This version of the form is not currently in use and is provided for reference only. Download this version of

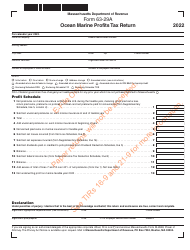

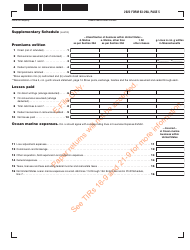

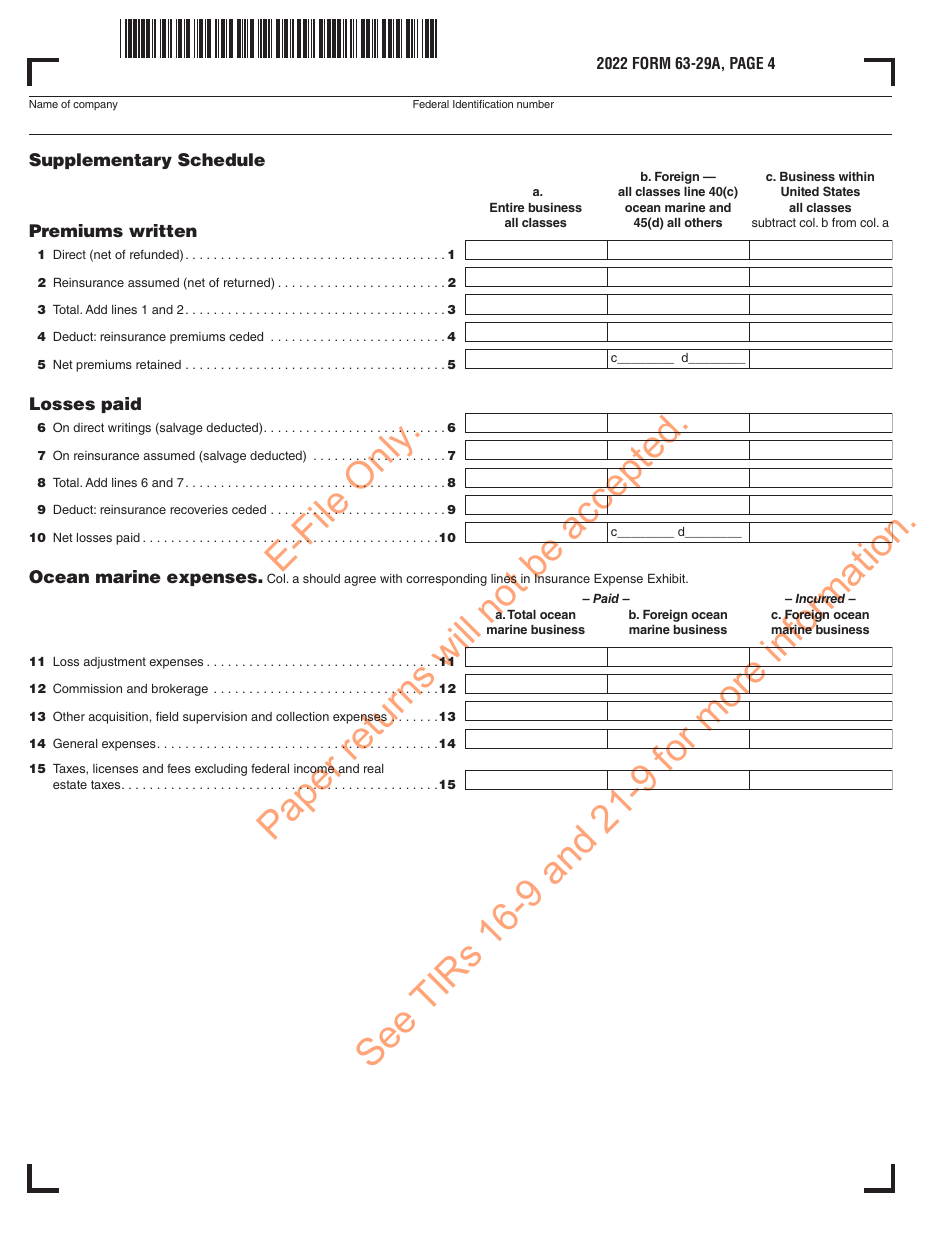

