This version of the form is not currently in use and is provided for reference only. Download this version of

Form 63-23P

for the current year.

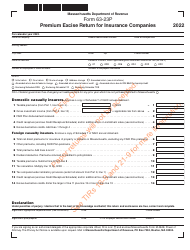

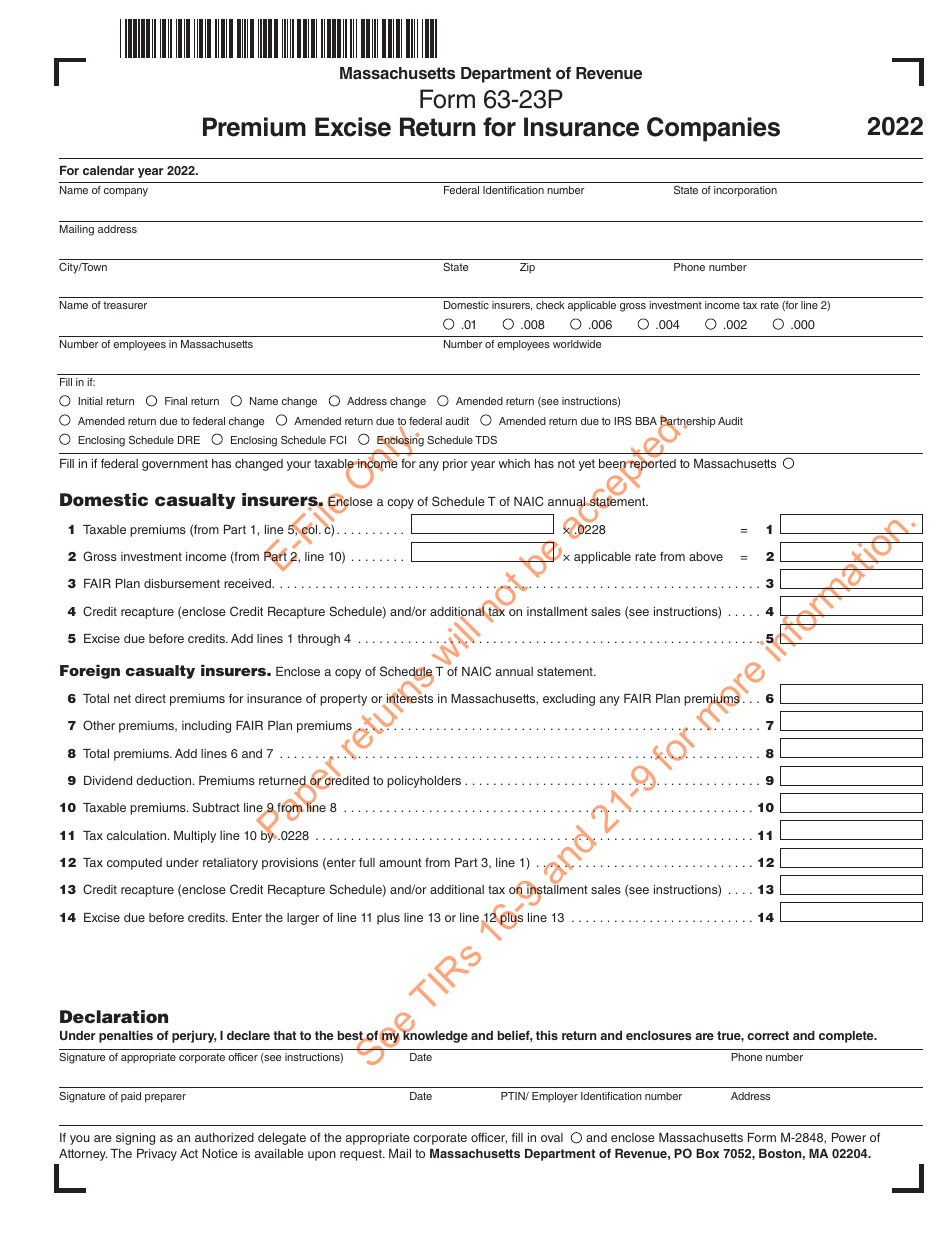

