Form REV41 0056 Instructions for Determining Your Quarterly Small Business Credit (Sbc) - Washington

What Is Form REV41 0056?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

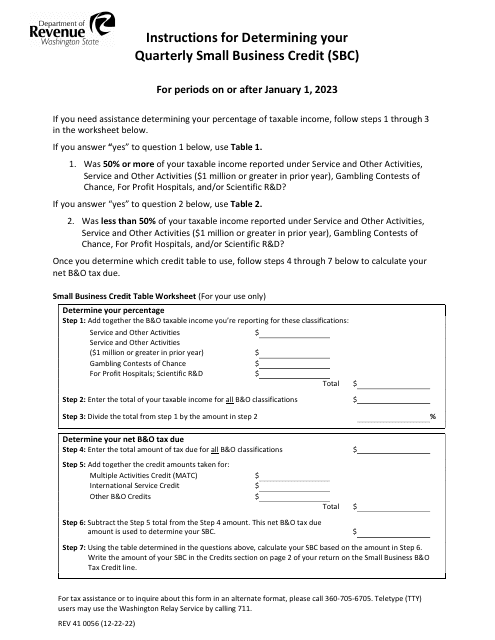

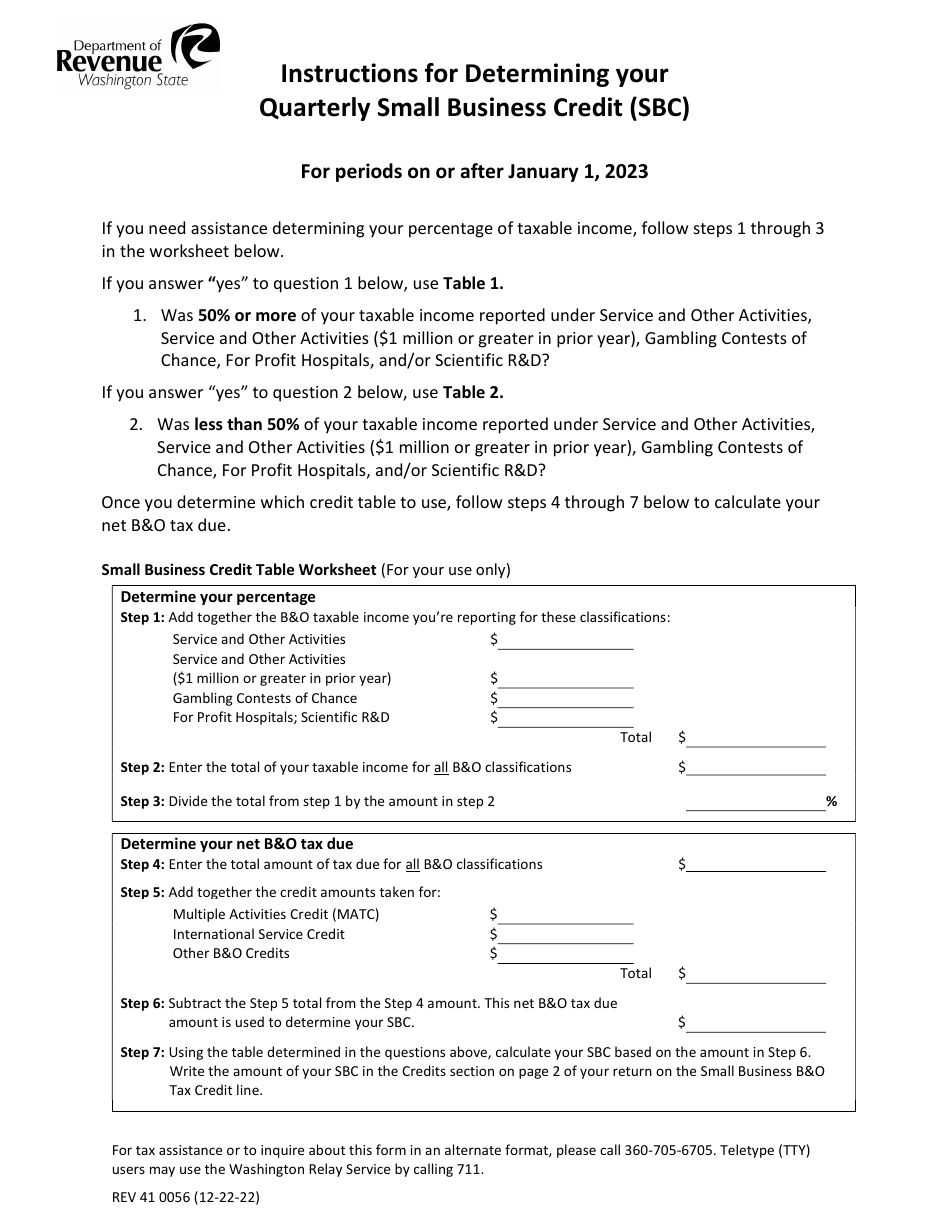

Q: What is Form REV41 0056?

