This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

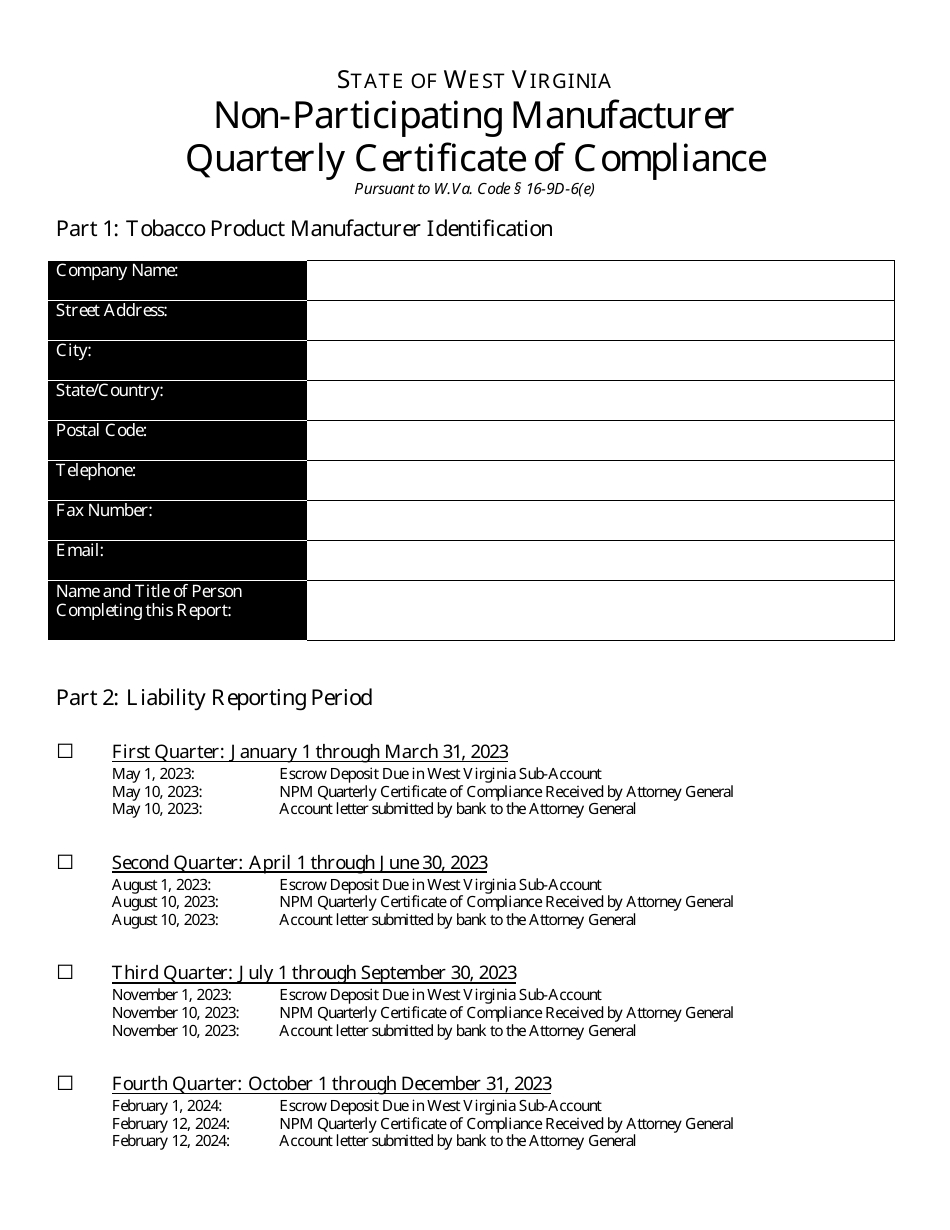

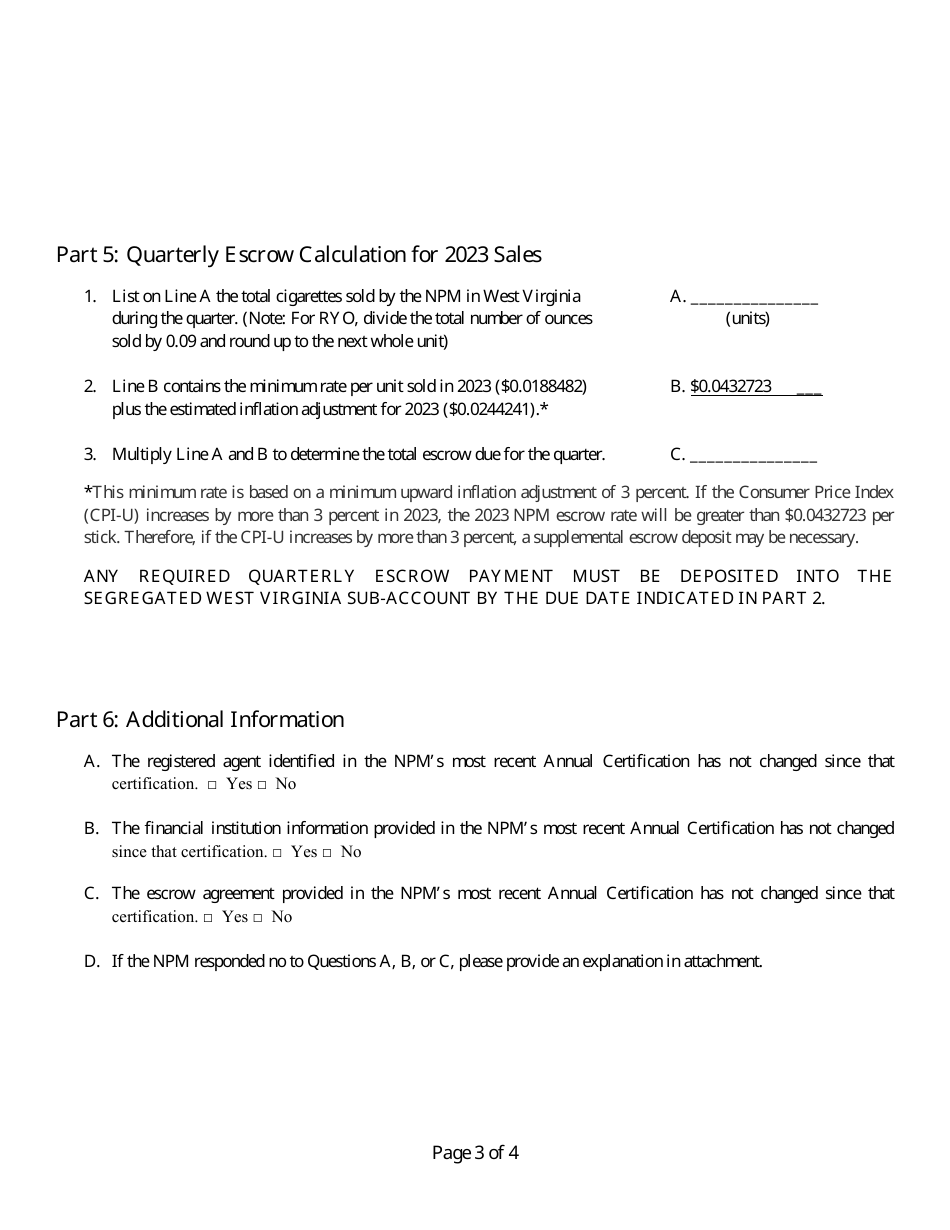

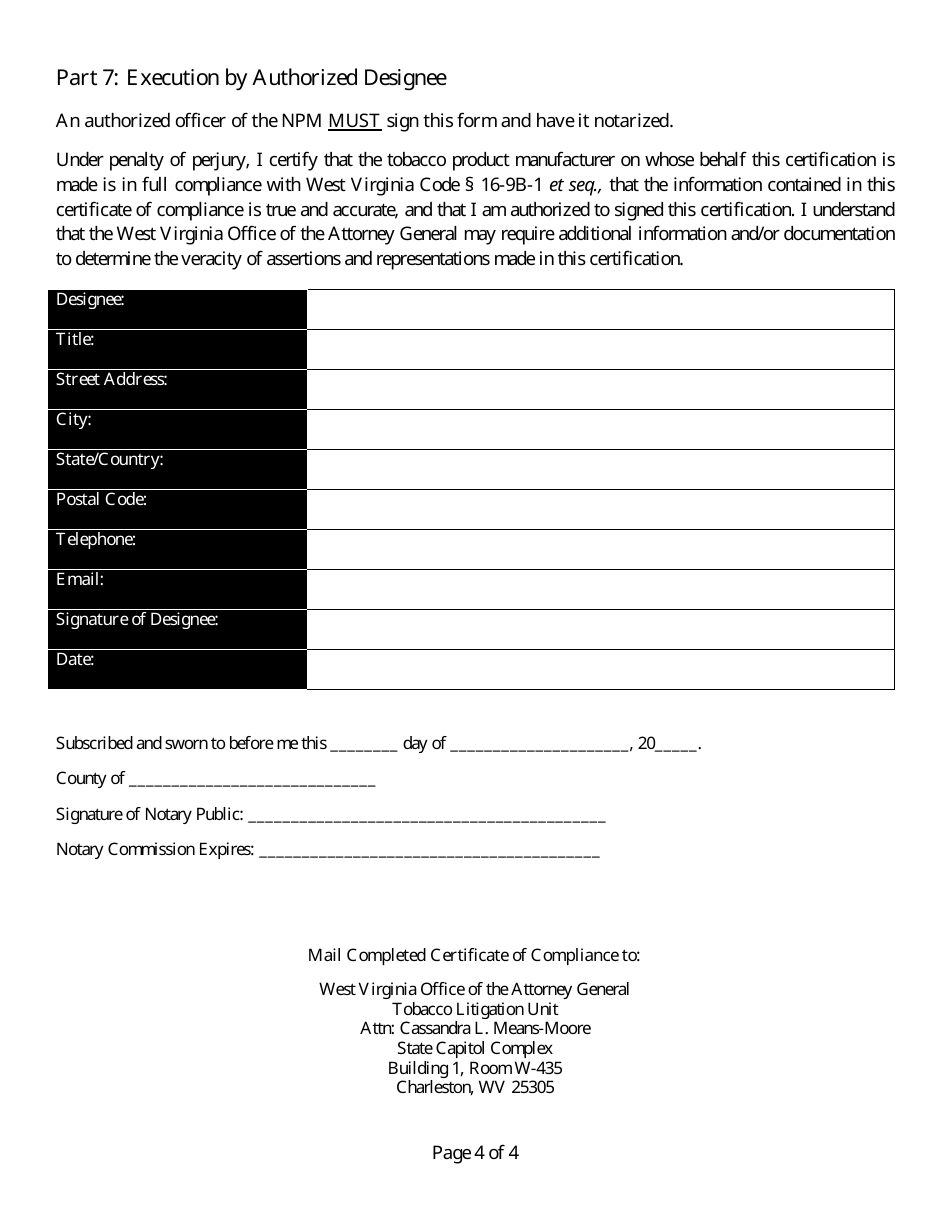

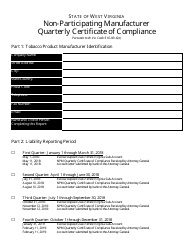

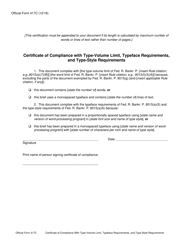

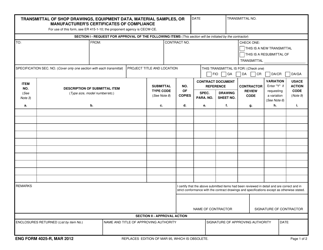

Non-participating Manufacturer Quarterly Certificate of Compliance - West Virginia

Non-participating Manufacturer Quarterly Certificate of Compliance is a legal document that was released by the West Virginia State Tax Department - a government authority operating within West Virginia.

FAQ

Q: What is the Non-participating Manufacturer Quarterly Certificate of Compliance?

A: The Non-participating Manufacturer (NPM) Quarterly Certificate of Compliance is a document required in West Virginia to verify that non-participating tobacco manufacturers are in compliance with state tobacco laws and regulations.

Q: Who needs to submit the Non-participating Manufacturer Quarterly Certificate of Compliance?

A: Non-participating tobacco manufacturers who do not have a Master Settlement Agreement (MSA) with West Virginia need to submit this document.

Q: What is a non-participating tobacco manufacturer?

A: A non-participating tobacco manufacturer is a tobacco company that has not entered into the MSA and has not agreed to follow its terms and requirements.

