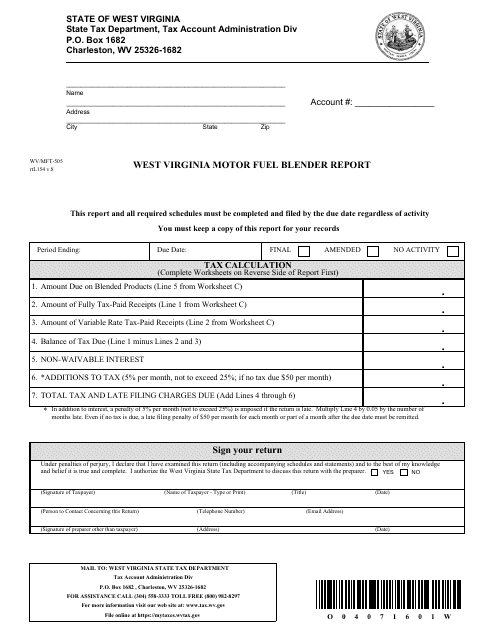

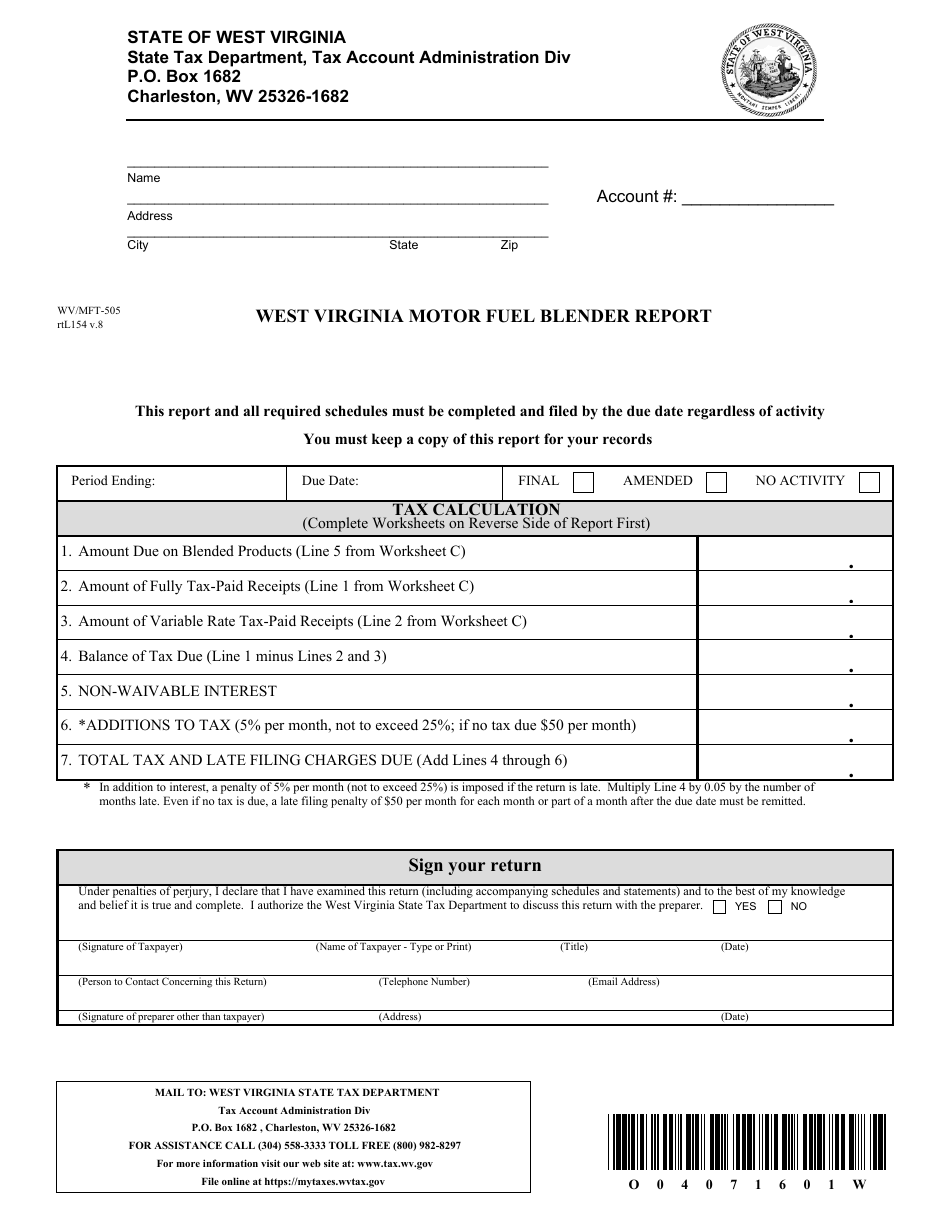

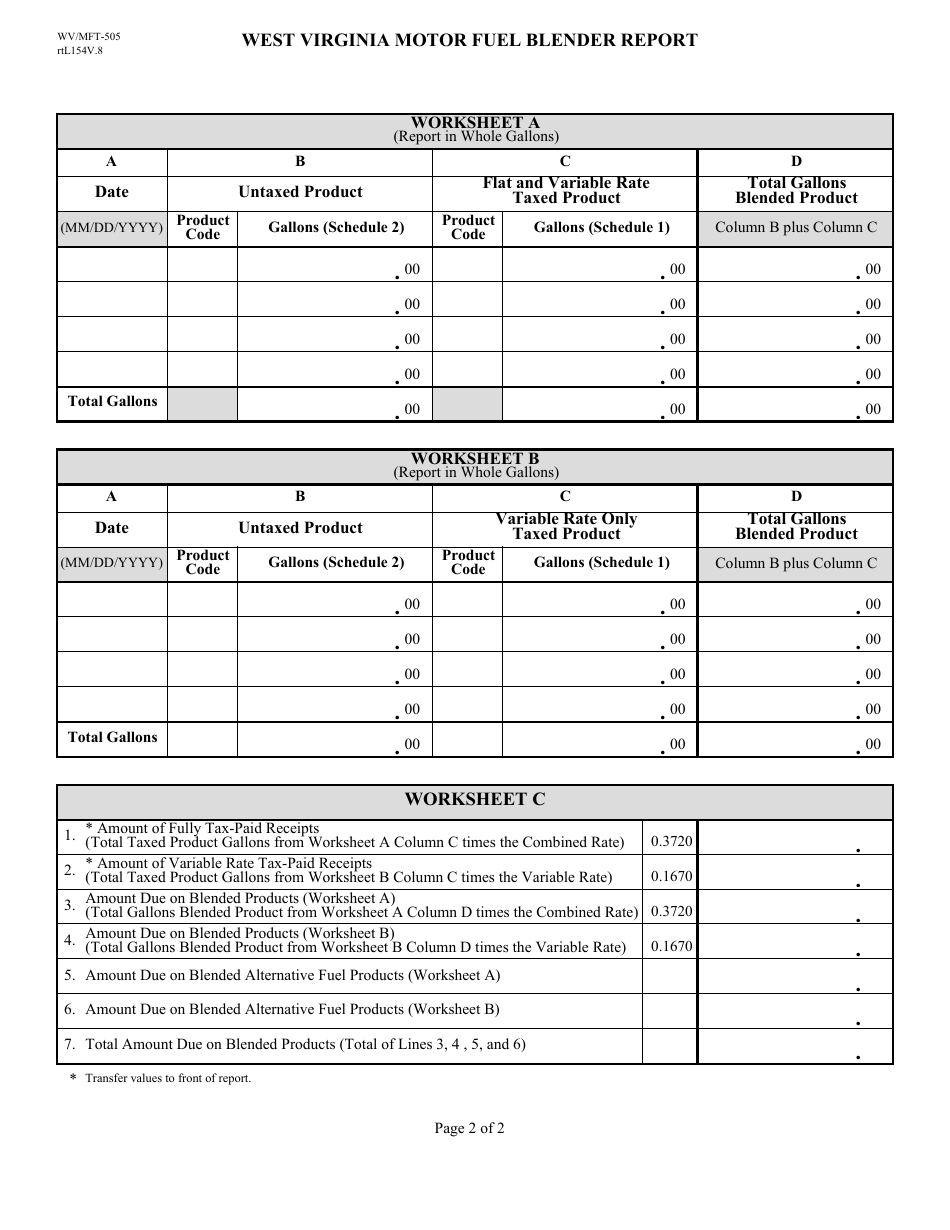

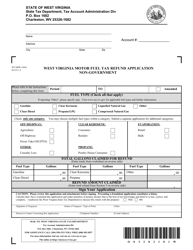

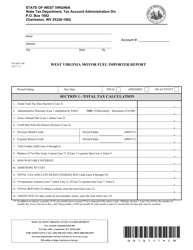

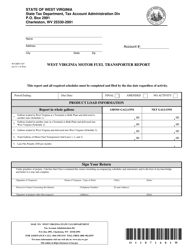

Form WV / MFT-505 West Virginia Motor Fuel Blender Report - West Virginia

What Is Form WV/MFT-505?

This is a legal form that was released by the West Virginia State Tax Department - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the WV/MFT-505 form?

A: The WV/MFT-505 form is the Motor Fuel Blender Report for West Virginia.

Q: Who needs to file the WV/MFT-505 form?

A: Motor fuel blenders in West Virginia are required to file the WV/MFT-505 form.

Q: What is the purpose of the WV/MFT-505 form?

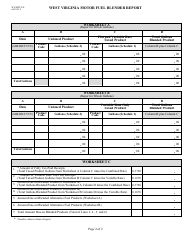

A: The WV/MFT-505 form is used to report the blending and distribution of motor fuel in West Virginia.

Q: When is the WV/MFT-505 form due?

A: The due date for the WV/MFT-505 form varies, but it is typically due on a quarterly basis.

Q: Are there any penalties for not filing the WV/MFT-505 form?

A: Yes, there are penalties for non-filing or late filing of the WV/MFT-505 form. The specific penalties depend on the circumstances.

Q: Are there any exemptions or deductions available on the WV/MFT-505 form?

A: Yes, there are certain exemptions and deductions available on the WV/MFT-505 form. Consult the instructions for more information.

Q: What documentation do I need to attach to the WV/MFT-505 form?

A: You may need to attach supporting documentation, such as blending records and purchase invoices, to the WV/MFT-505 form.

Q: Who can I contact for more information about the WV/MFT-505 form?

A: For more information about the WV/MFT-505 form, you can contact the West Virginia State Tax Department.

Form Details:

- The latest edition provided by the West Virginia State Tax Department;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form WV/MFT-505 by clicking the link below or browse more documents and templates provided by the West Virginia State Tax Department.