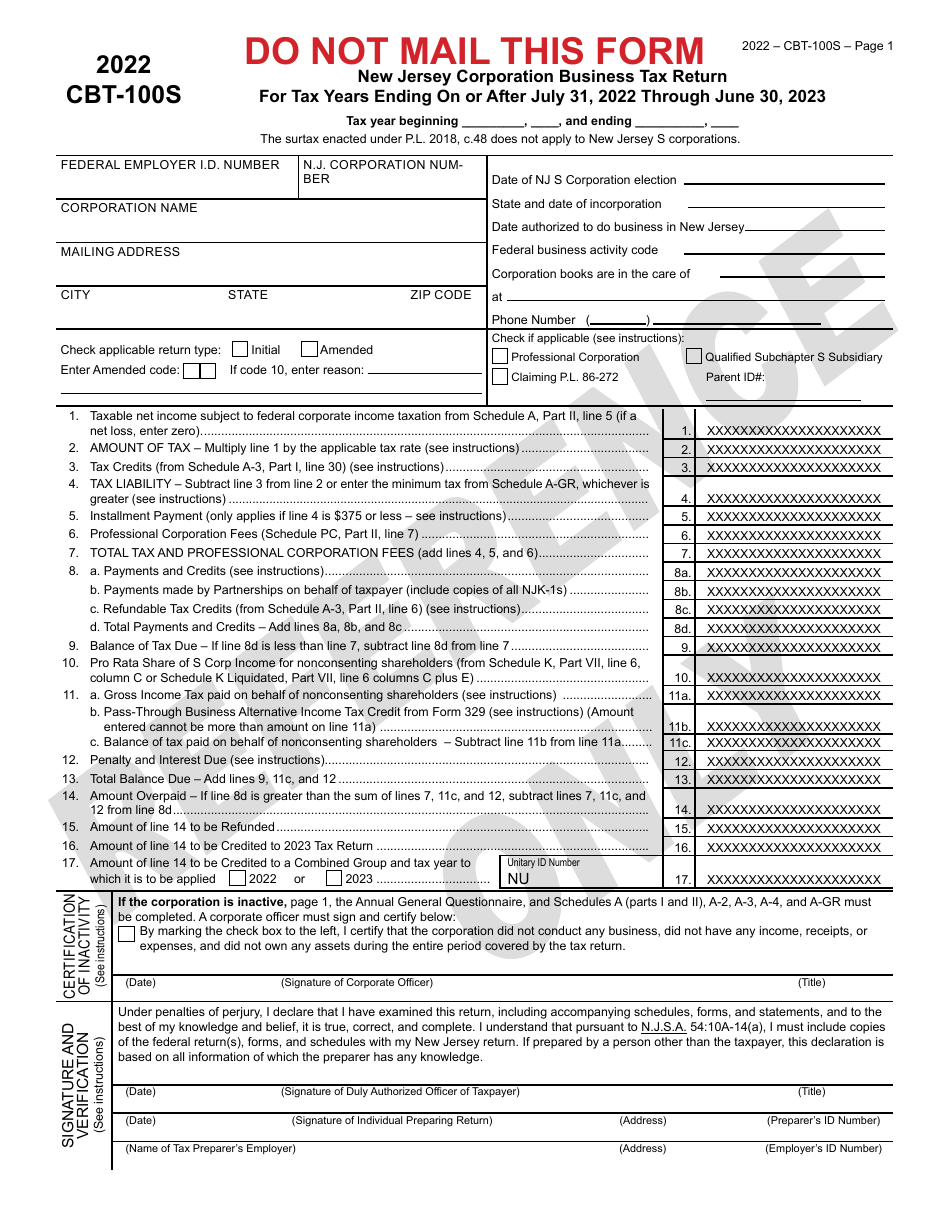

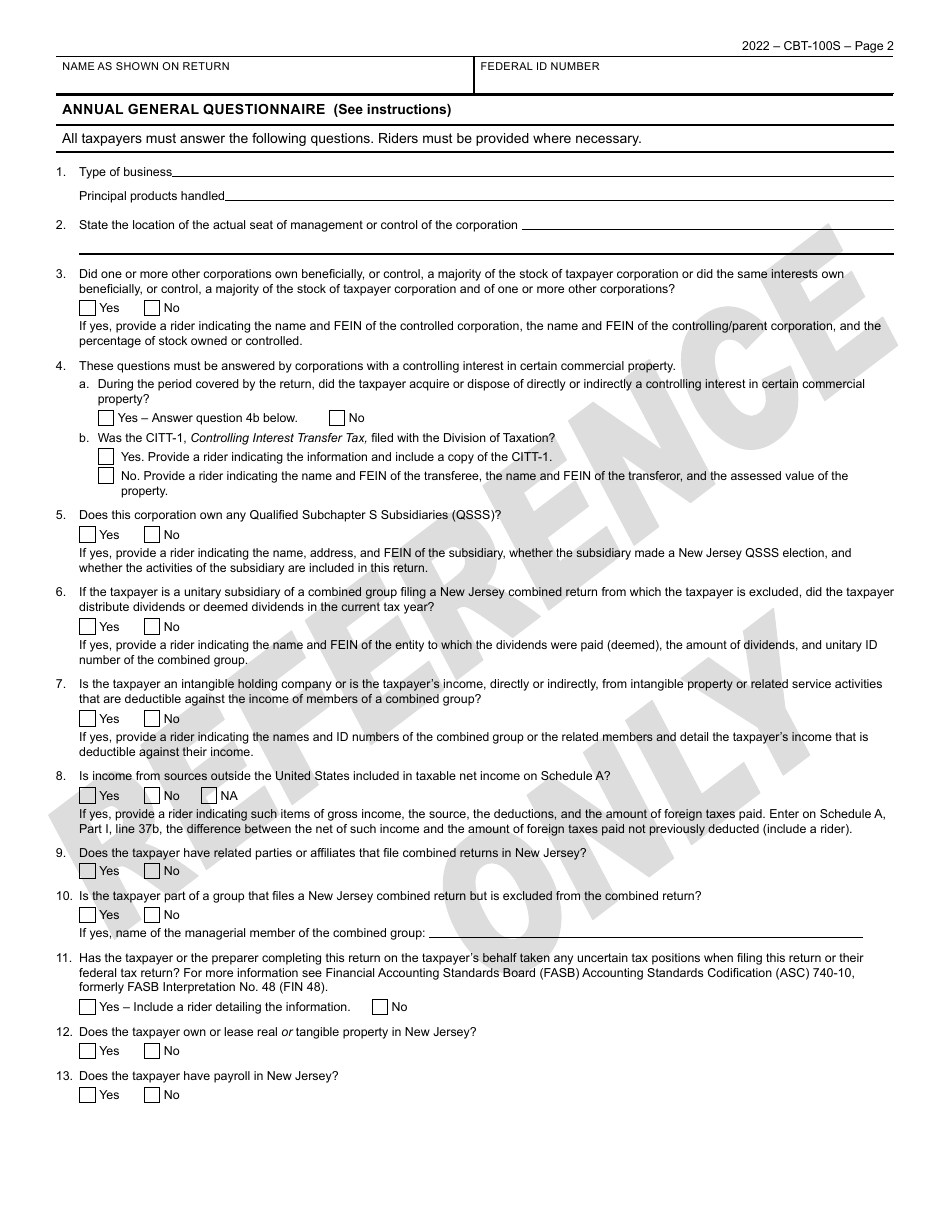

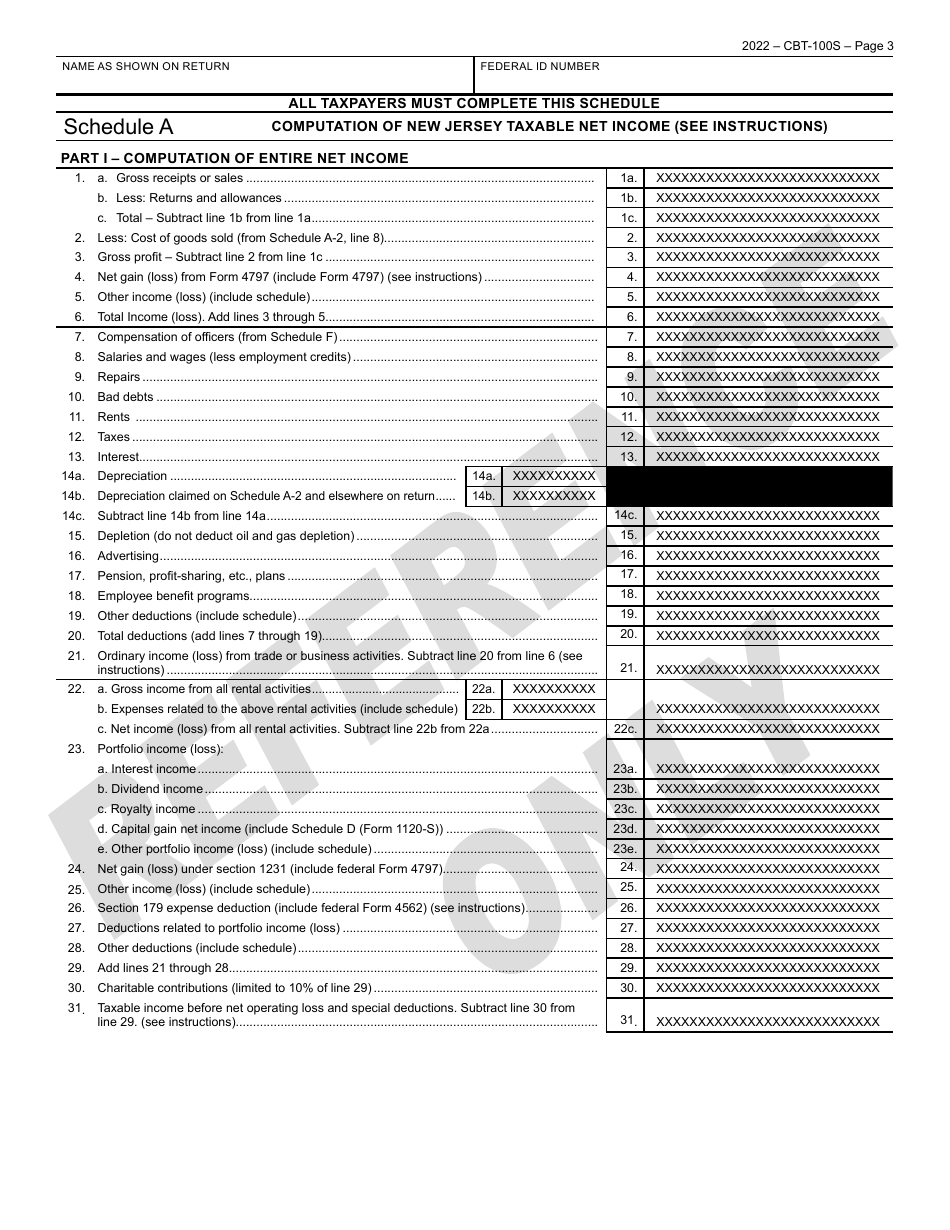

