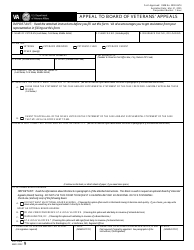

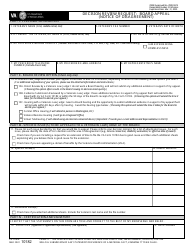

This version of the form is not currently in use and is provided for reference only. Download this version of

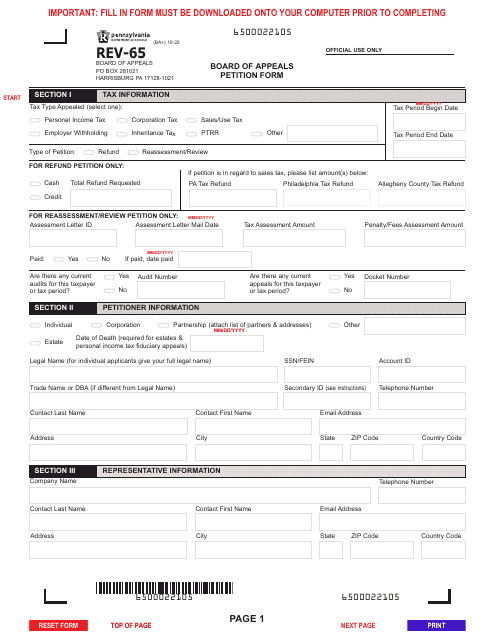

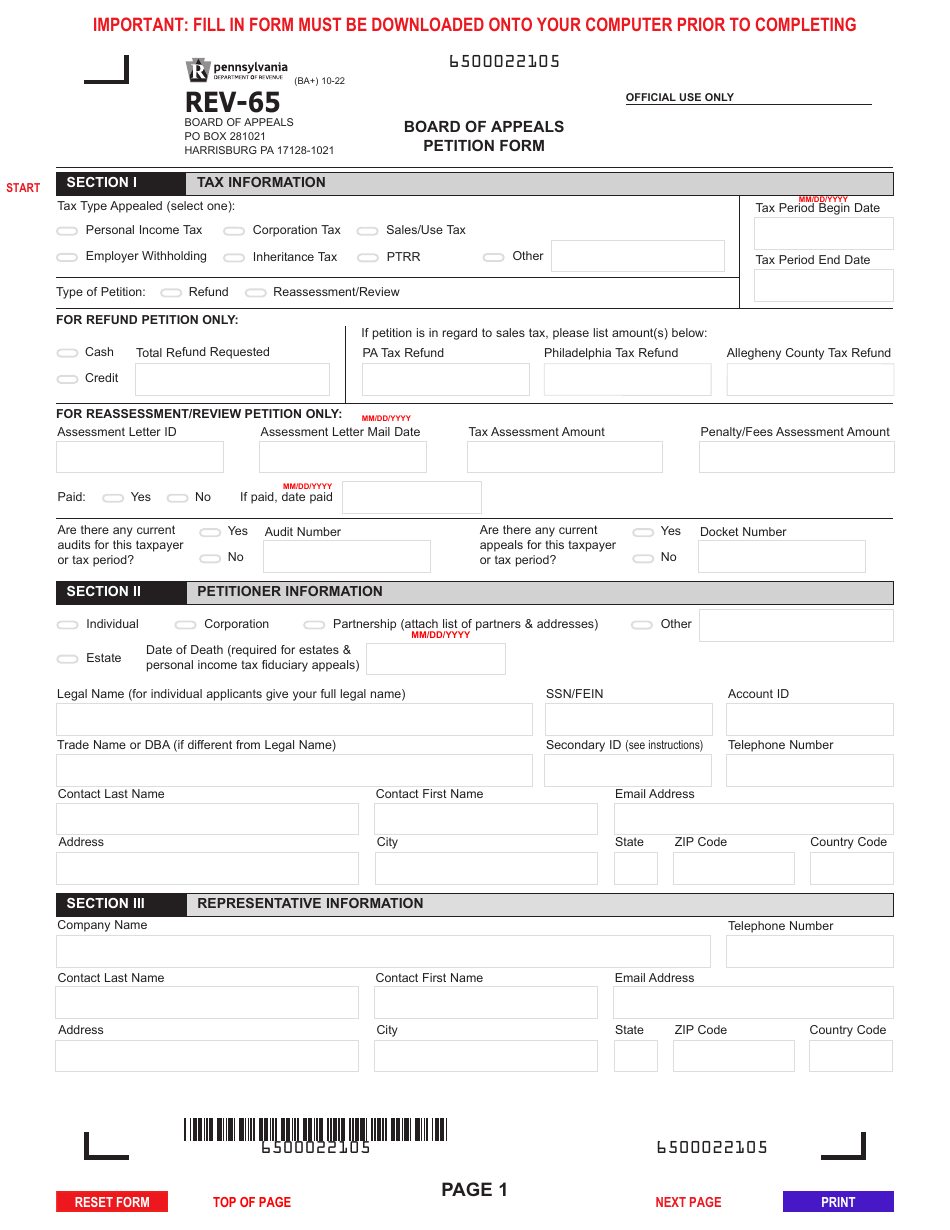

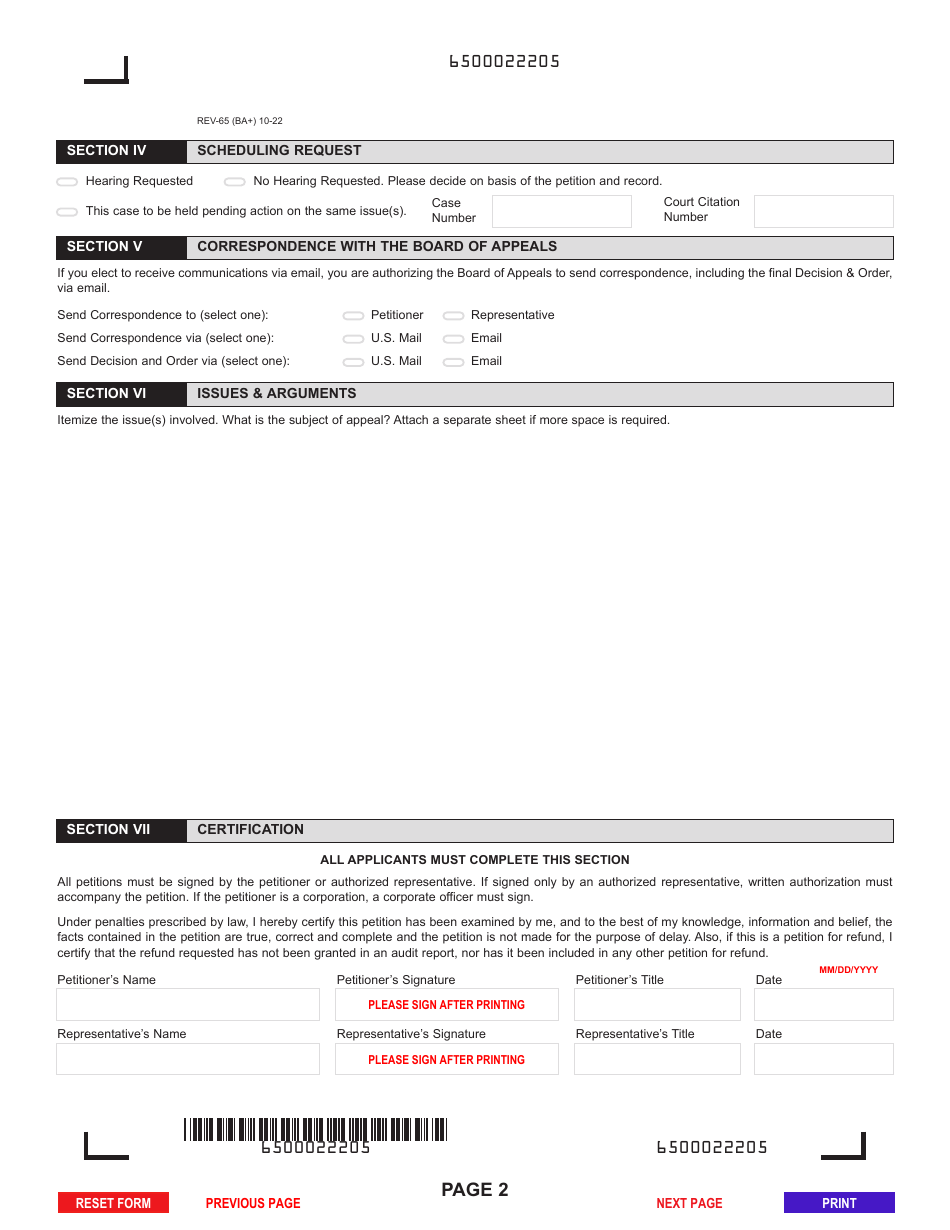

Form REV-65

for the current year.

