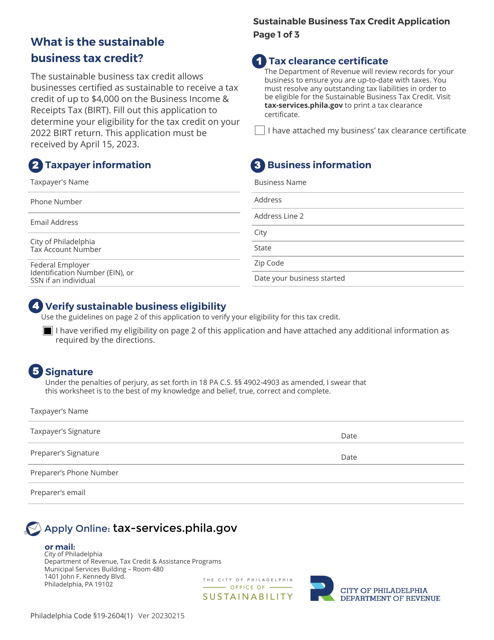

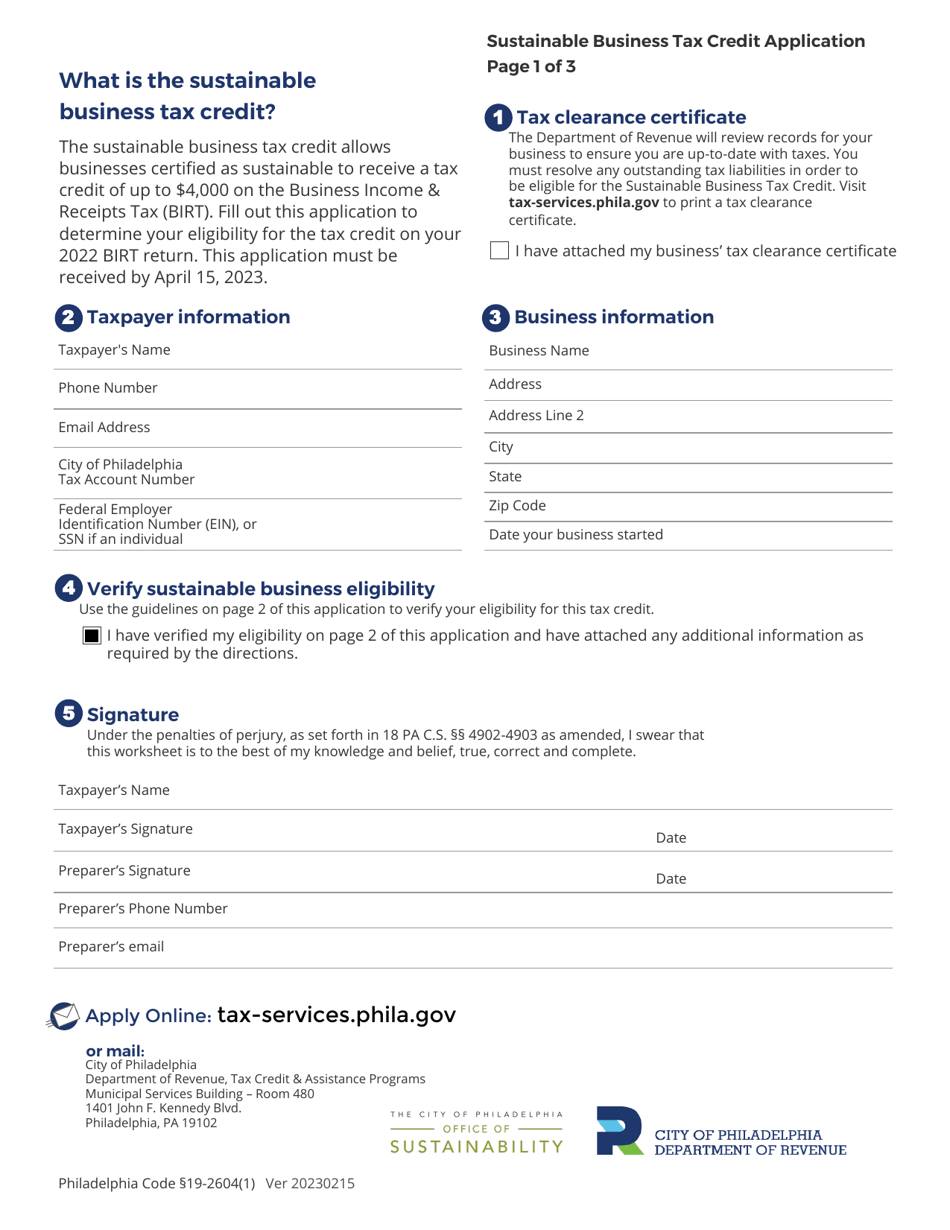

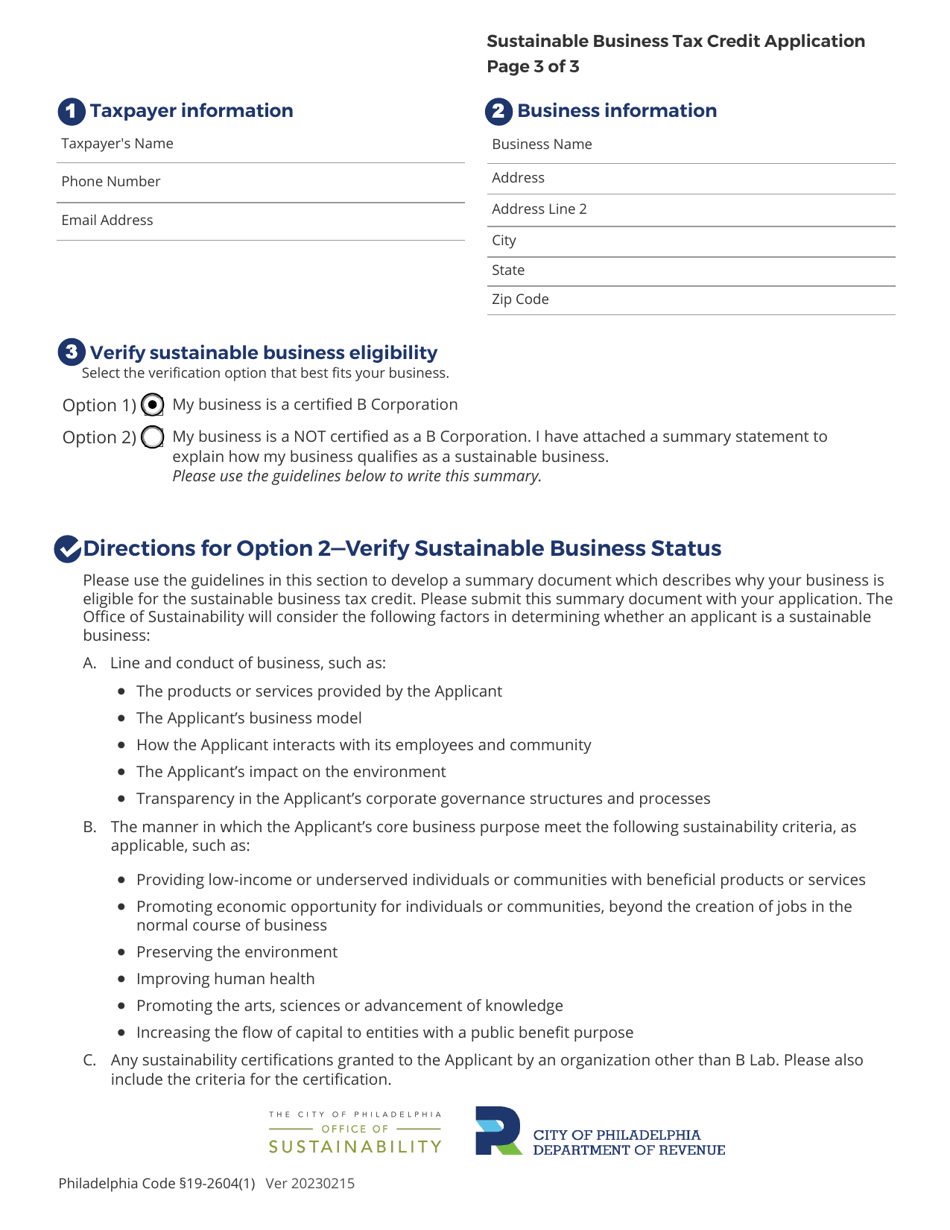

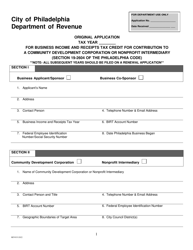

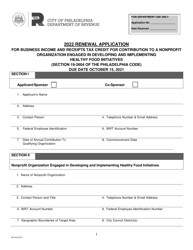

Sustainable Business Tax Credit Application - City of Philadelphia, Pennsylvania

Sustainable Business Tax Credit Application is a legal document that was released by the Department of Revenue - City of Philadelphia, Pennsylvania - a government authority operating within Pennsylvania. The form may be used strictly within City of Philadelphia.

FAQ

Q: What is the Sustainable Business Tax Credit Application?

A: The Sustainable Business Tax Credit Application is a form that businesses in Philadelphia, Pennsylvania can submit to apply for tax credits for sustainable practices.

Q: Who is eligible to apply for the Sustainable Business Tax Credit?

A: All businesses operating in Philadelphia, Pennsylvania are eligible to apply for the Sustainable Business Tax Credit.

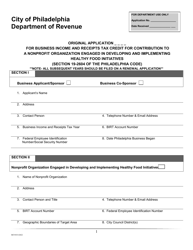

Q: What are the requirements for the Sustainable Business Tax Credit?