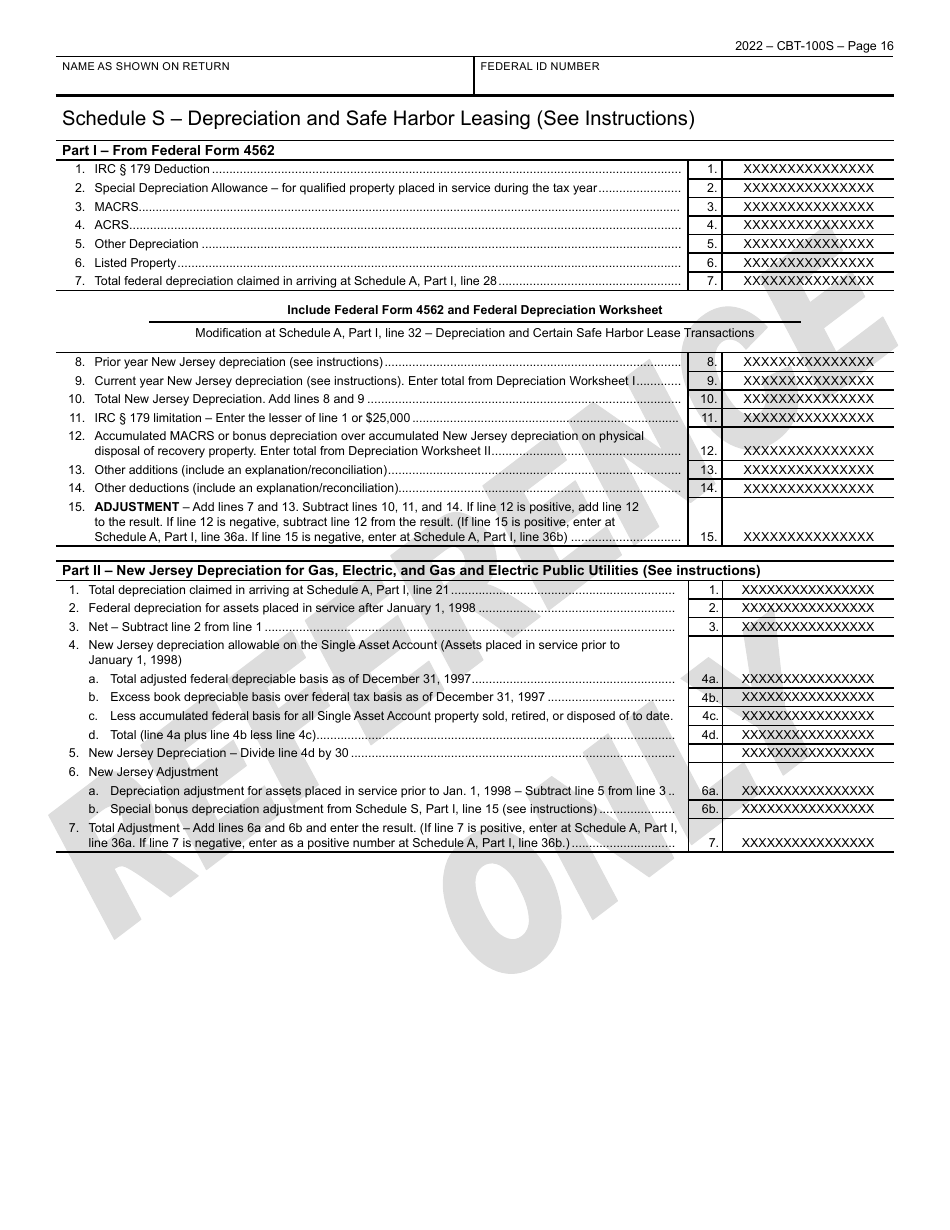

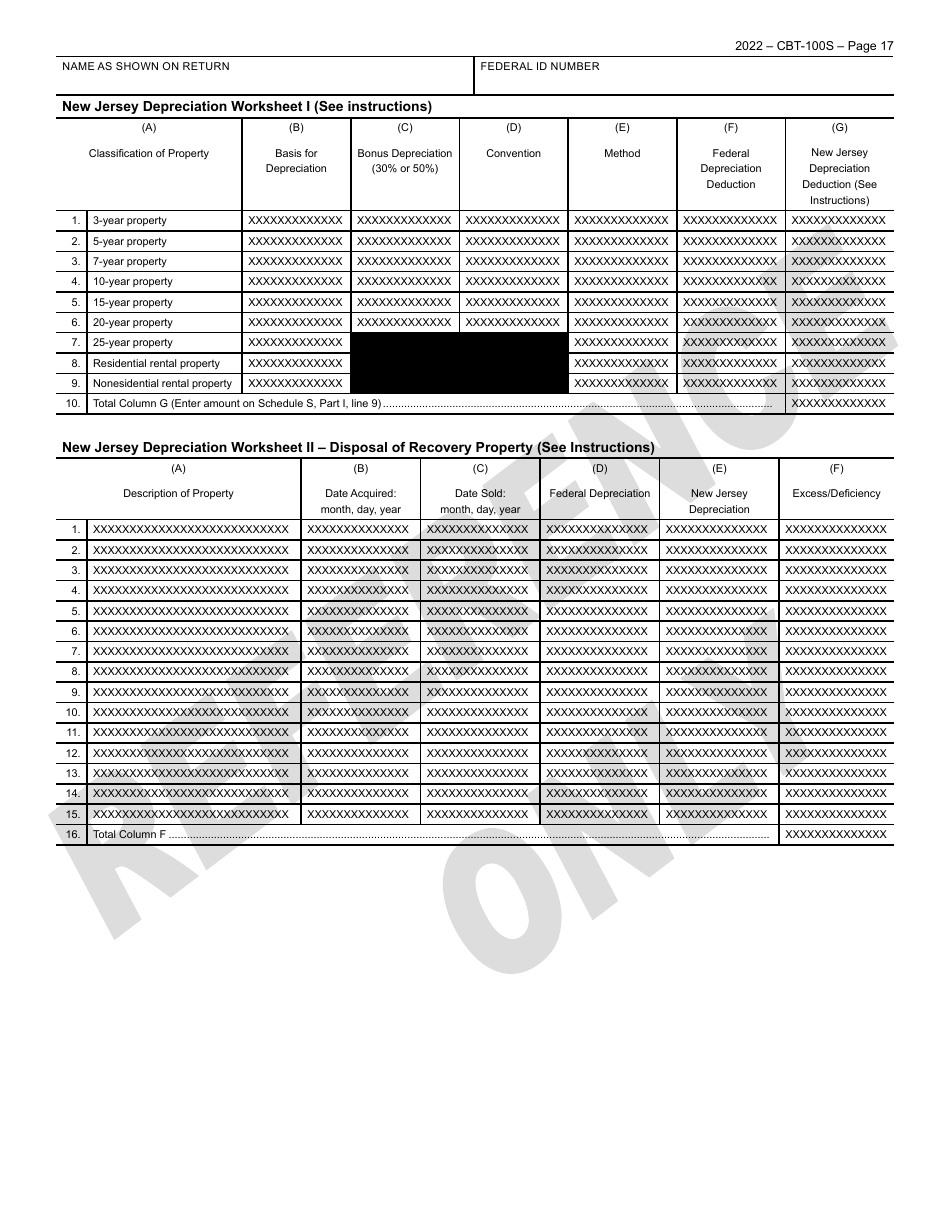

