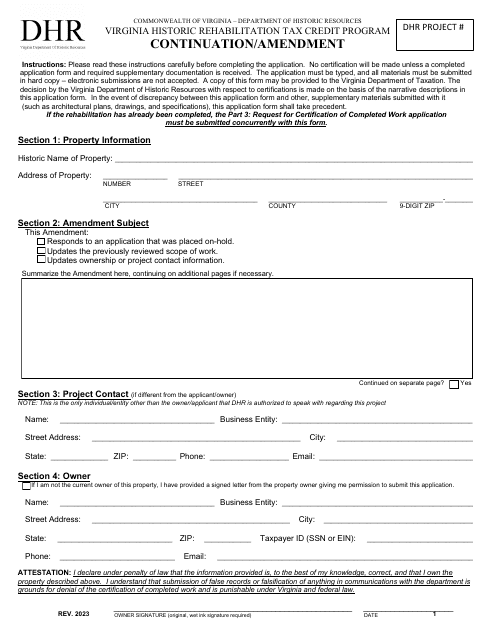

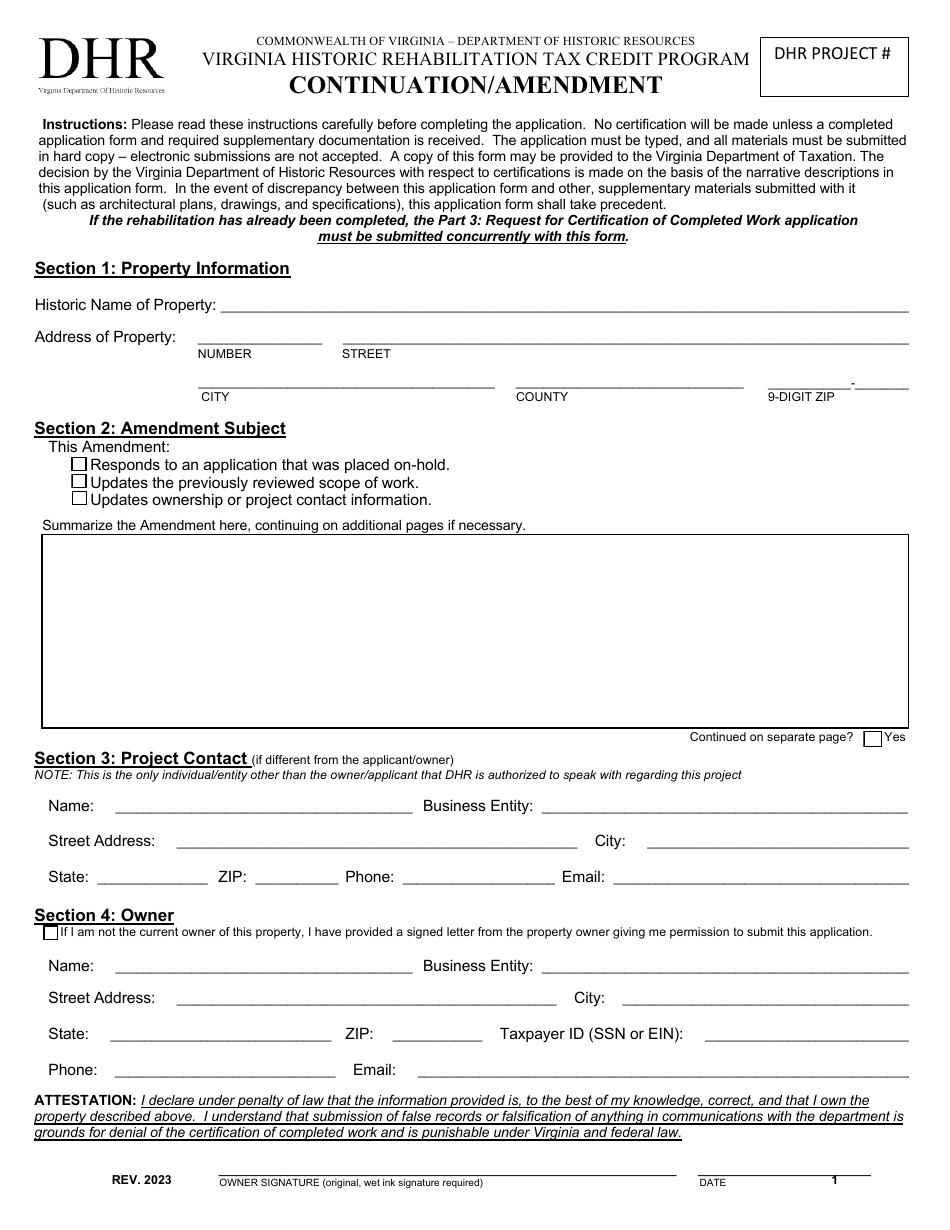

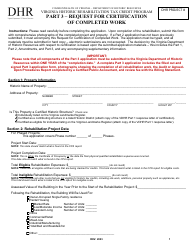

Continuation / Amendment - Virginia Historic Rehabilitation Tax Credit Program - Virginia

Continuation/Amendment - Virginia Historic Rehabilitation Tax Credit Program is a legal document that was released by the Virginia Department of Historic Resources - a government authority operating within Virginia.

FAQ

Q: What is the Virginia Historic Rehabilitation Tax Credit Program?

A: The Virginia Historic RehabilitationTax Credit Program is a program that provides tax incentives for the rehabilitation of historic properties in Virginia.

Q: What does the program aim to achieve?

A: The program aims to preserve and restore historic buildings and promote economic development in Virginia.

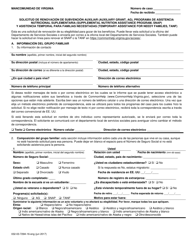

Q: Who can participate in the program?

A: Property owners, developers, or investors who are rehabilitating historic properties in Virginia can participate in the program.

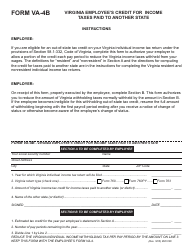

Q: What are the benefits of participating in the program?

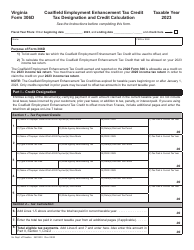

A: Participants in the program can receive tax credits equal to a percentage of qualified rehabilitation expenses incurred.

Q: What are qualified rehabilitation expenses?

A: Qualified rehabilitation expenses include costs for the physical work done to rehabilitate a historic property.

Q: How can the tax credits be used?

A: The tax credits can be used to offset income tax liabilities or sold to third parties.

Q: Are there any restrictions on the program?

A: Yes, there are certain eligibility requirements and guidelines that must be followed to qualify for the tax credits.

Form Details:

- Released on January 1, 2023;

- The latest edition currently provided by the Virginia Department of Historic Resources;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Virginia Department of Historic Resources.