This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

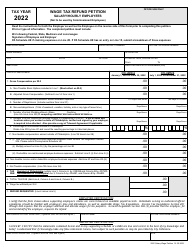

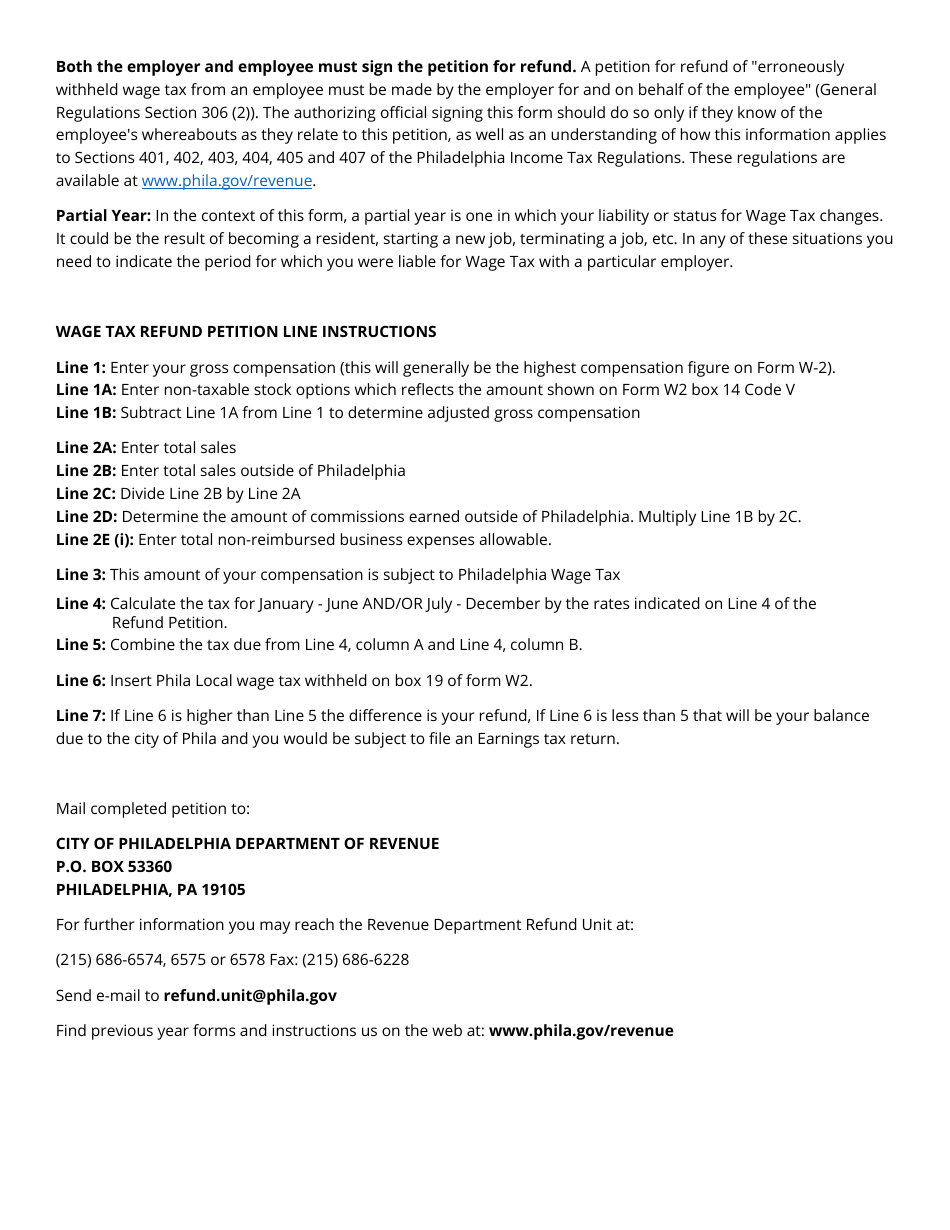

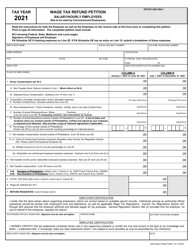

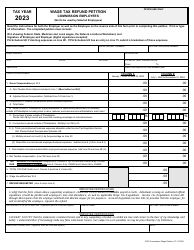

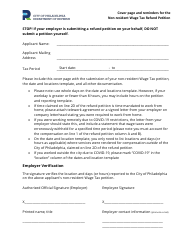

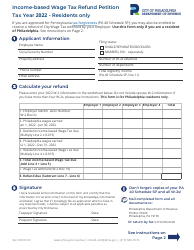

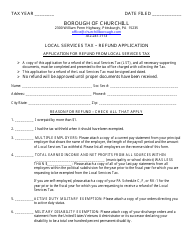

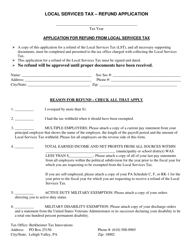

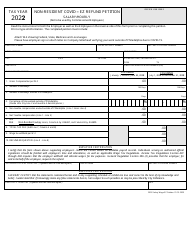

Wage Tax Refund Petition - Salary / Hourly Employees - City of Philadelphia, Pennsylvania

Wage Tax Refund Petition - Salary/Hourly Employees is a legal document that was released by the Department of Revenue - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

Q: What is a wage tax refund petition?

