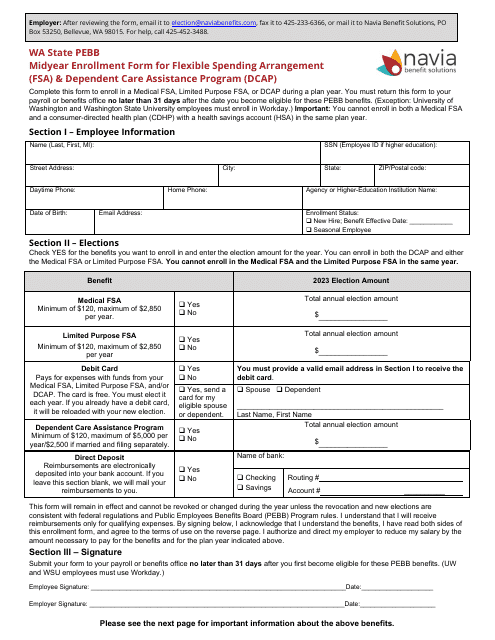

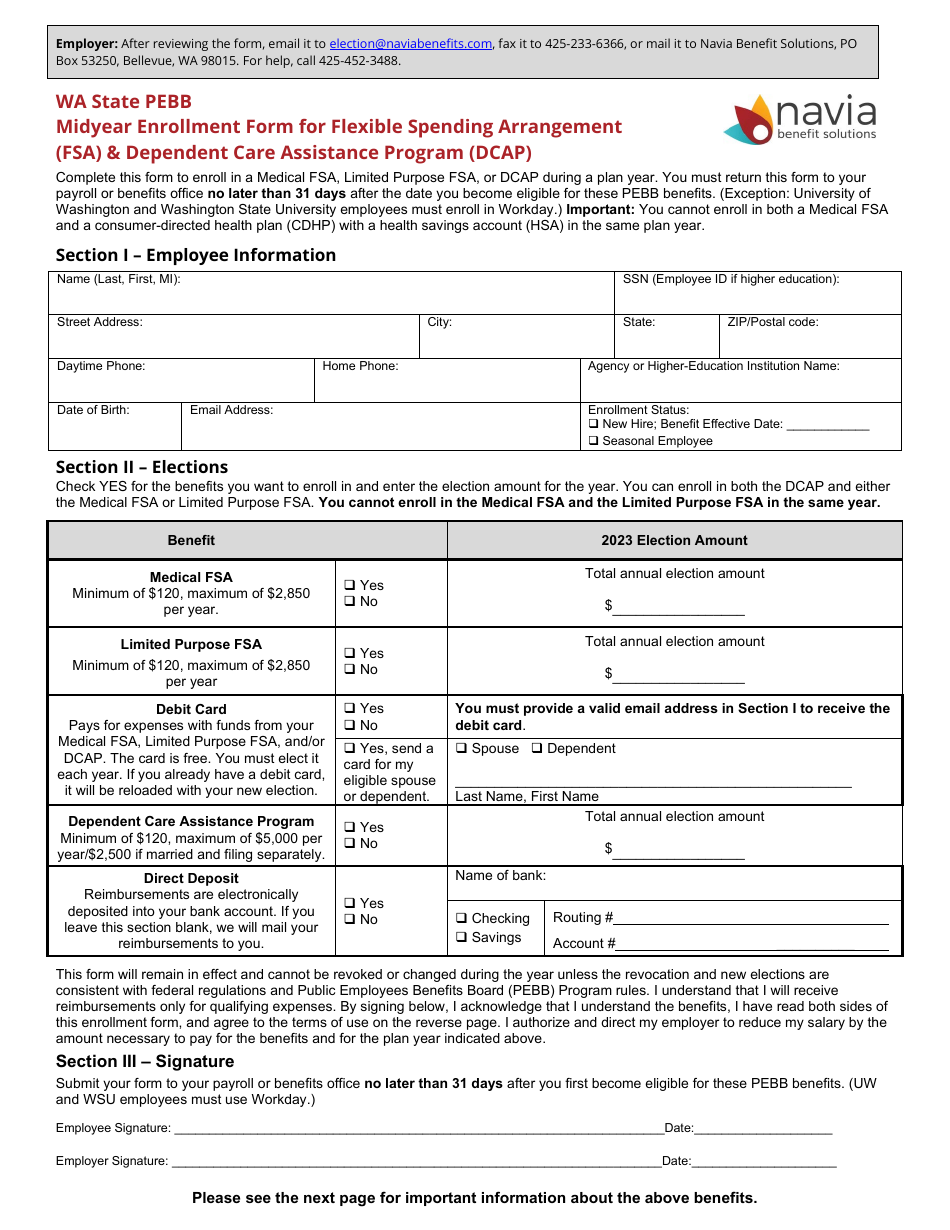

Midyear Enrollment Form for Flexible Spending Arrangement (FSA) & Dependent Care Assistance Program (Dcap) - Washington

Midyear Enrollment Form for Flexible Spending Arrangement (FSA) & Dependent Care Assistance Program (Dcap) is a legal document that was released by the Washington State Health Care Authority - a government authority operating within Washington.

FAQ

Q: What is the Midyear Enrollment Form?

A: The Midyear Enrollment Form is a document for enrolling in the Flexible Spending Arrangement (FSA) and Dependent Care Assistance Program (Dcap) in Washington.

