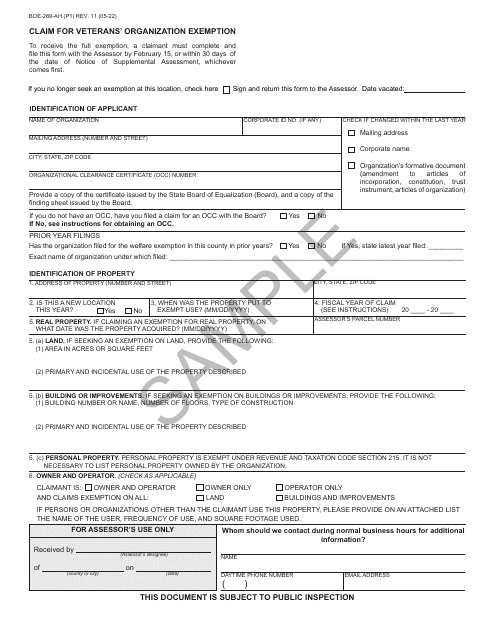

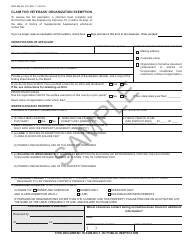

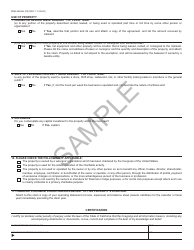

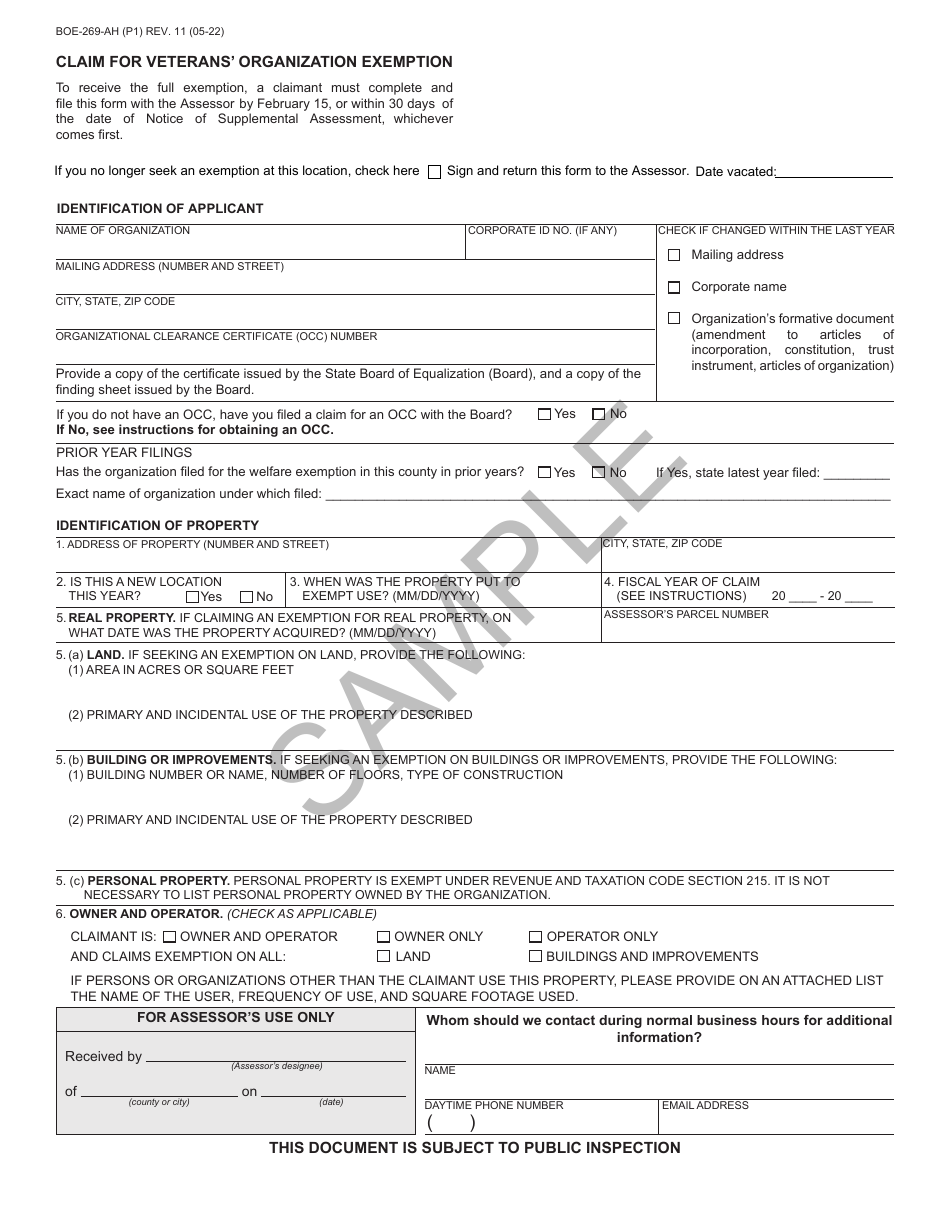

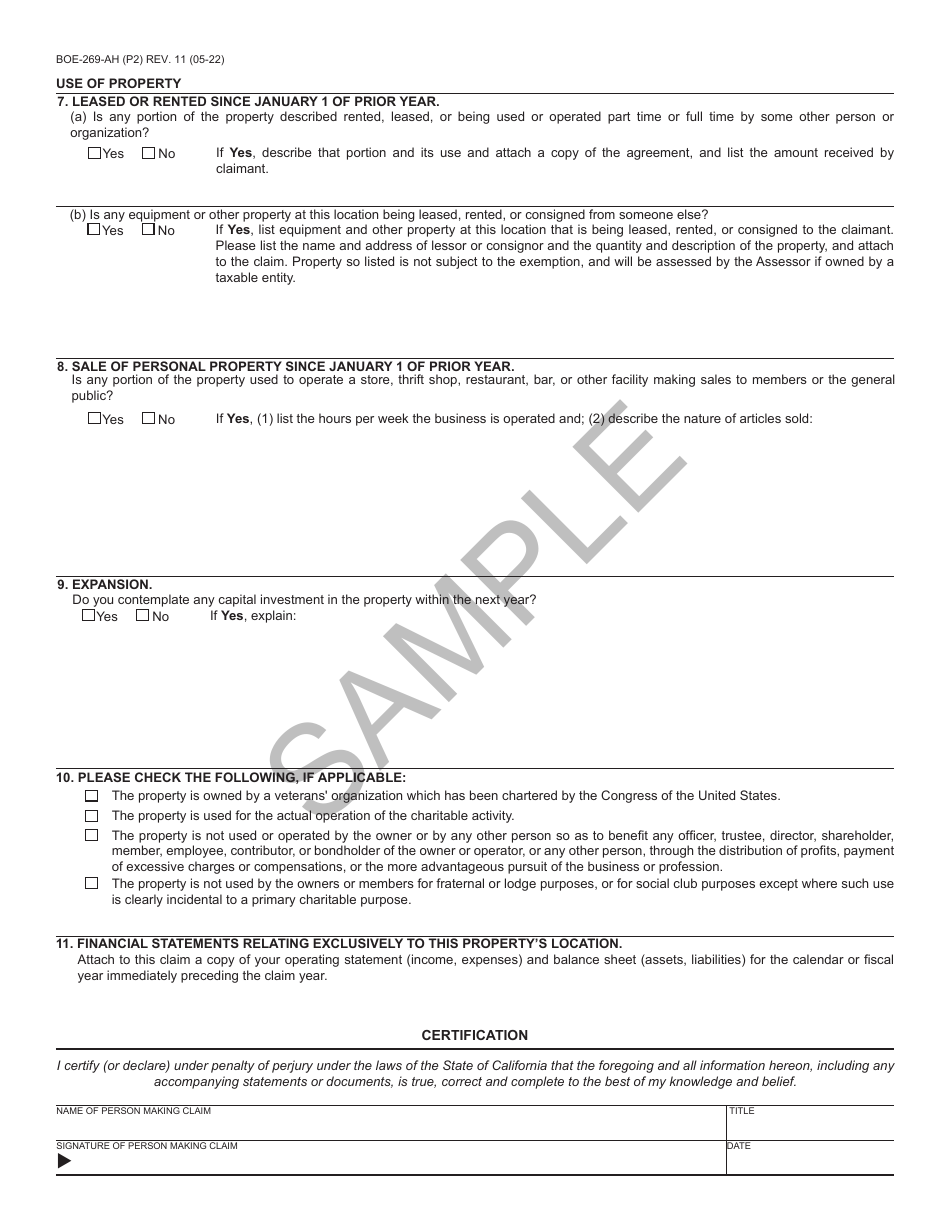

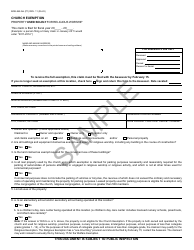

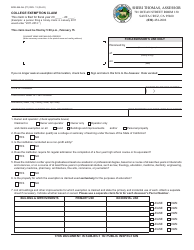

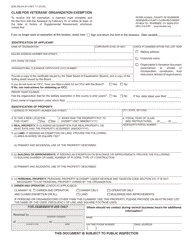

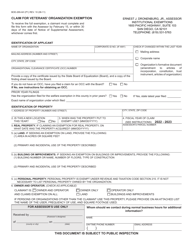

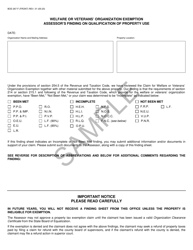

