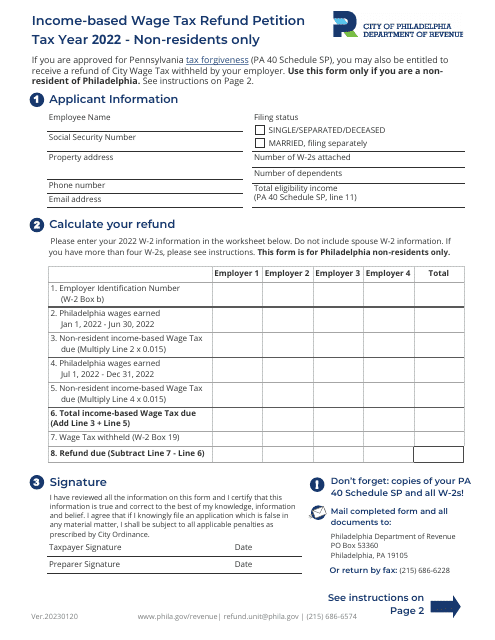

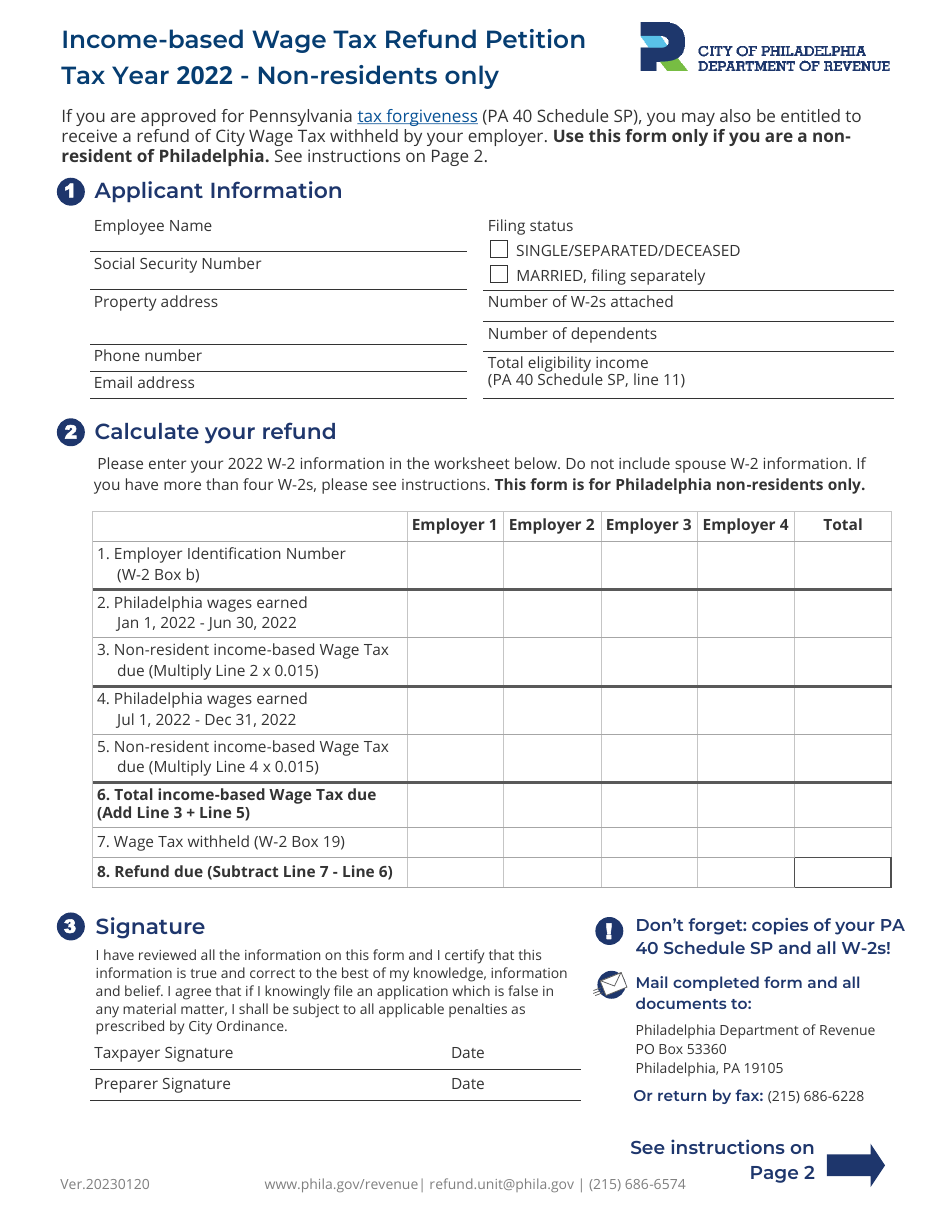

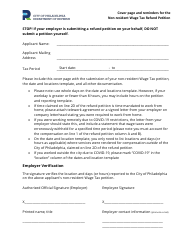

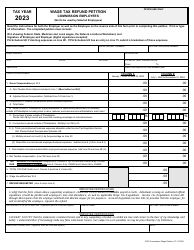

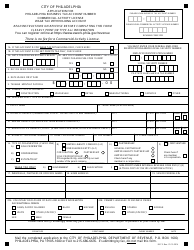

Income-Based Wage Tax Refund Petition - Non-residents Only - City of Philadelphia, Pennsylvania

Income-Based Wage Tax Refund Petition - Non-residents Only is a legal document that was released by the Department of Revenue - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

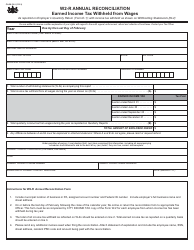

Q: Who can file the Income-Based Wage Tax Refund petition in Philadelphia?

