This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form 63D-ELT

for the current year.

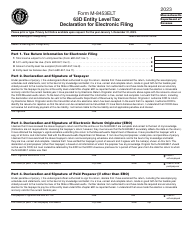

Instructions for Form 63D-ELT Entity Level Tax - Massachusetts

This document contains official instructions for Form 63D-ELT , Entity Level Tax - a form released and collected by the Massachusetts Department of Revenue. An up-to-date fillable Form 63D-ELT is available for download through this link.

FAQ

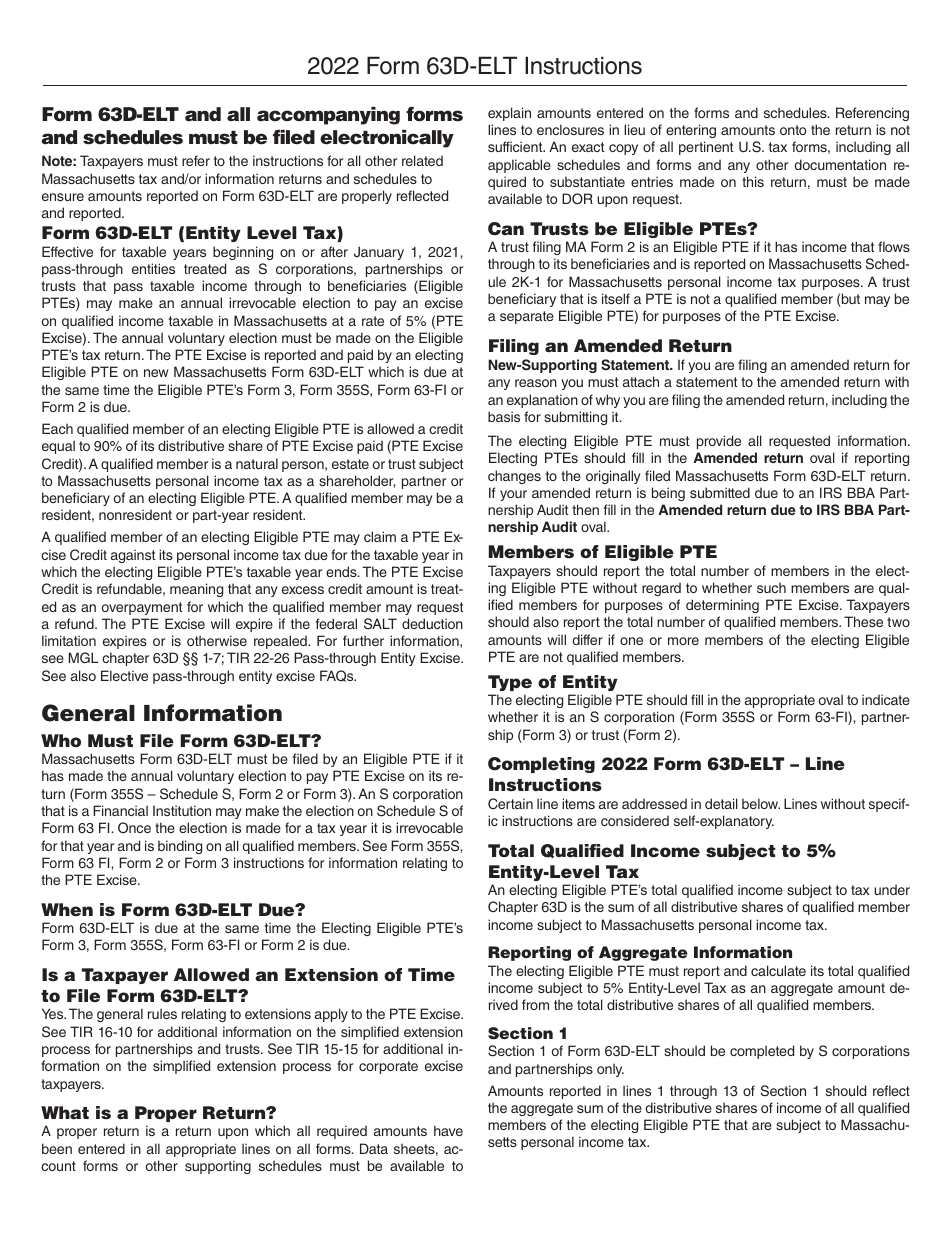

Q: What is Form 63D-ELT?

A: Form 63D-ELT is the Entity Level Tax form for Massachusetts.

Q: Who needs to file Form 63D-ELT?

A: Entities doing business in Massachusetts, including corporations and limited liability companies, are required to file Form 63D-ELT.

Q: What is the purpose of Form 63D-ELT?

A: Form 63D-ELT is used to report and pay the Entity Level Tax in Massachusetts.

Q: How often should Form 63D-ELT be filed?

