Agriculture Building Exemption - Shasta County, California

Agriculture Building Exemption is a legal document that was released by the Department of Resource Management - Shasta County, California - a government authority operating within California. The form may be used strictly within Shasta County.

FAQ

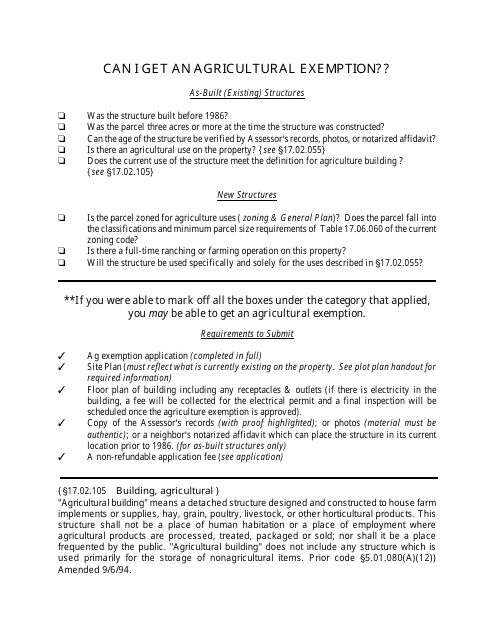

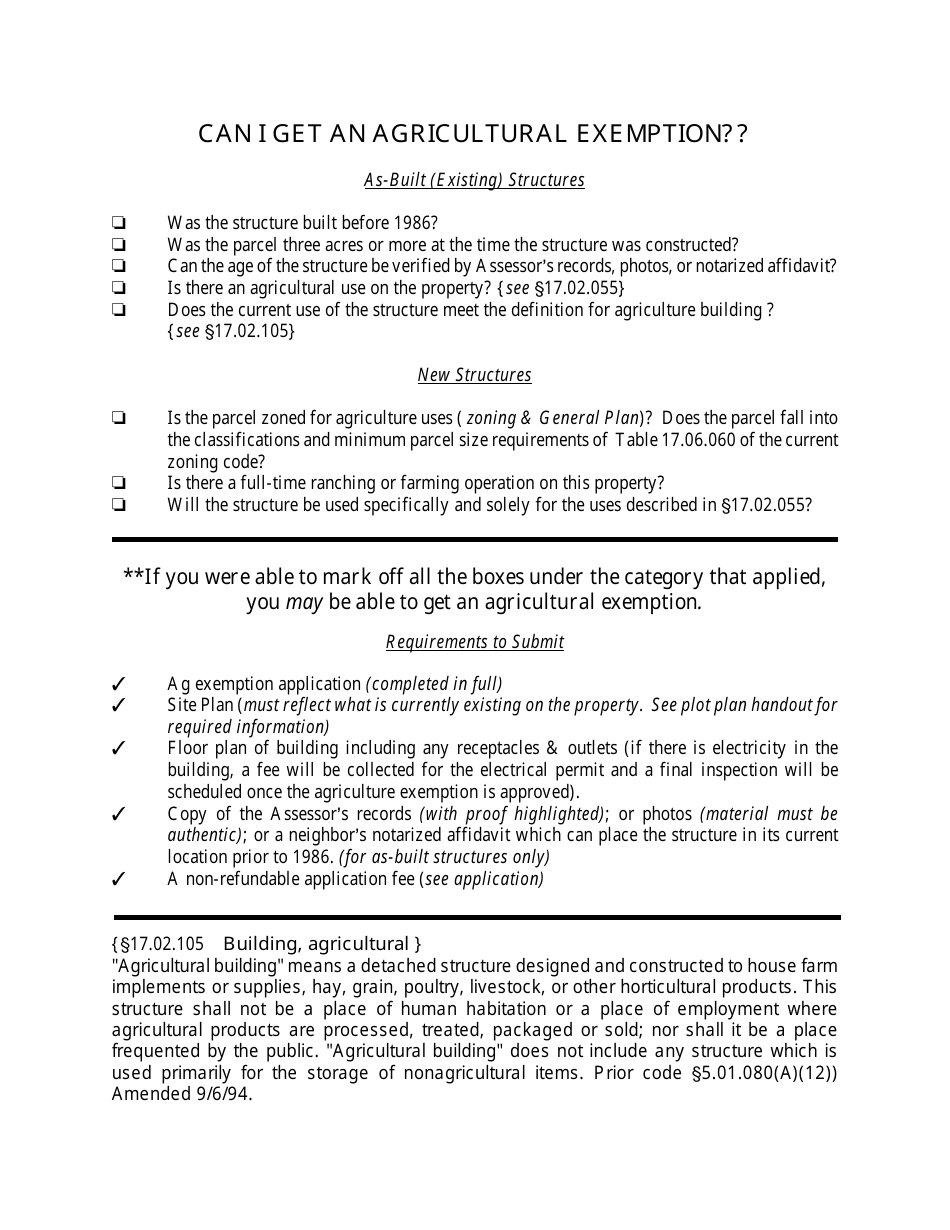

Q: What is the Agriculture Building Exemption in Shasta County, California?

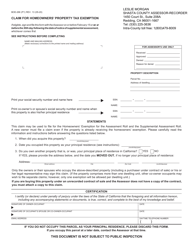

A: The Agriculture Building Exemption is a regulation in Shasta County, California that provides certain tax benefits for agricultural structures.

Q: What are the tax benefits offered by the Agriculture Building Exemption?

A: The tax benefits offered by the Agriculture Building Exemption include property tax exemptions for qualifying agricultural structures.

