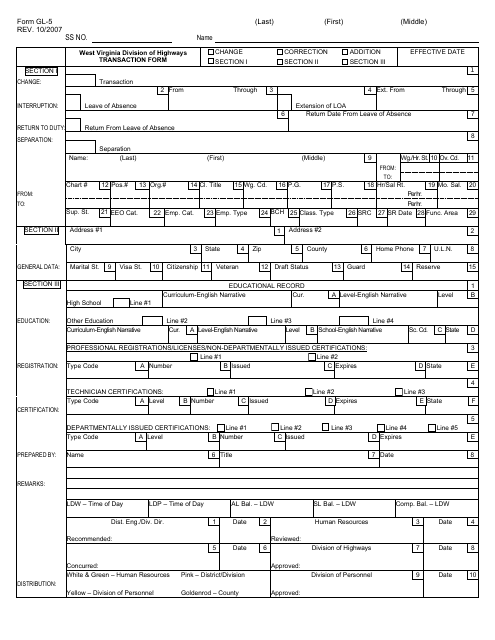

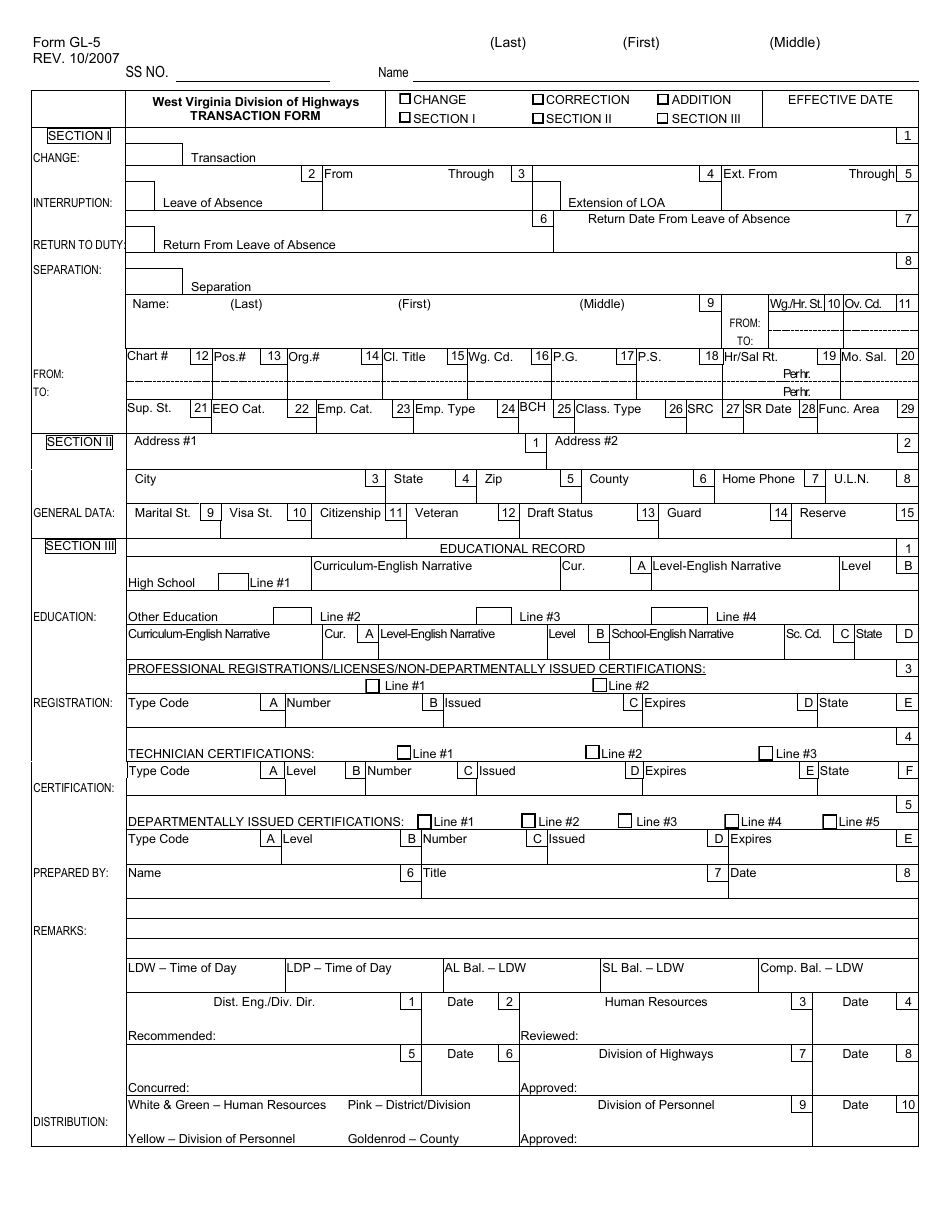

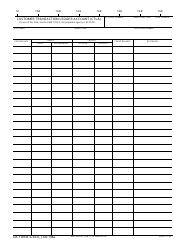

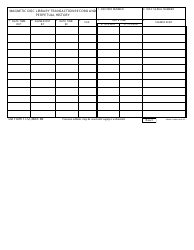

Form GL-5 Transaction Form - West Virginia

What Is Form GL-5?

This is a legal form that was released by the West Virginia Department of Transportation - a government authority operating within West Virginia. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

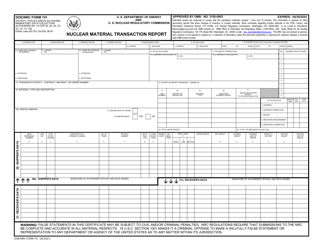

Q: What is the GL-5 Transaction Form?

A: The GL-5 Transaction Form is a form used in West Virginia for reporting certain types of transactions.

Q: Who needs to use the GL-5 Transaction Form?

A: Individuals and businesses in West Virginia who are involved in the specified types of transactions need to use the GL-5 Transaction Form.

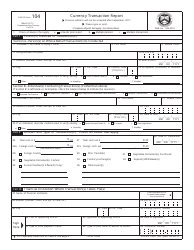

Q: What types of transactions does the GL-5 Transaction Form cover?

A: The GL-5 Transaction Form is used for reporting transactions such as real estate sales, vehicle purchases, and certain business transactions.

Q: Is the GL-5 Transaction Form required for all transactions?

A: No, the GL-5 Transaction Form is only required for certain specified types of transactions.

Q: What information is needed to complete the GL-5 Transaction Form?

