This version of the form is not currently in use and is provided for reference only. Download this version of

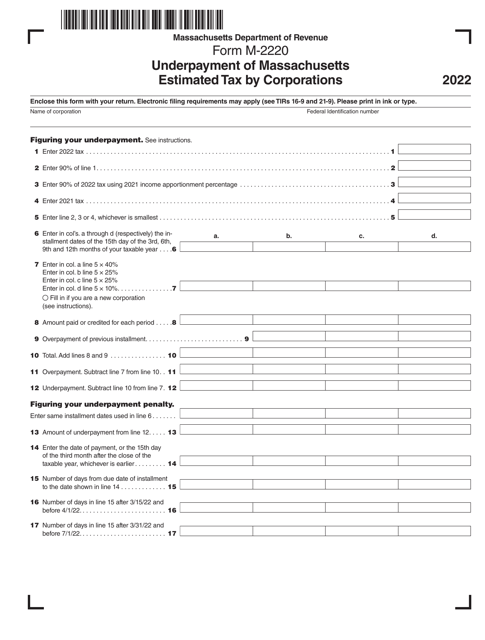

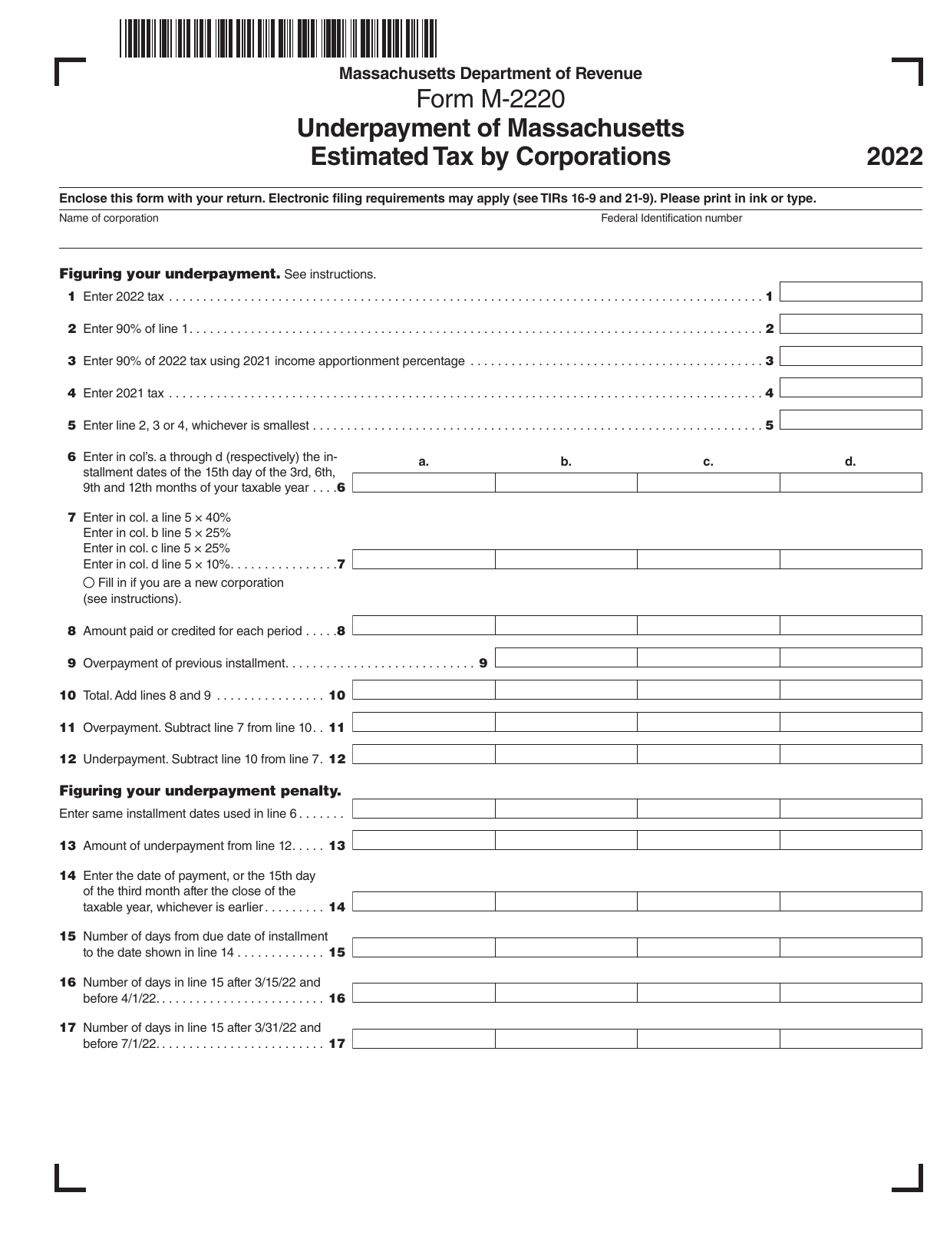

