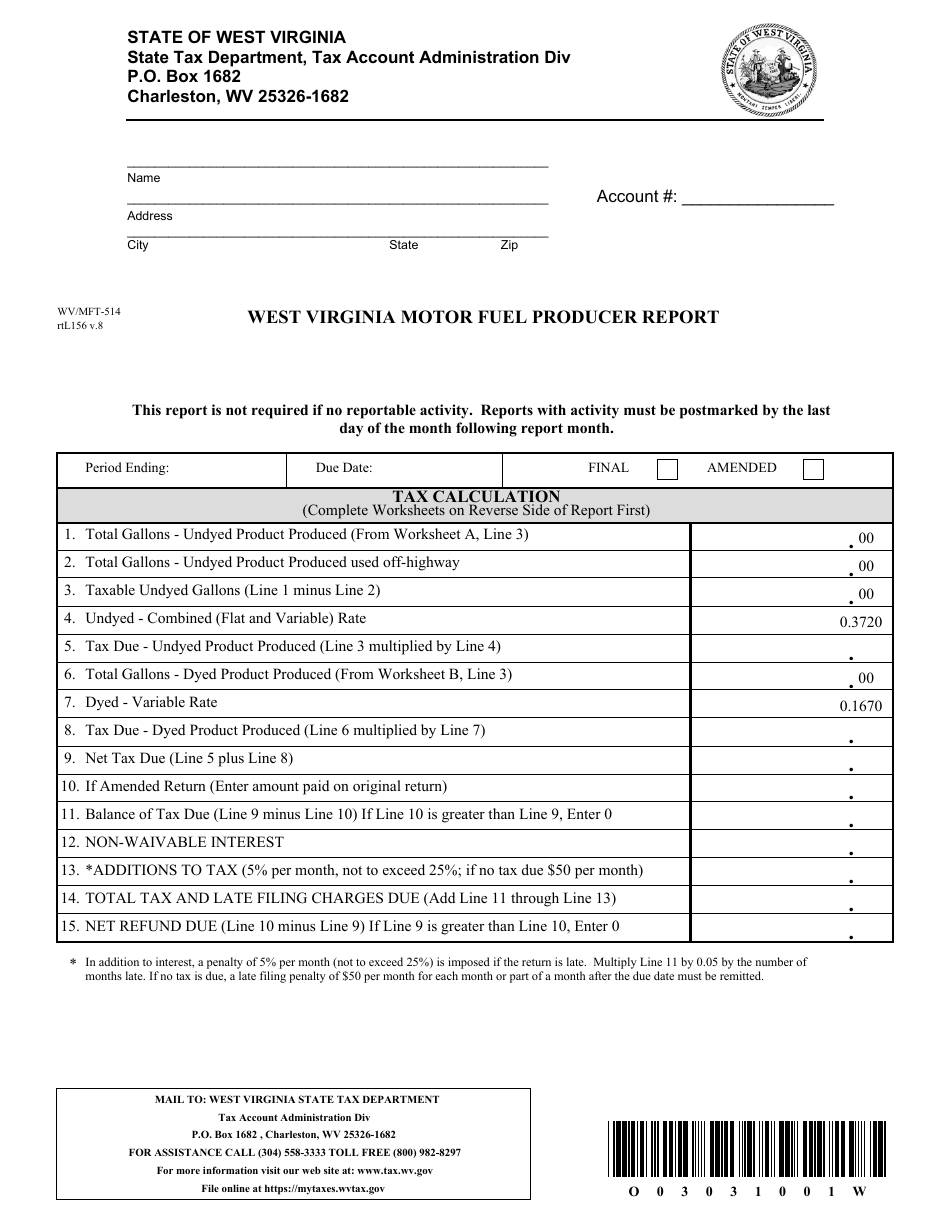

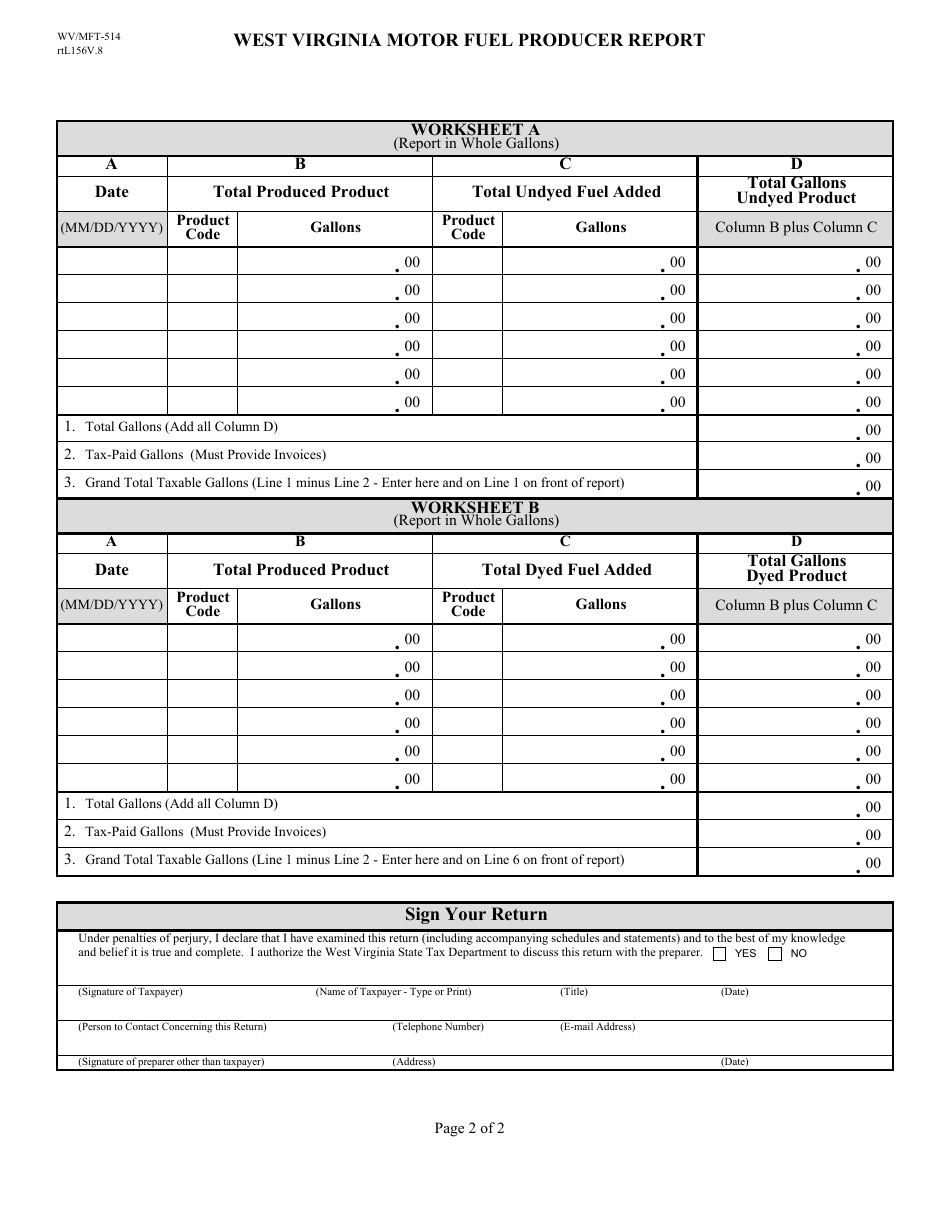

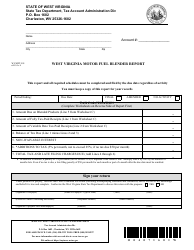

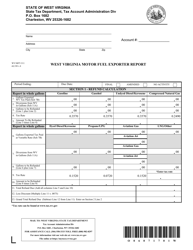

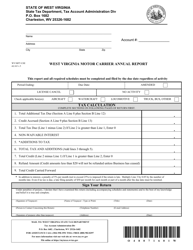

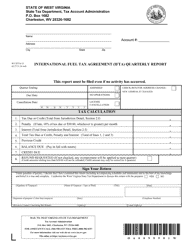

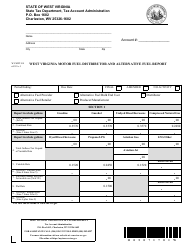

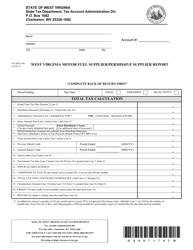

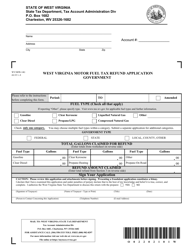

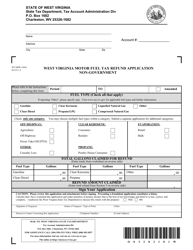

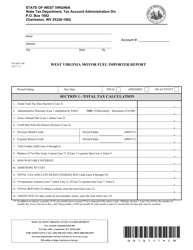

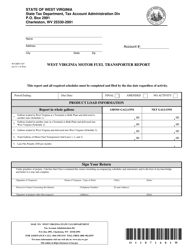

Form WV / MFT-514 West Virginia Motor Fuel Producer Report - West Virginia

What Is Form WV/MFT-514?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the WV/MFT-514 form?

A: The WV/MFT-514 form is the West Virginia Motor Fuel Producer Report.

Q: Who needs to file the WV/MFT-514 form?

A: Motor fuel producers in West Virginia need to file the WV/MFT-514 form.

Q: What is the purpose of the WV/MFT-514 form?

A: The WV/MFT-514 form is used to report motor fuel production in West Virginia.

Q: What information is required on the WV/MFT-514 form?

A: The WV/MFT-514 form requires information such as the type and quantity of motor fuel produced, the producer's name and address, and other related details.

Q: When is the deadline to file the WV/MFT-514 form?

A: The WV/MFT-514 form must be filed on a monthly basis, with a deadline typically at the end of the following month.

Q: Are there any penalties for late filing of the WV/MFT-514 form?

A: Yes, late filing of the WV/MFT-514 form may result in penalties and interest charges.

Q: Is the WV/MFT-514 form only for motor fuel producers in West Virginia?

A: Yes, the WV/MFT-514 form is specifically for motor fuel producers in West Virginia.

Q: Are there any exemptions or exceptions for filing the WV/MFT-514 form?

A: Specific exemptions or exceptions may apply, and it's advisable to consult the West Virginia State Tax Department for more information.

Q: What should I do if I have questions or need assistance with the WV/MFT-514 form?

A: If you have questions or need assistance with the WV/MFT-514 form, you can contact the West Virginia State Tax Department for guidance.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/MFT-514 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.