A: Non-residents only.

Q: What is the purpose of the Income-Based Wage Tax Refund petition?

A: To request a refund of wage taxes based on income.

Q: Which city is this petition applicable to?

A: Philadelphia, Pennsylvania.

Q: Who is eligible to file this petition?

A: Non-residents who paid wage taxes in Philadelphia.

Q: What type of refund is requested in this petition?

A: A refund of wage taxes.

Q: Based on what is the refund amount determined?

A: The refund amount is determined based on the individual's income.

Q: Who can't file this petition?

A: Residents of Philadelphia.

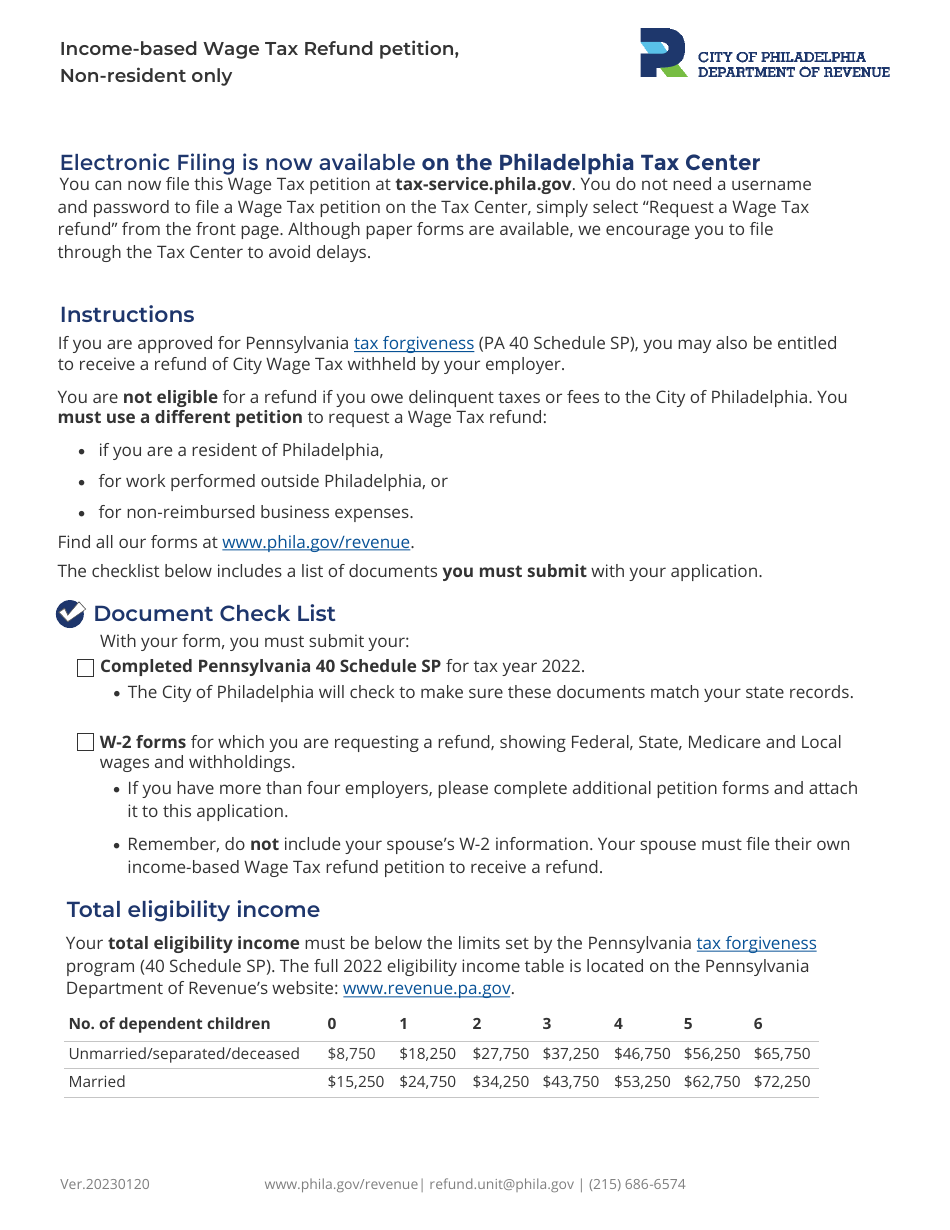

Q: Are there any specific requirements to include while filing the petition?

A: Yes, you need to include proof of income and other required documents.

Q: Can I file this petition if I am a resident of Philadelphia?

A: No, this petition is only applicable to non-residents.

Form Details:

- Released on January 20, 2023;

- The latest edition currently provided by the Department of Revenue - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Department of Revenue - City of Philadelphia, Pennsylvania.