This version of the form is not currently in use and is provided for reference only. Download this version of

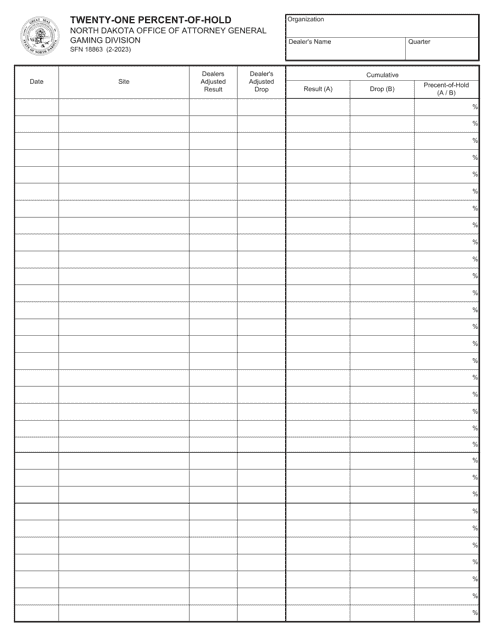

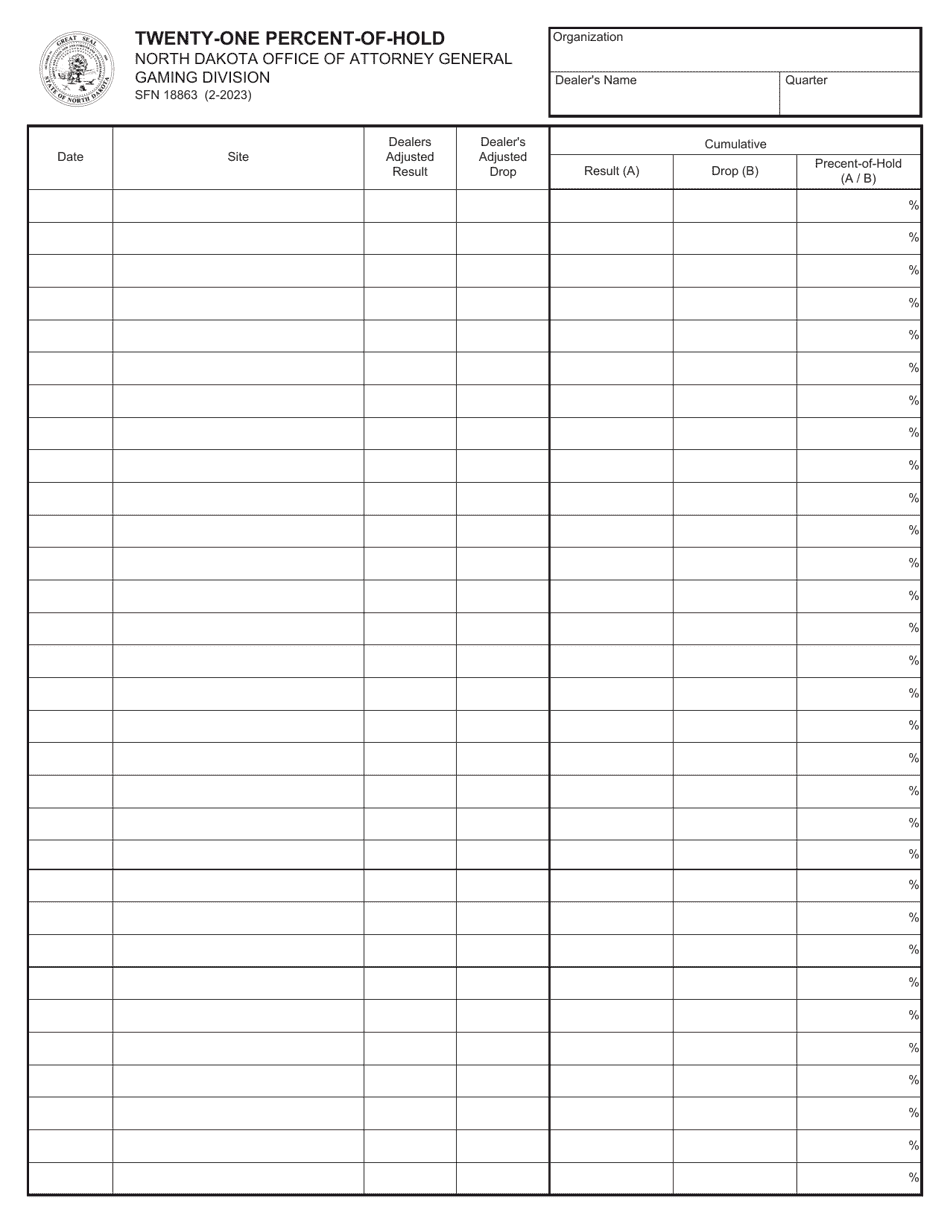

Form SFN18863

for the current year.

Form SFN18863 Twenty-One Percent-Of-Hold - North Dakota

What Is Form SFN18863?

This is a legal form that was released by the North Dakota Attorney General's Office - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SFN18863?

A: Form SFN18863 is a tax form used in North Dakota.

Q: What does Twenty-One Percent-Of-Hold mean?

A: Twenty-One Percent-Of-Hold refers to a specific tax calculation or withholding rate.

Q: Who uses Form SFN18863?

A: Form SFN18863 is used by individuals or businesses in North Dakota.

Q: What is the purpose of Form SFN18863?

A: The purpose of Form SFN18863 is to calculate and report tax withholdings.

Q: What information do I need to fill out Form SFN18863?

A: You will typically need personal or business information, income details, and any applicable deductions or credits.

Q: When is Form SFN18863 due?

A: The due date for Form SFN18863 varies, so you should refer to the instructions or contact the North Dakota Tax Commissioner for the specific deadline.

Q: Are there any penalties for not filing Form SFN18863?

A: Yes, there may be penalties for not filing Form SFN18863 or for filing it late. It is important to comply with tax filing requirements.

Q: What if I need help with Form SFN18863?

A: If you need assistance with Form SFN18863, you can reach out to the North Dakota Tax Commissioner's office or consult with a tax professional.

Form Details:

- Released on February 1, 2023;

- The latest edition provided by the North Dakota Attorney General's Office;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SFN18863 by clicking the link below or browse more documents and templates provided by the North Dakota Attorney General's Office.