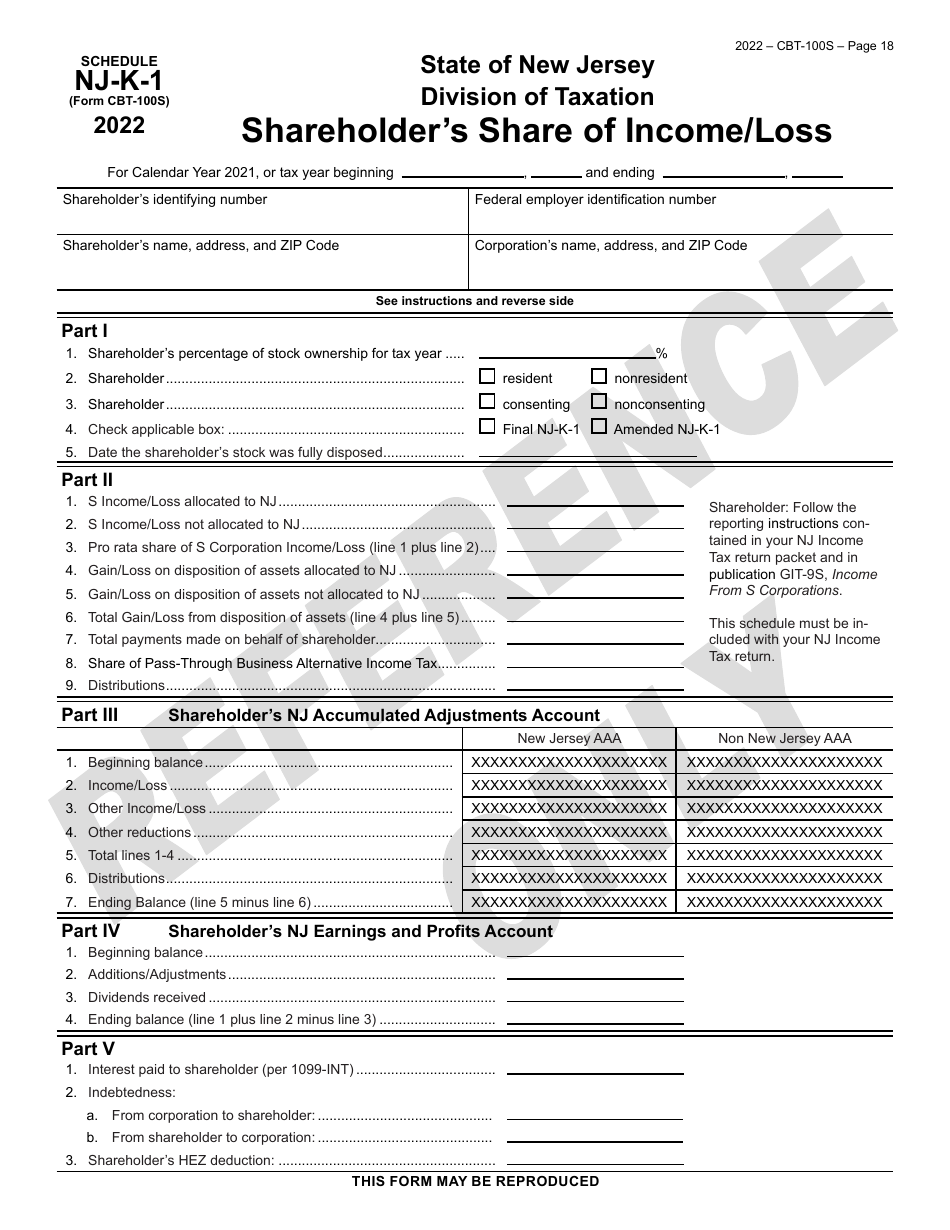

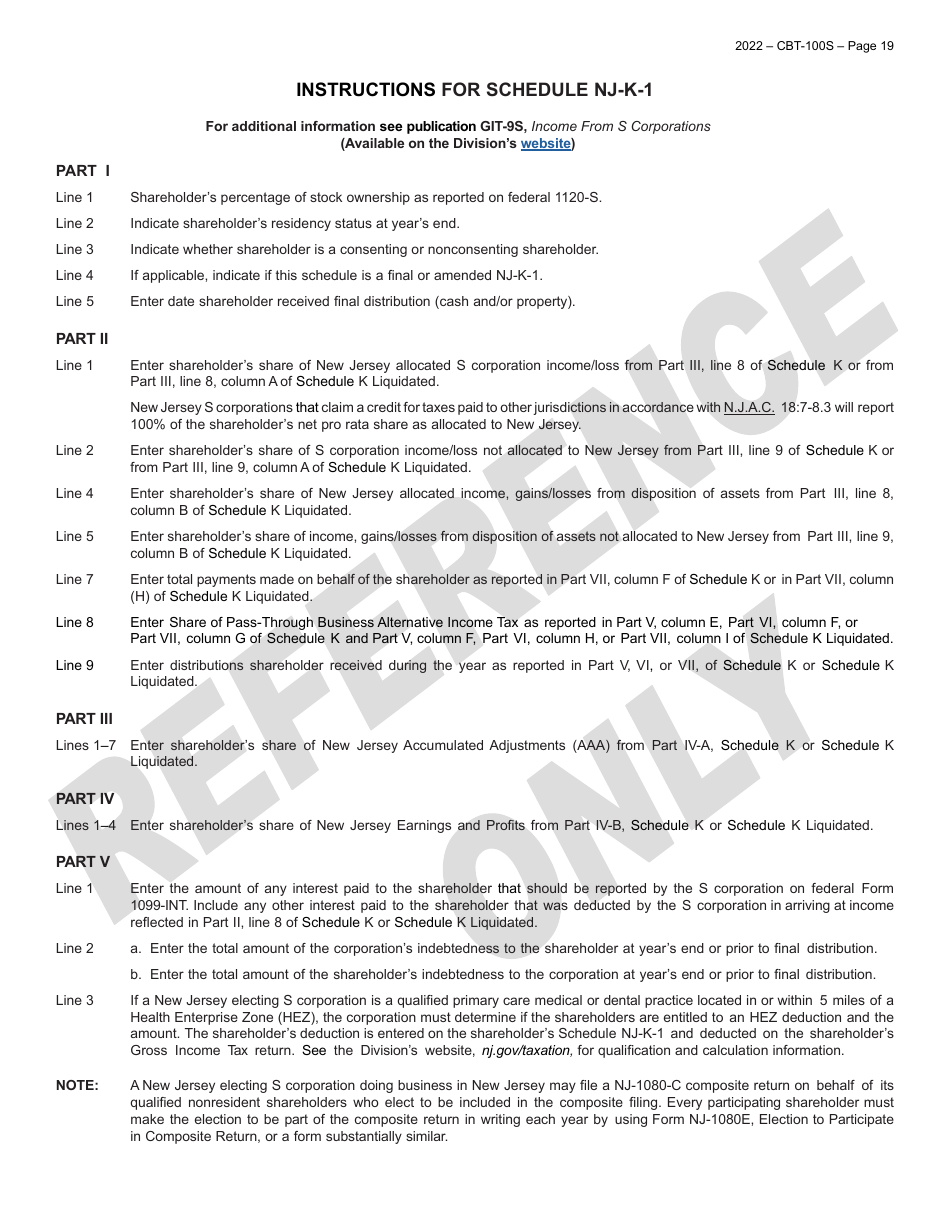

Form CBT-100S New Jersey Corporation Business Tax Return - Sample - New Jersey

What Is Form CBT-100S?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CBT-100S?