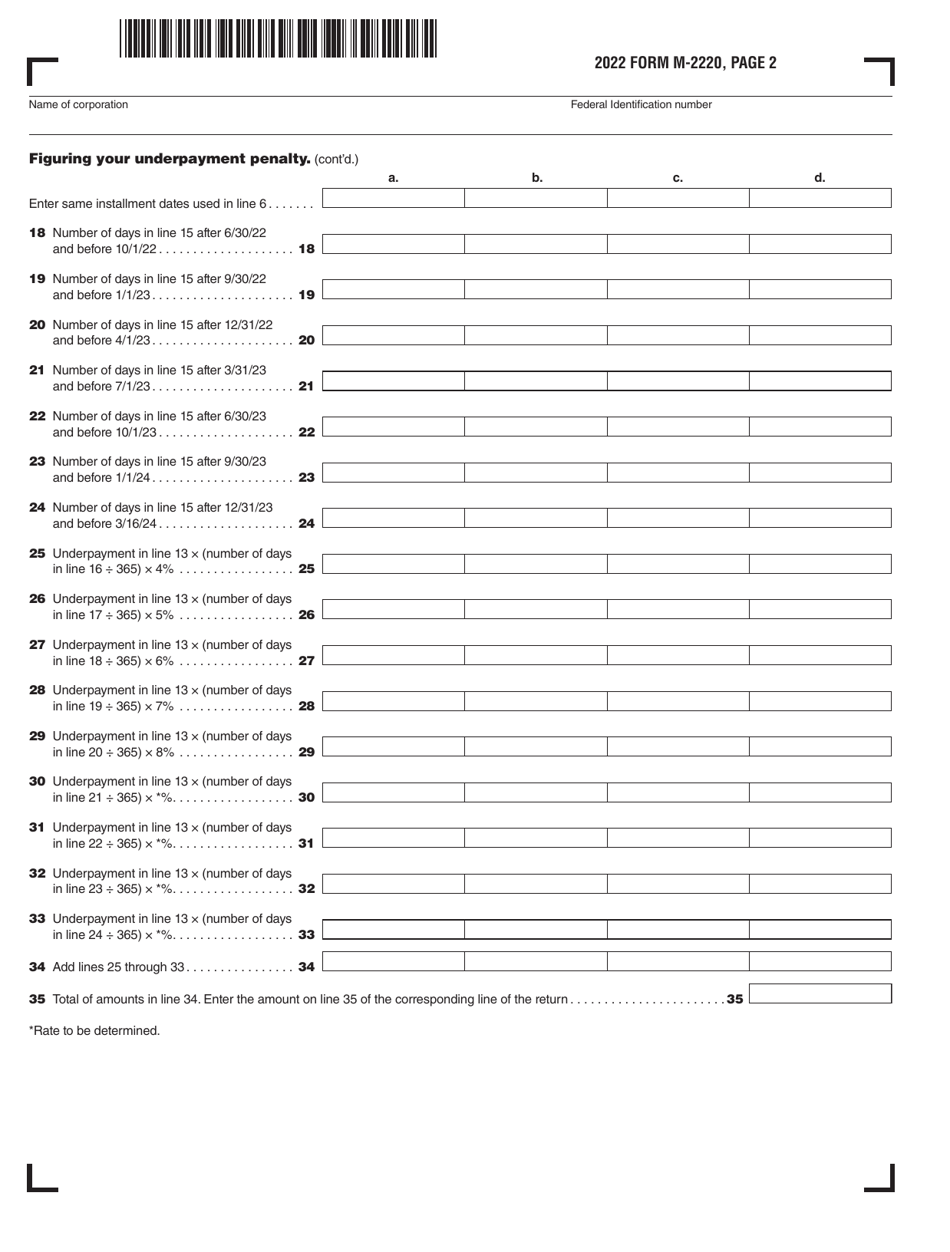

Form M-2220

for the current year.

Form M-2220 Underpayment of Massachusetts Estimated Tax by Corporations - Massachusetts

What Is Form M-2220?