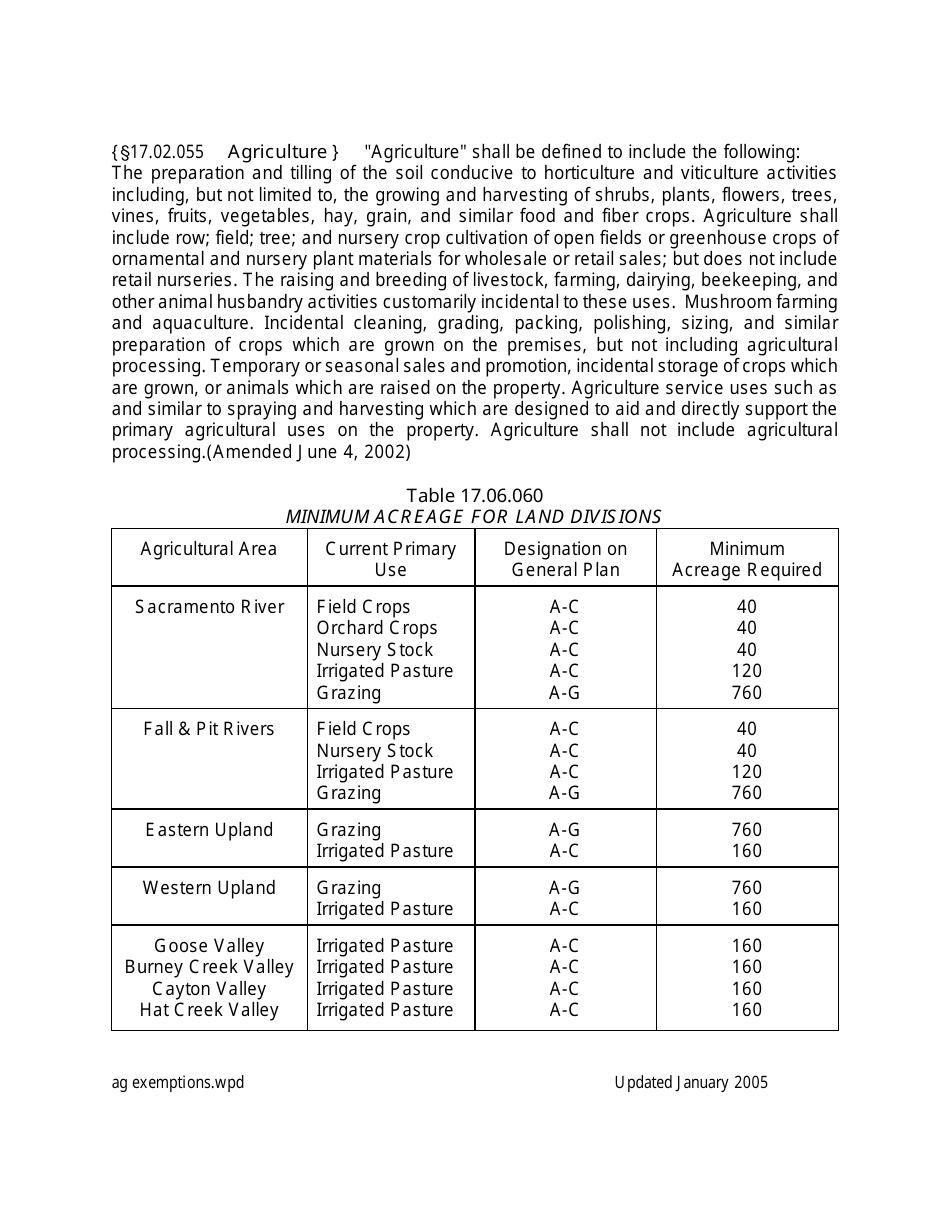

Q: What is considered a qualifying agricultural structure?

A: Qualifying agricultural structures typically include barns, sheds, silos, and other structures used for agricultural purposes.