Form BOE-269-AH Claim for Veterans' Organization Exemption - Sample - California

What Is Form BOE-269-AH?

This is a legal form that was released by the California State Board of Equalization - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

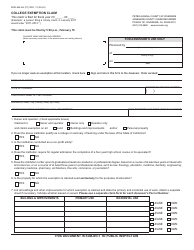

Q: What is Form BOE-269-AH?

A: Form BOE-269-AH is a claim form for the Veterans' Organization Exemption in California.

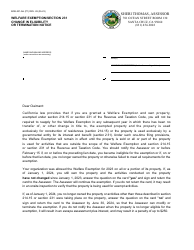

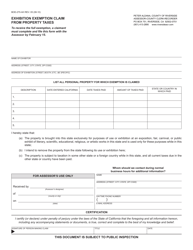

Q: Who can use Form BOE-269-AH?

A: This form can be used by veterans' organizations in California to claim an exemption from property taxes.

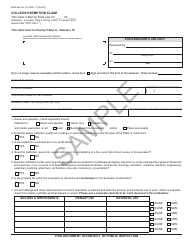

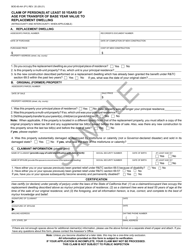

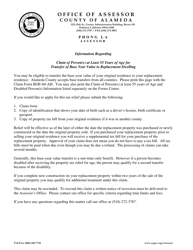

Q: What is the purpose of the Veterans' Organization Exemption?

A: The purpose of the Veterans' Organization Exemption is to provide property tax relief for qualifying veterans' organizations.