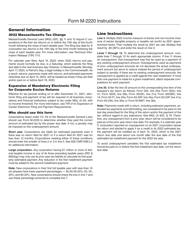

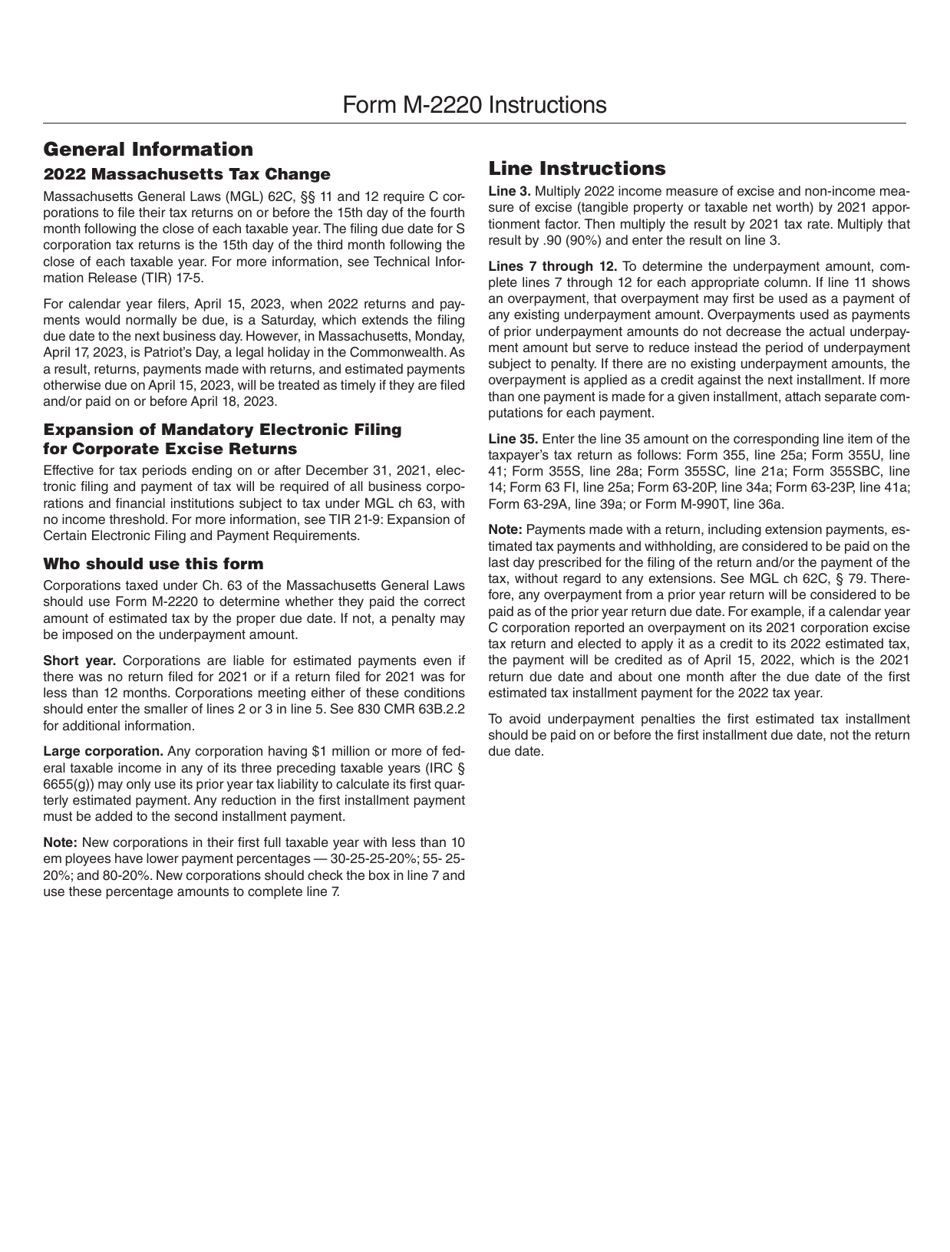

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-2220?

A: Form M-2220 is a tax form used by corporations in Massachusetts to report and calculate any underpayment of estimated tax.

Q: What is the purpose of Form M-2220?

A: The purpose of Form M-2220 is to determine if a corporation owes any penalties or interest for underpaying their estimated tax in Massachusetts.

Q: Who is required to file Form M-2220?

A: Corporations in Massachusetts are required to file Form M-2220 if they have underpaid their estimated tax for the tax year.

Q: How do I fill out Form M-2220?

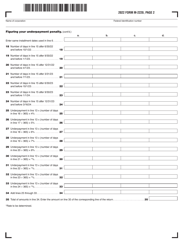

A: You need to provide information about your corporation's estimated tax payments, the amount of tax due, and any penalties or interest owed.

Q: When is Form M-2220 due?

A: Form M-2220 is generally due on the same date as the corporation's annual tax return, which is usually March 15th.

Q: Are there any penalties for not filing Form M-2220?

A: Yes, if you fail to file Form M-2220 or underpay your estimated tax, you may be subject to penalties and interest charges.

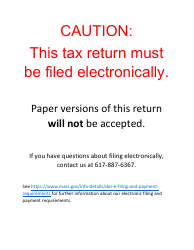

Q: Can I file Form M-2220 electronically?

A: Yes, Massachusetts allows electronic filing of Form M-2220.

Q: Is Form M-2220 only for corporations?

A: Yes, Form M-2220 is specifically for corporations in Massachusetts.

Q: Is Form M-2220 used for federal taxes?

A: No, Form M-2220 is used for calculating and reporting underpayment of estimated tax in Massachusetts only.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form M-2220 by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.