A: The GL-5 Transaction Form typically requires information such as the names and addresses of the buyer and seller, details of the transaction, and any applicable sales tax information.

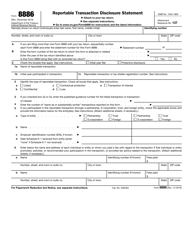

Q: Are there any fees associated with filing the GL-5 Transaction Form?

A: There may be nominal fees associated with filing the GL-5 Transaction Form, such as notary fees or filing fees. It is best to check with the West Virginia Department of Tax and Revenue for the current fee schedule.

Q: What should I do with the completed GL-5 Transaction Form?

A: The completed GL-5 Transaction Form should be submitted to the West Virginia Department of Tax and Revenue according to their instructions.

Q: Is there a deadline for filing the GL-5 Transaction Form?

A: The deadline for filing the GL-5 Transaction Form may vary depending on the type of transaction. It is important to check the specific instructions provided by the West Virginia Department of Tax and Revenue.

Q: What happens if I don't file the GL-5 Transaction Form?

A: Failure to file the GL-5 Transaction Form when required may result in penalties and potential legal consequences.

Form Details:

- Released on October 1, 2007;

- The latest edition provided by the West Virginia Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GL-5 by clicking the link below or browse more documents and templates provided by the West Virginia Department of Transportation.