A: Form REV41 0056 is the form used to determine your Quarterly Small Business Credit (SBC) in Washington.

Q: What is the purpose of the SBC?

A: The purpose of the SBC is to provide a tax credit to small businesses in Washington.

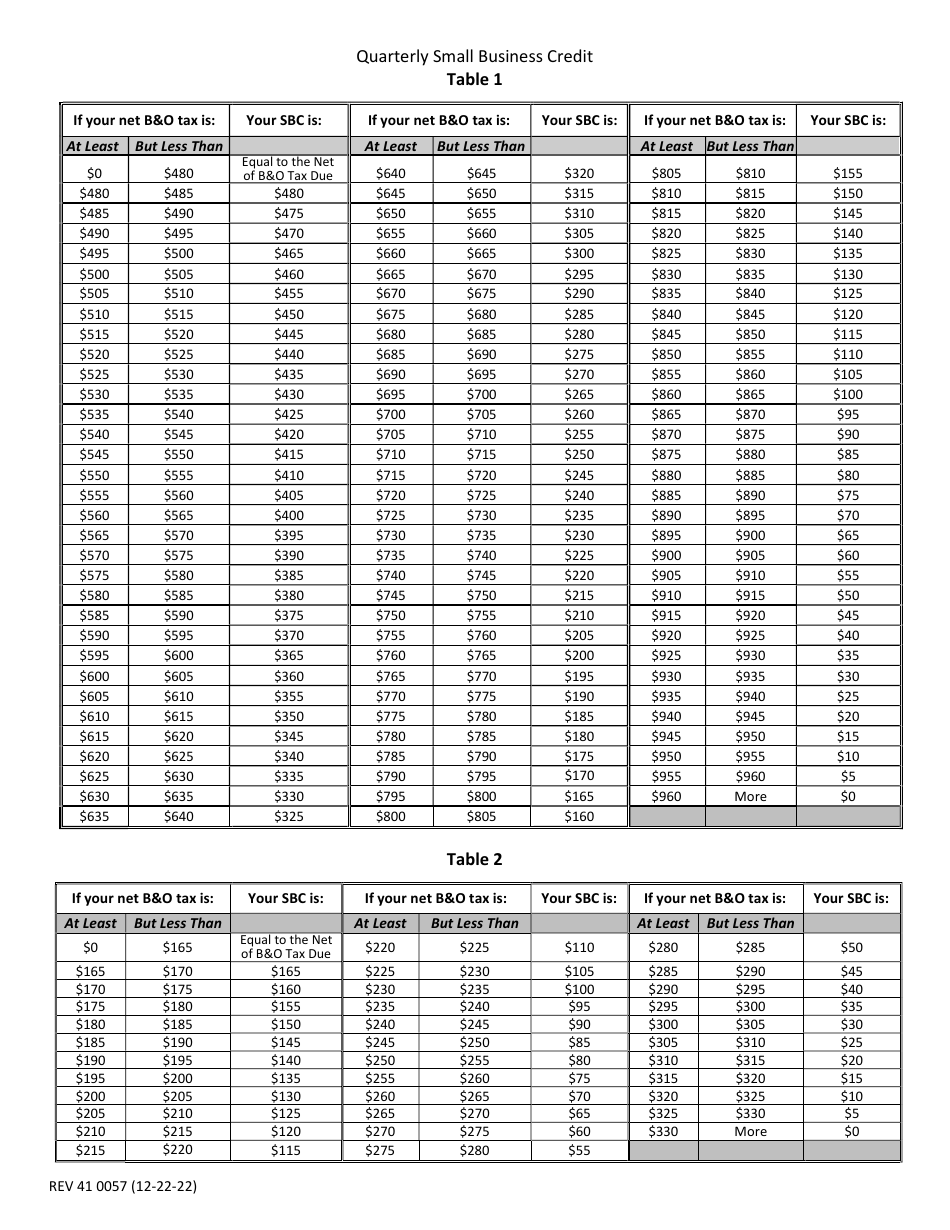

Q: How is the SBC determined?

A: The SBC is determined based on the number of employees and the amount of wages paid by the small business.

Q: Who is eligible for the SBC?

A: Small businesses that meet certain criteria are eligible for the SBC in Washington.

Q: How can I claim the SBC?

A: You can claim the SBC by filling out Form REV41 0056 and submitting it to the appropriate tax authorities.

Q: Are there any deadlines for claiming the SBC?

A: Yes, there are specific deadlines for claiming the SBC. Please refer to the instructions provided with Form REV41 0056.

Q: What are the benefits of the SBC?

A: The SBC provides a tax credit that can help reduce the tax liability of small businesses in Washington.

Form Details:

- Released on December 22, 2022;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form REV41 0056 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.