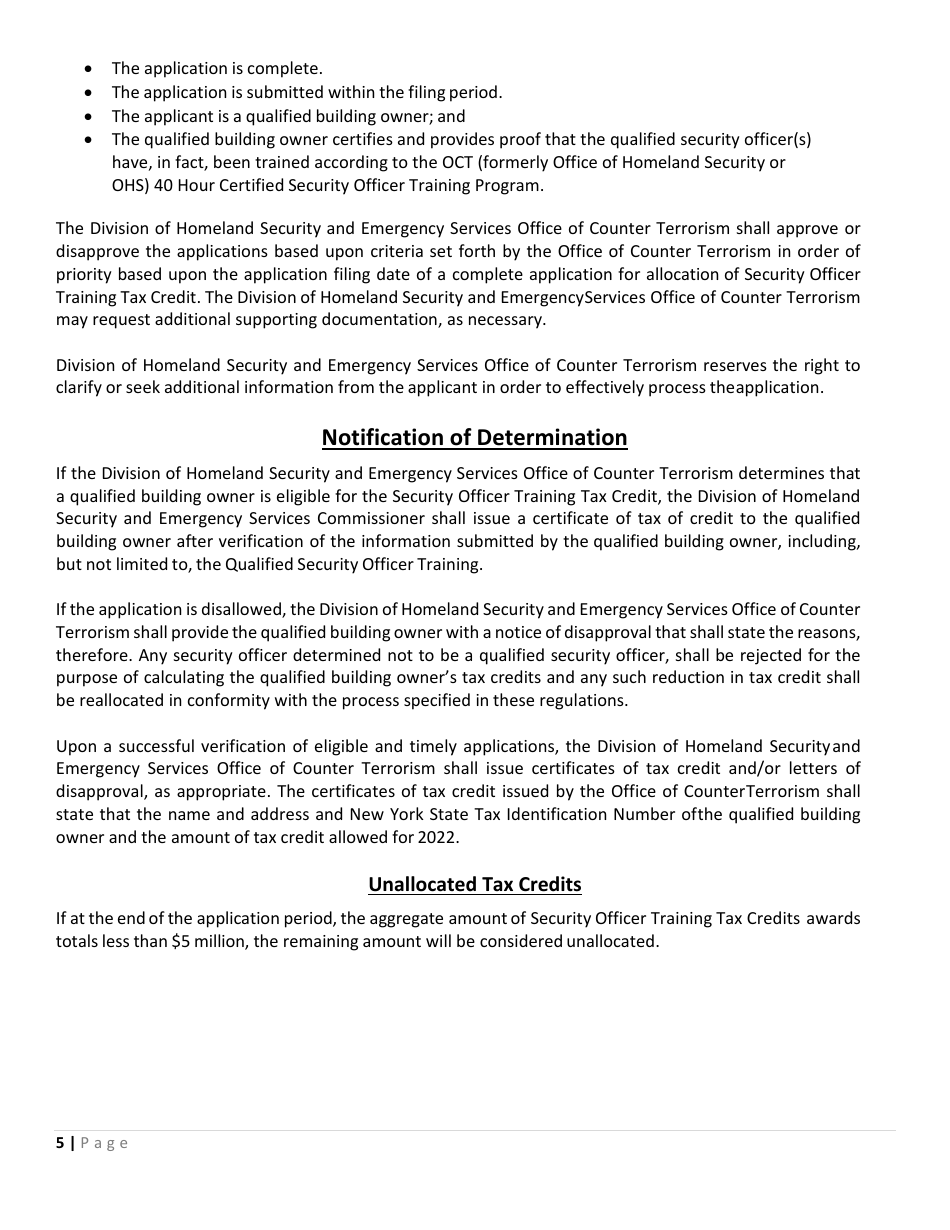

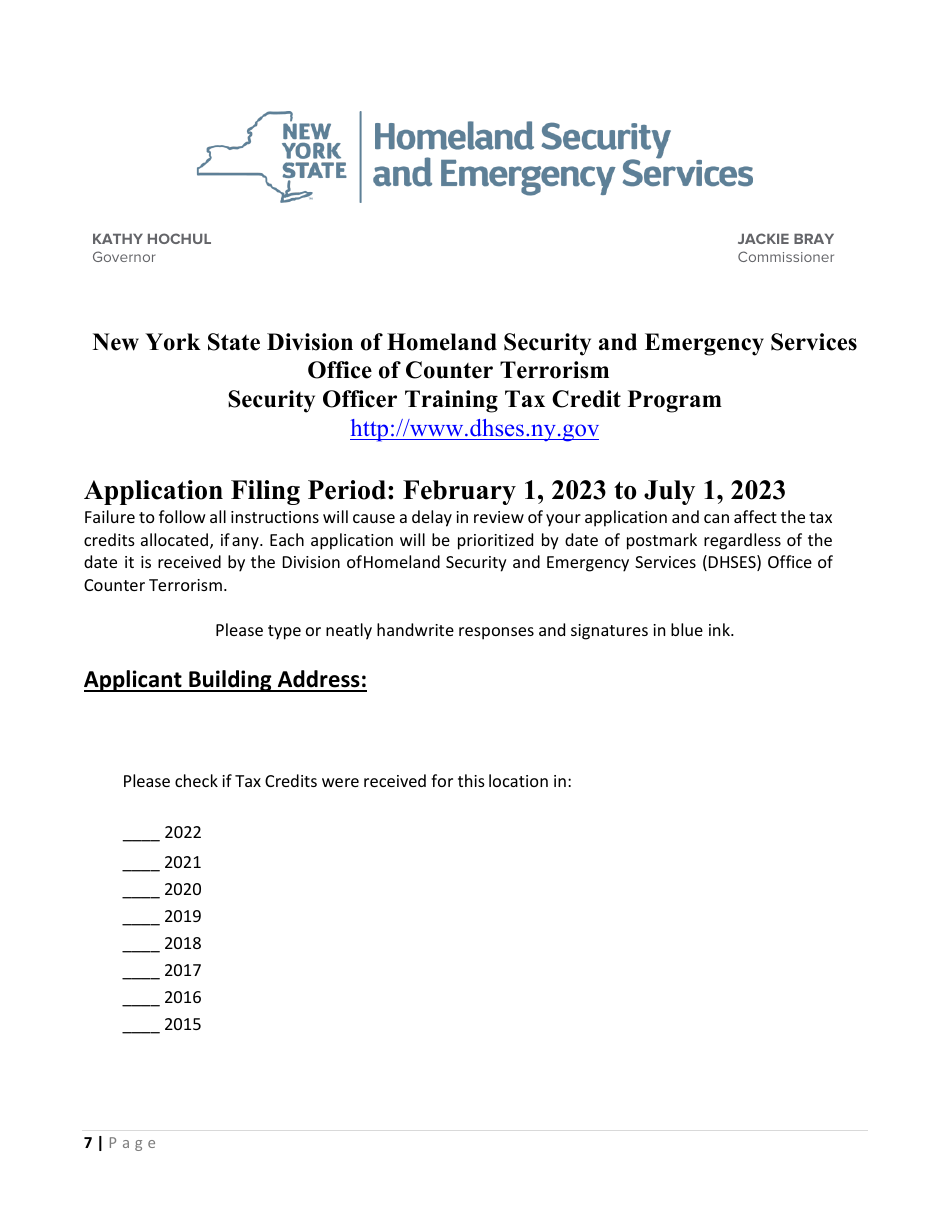

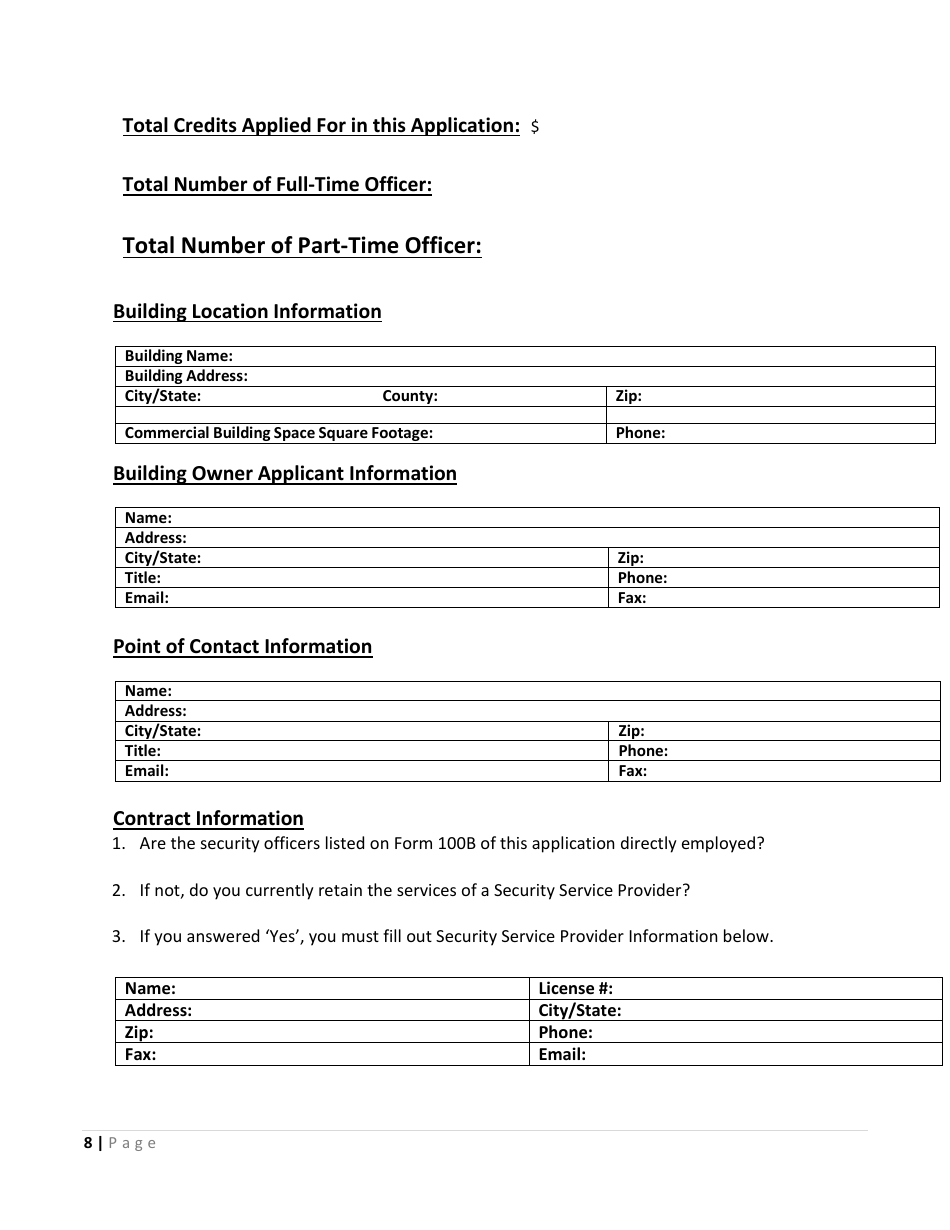

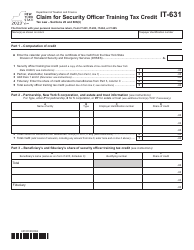

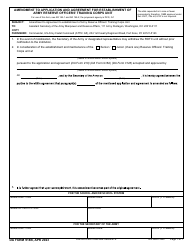

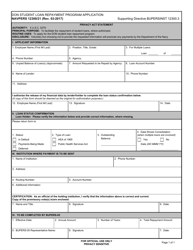

Security Officer Training Tax Credit Program Application - New York

Security Officer Training Tax Credit Program Application is a legal document that was released by the New York State Division of Homeland Security & Emergency Services - a government authority operating within New York.

FAQ

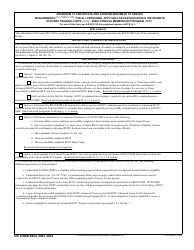

Q: What is the Security Officer Training Tax Credit Program?

A: The Security Officer Training Tax Credit Program is a program in New York that provides tax credits to businesses that train security officers.

Q: Who is eligible to apply for the Security Officer Training Tax Credit Program?

A: Businesses in New York that train security officers are eligible to apply for the program.

Q: How does the Security Officer Training Tax Credit Program work?

A: Businesses that train security officers can apply for tax credits based on the number of hours of training provided.

Q: What are the benefits of the Security Officer Training Tax Credit Program?

A: The program provides tax credits to businesses, which can help offset the cost of providing security officer training.

Q: How can businesses apply for the Security Officer Training Tax Credit Program?

A: Businesses can apply for the program by submitting an application to the New York State Department of Labor.

Q: Is there a deadline to apply for the Security Officer Training Tax Credit Program?

A: There is no specific deadline mentioned in the document. It is advisable to check with the New York State Department of Labor for the application deadline.

Form Details:

- The latest edition currently provided by the New York State Division of Homeland Security & Emergency Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York State Division of Homeland Security & Emergency Services.