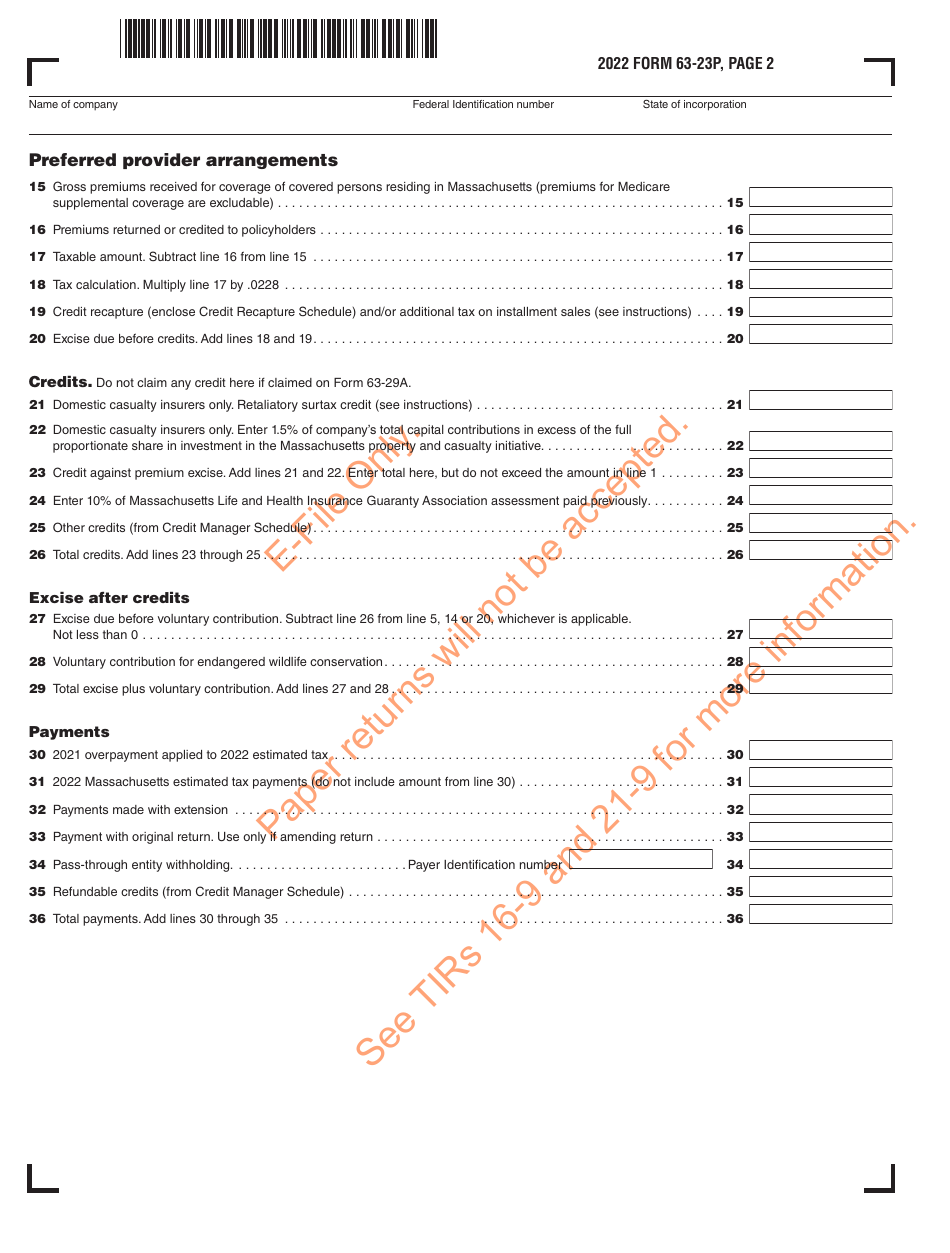

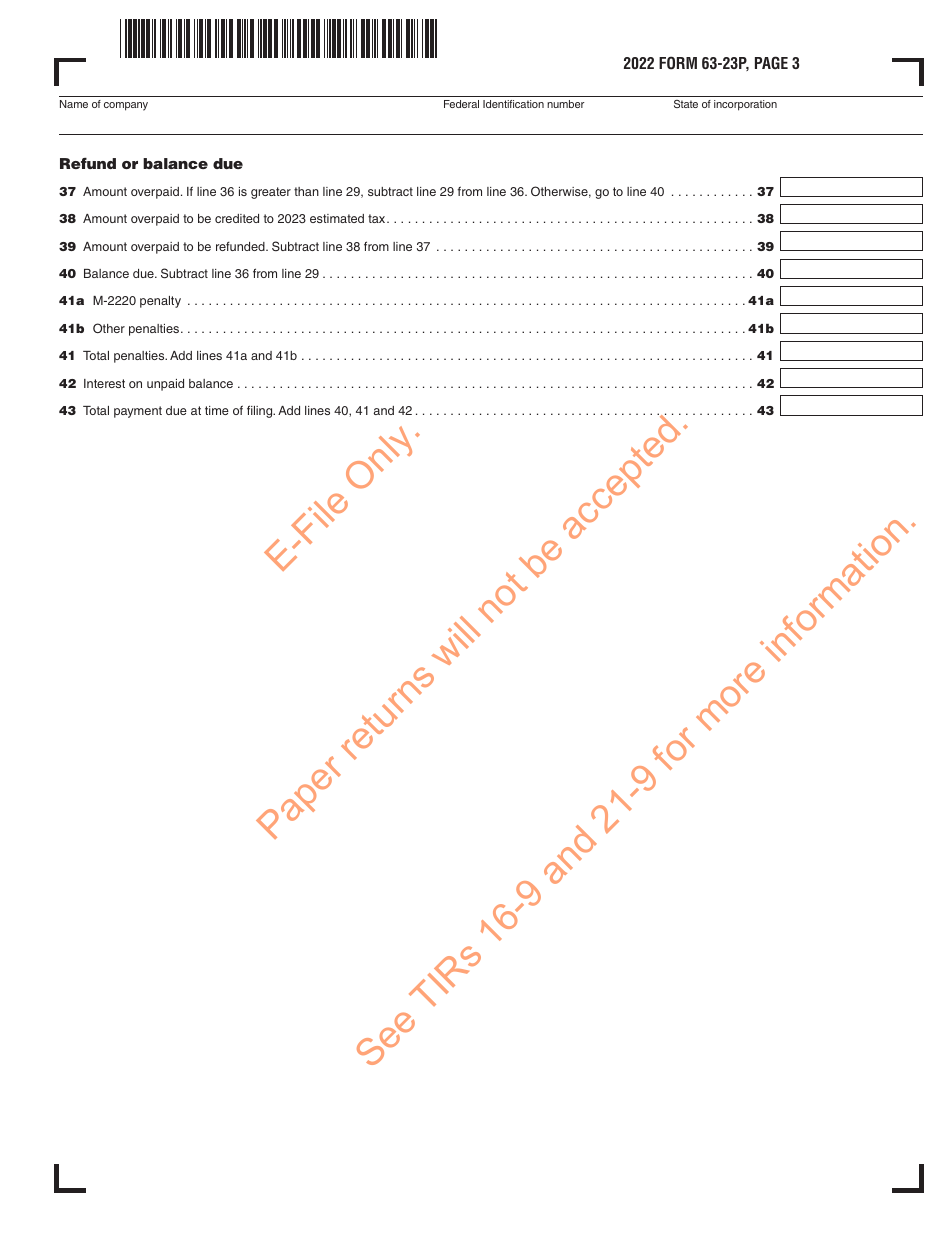

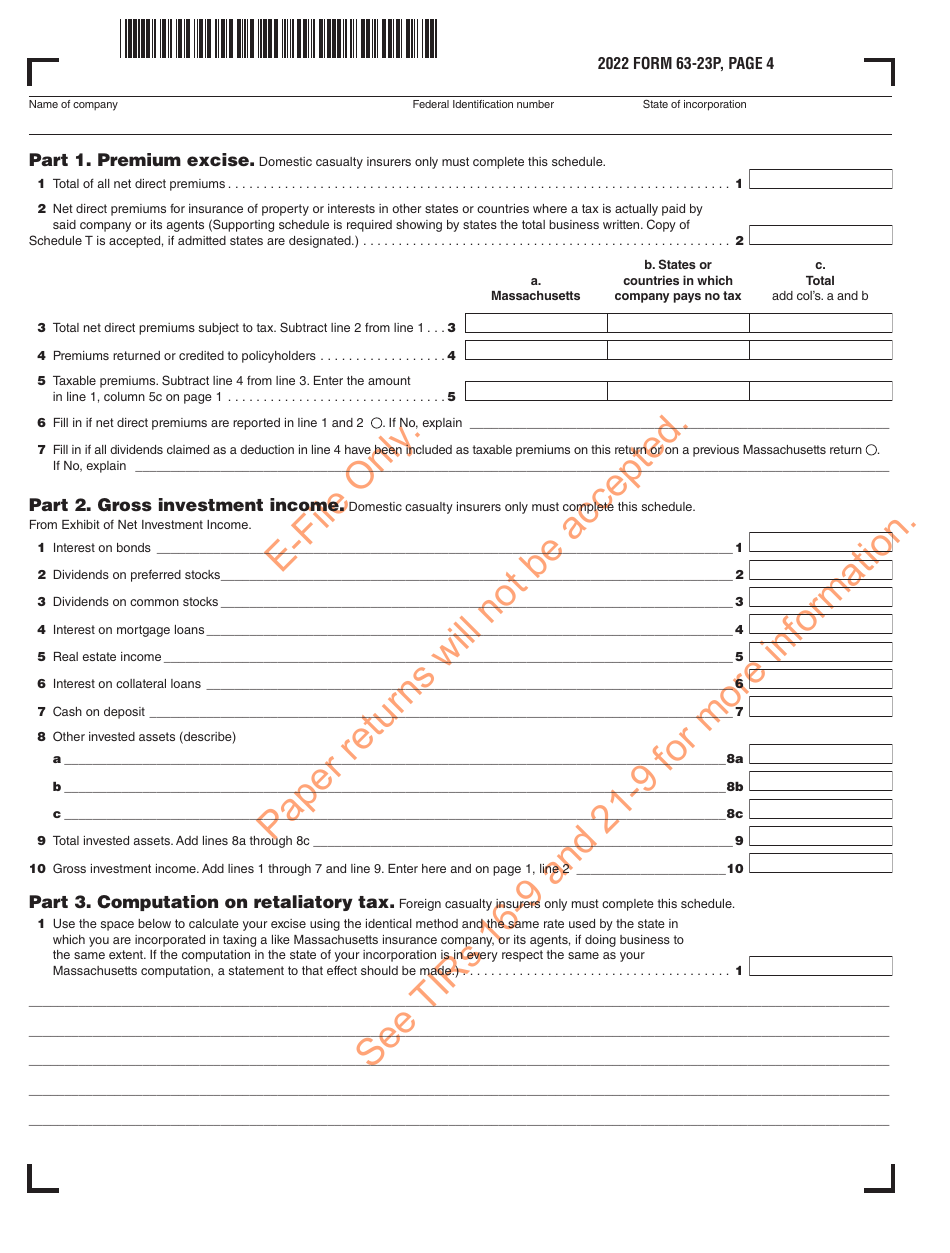

Form 63-23P Premium Excise Return for Insurance Companies - Massachusetts

What Is Form 63-23P?

