This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

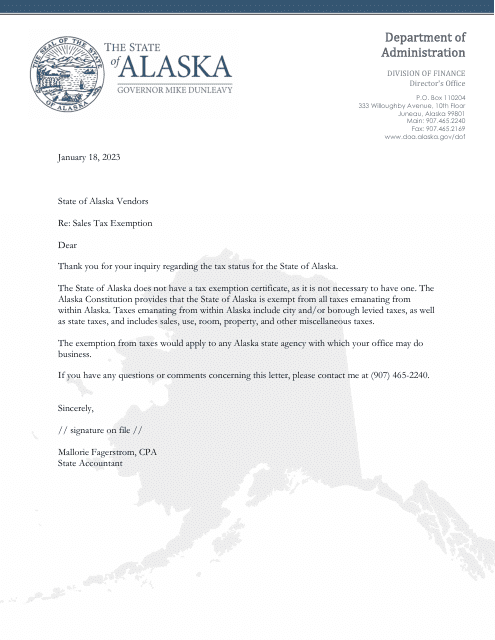

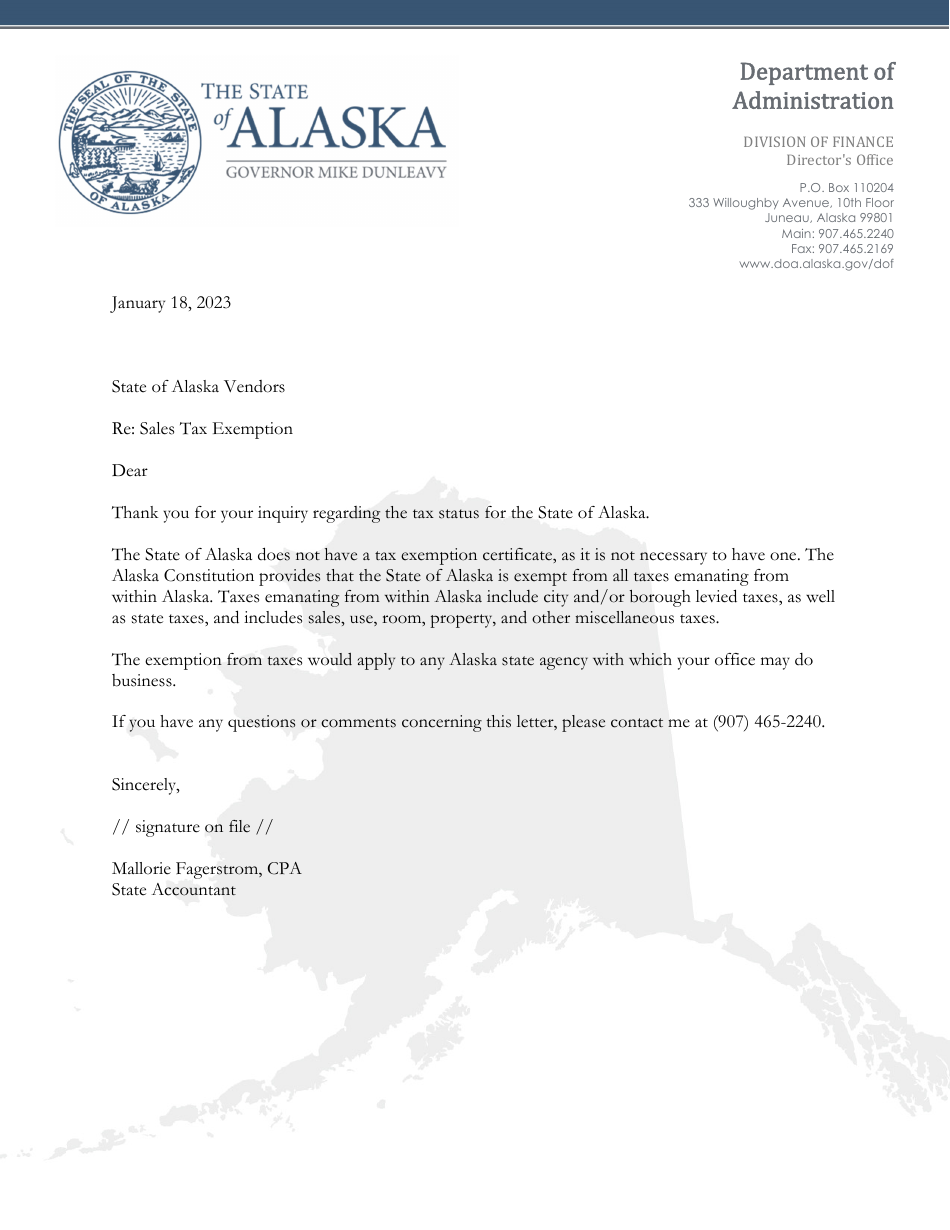

State Sales Tax Exemption - Response Letter - Alaska

State Sales Tax Exemption - Response Letter is a legal document that was released by the Alaska Department of Administration - a government authority operating within Alaska.

FAQ

Q: What is a state sales tax exemption?

A: A state sales tax exemption is a privilege granted to certain individuals or entities that allows them to make purchases without paying state sales tax.

Q: What is the purpose of a state sales tax exemption?

A: The purpose of a state sales tax exemption is to provide relief for specific individuals or entities from paying sales tax on particular types of purchases.

Q: Who can qualify for a state sales tax exemption?

A: Qualification for a state sales tax exemption varies depending on the specific exemption, but it can apply to non-profit organizations, government entities, certain types of businesses, and individuals in certain circumstances.

Q: Is there a state sales tax exemption in Alaska?

A: No, Alaska does not have a statewide sales tax, therefore a state sales tax exemption is not applicable.

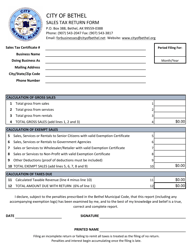

Q: Are there any local sales taxes in Alaska?

A: Yes, some localities in Alaska may impose local sales taxes. It is important to check with the specific locality to determine if a sales tax exemption applies.

Q: What should I do if I have further questions about state sales tax exemptions in Alaska?

A: If you have further questions about state sales tax exemptions in Alaska, it is recommended to consult with a tax professional or the Alaska Department of Revenue for clarification and guidance.

Form Details:

- Released on January 18, 2023;

- The latest edition currently provided by the Alaska Department of Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Alaska Department of Administration.