A: Form 63D-ELT is an annual tax return and should be filed once a year.

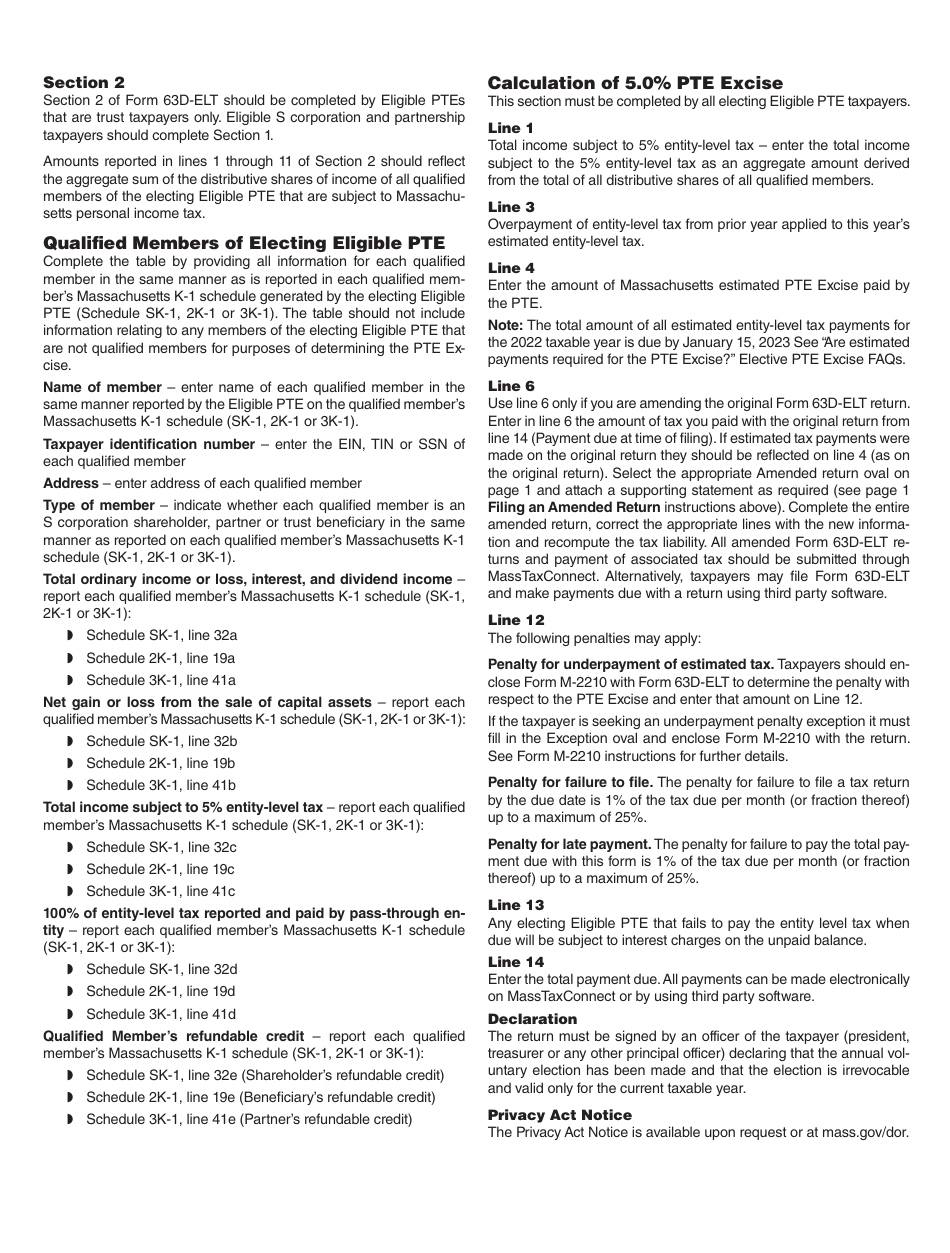

Q: What are the penalties for not filing Form 63D-ELT?

A: Penalties for not filing Form 63D-ELT include late filing penalties, interest on unpaid taxes, and potential loss of limited liability protection for LLCs.

Q: Is Form 63D-ELT the same as the Massachusetts income tax return?

A: No, Form 63D-ELT is a separate tax form and must be filed in addition to the Massachusetts income tax return.

Q: What is the deadline for filing Form 63D-ELT?

A: The deadline for filing Form 63D-ELT is usually April 15th, unless an extension has been granted.

Q: What if my entity has no income to report on Form 63D-ELT?

A: If your entity has no income to report, you may still be required to file Form 63D-ELT with zero income.

Q: Are there any exemptions from filing Form 63D-ELT?

A: There may be exemptions available for certain entities, such as non-profit organizations. It is best to consult the Massachusetts DOR or a tax professional for guidance.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Massachusetts Department of Revenue.