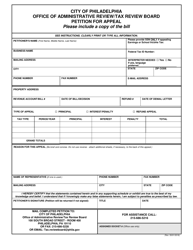

Form REV-65 Board of Appeals Petition Form - Pennsylvania

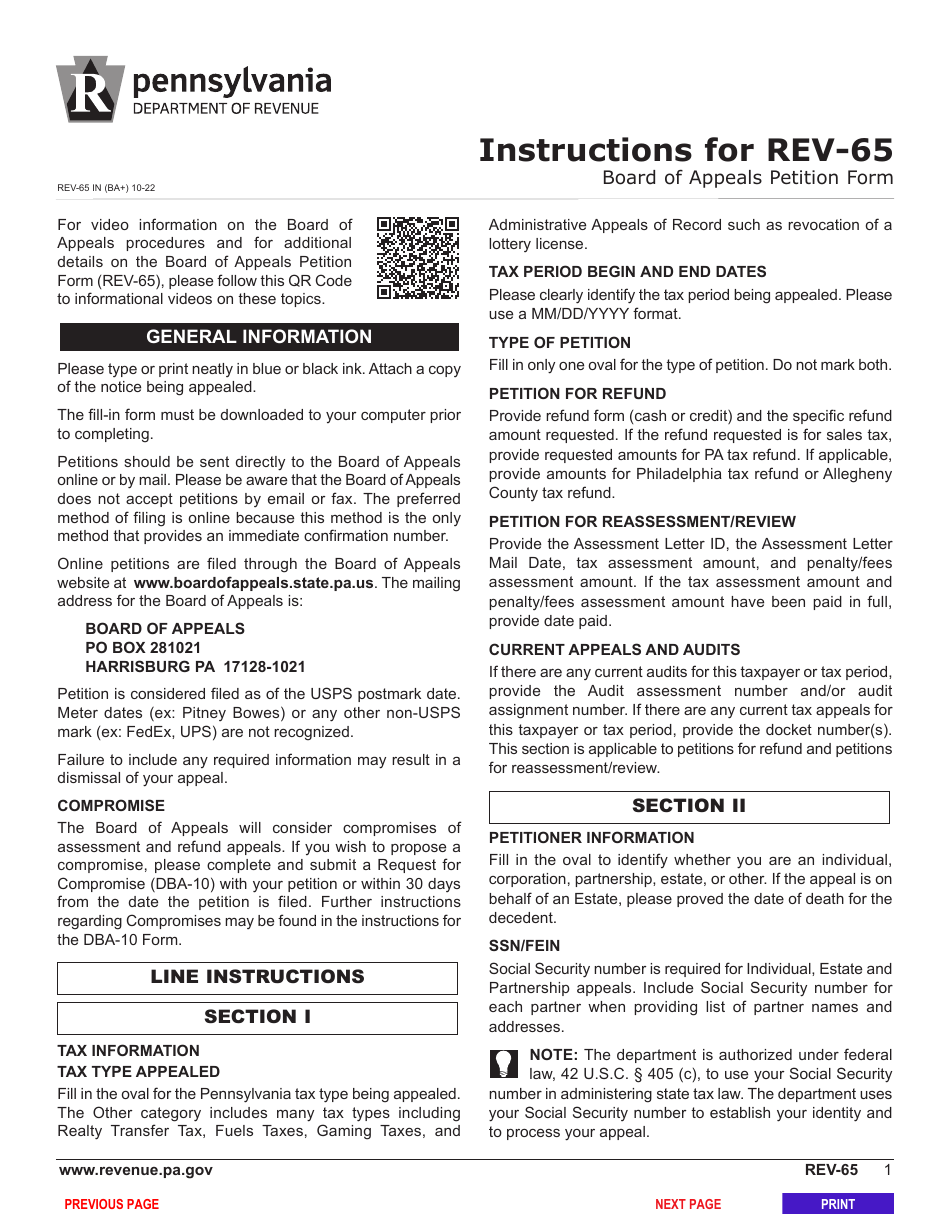

What Is Form REV-65?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form REV-65?

A: Form REV-65 is the Board of Appeals Petition Form in Pennsylvania.

Q: What is the purpose of Form REV-65?

A: The purpose of Form REV-65 is to file a petition with the Board of Appeals in Pennsylvania.