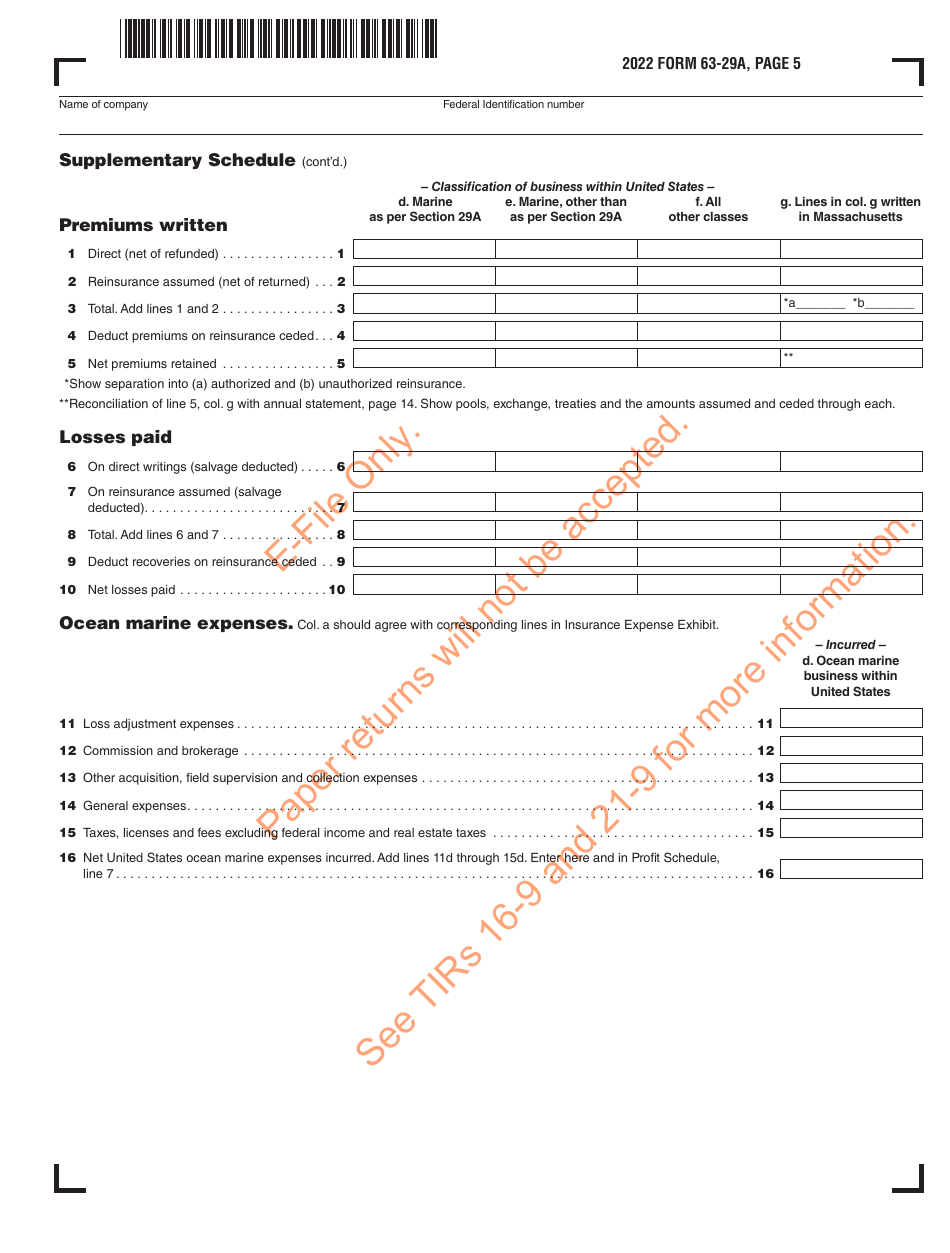

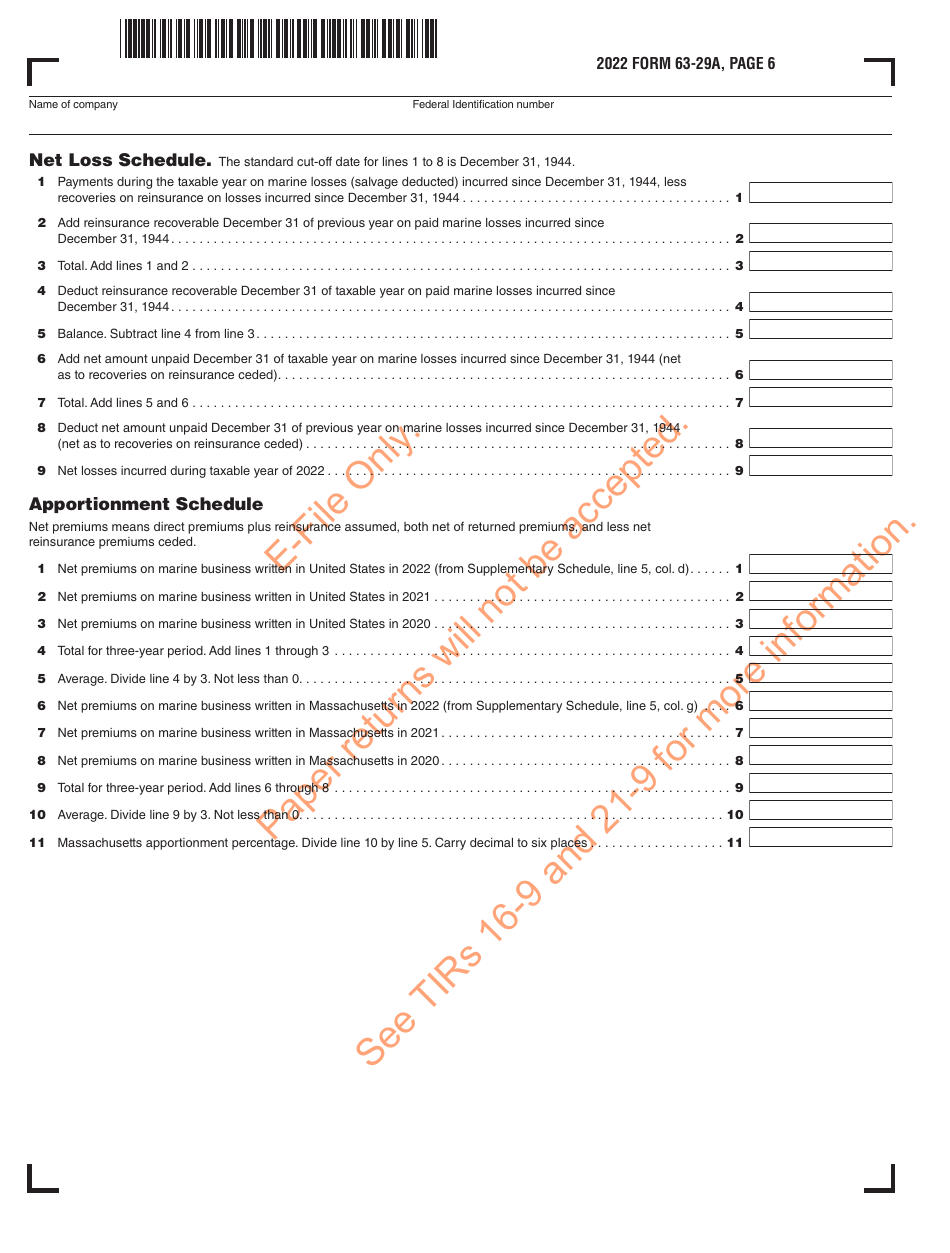

Form 63-29A

for the current year.

