This version of the form is not currently in use and is provided for reference only. Download this version of

Form PCR

for the current year.

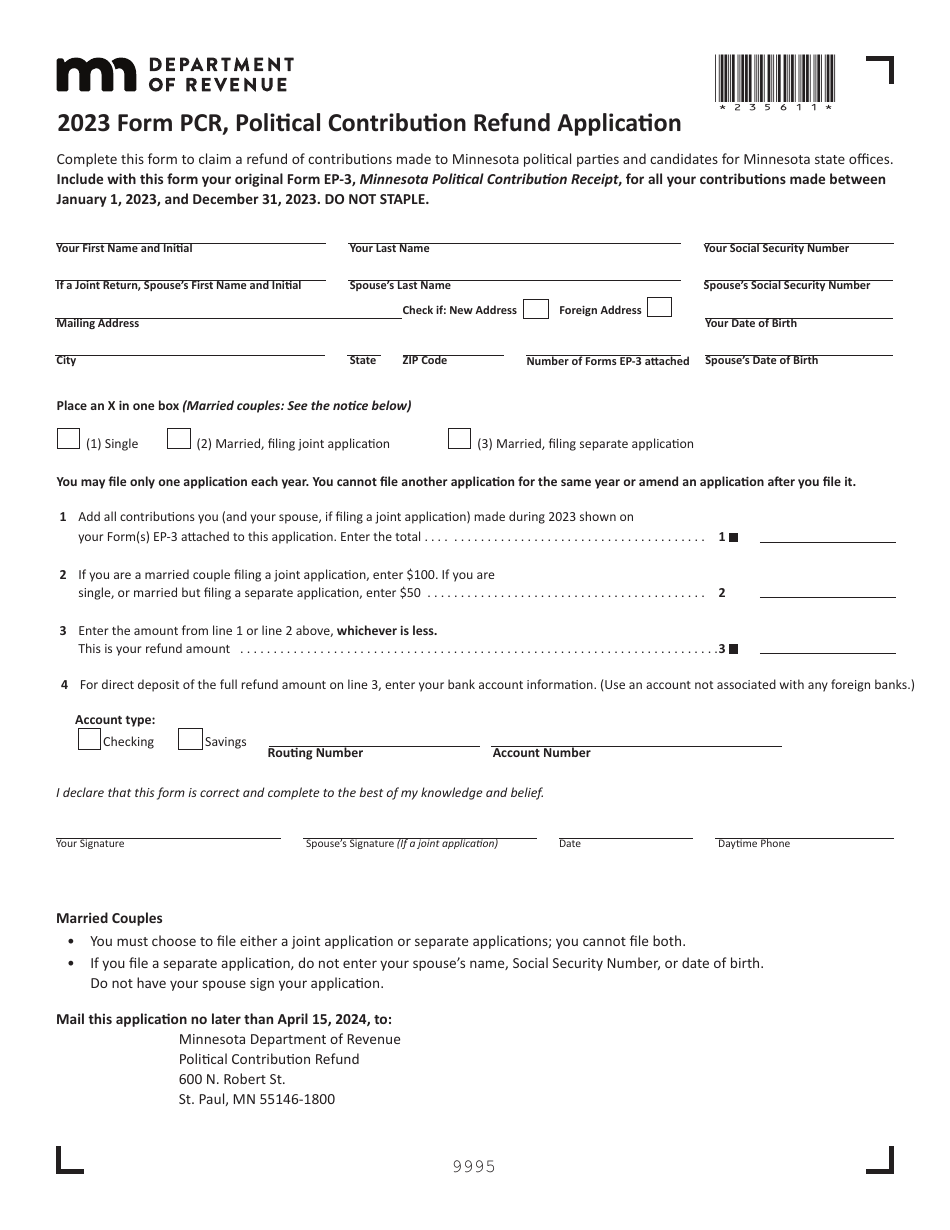

Form PCR Political Contribution Refund Application - Minnesota

What Is Form PCR?