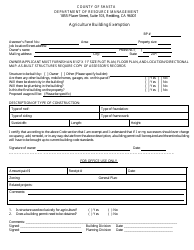

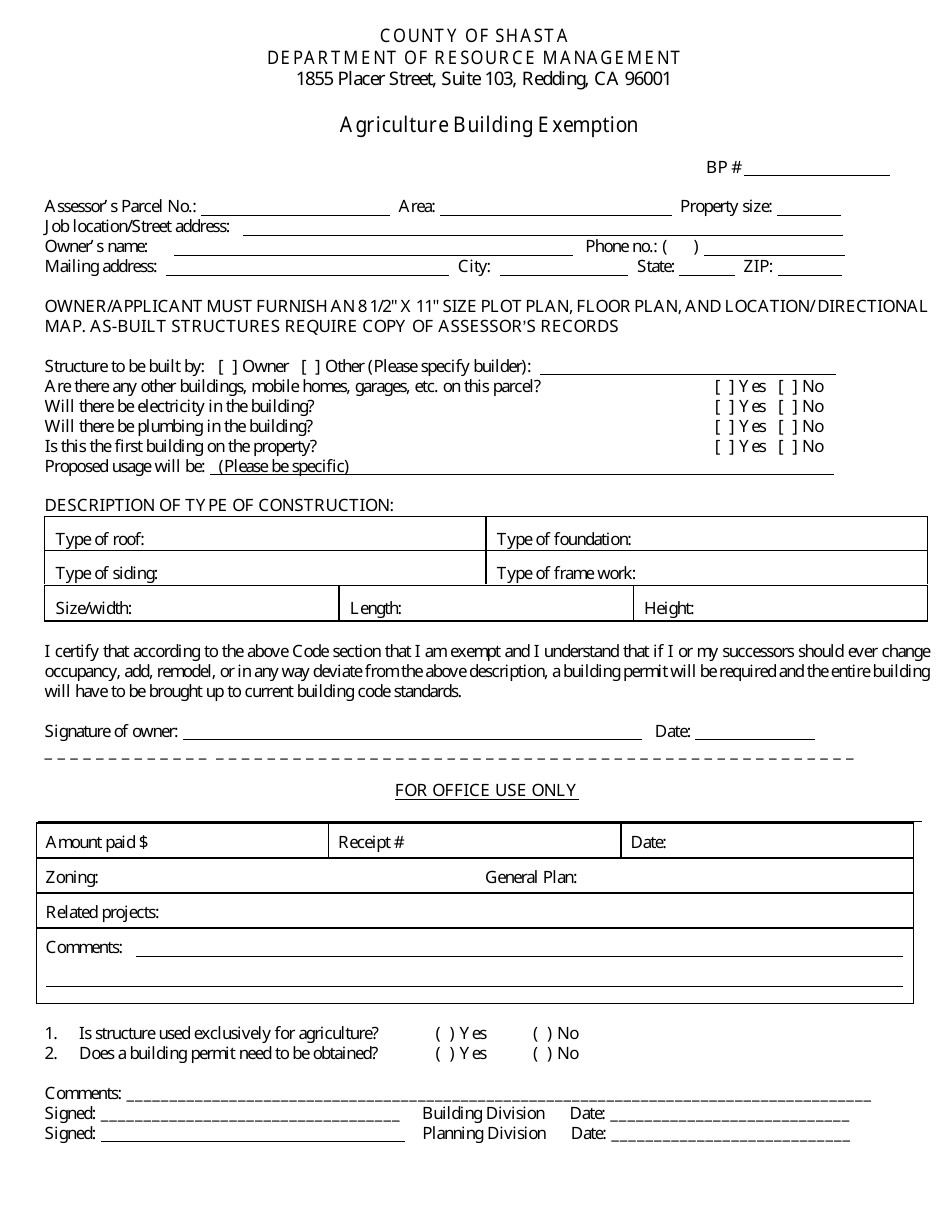

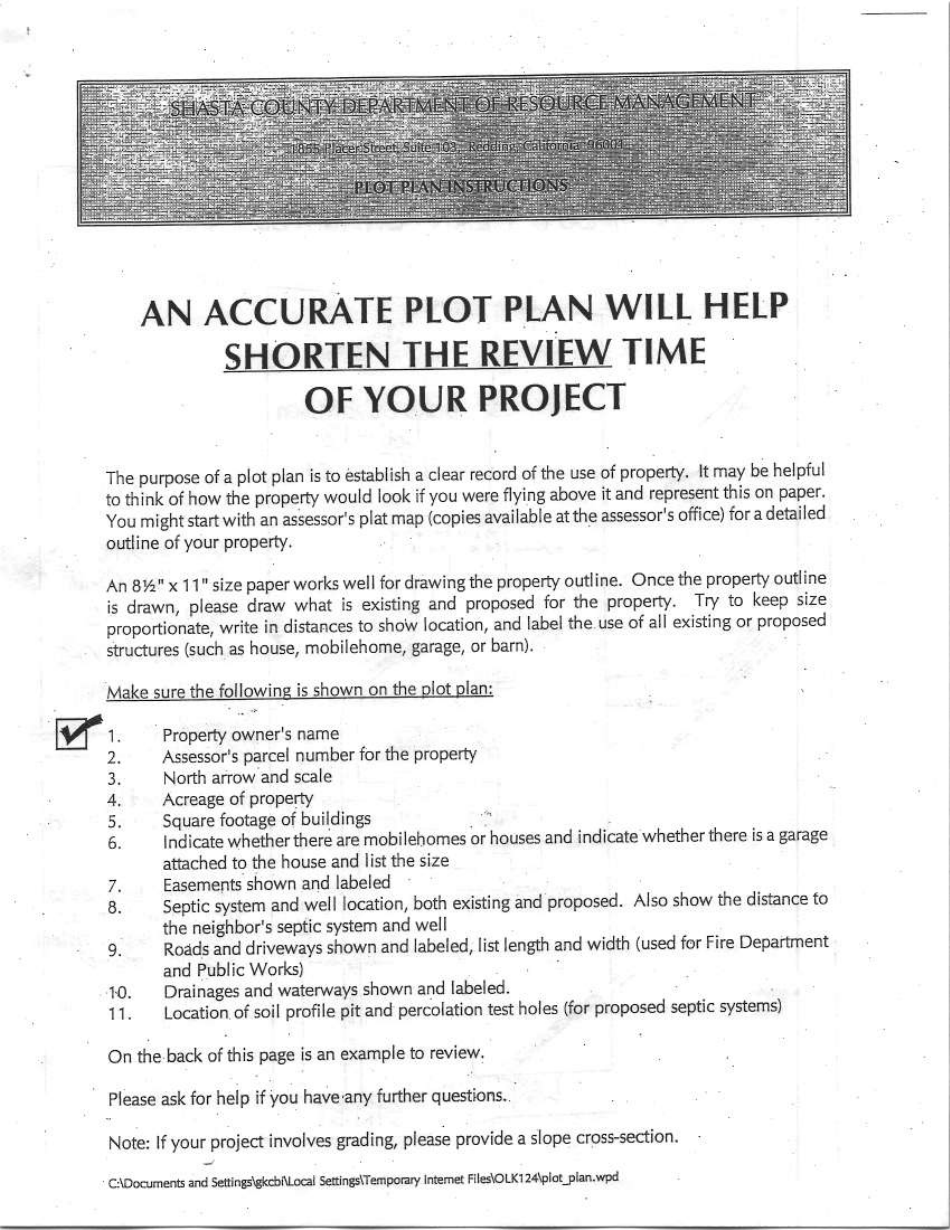

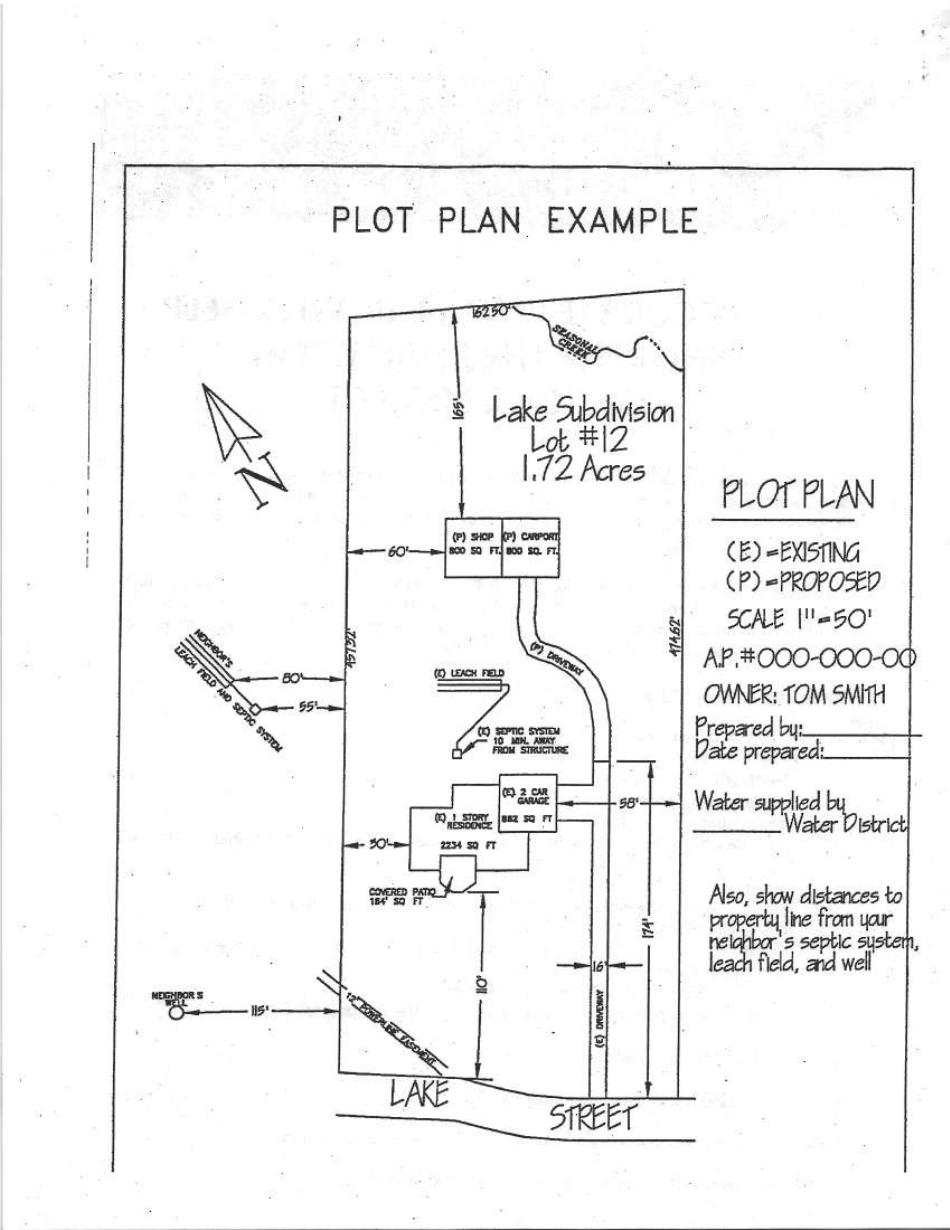

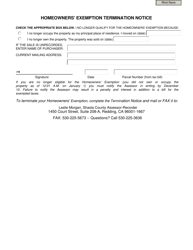

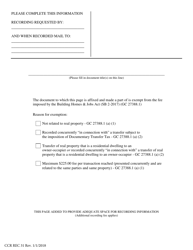

Q: How do I apply for the Agriculture Building Exemption?

A: To apply for the Agriculture Building Exemption, you need to fill out an application form provided by the Shasta County Assessor's Office.

Q: Who is eligible for the Agriculture Building Exemption?

A: Property owners who use their structures primarily for agricultural purposes are generally eligible for the Agriculture Building Exemption.

Form Details:

- Released on January 1, 2005;

- The latest edition currently provided by the Department of Resource Management - Shasta County, California;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Department of Resource Management - Shasta County, California.