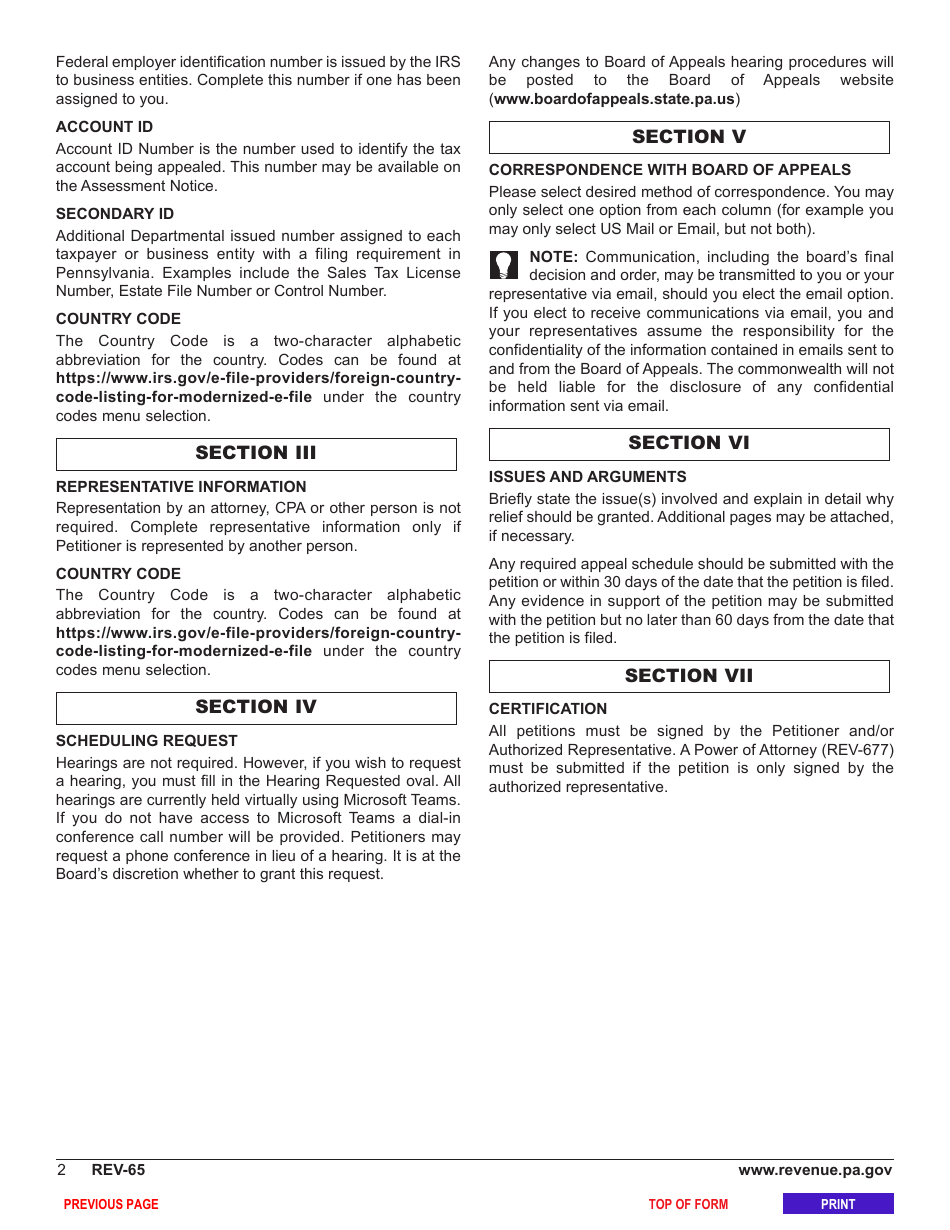

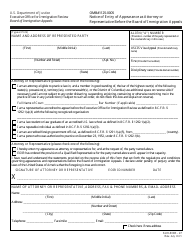

Q: What information do I need to provide on Form REV-65?

A: On Form REV-65, you need to provide your personal information, the specific tax matter you are appealing, and the reasons for your appeal.

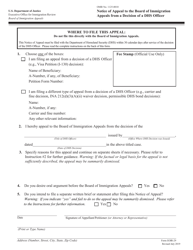

Q: What happens after I submit Form REV-65?

A: After submitting Form REV-65, your appeal will be reviewed by the Board of Appeals, and they will make a decision based on the information provided.

Q: Is there a deadline for submitting Form REV-65?

A: Yes, there is a deadline for submitting Form REV-65. The deadline is generally 90 days from the date of the Department of Revenue's notice of action or decision.

Q: Can I appeal the decision made by the Board of Appeals?

A: Yes, if you disagree with the decision made by the Board of Appeals, you can further appeal to the Pennsylvania Commonwealth Court.

Q: Is there a fee to file Form REV-65?

A: No, there is no fee to file Form REV-65 with the Board of Appeals.

Q: Can I get help filling out Form REV-65?

A: Yes, you can seek assistance from a tax professional or seek guidance from the Pennsylvania Department of Revenue.

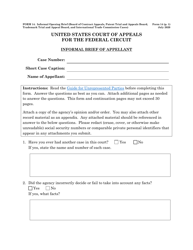

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-65 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.