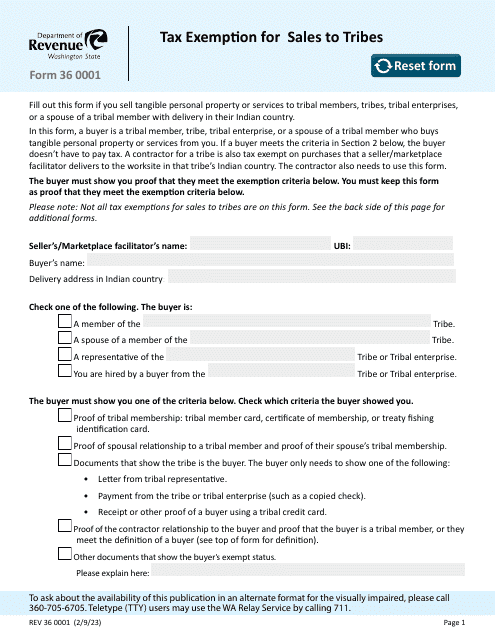

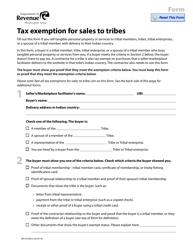

Form REV36 0001 Tax Exemption for Sales to Tribes - Washington

What Is Form REV36 0001?

This is a legal form that was released by the Washington State Department of Revenue - a government authority operating within Washington. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form REV36 0001?

A: Form REV36 0001 is the Tax Exemption for Sales to Tribes form in Washington.

