This version of the form is not currently in use and is provided for reference only. Download this version of

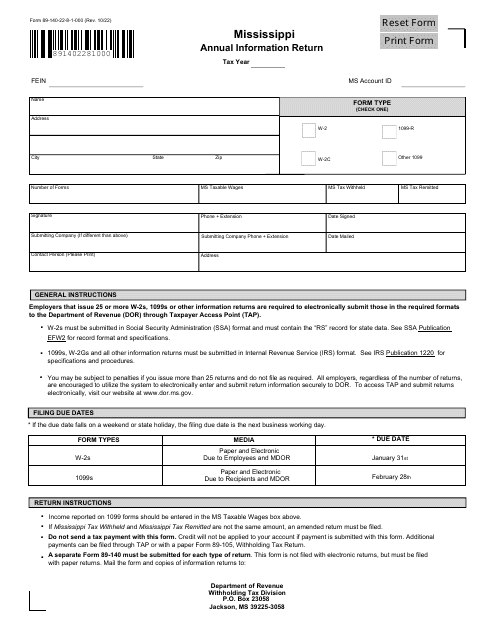

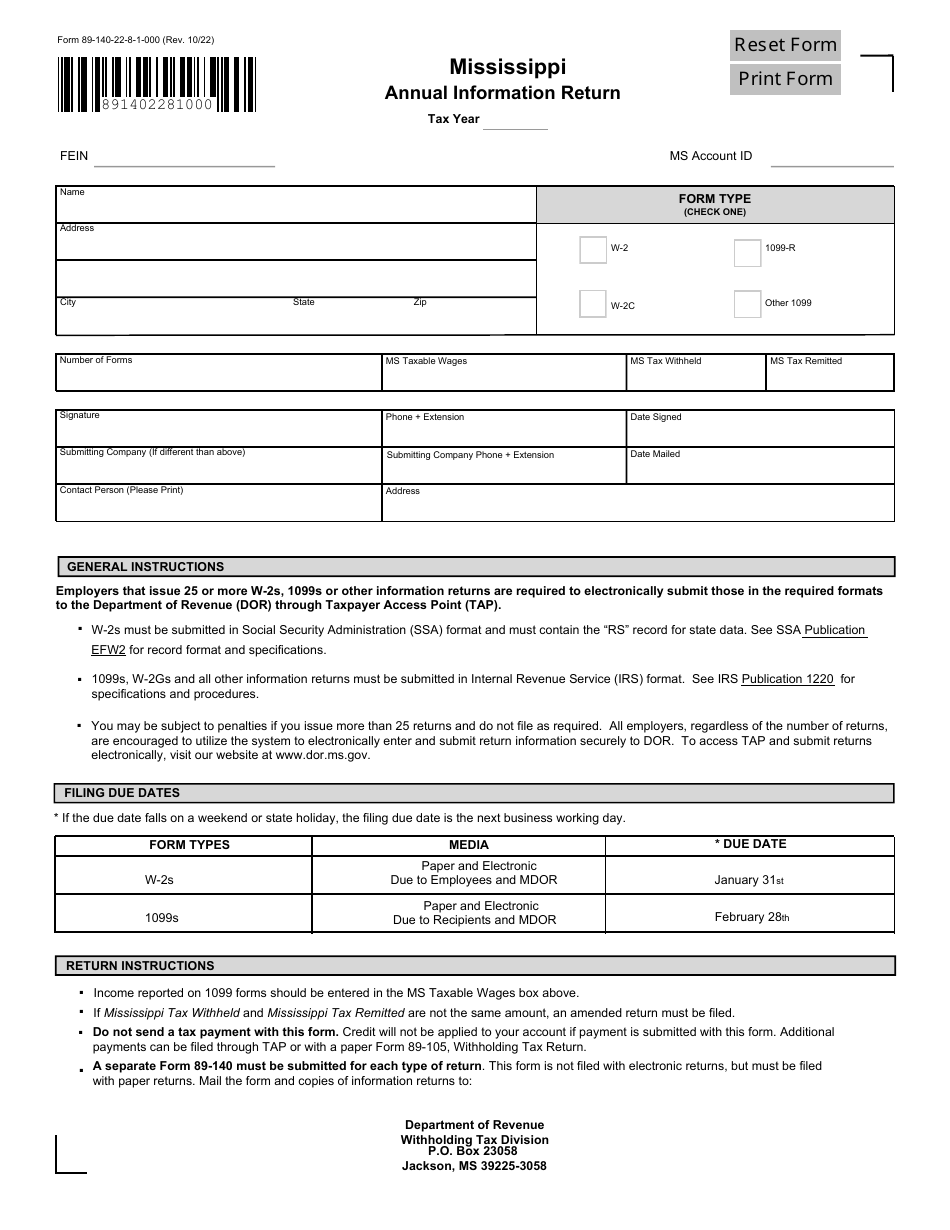

Form 89-140

for the current year.

Form 89-140 Mississippi Annual Information Return - Mississippi

What Is Form 89-140?

This is a legal form that was released by the Mississippi Department of Revenue - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 89-140?

A: Form 89-140 is the Mississippi Annual Information Return.

Q: Who needs to file Form 89-140?

A: Anyone who is required to file Mississippi state taxes needs to file Form 89-140.

Q: What is the purpose of Form 89-140?

A: Form 89-140 is used to report Mississippi state tax information.

Q: What information do I need to complete Form 89-140?

A: You will need to provide your personal and financial information, as well as any applicable tax deductions or credits.

Q: When is the deadline to file Form 89-140?

A: The deadline to file Form 89-140 is typically April 15th, unless an extension has been granted.

Q: Do I need to include any additional documentation with Form 89-140?

A: You may need to include supporting documentation, such as W-2 forms or receipts, depending on your individual circumstances.

Q: What happens if I don't file Form 89-140?

A: If you fail to file Form 89-140, you may be subject to penalties and interest charges.

Q: Can I amend my Form 89-140 if I make a mistake?

A: Yes, you can file an amended Form 89-140 if you need to correct any errors or make changes to your original filing.

Form Details:

- Released on October 1, 2022;

- The latest edition provided by the Mississippi Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 89-140 by clicking the link below or browse more documents and templates provided by the Mississippi Department of Revenue.