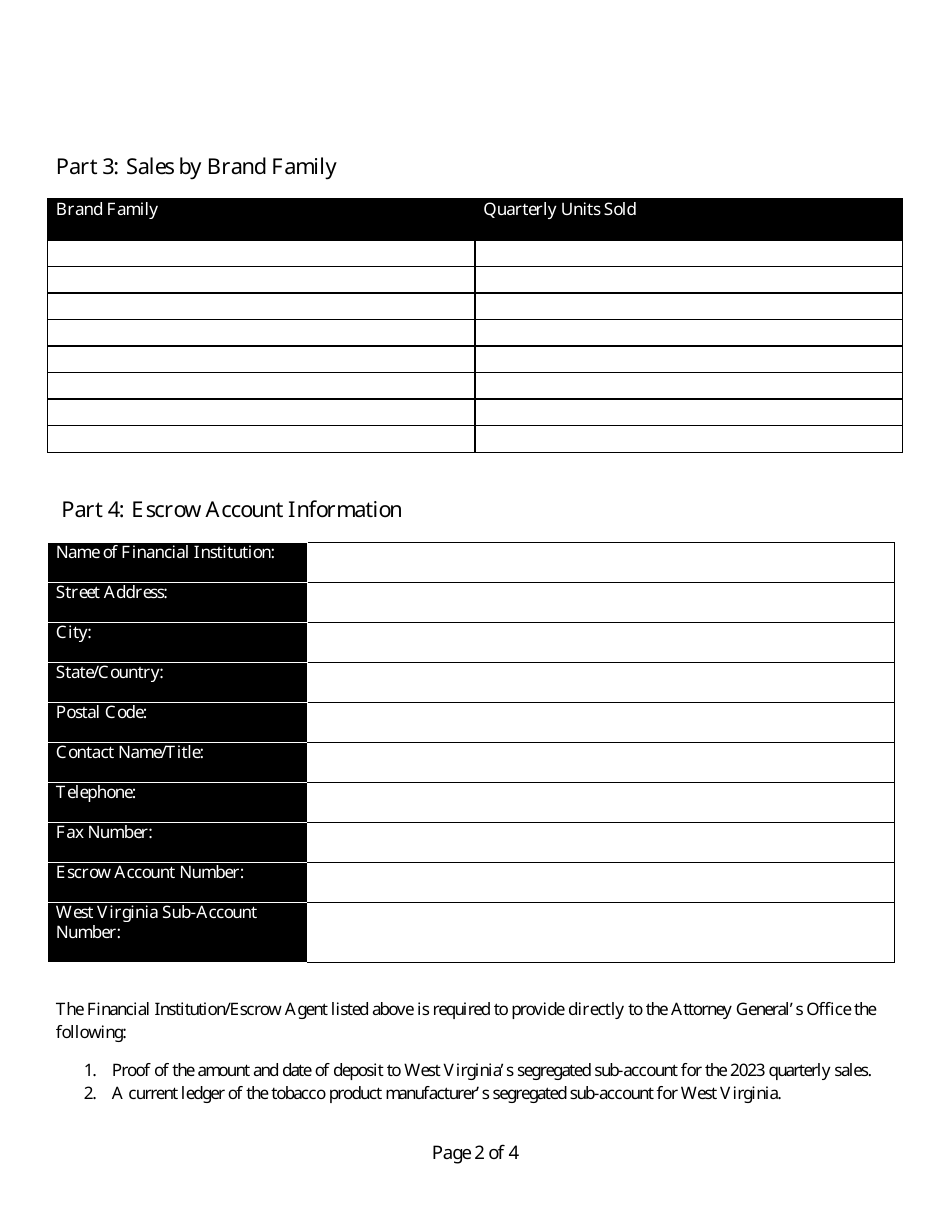

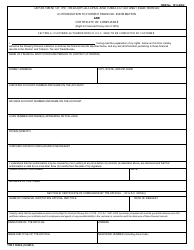

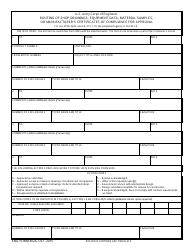

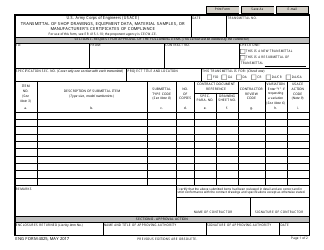

Q: What information is included in the Non-participating Manufacturer Quarterly Certificate of Compliance?

A: The document includes information about the manufacturer, such as contact details, payment information, and a statement of compliance.

Q: How often does the Non-participating Manufacturer Quarterly Certificate of Compliance need to be submitted?

A: The certificate needs to be submitted on a quarterly basis, meaning four times a year.

Q: What happens if a non-participating tobacco manufacturer fails to submit the Quarterly Certificate of Compliance?

A: Failure to submit the certificate can result in penalties and legal consequences for the manufacturer.

Q: Are there any fees associated with submitting the Non-participating Manufacturer Quarterly Certificate of Compliance?

A: Yes, there are fees associated with submitting the certificate. The specific fees can be found in the state's tobacco laws and regulations.

Q: Can a non-participating tobacco manufacturer become compliant with the Master Settlement Agreement?

A: Yes, a non-participating tobacco manufacturer can become compliant by entering into the MSA and agreeing to follow its terms and requirements.

Q: Are there any other reporting requirements for non-participating tobacco manufacturers in West Virginia?

A: Yes, in addition to the Quarterly Certificate of Compliance, non-participating tobacco manufacturers may have other reporting requirements, such as providing sales and shipment data.

Form Details:

- The latest edition currently provided by the West Virginia State Tax Department;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.