This version of the form is not currently in use and is provided for reference only. Download this version of

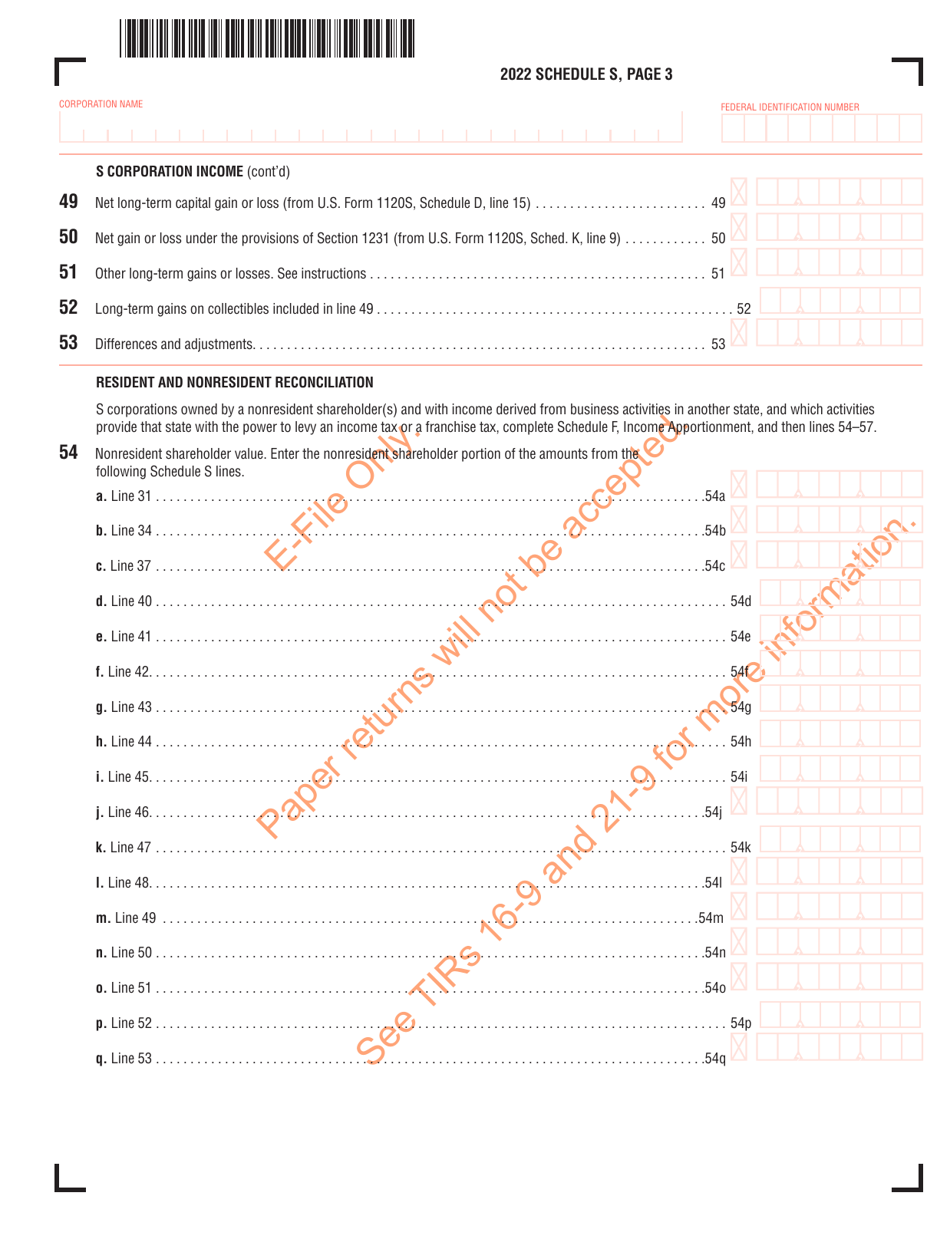