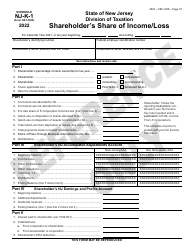

A: Form CBT-100S is the New Jersey Corporation Business Tax Return for S Corporations.

Q: Who needs to file Form CBT-100S?

A: S Corporations in New Jersey.

Q: What is the purpose of Form CBT-100S?

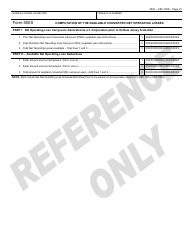

A: The purpose of Form CBT-100S is to report the income, deductions, and tax liability of S Corporations in New Jersey.

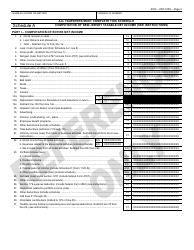

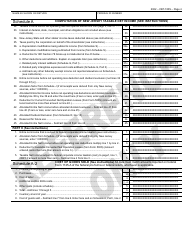

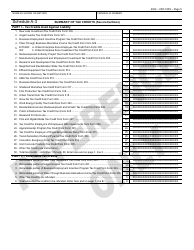

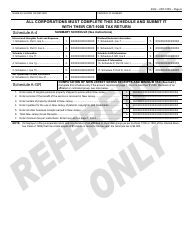

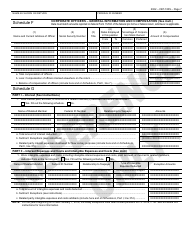

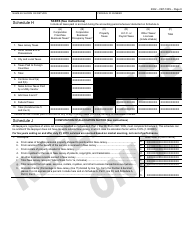

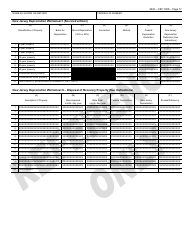

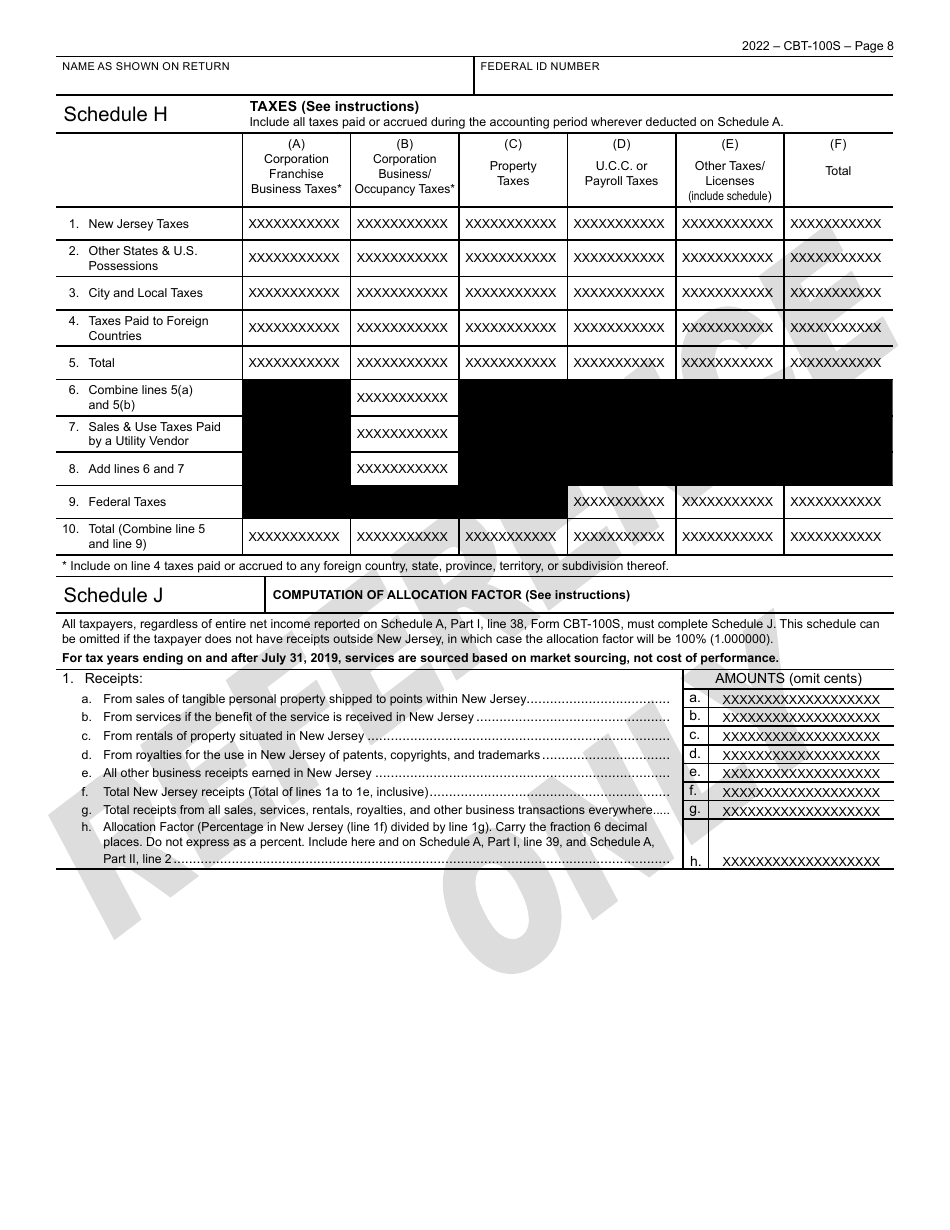

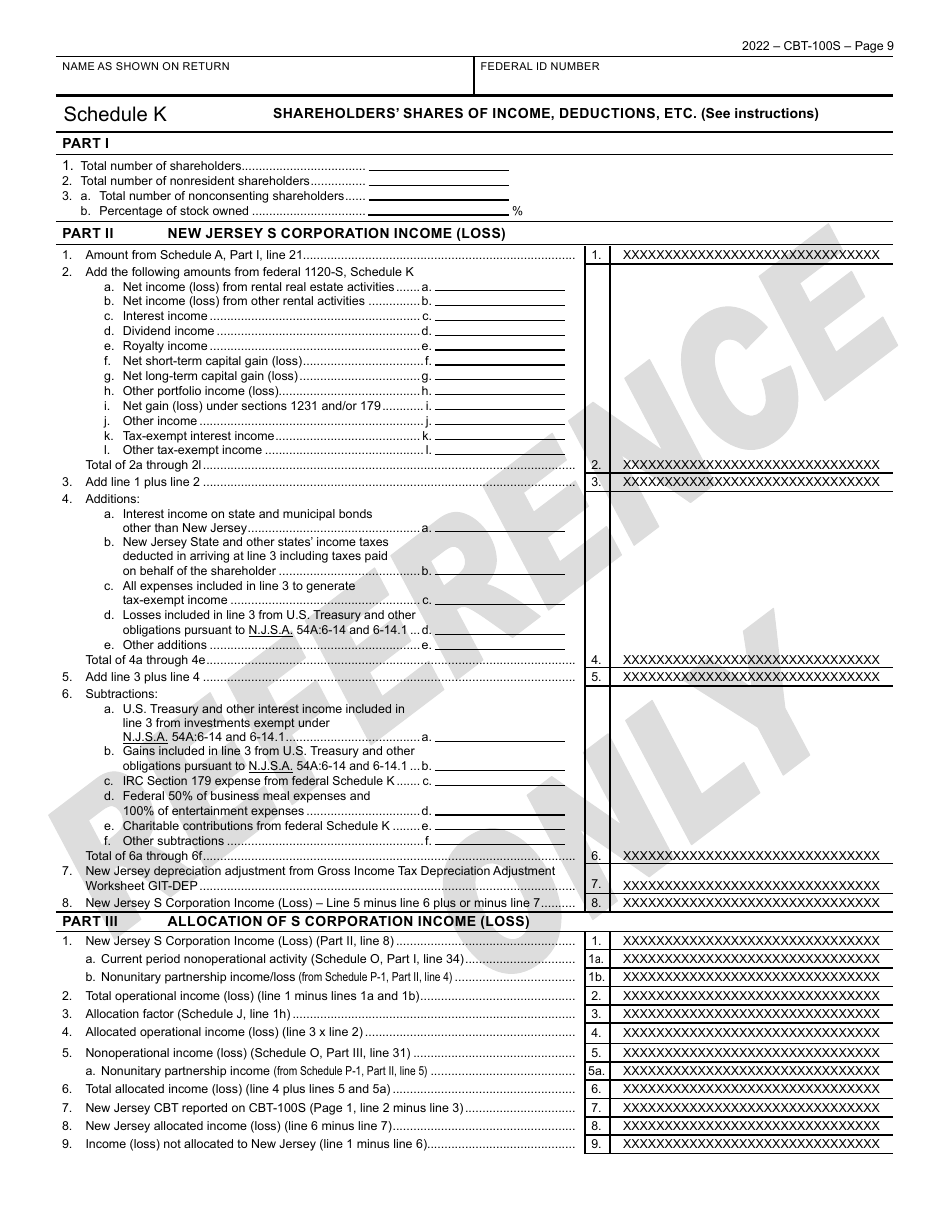

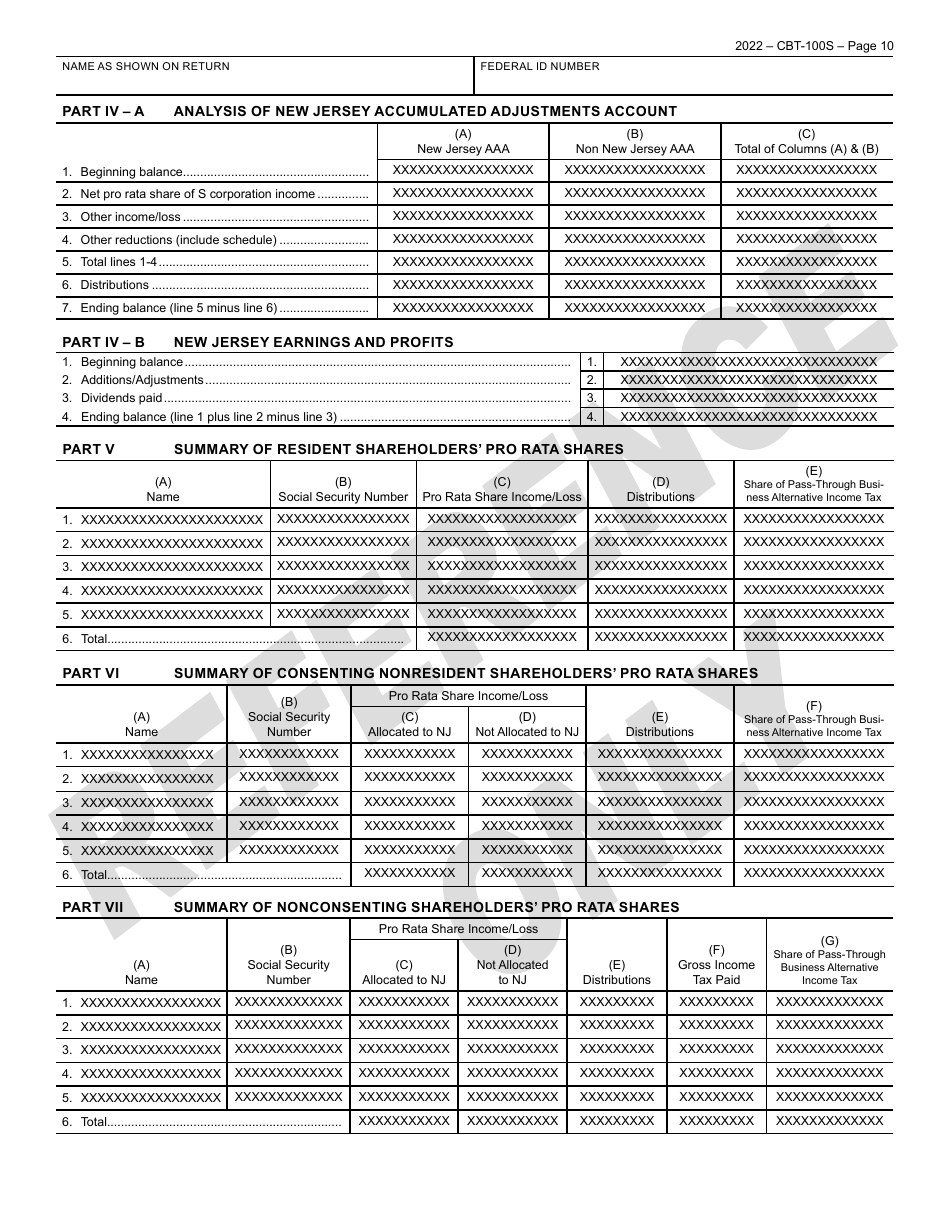

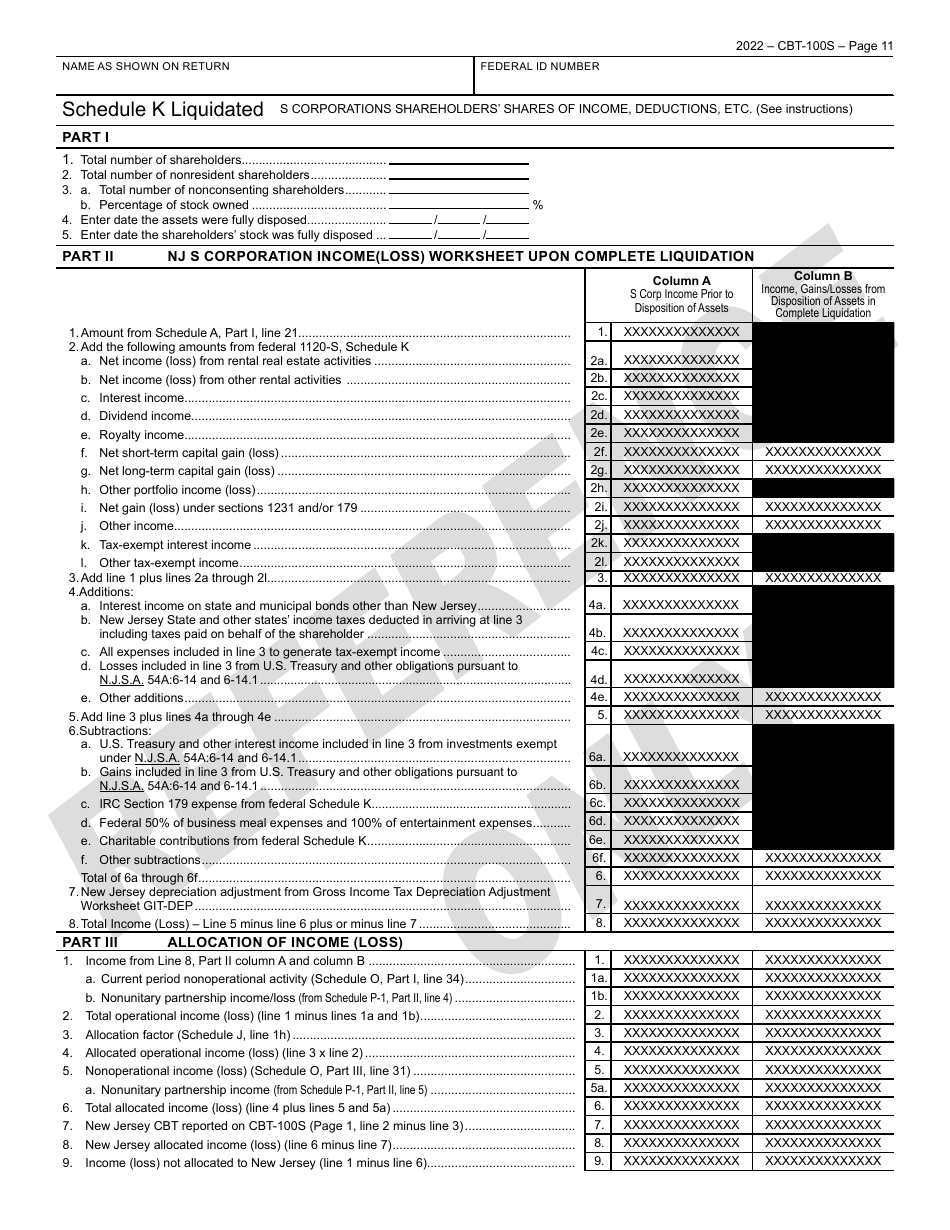

Q: What information is required on Form CBT-100S?

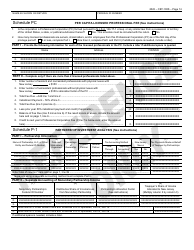

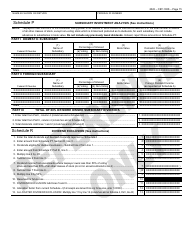

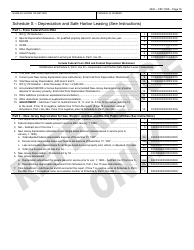

A: Form CBT-100S requires information such as federal tax return data, income and deductions from New Jersey sources, and details about shareholders and their allocations.

Q: When is the deadline to file Form CBT-100S?

A: The deadline to file Form CBT-100S in New Jersey is on or before the 15th day of the 4th month following the close of the fiscal year.

Q: Can Form CBT-100S be filed electronically?

A: Yes, New Jersey allows electronic filing of Form CBT-100S.