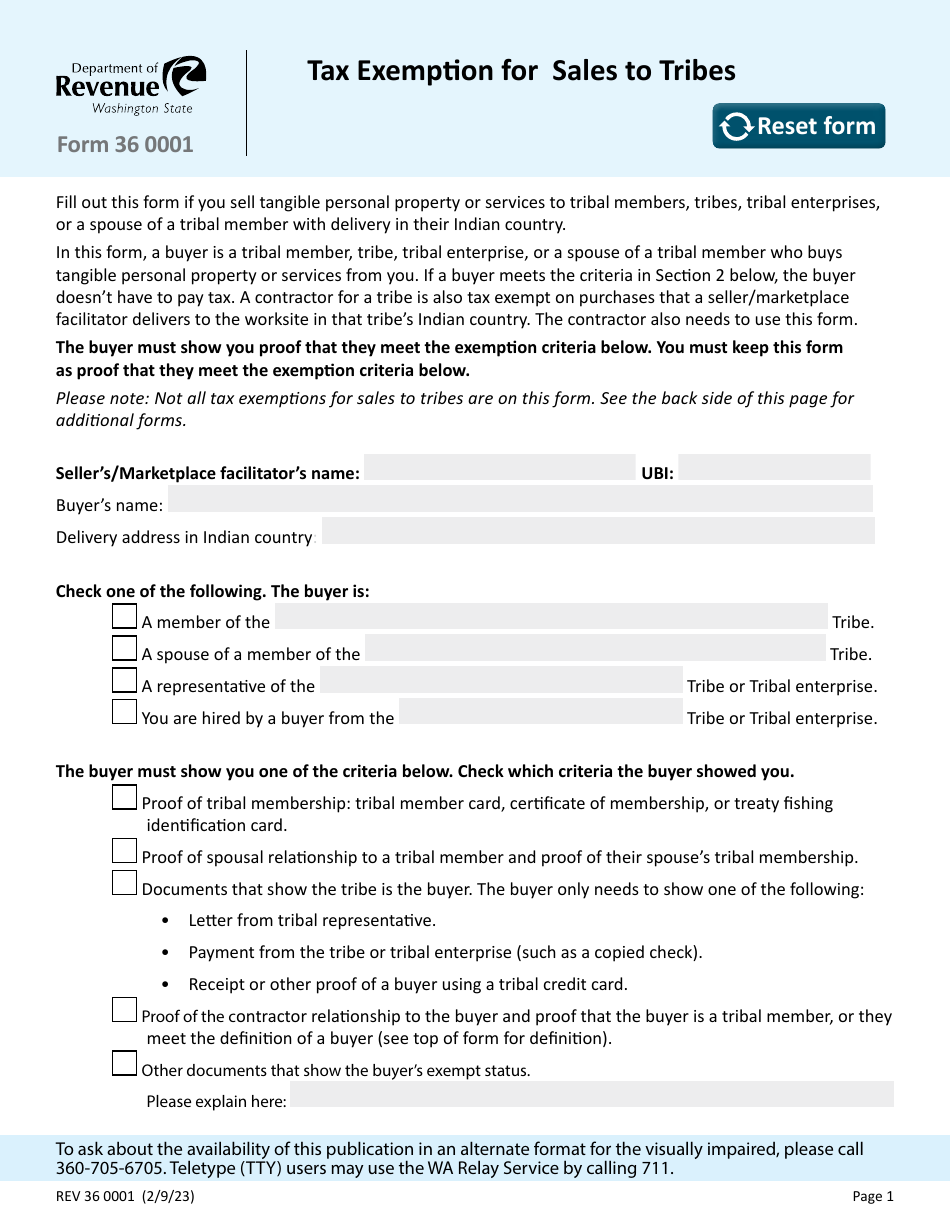

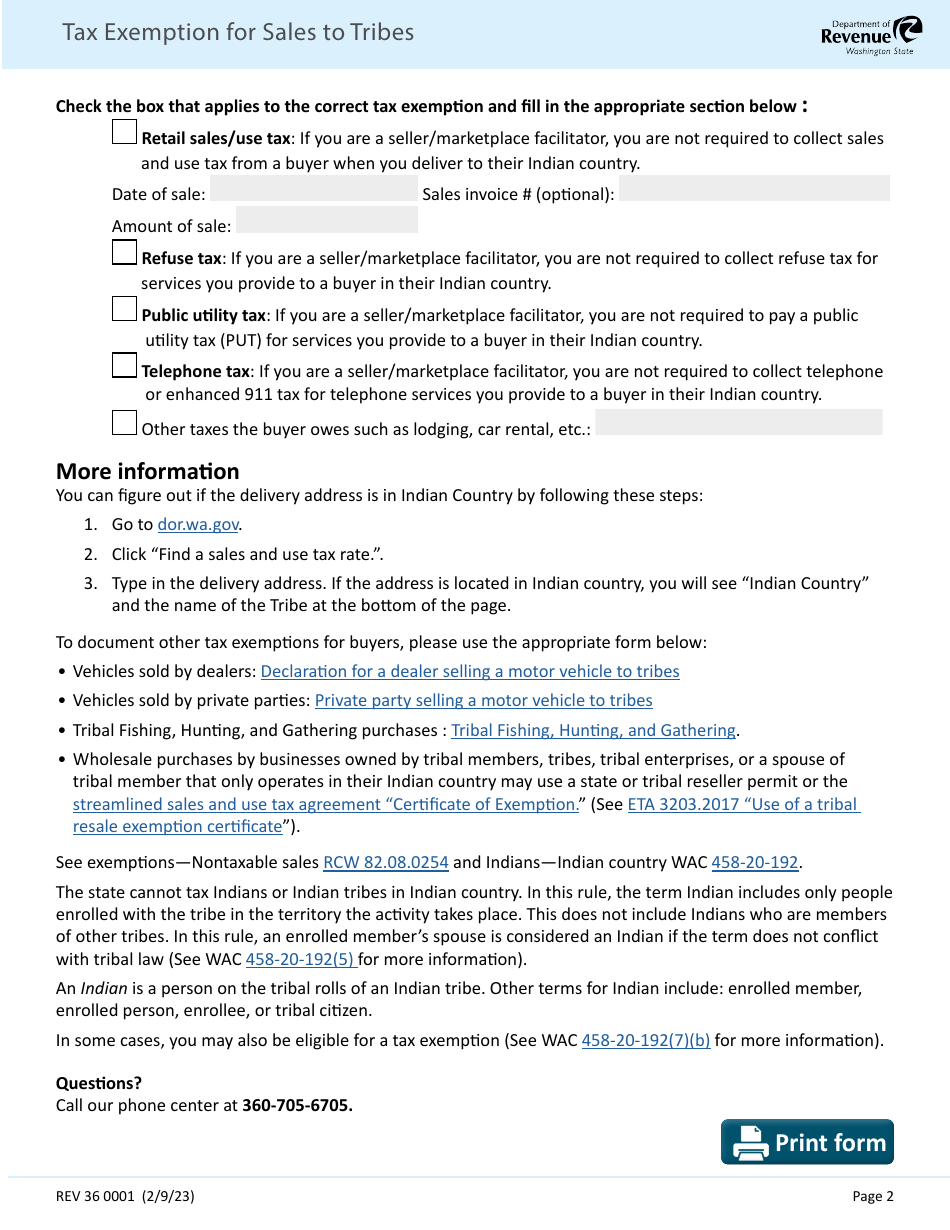

Q: What is the purpose of form REV36 0001?

A: The purpose of form REV36 0001 is to claim tax exemption for sales made to tribes in Washington.

Q: Who can use form REV36 0001?

A: Form REV36 0001 can be used by businesses in Washington State that make sales to tribes and want to claim a tax exemption.

Q: What information is required on form REV36 0001?

A: Form REV36 0001 requires information about the buyer and seller, description of the goods or services, and certification of tribal membership or enrollment.

Q: When should I file form REV36 0001?

A: Form REV36 0001 should be filed with each tax return that includes sales to tribes in Washington.

Q: Is there a deadline to file form REV36 0001?

A: Yes, form REV36 0001 must be filed by the due date of the tax return that includes the sales to tribes.

Form Details:

- Released on February 9, 2023;

- The latest edition provided by the Washington State Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV36 0001 by clicking the link below or browse more documents and templates provided by the Washington State Department of Revenue.