This is a legal form that was released by the Minnesota Department of Revenue - a government authority operating within Minnesota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

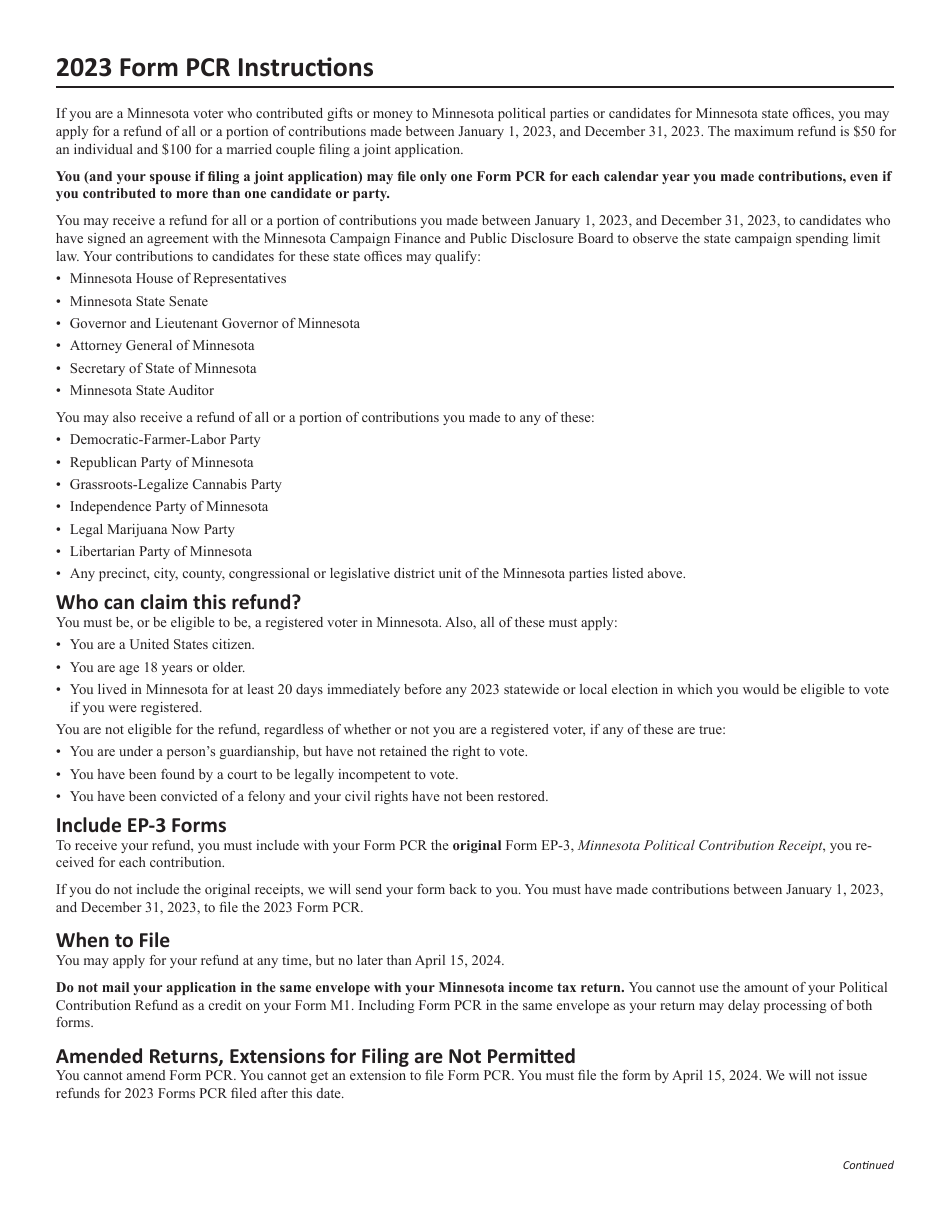

Q: What is a PCR Political Contribution Refund Application in Minnesota?

A: The PCR Political Contribution Refund Application is a form used in Minnesota to request a refund of political contributions made to a candidate or political party.

Q: Who is eligible to request a political contribution refund in Minnesota?

A: Eligible individuals in Minnesota can request a political contribution refund if they are a registered voter in the state and have made a contribution to a candidate or political party.

Q: How much can I receive as a political contribution refund in Minnesota?

A: In Minnesota, individuals can receive a refund of up to $50 per person or $100 per couple for contributions made to candidates or political parties.

