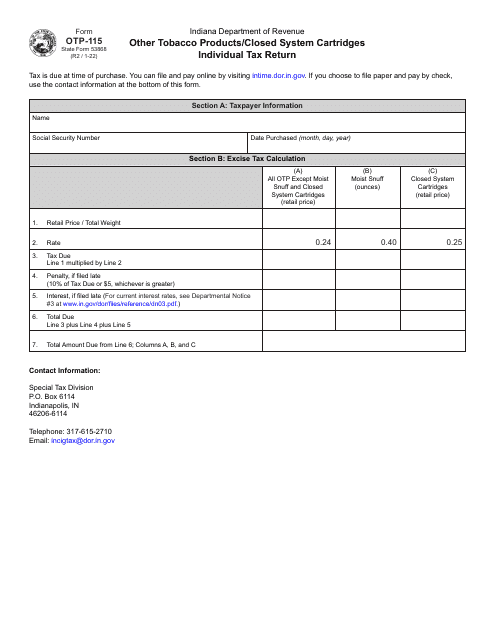

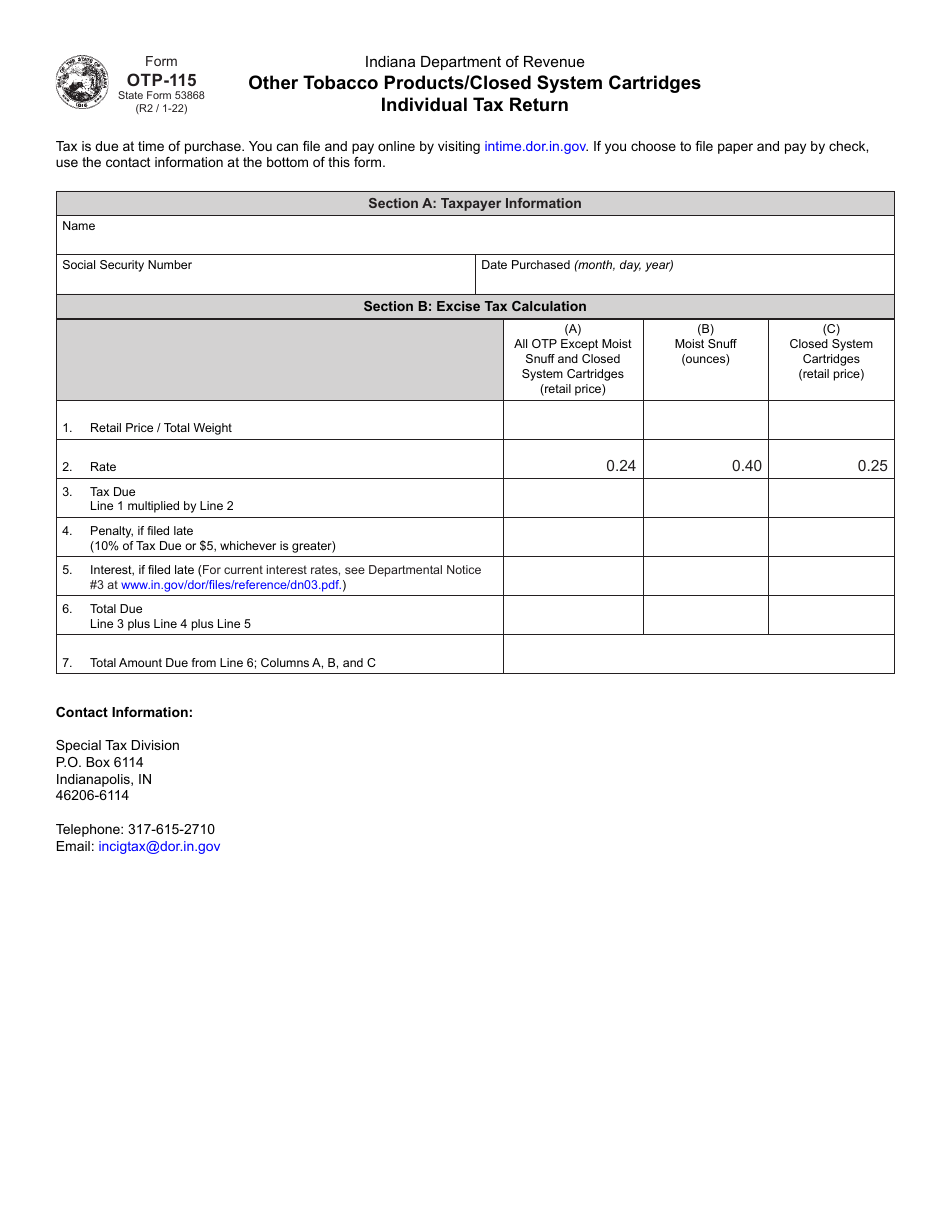

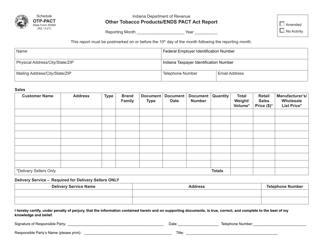

Form OTP-115 (State Form 53868) Other Tobacco Products / Closed System Cartridges Individual Tax Return - Indiana

What Is Form OTP-115 (State Form 53868)?

This is a legal form that was released by the Indiana Department of Revenue - a government authority operating within Indiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OTP-115?

A: Form OTP-115 is the Individual Tax Return specifically for Other Tobacco Products/Closed System Cartridges in Indiana.

Q: Who is required to file Form OTP-115?

A: Individuals who sell or distribute other tobacco products or closed system cartridges in Indiana are required to file Form OTP-115.

Q: What information is needed to complete Form OTP-115?

A: To complete Form OTP-115, you will need information about your sales and distribution of other tobacco products or closed system cartridges in Indiana, as well as your tax liability.

Q: When is the due date for filing Form OTP-115?

A: The due date for filing Form OTP-115 is April 15th of each tax year.

Q: Are there any penalties for late filing of Form OTP-115?

A: Yes, there may be penalties for late filing of Form OTP-115. It is important to file your tax return on time to avoid penalties and interest.

Form Details:

- Released on January 1, 2022;

- The latest edition provided by the Indiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form OTP-115 (State Form 53868) by clicking the link below or browse more documents and templates provided by the Indiana Department of Revenue.