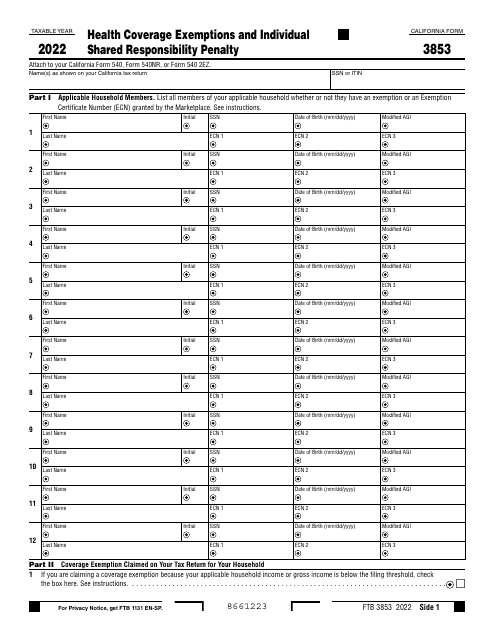

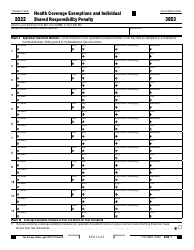

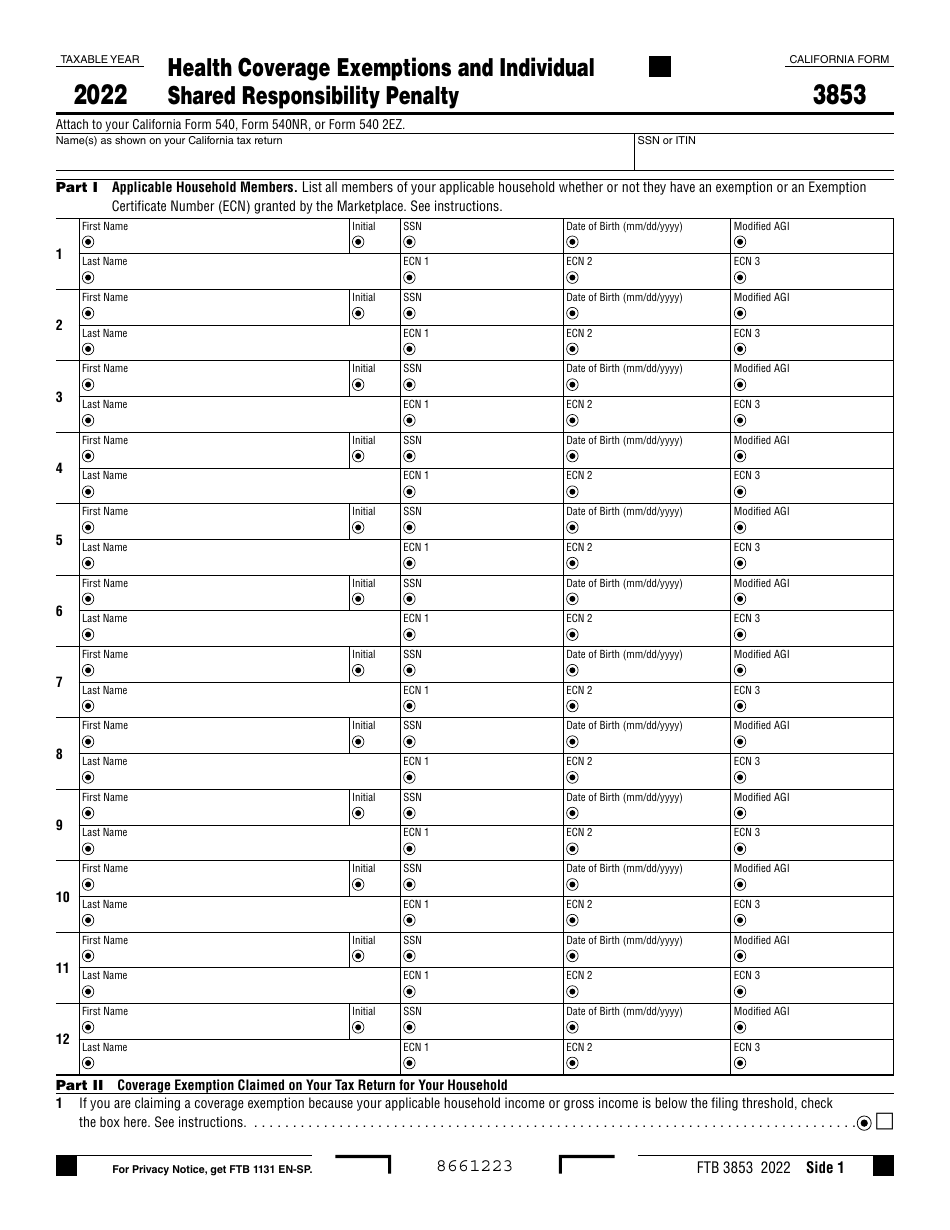

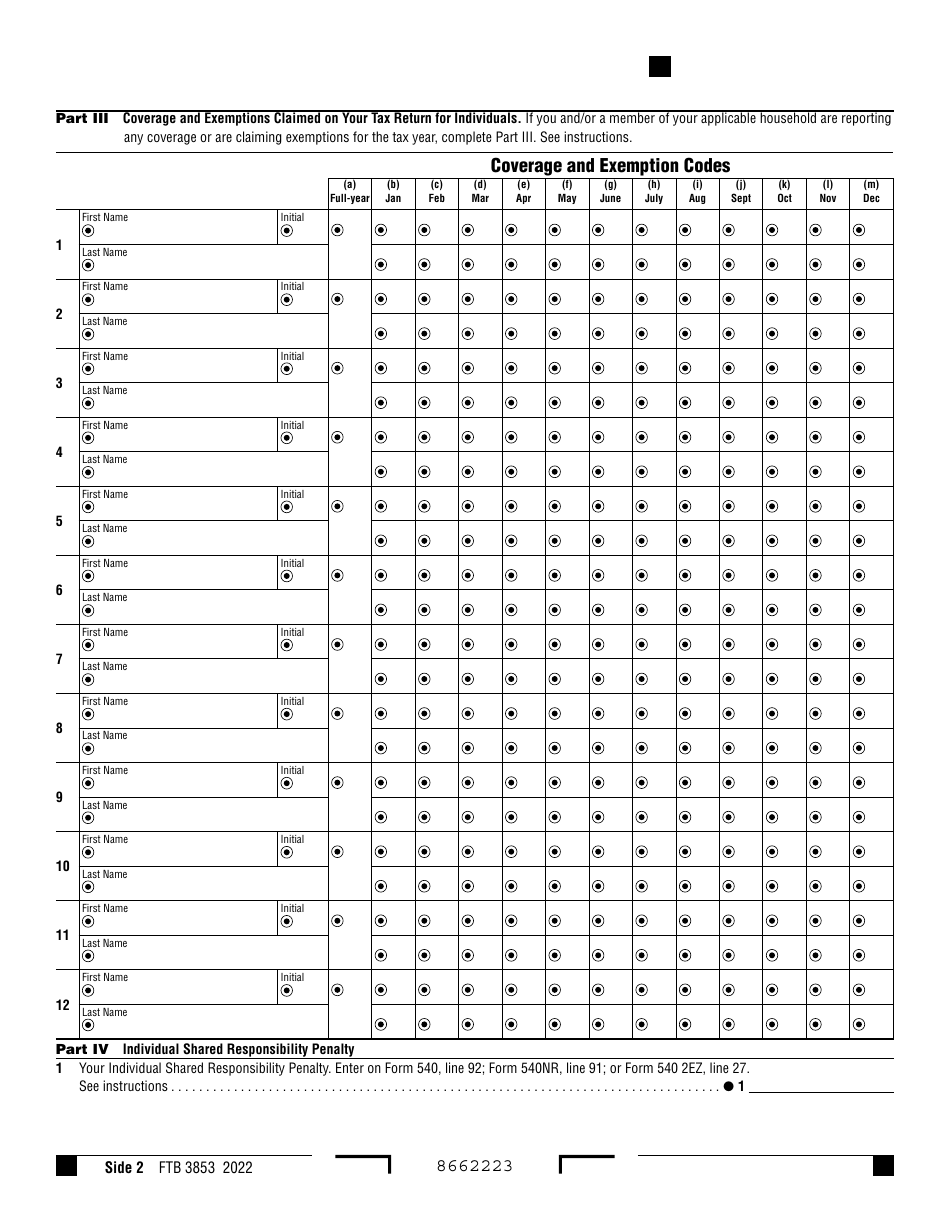

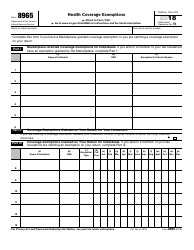

Form 3853 Health Coverage Exemptions and Individual Shared Responsibility Penalty - California

What Is Form 3853?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 3853?

A: Form 3853 is the Health Coverage Exemptions and Individual Shared Responsibility Penalty form specific to California.

Q: What is the purpose of Form 3853?

A: The purpose of Form 3853 is to claim a health coverage exemption or report an individual shared responsibility penalty for California residents.

Q: Who needs to use Form 3853?

A: California residents who are claiming a health coverage exemption or reporting an individual shared responsibility penalty need to use Form 3853.

Q: What is a health coverage exemption?

A: A health coverage exemption is a specific circumstance that allows individuals to be exempt from having to pay a penalty for not having health insurance.

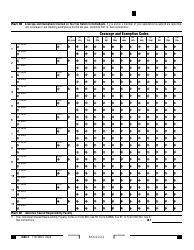

Q: What is the individual shared responsibility penalty?

A: The individual shared responsibility penalty is the penalty that individuals may have to pay if they do not have qualifying health insurance throughout the year.

Q: When is Form 3853 due?

A: Form 3853 is typically due by the tax filing deadline, which is generally April 15th of each year.

Q: What happens if I don't file Form 3853?

A: If you are required to file Form 3853 but fail to do so, you may be subject to penalties and interest.

Q: Are there any exceptions to the individual shared responsibility penalty?

A: Yes, there are several exemptions available that can waive the individual shared responsibility penalty. These exemptions include religious exemptions, hardship exemptions, and exemptions for certain types of coverage.

Q: Can I claim a health coverage exemption on Form 3853 if I had coverage for part of the year?

A: Yes, you can claim a health coverage exemption on Form 3853 even if you had coverage for only part of the year. You will need to provide documentation to support your exemption claim.

Form Details:

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 3853 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.