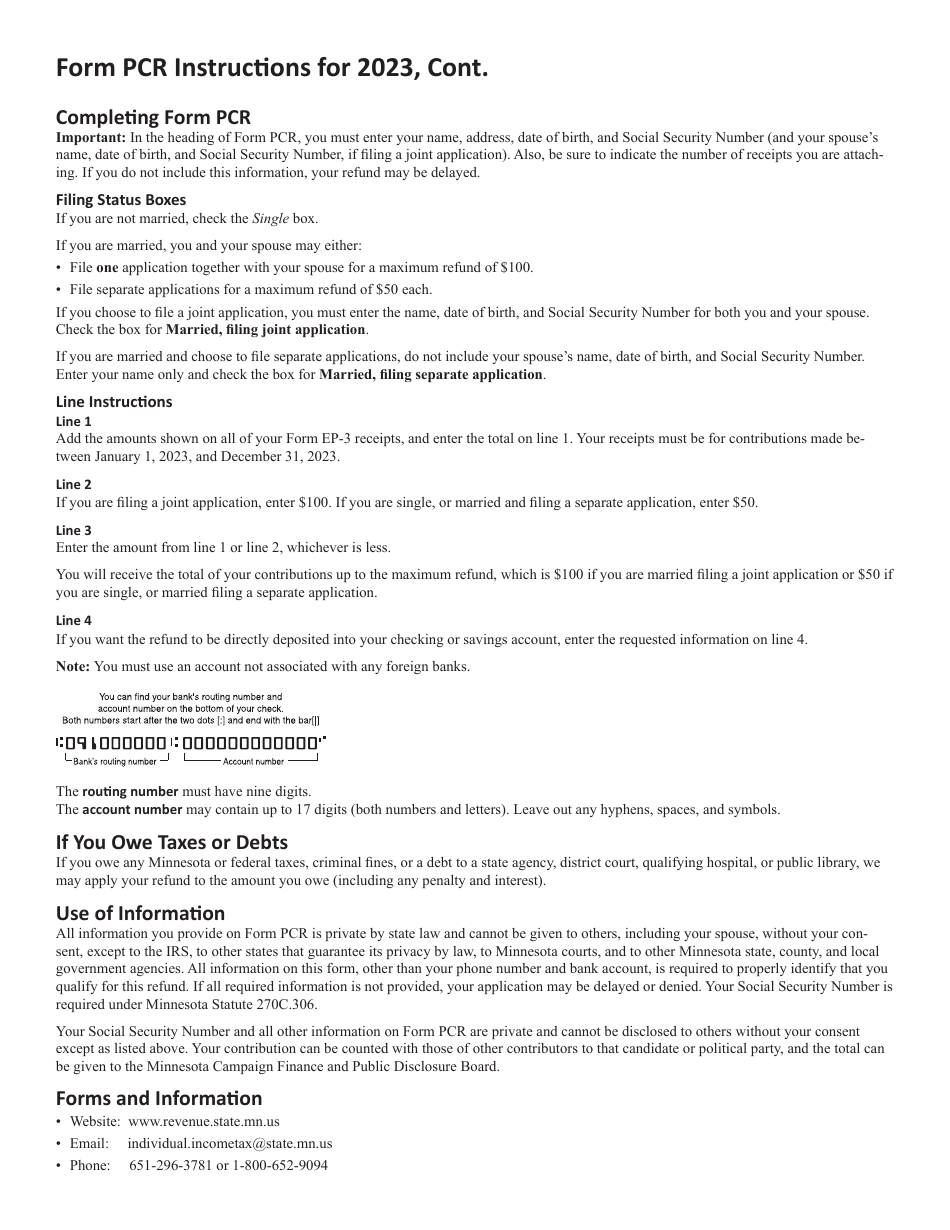

Q: What information do I need to provide on the PCR Political Contribution Refund Application?

A: When filling out the PCR Political Contribution Refund Application, you will need to provide your personal information, details of the contribution, and the recipient of the contribution.

Q: What is the deadline for submitting a PCR Political Contribution Refund Application in Minnesota?

A: The deadline for submitting a PCR Political Contribution Refund Application in Minnesota is typically within two years from the date of the contribution.

Q: How long does it take to receive a political contribution refund in Minnesota?

A: It usually takes approximately 30 days for the Minnesota Secretary of State's office to process and issue a political contribution refund.

Q: Can I request a refund for contributions made to federal candidates or political parties?

A: No, the PCR Political Contribution Refund Application in Minnesota only applies to contributions made to candidates or political parties at the state level.

Q: Can I request a political contribution refund if I have already claimed a tax deduction for the contribution?

A: No, if you have already claimed a tax deduction for the political contribution, you are not eligible to request a refund in Minnesota.

Q: Are there any restrictions on the political contribution refund amount I can receive in Minnesota?

A: Yes, the total amount of political contribution refunds given out by the state of Minnesota is limited each year, so refunds are distributed on a first-come, first-served basis.

Form Details:

- The latest edition provided by the Minnesota Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PCR by clicking the link below or browse more documents and templates provided by the Minnesota Department of Revenue.