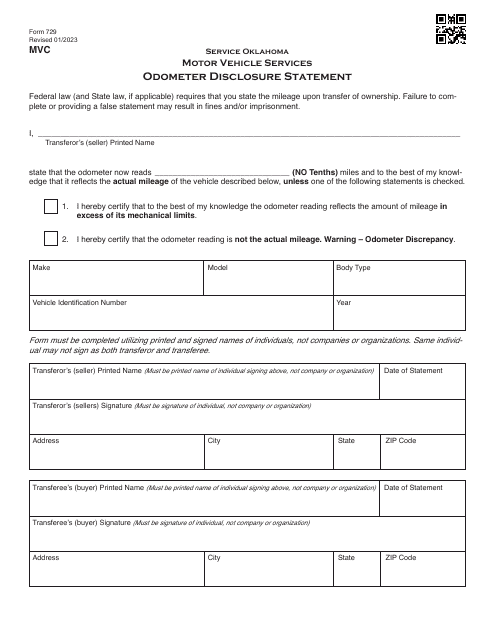

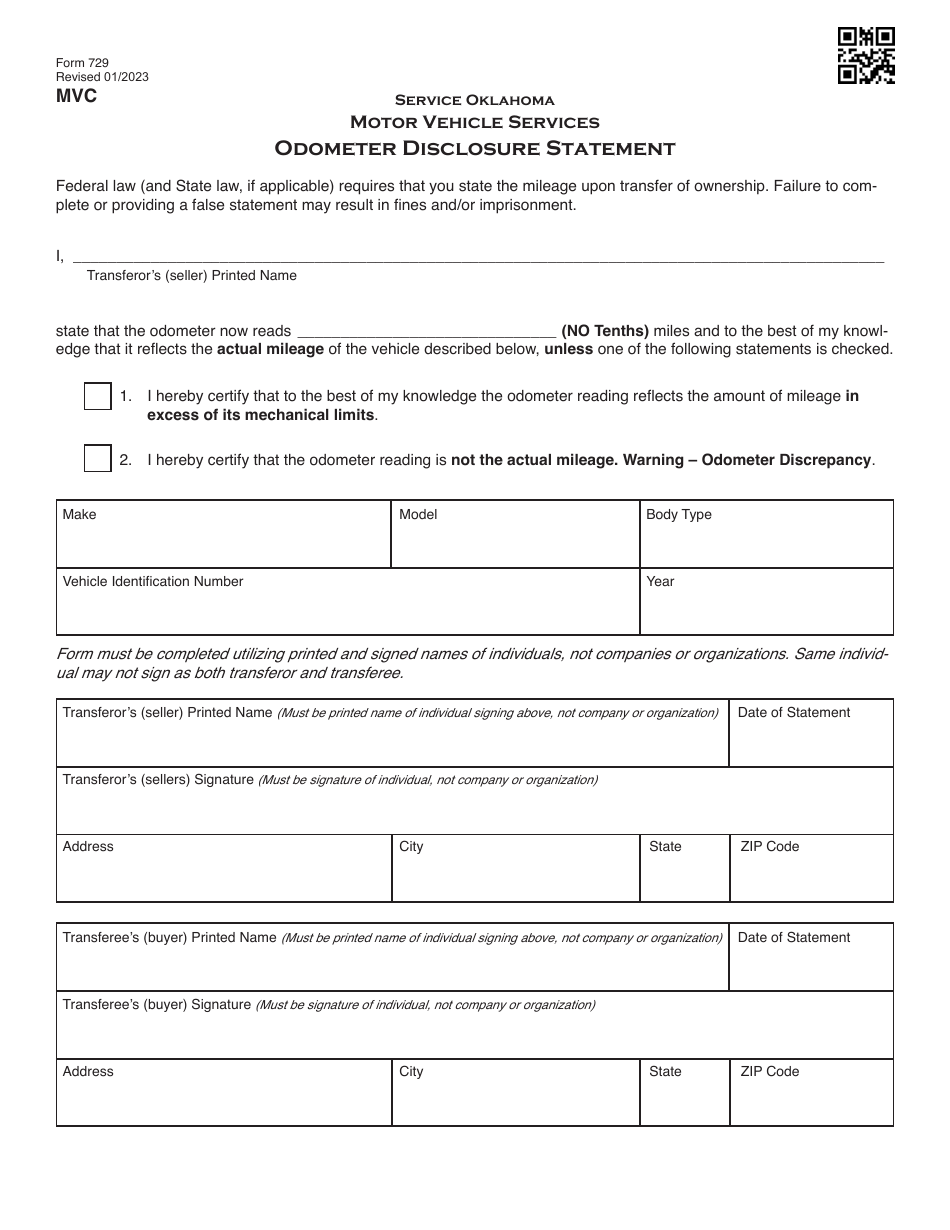

Form 729 Odometer Disclosure Statement - Oklahoma

What Is Form 729?

This is a legal form that was released by the Oklahoma Tax Commission - a government authority operating within Oklahoma. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 729?

A: Form 729 is the Odometer Disclosure Statement used in the state of Oklahoma.

Q: What is the purpose of Form 729?

A: The purpose of Form 729 is to disclose the accurate mileage or odometer reading of a motor vehicle at the time of sale or transfer.

Q: Who needs to fill out Form 729?

A: Both the buyer and the seller of a motor vehicle in Oklahoma need to fill out Form 729.

Q: When is Form 729 required?

A: Form 729 is required when a motor vehicle is being sold or transferred in Oklahoma.

Q: What information is required on Form 729?

A: Form 729 requires information about the vehicle, including the make, model, year, VIN, and odometer reading.

Q: Is there a fee for filing Form 729?

A: No, there is no fee for filing Form 729.

Q: Are there any penalties for not filing Form 729?

A: Yes, failure to file Form 729 can result in fines and other legal consequences.

Q: How long do I have to submit Form 729?

A: Form 729 must be submitted within 30 days of the sale or transfer of the motor vehicle.

Form Details:

- Released on January 1, 2023;

- The latest edition provided by the Oklahoma Tax Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 729 by clicking the link below or browse more documents and templates provided by the Oklahoma Tax Commission.