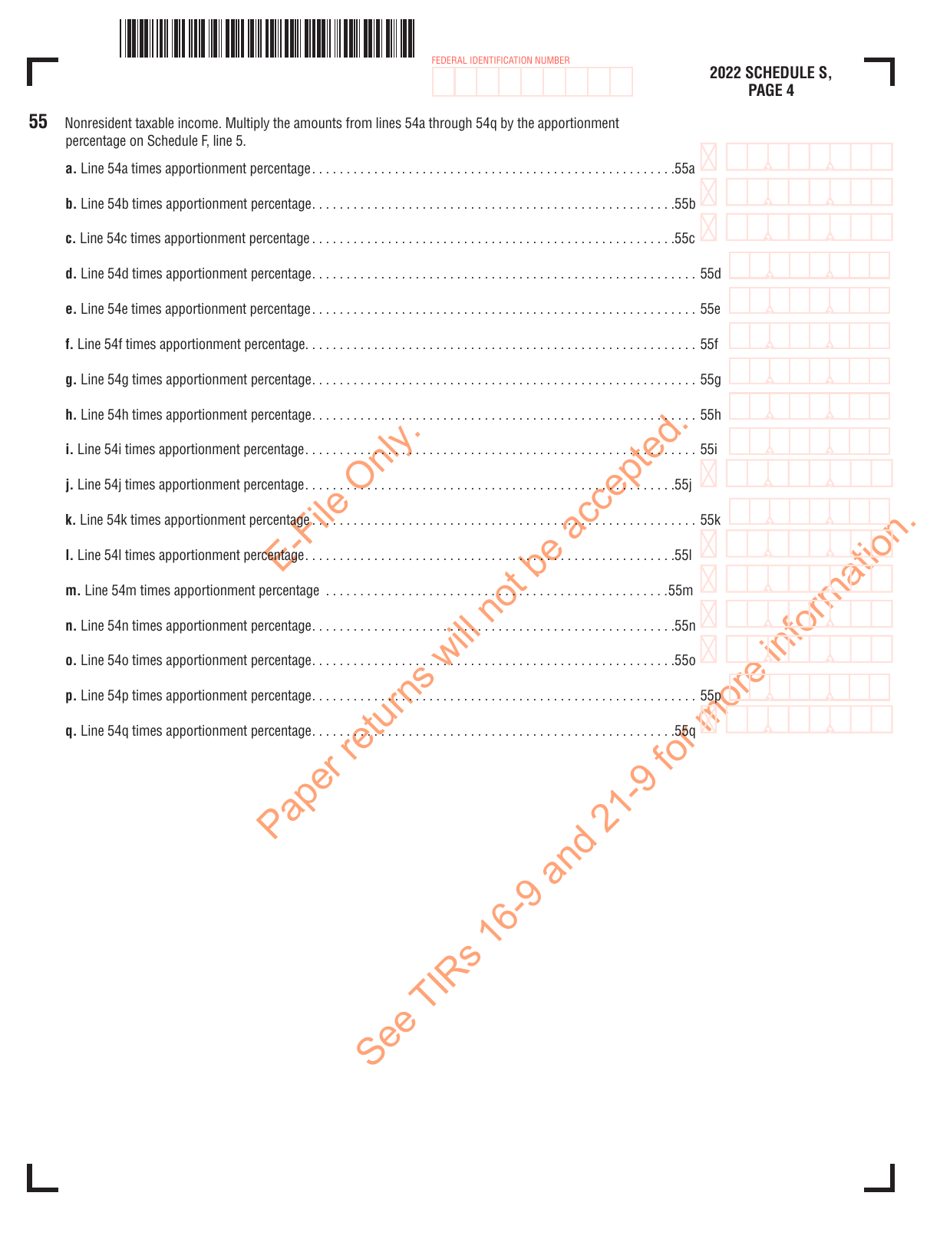

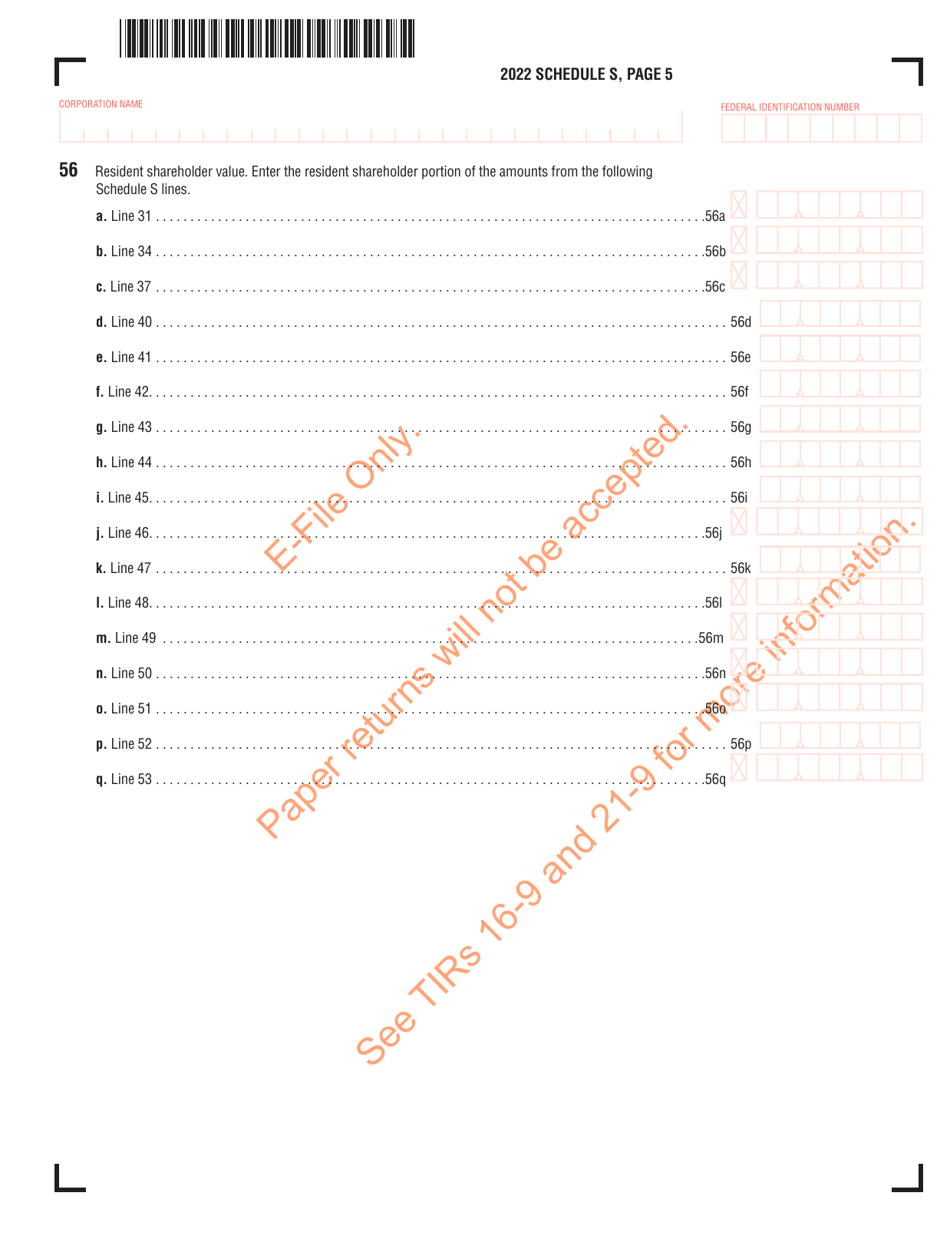