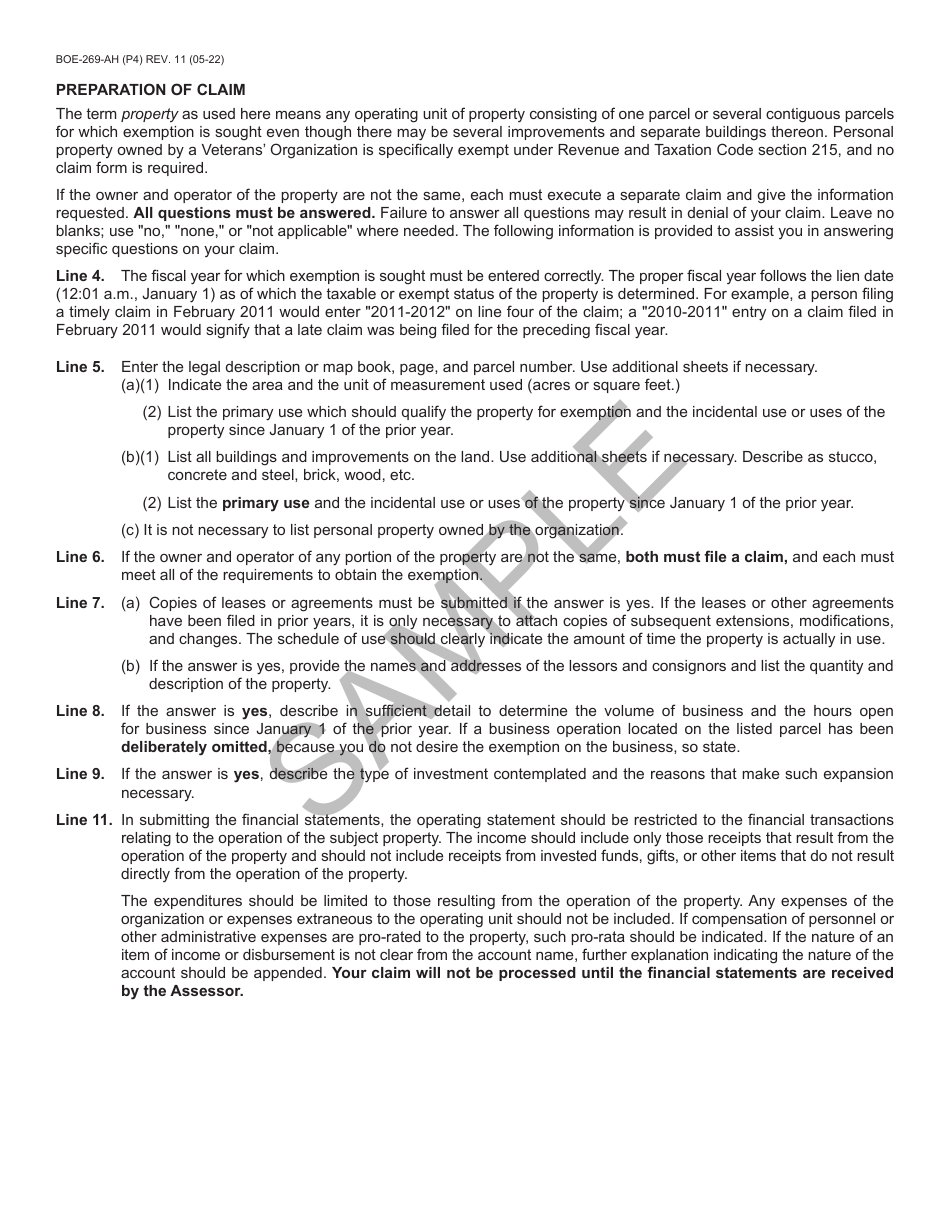

Q: How do I qualify for the Veterans' Organization Exemption?

A: To qualify for this exemption, your organization must be a nonprofit veterans' organization and meet certain eligibility criteria set by the California State Board of Equalization.

