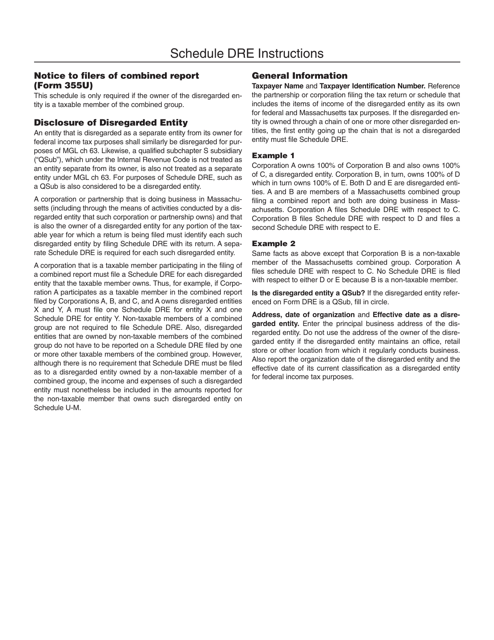

Instructions for Schedule DRE Disclosure of Disregarded Entity - Massachusetts

This document contains official instructions for Schedule DRE , Disclosure of Disregarded Entity - a form released and collected by the Massachusetts Department of Revenue.

FAQ

Q: What is Schedule DRE?

A: Schedule DRE is a form used by Massachusetts residents to disclose information about disregarded entities for tax purposes.

Q: What is a disregarded entity?

A: A disregarded entity is a business entity that is separate from its owner for legal purposes but disregarded for tax purposes. It includes single-member limited liability companies (LLCs) and certain other business entities.

Q: Who needs to file Schedule DRE?

A: Massachusetts residents who have a disregarded entity need to file Schedule DRE as part of their state tax return.

Q: What information is required on Schedule DRE?

A: Schedule DRE requires information about the disregarded entity, including its name, federal identification number, filing type, and the owner's information.

Q: When is the deadline to file Schedule DRE?

A: The deadline to file Schedule DRE is typically the same as the deadline for filing the Massachusetts state tax return, which is usually April 15th.

Q: Is there a penalty for not filing Schedule DRE?

A: Failure to file Schedule DRE or providing inaccurate information may result in penalties imposed by the Massachusetts Department of Revenue.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Massachusetts Department of Revenue.