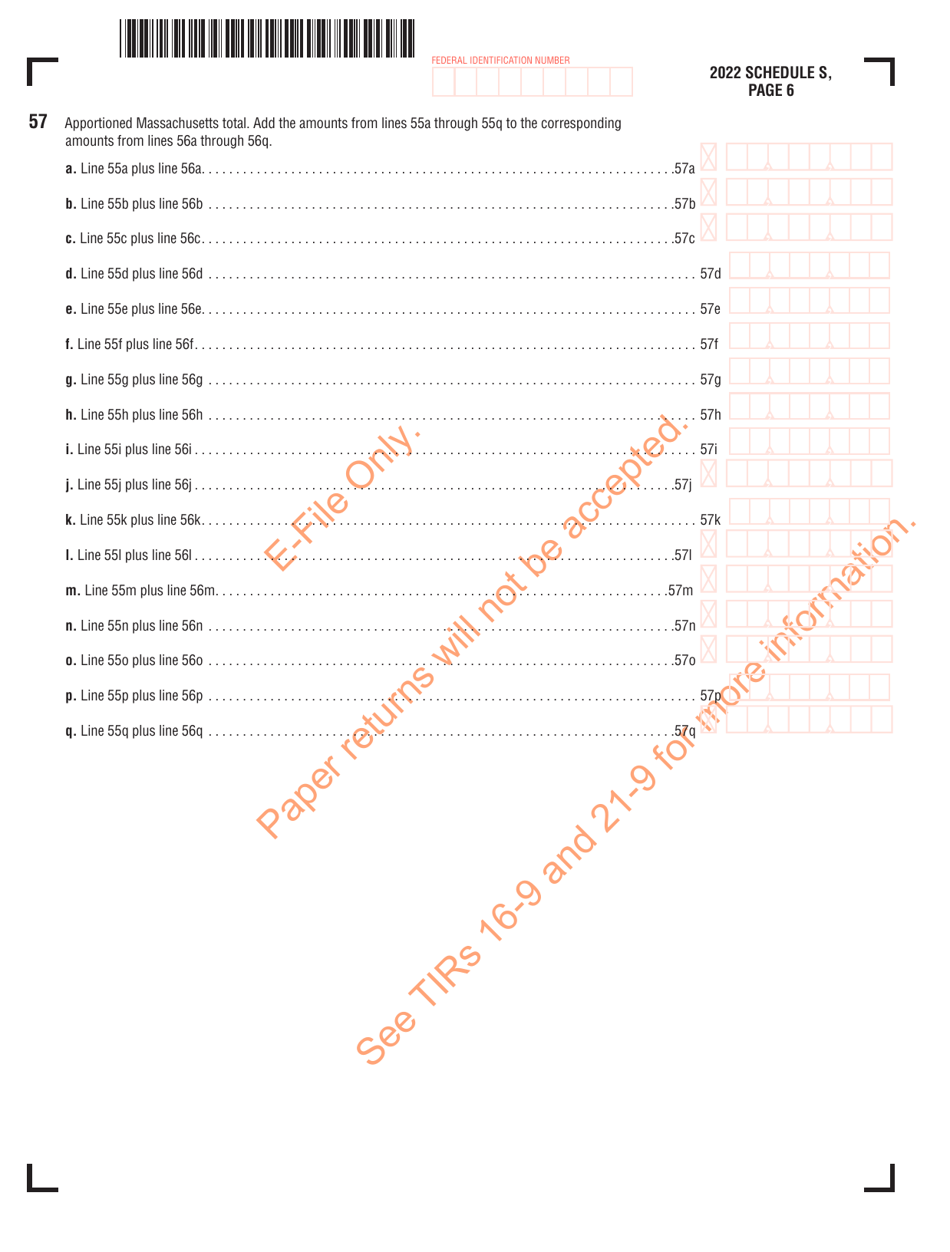

Schedule S

for the current year.