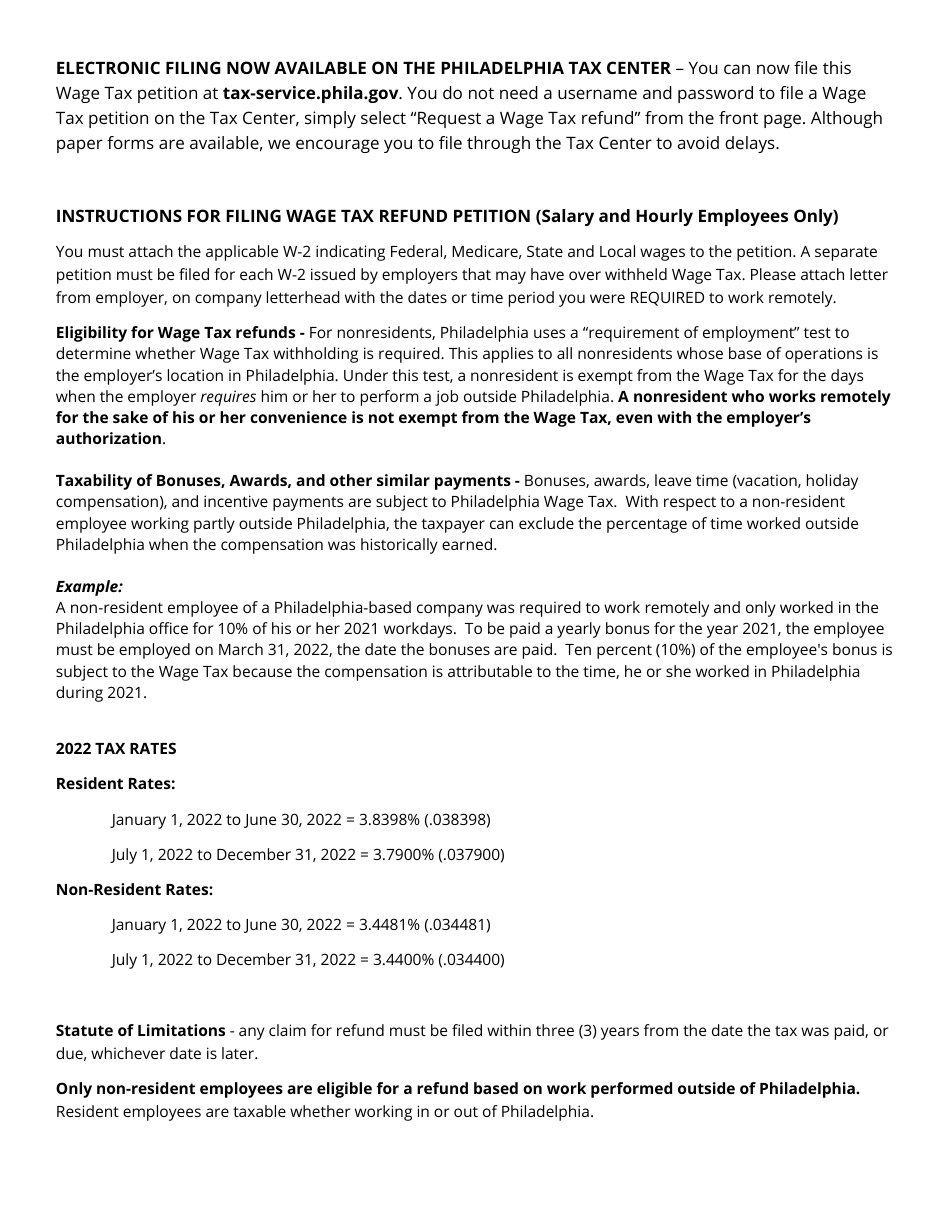

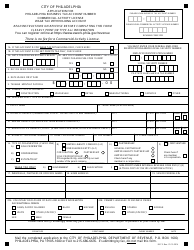

A: A wage tax refund petition is a form that allows salary or hourly employees in the City of Philadelphia, Pennsylvania to request a refund of any excess wage taxes paid.

Q: Who can file a wage tax refund petition in Philadelphia?

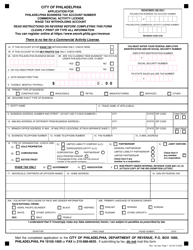

A: Salary or hourly employees who work in the City of Philadelphia, Pennsylvania can file a wage tax refund petition.

Q: How can I file a wage tax refund petition in Philadelphia?

A: To file a wage tax refund petition in Philadelphia, you will need to complete the necessary form and submit it to the appropriate department or office.

Q: What do I need to include in my wage tax refund petition in Philadelphia?

A: In your wage tax refund petition in Philadelphia, you will need to include your personal information, employment details, and supporting documentation.

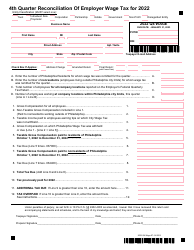

Q: What is the deadline for filing a wage tax refund petition in Philadelphia?

A: The deadline for filing a wage tax refund petition in Philadelphia may vary, so it's best to check with the appropriate department or office.

Q: How long does it take to receive a refund from a wage tax refund petition in Philadelphia?

A: The processing time for a wage tax refund petition in Philadelphia may vary, but it typically takes several weeks to receive a refund.

Q: What should I do if my wage tax refund petition in Philadelphia is denied?

A: If your wage tax refund petition in Philadelphia is denied, you may have the option to appeal the decision or seek further assistance from the appropriate department or office.

Q: Can I file a wage tax refund petition if I am self-employed?

A: No, a wage tax refund petition is specifically for salary or hourly employees in Philadelphia, so self-employed individuals are not eligible.

Q: Can I file a wage tax refund petition if I work outside of Philadelphia but commute to the city?

A: Yes, if you work outside of Philadelphia but commute to the city, you may still be eligible to file a wage tax refund petition.

Q: Are there any fees associated with filing a wage tax refund petition in Philadelphia?

A: There may be fees associated with filing a wage tax refund petition in Philadelphia, so be sure to check the requirements and instructions provided by the appropriate department or office.

Form Details:

- Released on January 30, 2023;

- The latest edition currently provided by the Department of Revenue - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Revenue - City of Philadelphia, Pennsylvania.