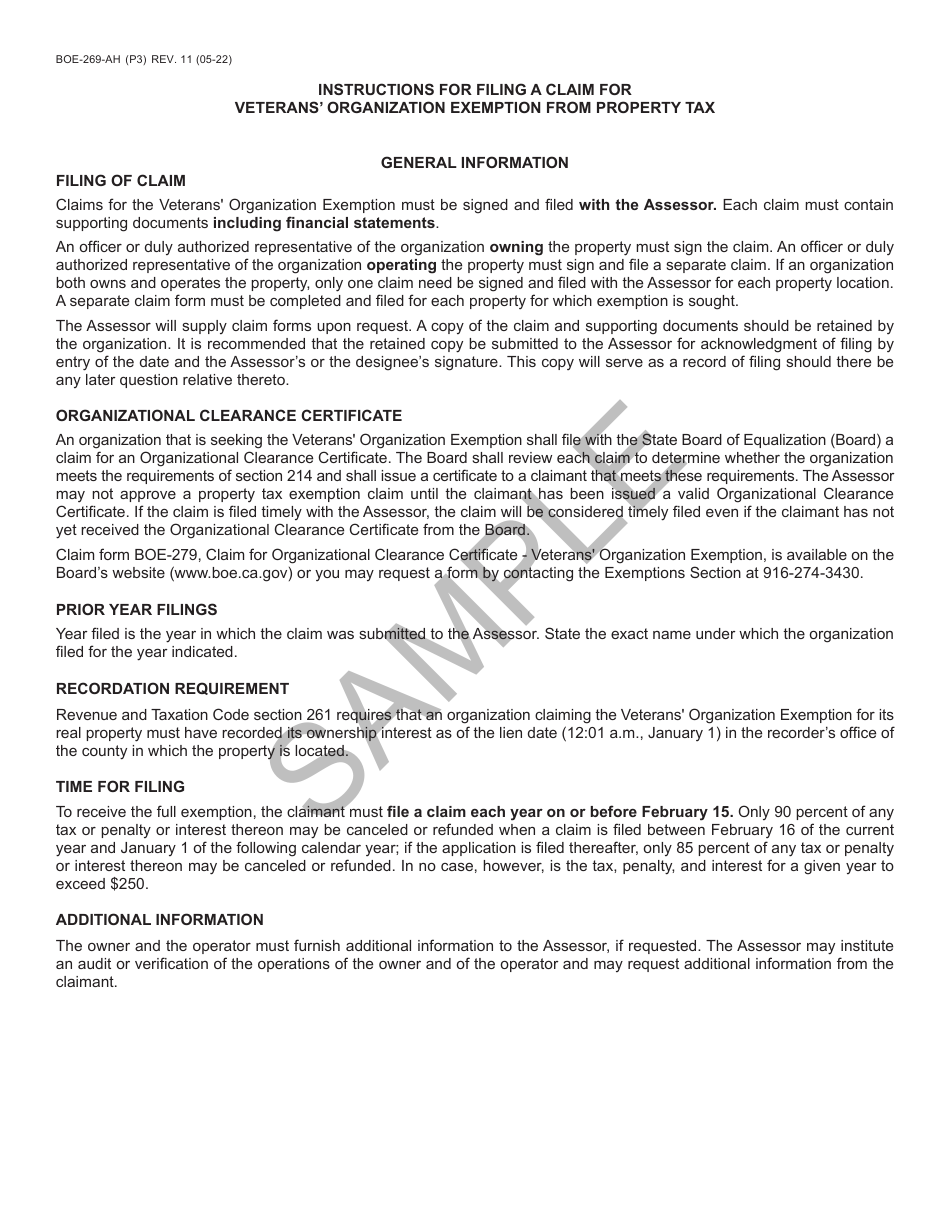

Q: Is there a deadline to file Form BOE-269-AH?

A: Yes, the deadline to file this form is usually February 15th of each year.

Q: Are there any fees associated with filing Form BOE-269-AH?

A: There are no fees for filing this form.

Q: What supporting documents do I need to submit with Form BOE-269-AH?

A: You will need to submit documentation proving your organization's eligibility for the exemption, such as its nonprofit status and veteran affiliation.

Q: How long does it take to process the claim for the Veterans' Organization Exemption?

A: Processing times may vary, but it typically takes several weeks to several months to process the claim.

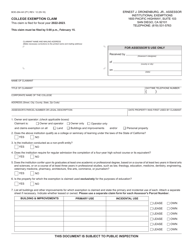

Form Details:

- Released on May 1, 2022;

- The latest edition provided by the California State Board of Equalization;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form BOE-269-AH by clicking the link below or browse more documents and templates provided by the California State Board of Equalization.