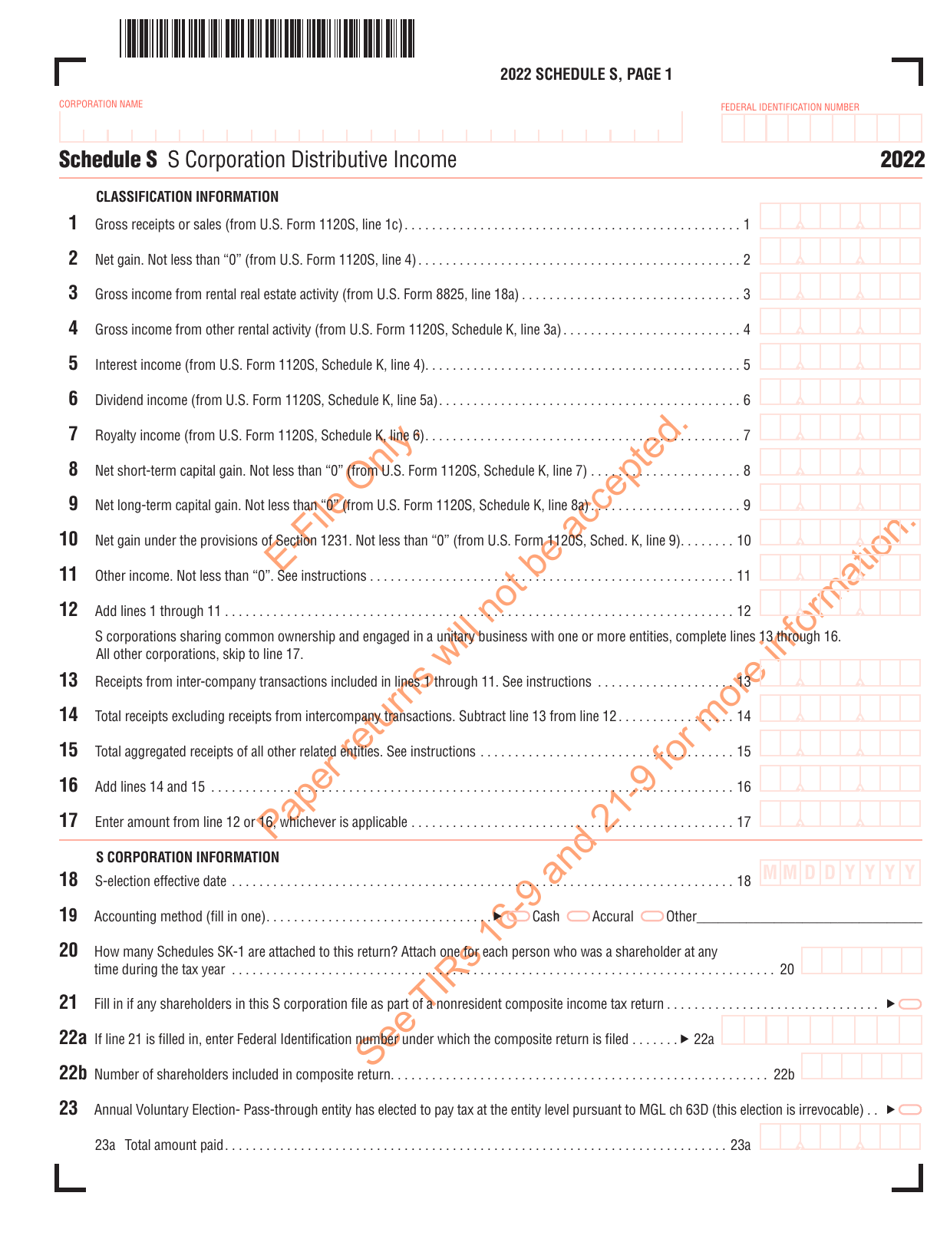

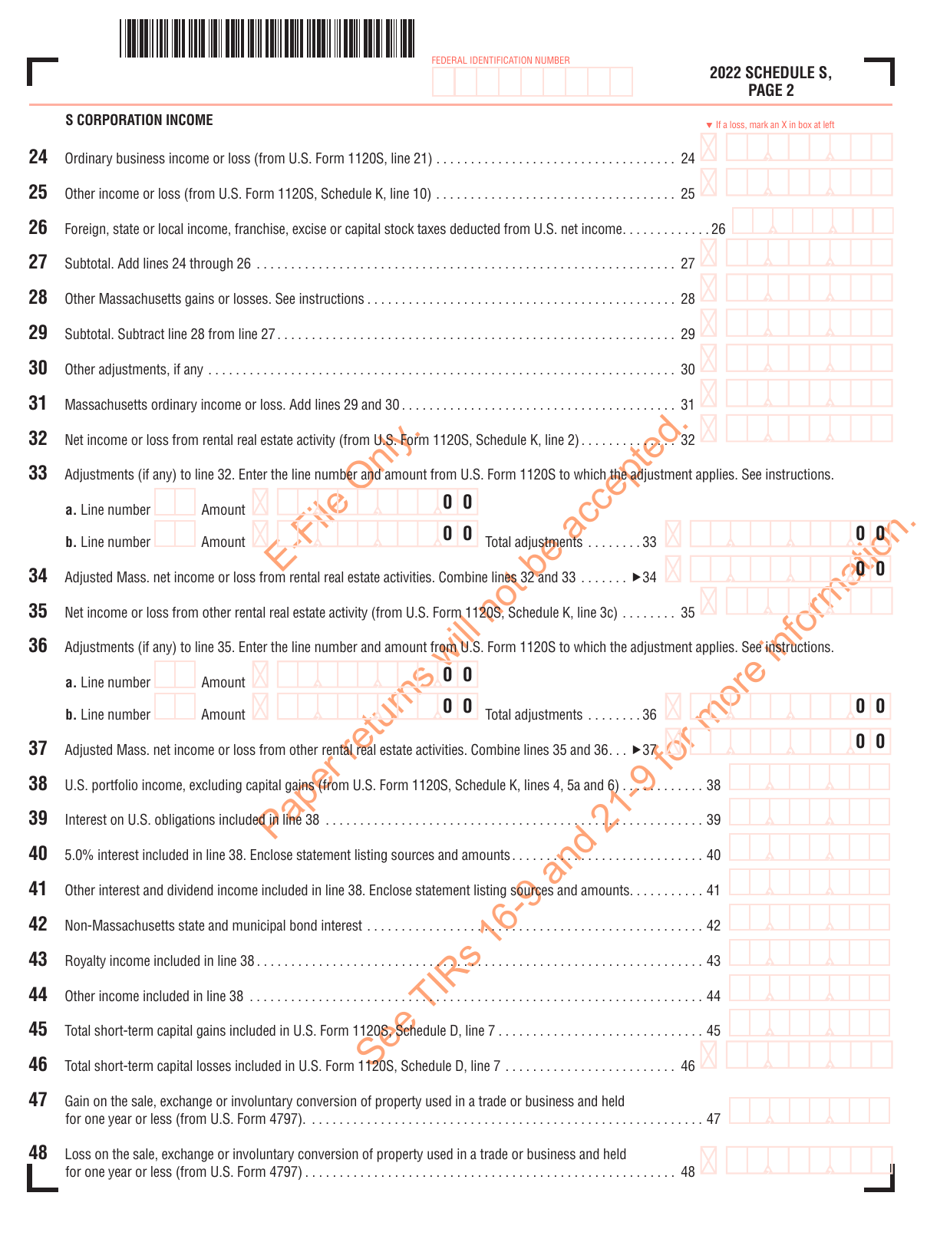

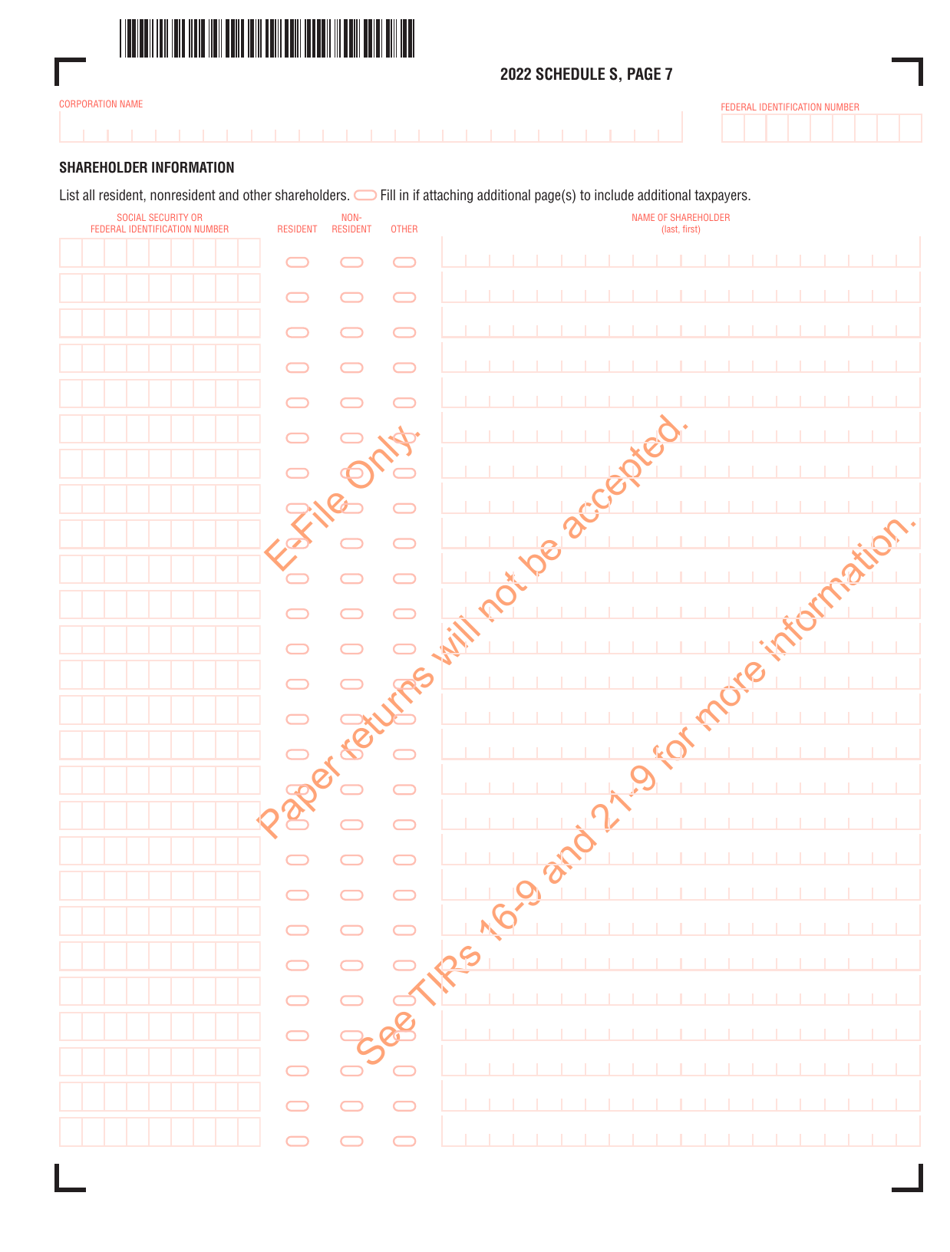

Schedule S S Corporation Distributive Income - Massachusetts

What Is Schedule S?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule S?

A: Schedule S is a form used to report the distributive income of an S Corporation in Massachusetts.

Q: What is an S Corporation?

A: An S Corporation is a type of business entity that elects to be taxed under Subchapter S of the Internal Revenue Code.

Q: What is distributive income?

A: Distributive income is the share of the S Corporation's profits or losses that is allocated to each shareholder.

Q: Why is Schedule S necessary?

A: Schedule S is necessary to report the distributive income of an S Corporation to the Massachusetts Department of Revenue.

Q: Who is required to file Schedule S?

A: Owners or shareholders of an S Corporation that conducts business in Massachusetts are required to file Schedule S.

Q: What information is required on Schedule S?

A: Schedule S requires information such as the name and address of the S Corporation, the names and addresses of the shareholders, and the amount of distributive income allocated to each shareholder.

Q: When is Schedule S due?

A: Schedule S is due on or before the 15th day of the third month following the close of the S Corporation's tax year.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule S by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.