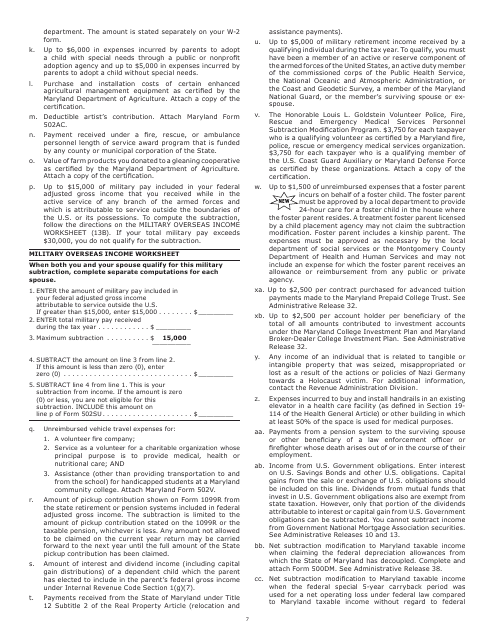

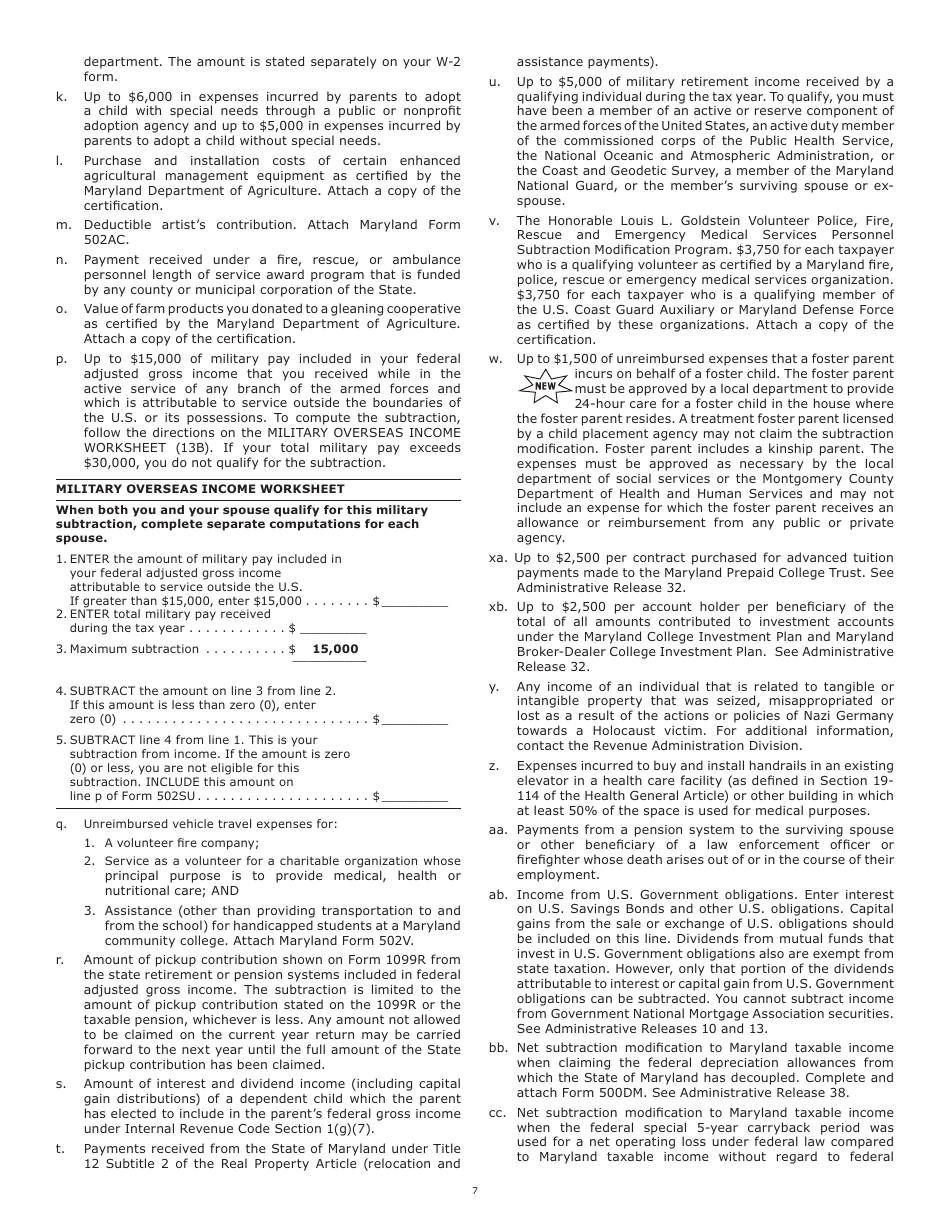

Military Overseas Income Worksheet - Maryland

Military Overseas Income Worksheet is a legal document that was released by the Comptroller of Maryland - a government authority operating within Maryland.

FAQ

Q: What is the Military Overseas Income Worksheet?

A: The Military Overseas Income Worksheet is a document used in Maryland to calculate the tax liability for military personnel who have earned income while serving overseas.

Q: Who needs to fill out the Military Overseas Income Worksheet?

A: Military personnel who have earned income while serving overseas and are residents of Maryland need to fill out the Military Overseas Income Worksheet.

Q: What is the purpose of the Military Overseas Income Worksheet?

A: The purpose of the Military Overseas Income Worksheet is to determine the amount of taxable income and the applicable deductions and credits for military personnel who have earned income while serving overseas.

Q: What information is required to fill out the Military Overseas Income Worksheet?

A: To fill out the Military Overseas Income Worksheet, you will need to provide details of your overseas income, including the amount earned and the sources of income. You will also need to report any deductions and credits that you are eligible for.

Q: Are there any special tax benefits for military personnel serving overseas?

A: Yes, there are special tax benefits for military personnel serving overseas, including the ability to exclude certain types of income from taxation and the availability of certain deductions and credits.

Q: Do I need to file a separate tax return for my overseas income?

A: In most cases, military personnel with overseas income are still required to file a federal income tax return. However, there may be additional forms and worksheets, such as the Military Overseas Income Worksheet, that need to be included with your tax return.

Q: Is the Military Overseas Income Worksheet specific to Maryland?

A: Yes, the Military Overseas Income Worksheet is specific to Maryland. Each state may have its own requirements and forms for military personnel with overseas income.

Q: Can I get assistance in filling out the Military Overseas Income Worksheet?

A: Yes, you can seek assistance from tax professionals or the Maryland Comptroller's office to help you in filling out the Military Overseas Income Worksheet.

Q: When is the deadline to file the Military Overseas Income Worksheet?

A: The deadline to file the Military Overseas Income Worksheet is the same as the deadline to file your federal income tax return, which is generally April 15th of each year.

Form Details:

- The latest edition currently provided by the Comptroller of Maryland;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Comptroller of Maryland.