Q: What is a Flexible Spending Arrangement (FSA)?

A: A Flexible Spending Arrangement (FSA) is a benefit program that allows employees to set aside pre-tax dollars to pay for certain eligible expenses.

Q: What is a Dependent Care Assistance Program (Dcap)?

A: A Dependent Care Assistance Program (Dcap) is a benefit program that allows employees to set aside pre-tax dollars to pay for qualified child or dependent care expenses.

Q: Who is eligible to enroll in the FSA and Dcap?

A: Employees who meet the eligibility requirements set by their employer are eligible to enroll in the FSA and Dcap.

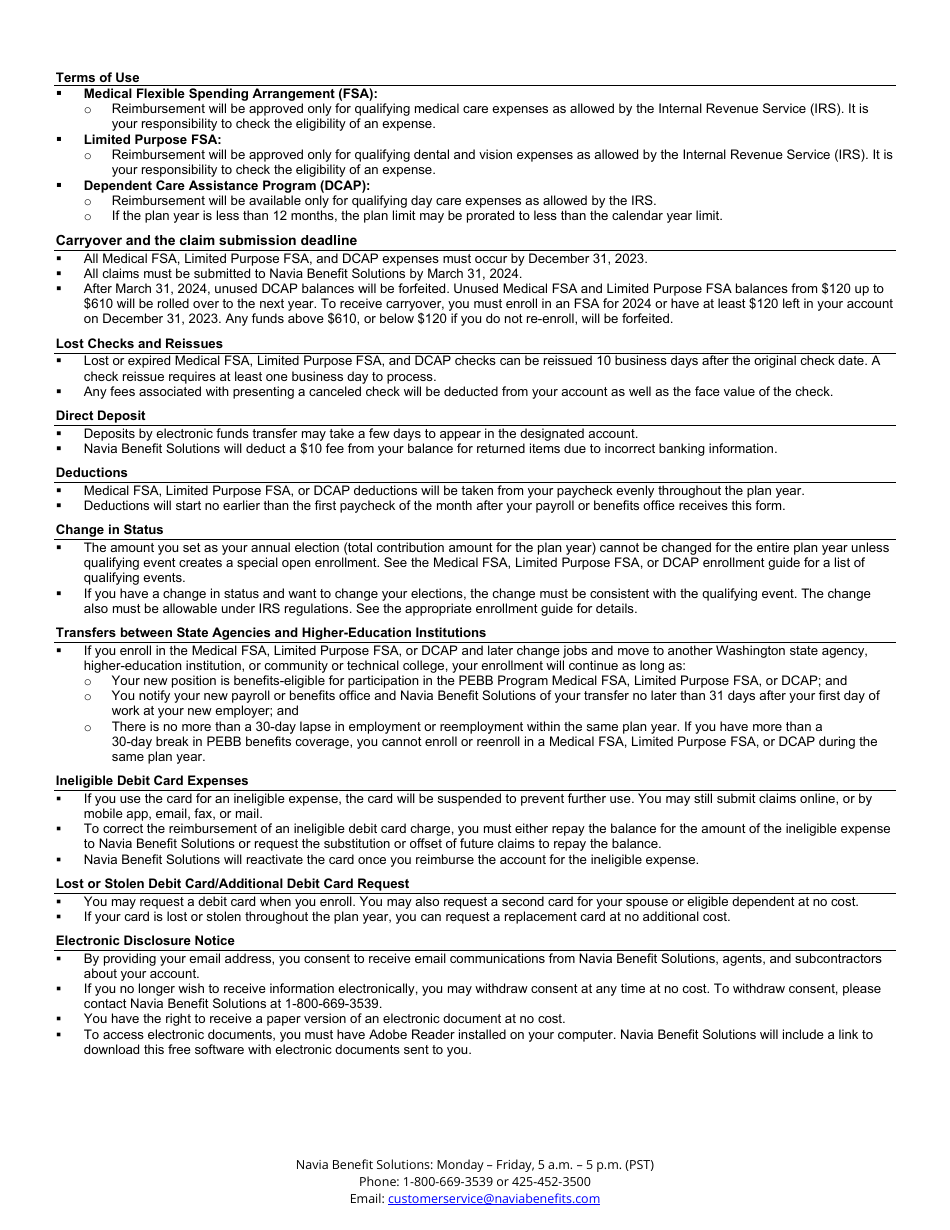

Q: What expenses can be covered by the FSA?

A: The FSA can be used to cover eligible expenses such as medical co-pays, prescription drugs, and health care-related items.

Q: What expenses can be covered by the Dcap?

A: The Dcap can be used to cover qualified child or dependent care expenses, such as daycare or after-school programs.

Q: Is there a deadline for submitting the Midyear Enrollment Form?

A: The deadline for submitting the Midyear Enrollment Form may vary, so it's important to check with your employer or human resources department.

Q: Can I change my FSA or Dcap contributions after enrolling?

A: Changes to FSA or Dcap contributions are generally allowed only during open enrollment periods or if you experience a qualifying life event.

Q: What happens to unspent FSA or Dcap funds at the end of the year?

A: Unused funds in the FSA or Dcap typically do not roll over and may be forfeited at the end of the year, depending on the plan rules.

Form Details:

- The latest edition currently provided by the Washington State Health Care Authority;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Washington State Health Care Authority.