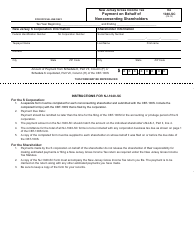

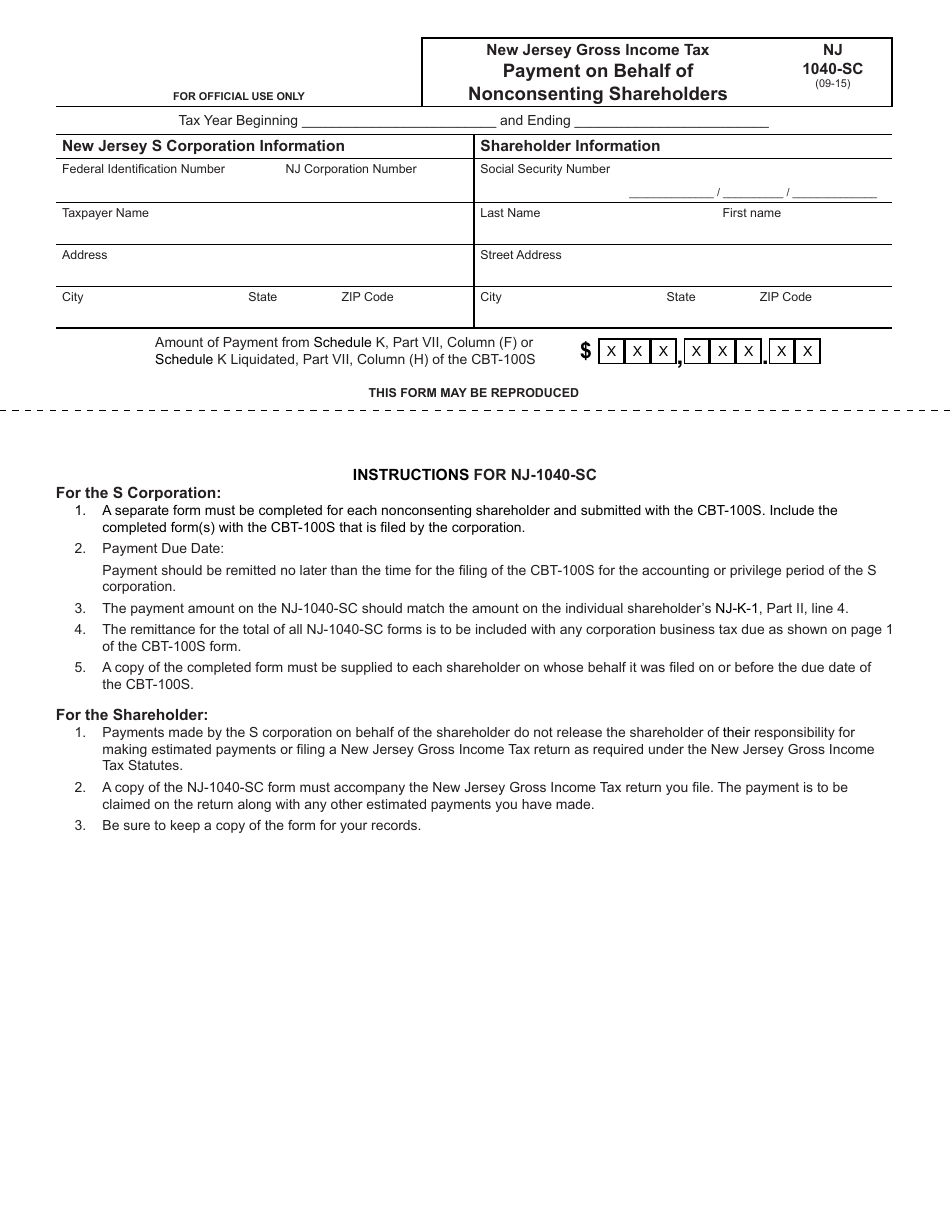

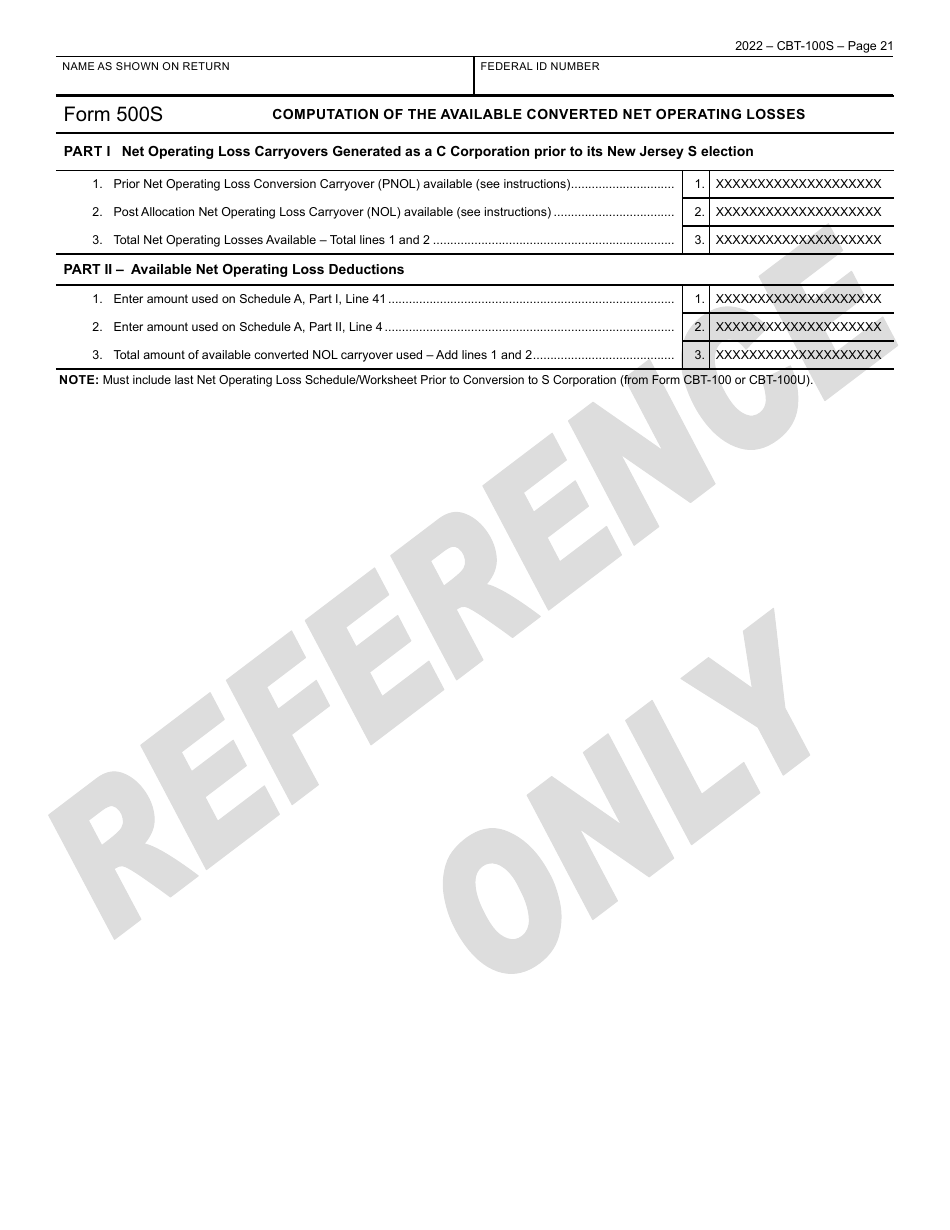

Q: Are there any additional forms or schedules required to be filed with Form CBT-100S?

A: Depending on the specific circumstances of the S Corporation, additional forms and schedules may be required to be filed along with Form CBT-100S, such as Schedule A or Schedule D.

Q: What are the penalties for late filing of Form CBT-100S?

A: Penalties for late filing of Form CBT-100S in New Jersey include a late filing penalty and interest on any unpaid tax.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CBT-100S by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.