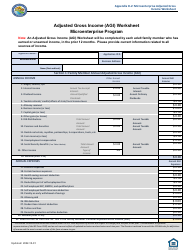

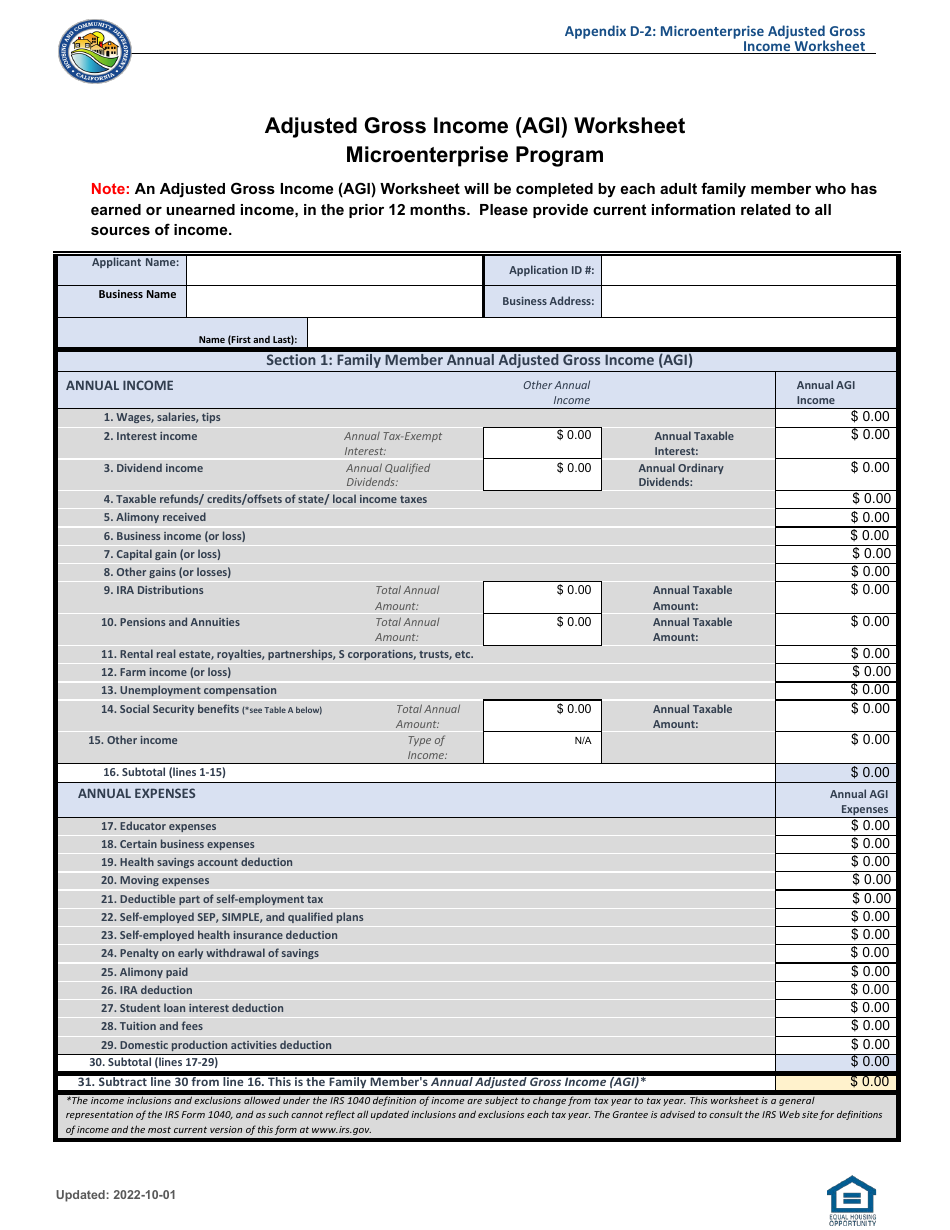

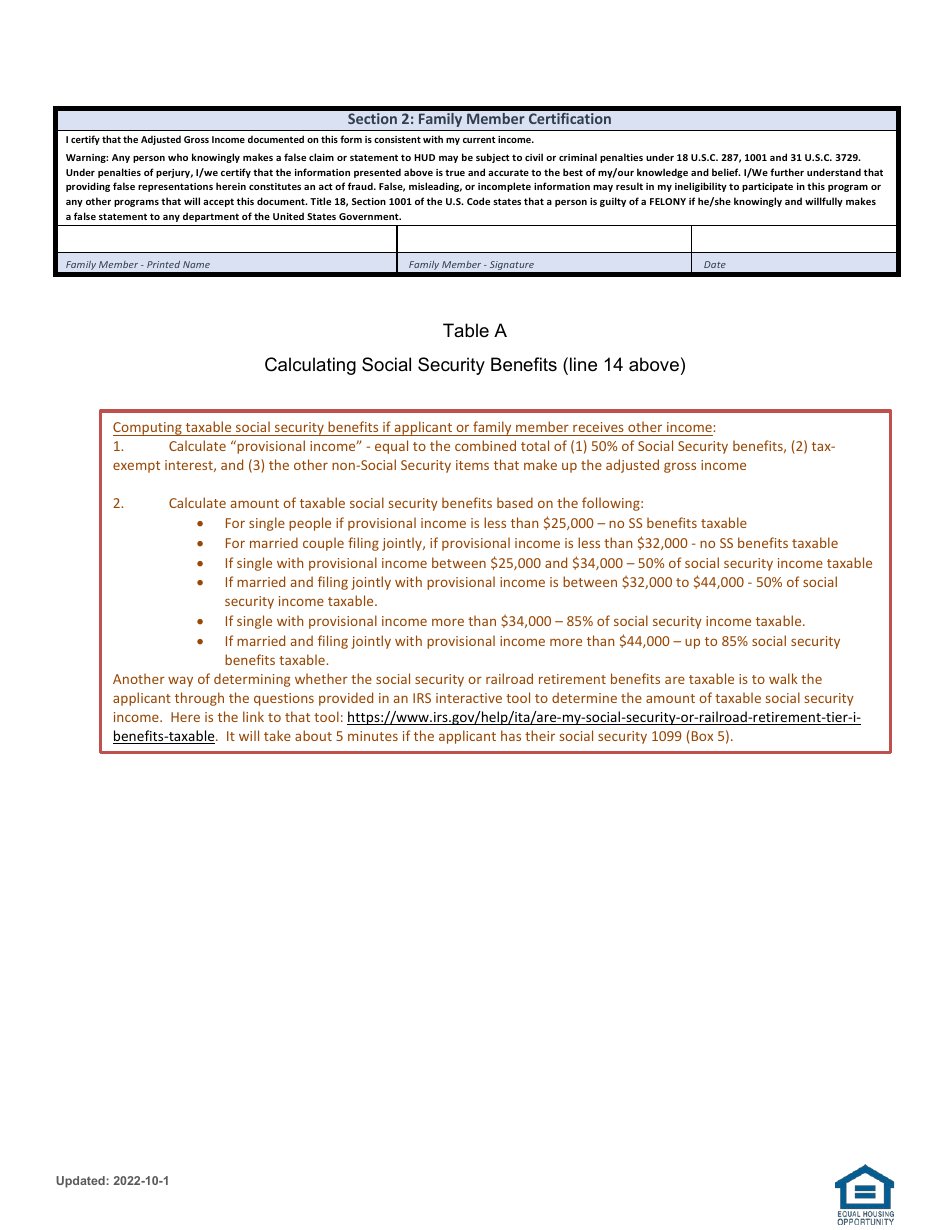

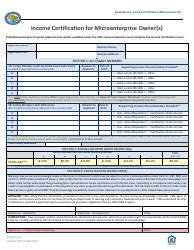

Appendix D-2 Adjusted Gross Income (Agi) Worksheet - Microenterprise Program - Community Development Block Grant (Cdbg) - California

What Is Appendix D-2?

This is a legal form that was released by the California Department of Housing & Community Development - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Appendix D-2 Adjusted Gross Income (AGI) Worksheet?

A: The Appendix D-2 Adjusted Gross Income (AGI) Worksheet is a document used in the Microenterprise Program under the Community Development Block Grant (CDBG) in California.

Q: What is the Microenterprise Program?

A: The Microenterprise Program is a program that provides assistance and support to small businesses and entrepreneurs.

Q: What is the Community Development Block Grant (CDBG)?

A: The Community Development Block Grant (CDBG) is a federal program that provides funding to local communities to support various community development projects.

Q: What is the purpose of the Appendix D-2 Adjusted Gross Income (AGI) Worksheet?

A: The purpose of the Appendix D-2 Adjusted Gross Income (AGI) Worksheet is to calculate the adjusted gross income of applicants for the Microenterprise Program.

Q: Who is eligible for the Microenterprise Program?

A: Eligibility for the Microenterprise Program is typically based on factors such as income level, business size, and the potential for job creation.

Q: Why is the Appendix D-2 Adjusted Gross Income (AGI) Worksheet important?

A: The Appendix D-2 Adjusted Gross Income (AGI) Worksheet is important because it helps determine the financial eligibility of applicants for the Microenterprise Program.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the California Department of Housing & Community Development;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Appendix D-2 by clicking the link below or browse more documents and templates provided by the California Department of Housing & Community Development.