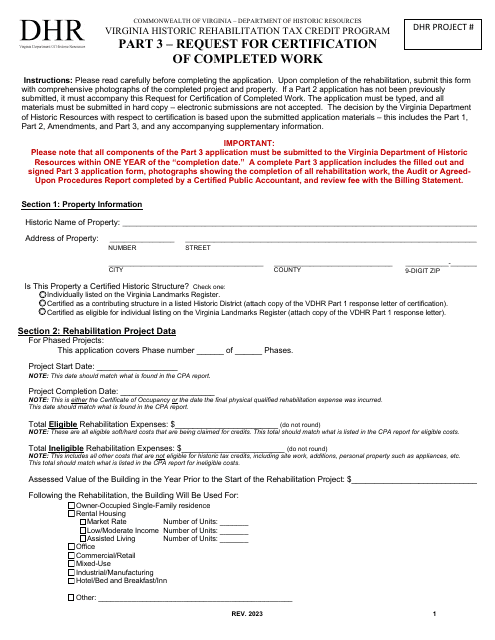

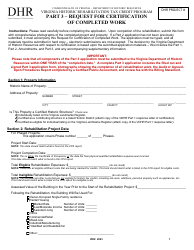

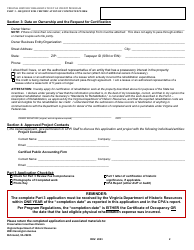

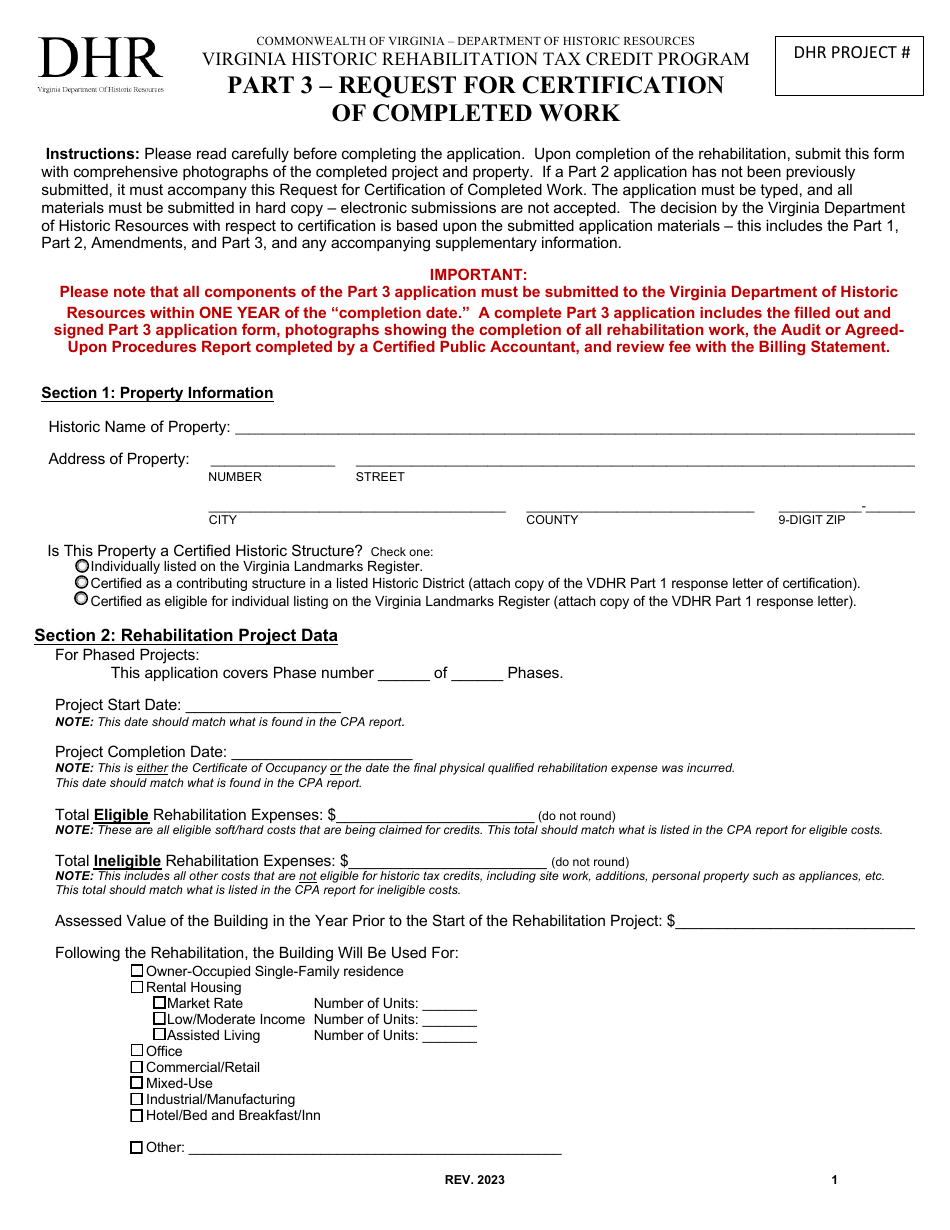

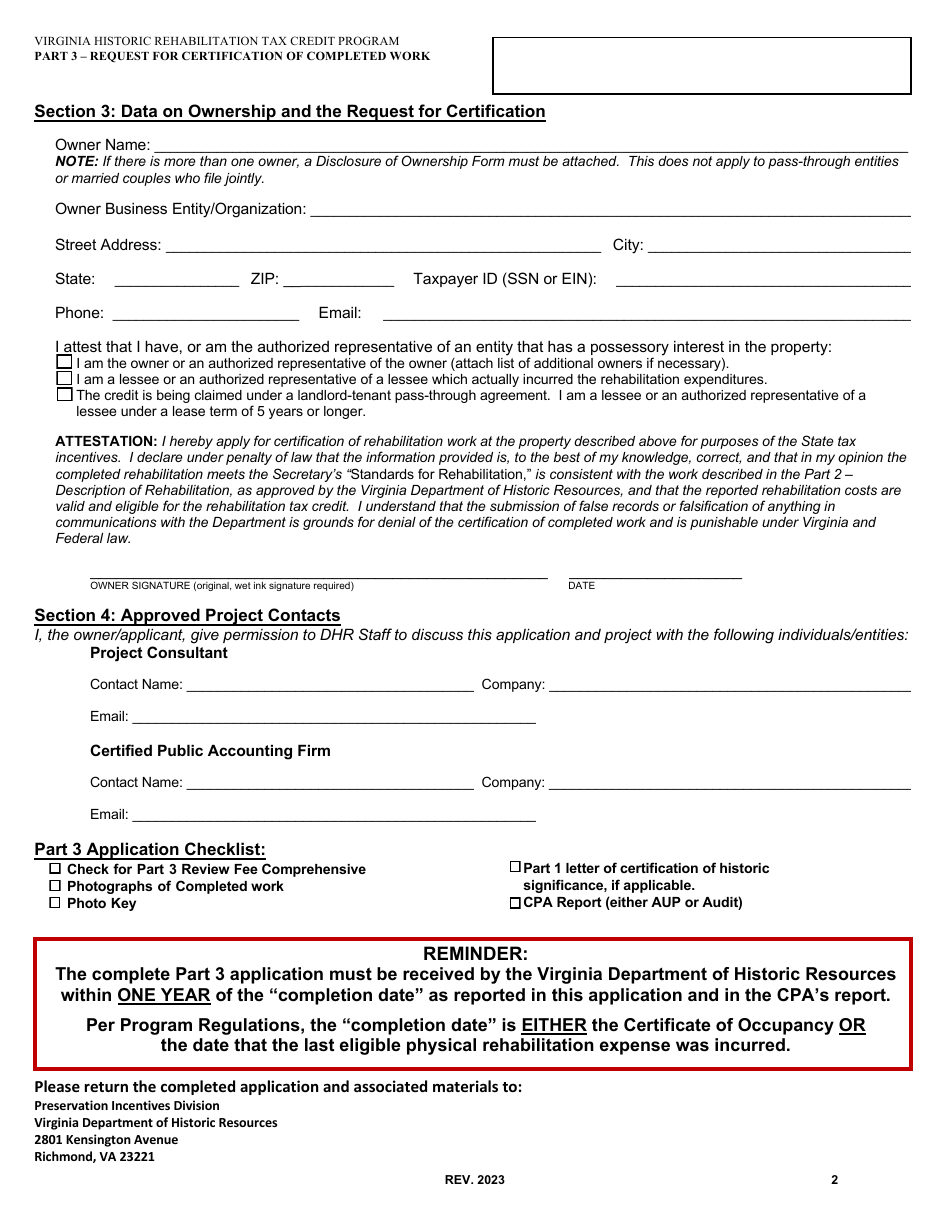

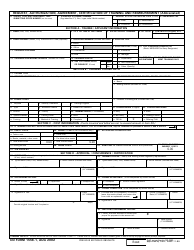

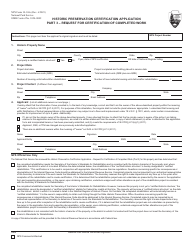

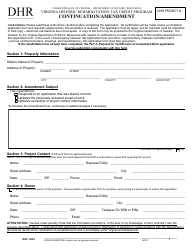

Part 3 Request for Certification of Completed Work - Virginia Historic Rehabilitation Tax Credit Program - Virginia

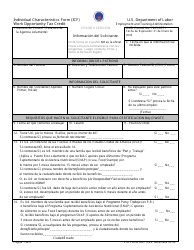

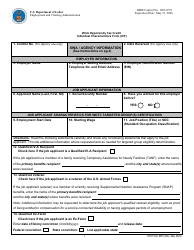

What Is Part 3?

This is a legal form that was released by the Virginia Department of Historic Resources - a government authority operating within Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Virginia Historic Rehabilitation Tax Credit Program?

A: The Virginia Historic RehabilitationTax Credit Program is a program that provides tax credits to encourage the rehabilitation of historic properties in Virginia.

Q: What is the purpose of a Request for Certification of Completed Work?

A: The purpose of a Request for Certification of Completed Work is to apply for certification that the rehabilitation work on a historic property has been completed according to the program requirements.

Q: Who is eligible to apply for the Virginia Historic Rehabilitation Tax Credit?

A: Property owners, developers, and lessees who have completed qualified rehabilitation work on a historic property in Virginia may be eligible to apply for the tax credit.

Q: What are the requirements for the Virginia Historic Rehabilitation Tax Credit?

A: The requirements for the tax credit include that the property must be listed on the Virginia Landmarks Register or be a contributing resource in a historic district, and the rehabilitation work must follow the Secretary of the Interior's Standards for Rehabilitation.

Q: How much is the tax credit for the Virginia Historic Rehabilitation Tax Credit Program?

A: The tax credit can be up to 25% of the eligible rehabilitation costs for the project.

Q: How can I apply for the Virginia Historic Rehabilitation Tax Credit?

A: To apply for the tax credit, you need to submit a Request for Certification of Completed Work along with supporting documentation to the Virginia Department of Historic Resources.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Virginia Department of Historic Resources;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Part 3 by clicking the link below or browse more documents and templates provided by the Virginia Department of Historic Resources.