This version of the form is not currently in use and is provided for reference only. Download this version of

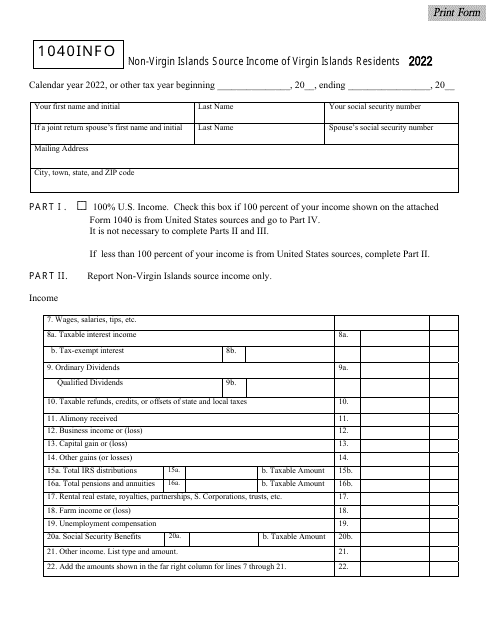

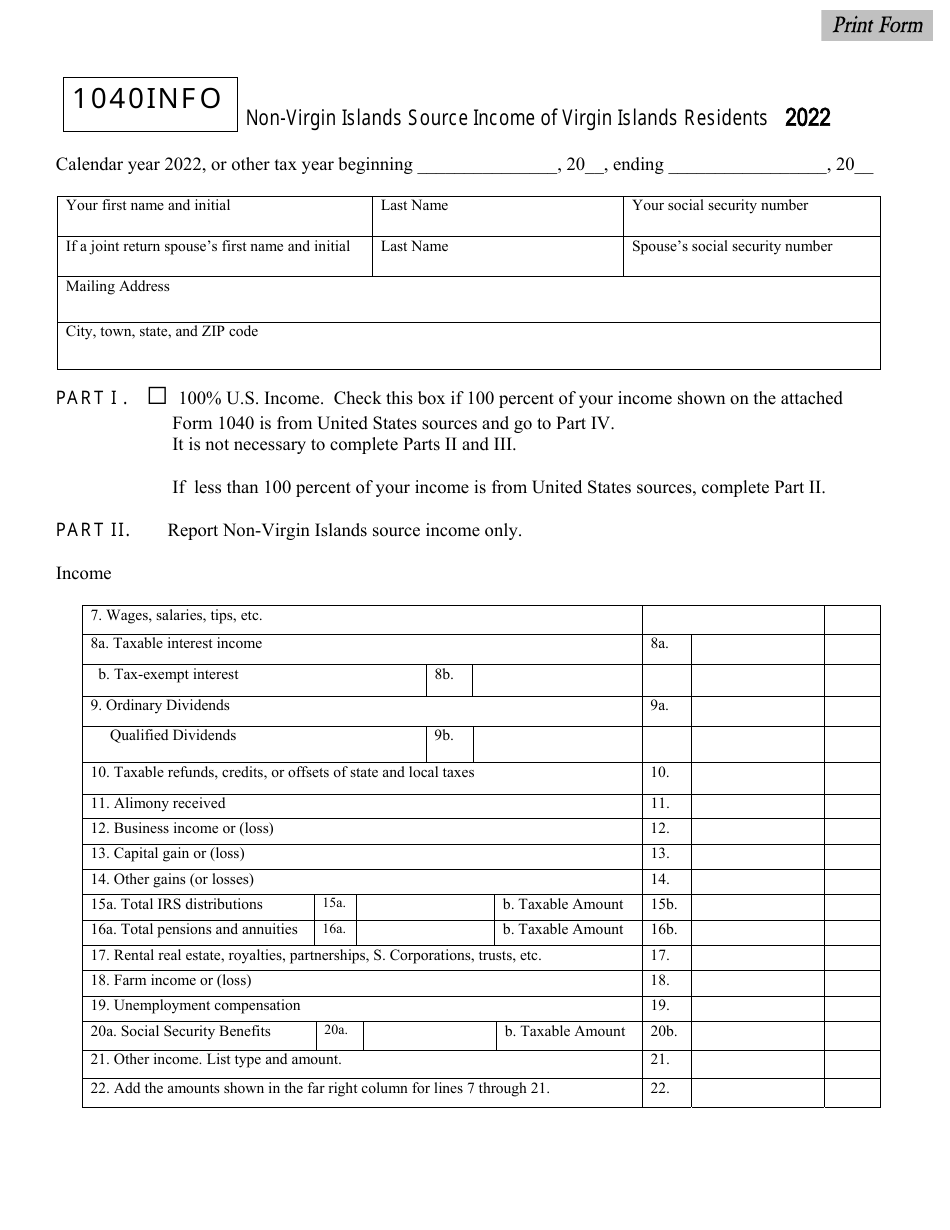

Form 1040INFO

for the current year.

Form 1040INFO Non-virgin Islands Source Income of Virgin Islands Resident S - Virgin Islands

What Is Form 1040INFO?

This is a legal form that was released by the Virgin Islands Bureau of Internal Revenue - a government authority operating within Virgin Islands. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1040INFO?

A: Form 1040INFO is a document used to provide information and instructions related to the Form 1040 individual income tax return.

Q: What is non-virgin Islands source income?

A: Non-virgin Islands source income refers to income earned or sourced from outside the U.S. Virgin Islands.

Q: Who is considered a resident of the U.S. Virgin Islands?

A: A resident of the U.S. Virgin Islands is an individual who meets certain residency requirements as determined by the U.S. Virgin Islands government.

Q: What is S - Virgin Islands?

A: S - Virgin Islands is a tax category on Form 1040 that is used to report income earned by a resident of the U.S. Virgin Islands from non-virgin Islands sources.

Q: What information is provided in Form 1040INFO for non-virgin Islands source income of a U.S. Virgin Islands resident?

A: Form 1040INFO provides instructions and guidance on how to report non-virgin Islands source income on Form 1040 for a U.S. Virgin Islands resident.

Q: What should a U.S. Virgin Islands resident do with Form 1040INFO?

A: A U.S. Virgin Islands resident should review the information and instructions provided in Form 1040INFO to properly report non-virgin Islands source income on their Form 1040.

Q: Is Form 1040INFO mandatory for U.S. Virgin Islands residents?

A: Form 1040INFO is not mandatory for U.S. Virgin Islands residents, but it is recommended to review the information to ensure proper reporting of non-virgin Islands source income.

Form Details:

- The latest edition provided by the Virgin Islands Bureau of Internal Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1040INFO by clicking the link below or browse more documents and templates provided by the Virgin Islands Bureau of Internal Revenue.