A: To be eligible for the tax credit, businesses must demonstrate that they have implemented sustainable practices such as energy efficiency, waste reduction, and water conservation.

Q: How much tax credit can a business receive?

A: The amount of tax credit a business can receive depends on the extent to which they have implemented sustainable practices. The maximum tax credit is $4,000 per year.

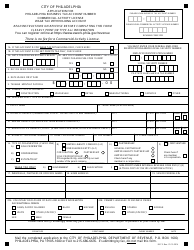

Q: How can businesses apply for the Sustainable Business Tax Credit?

A: Businesses can apply for the tax credit by completing and submitting the Sustainable Business Tax Credit Application form to the City of Philadelphia's Office of Sustainability.

Q: What is the deadline for applying for the tax credit?

A: The deadline for submitting the Sustainable Business Tax Credit Application is March 15th of each year.

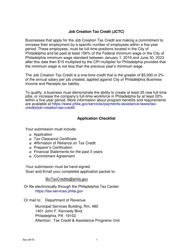

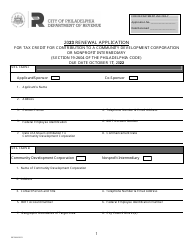

Form Details:

- Released on February 15, 2023;

- The latest edition currently provided by the Department of Revenue - City of Philadelphia, Pennsylvania;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Revenue - City of Philadelphia, Pennsylvania.