Form 63-29A Ocean Marine Profits Tax Return - Massachusetts

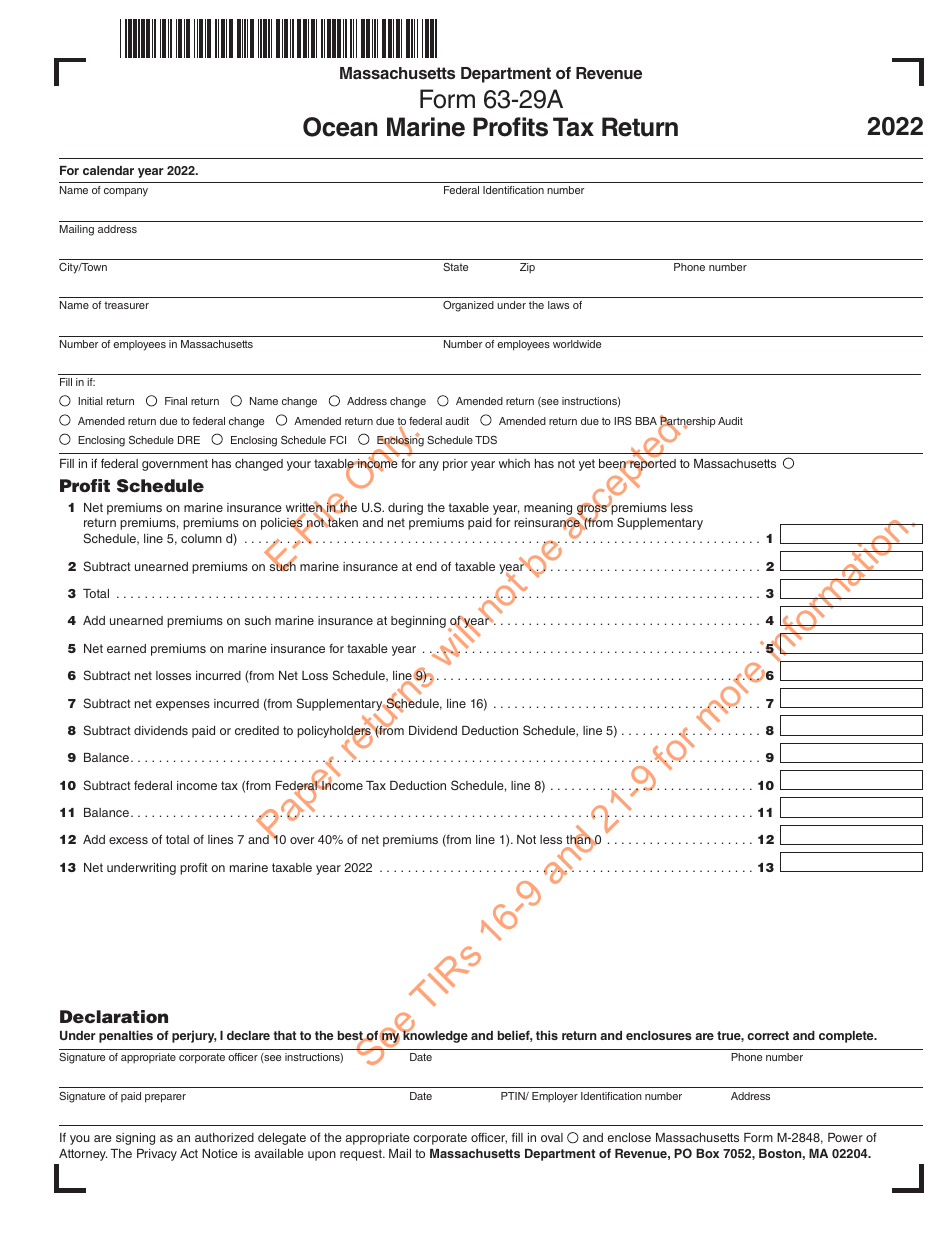

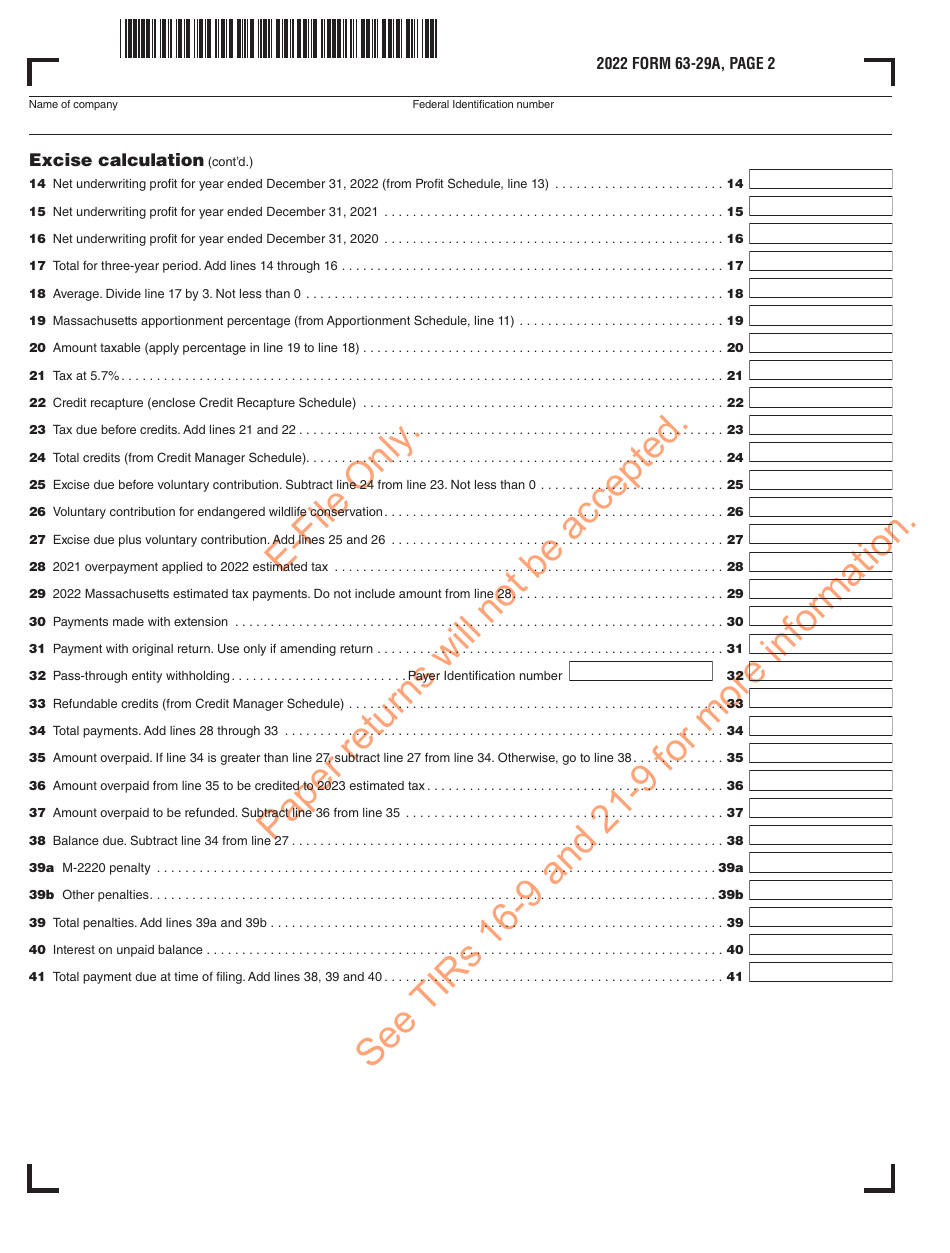

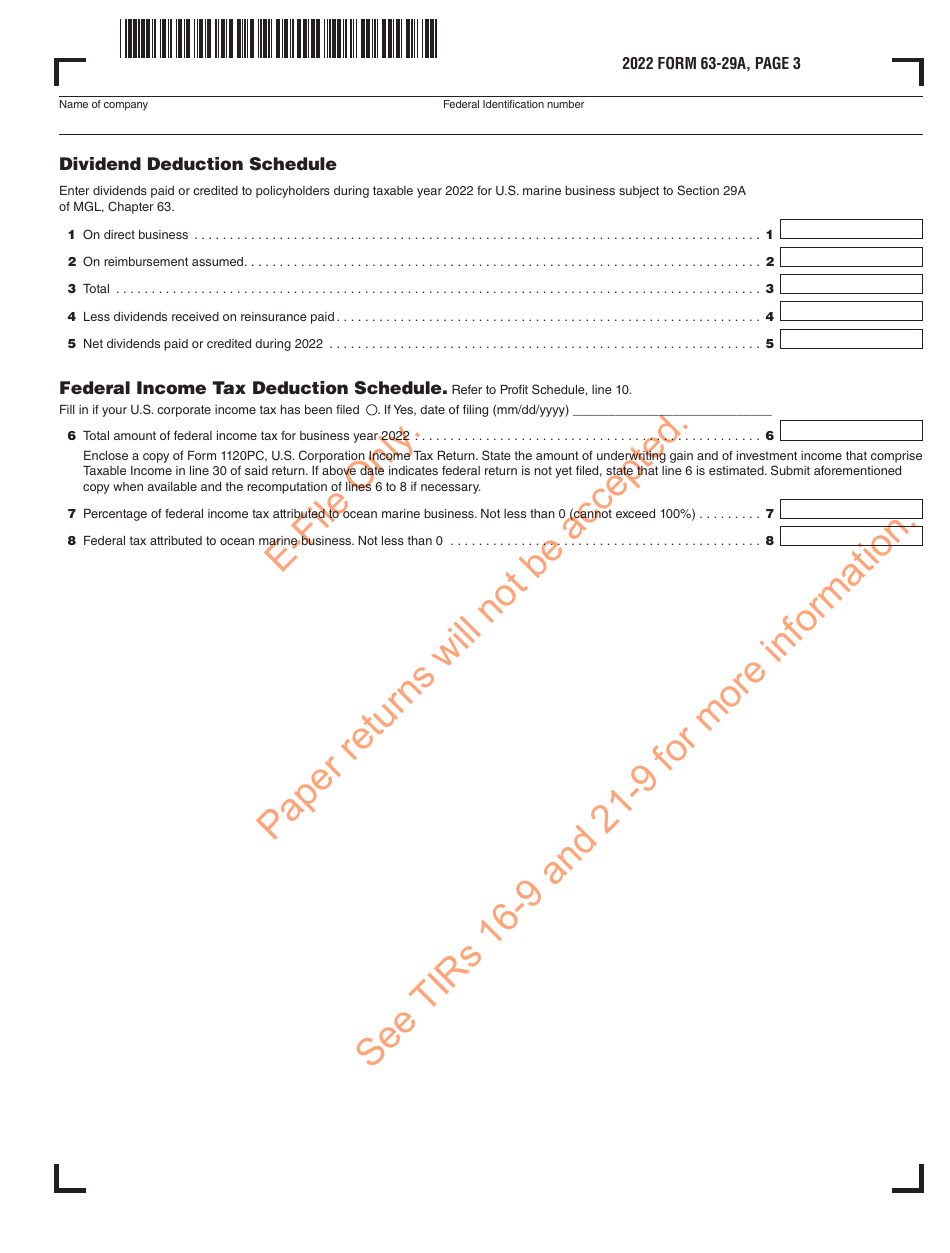

What Is Form 63-29A?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 63-29A?

A: Form 63-29A is the Ocean Marine Profits Tax Return for taxpayers in Massachusetts.

Q: Who needs to file Form 63-29A?

A: Taxpayers engaged in the business of ocean marine insurance or insurance upon vessels or other watercraft in Massachusetts need to file Form 63-29A.

Q: What is the purpose of Form 63-29A?

A: The purpose of Form 63-29A is to report and remit the ocean marine profits tax liability in Massachusetts.

Q: When is Form 63-29A due?

A: Form 63-29A is generally due on or before the 15th day of the third month following the close of the tax year.

Q: Are there any penalties for late filing of Form 63-29A?

A: Yes, penalties may apply for late filing or failure to file Form 63-29A, along with interest on the unpaid tax liability.

Q: Is Form 63-29A used for both individual and corporate taxpayers?

A: No, Form 63-29A is specifically for corporate taxpayers engaged in the business of ocean marine insurance or insurance upon vessels or other watercraft.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 63-29A by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.