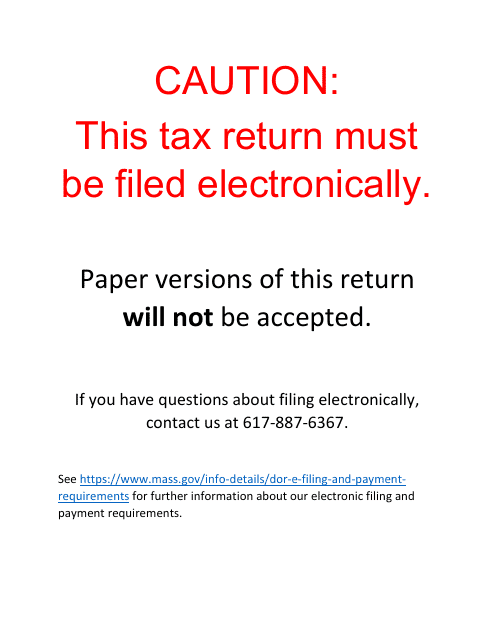

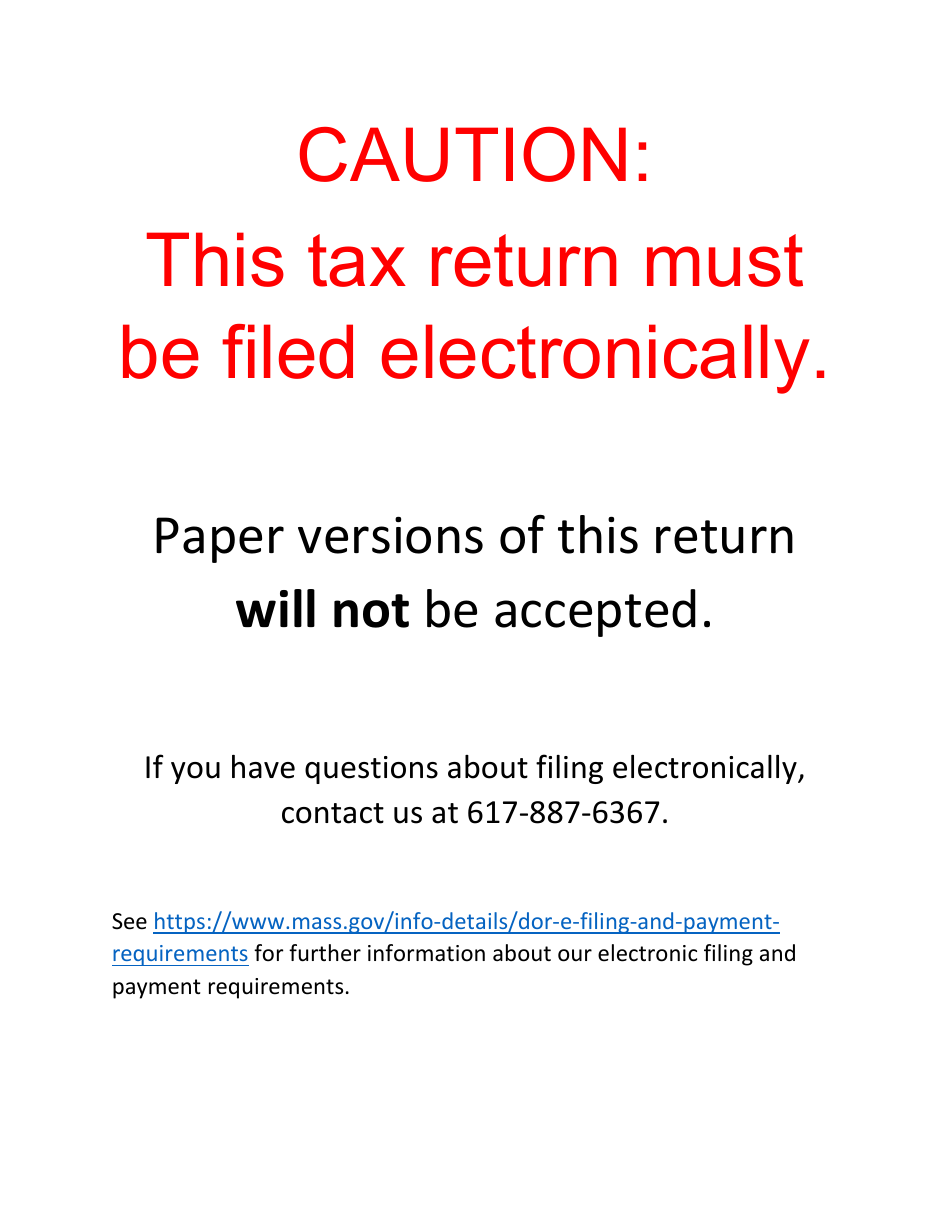

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 63-23P?

A: Form 63-23P is a Premium Excise Return for Insurance Companies in Massachusetts.

Q: Who needs to file Form 63-23P?

A: Insurance companies in Massachusetts are required to file Form 63-23P.

Q: What is the purpose of Form 63-23P?

A: The purpose of Form 63-23P is to report and pay the premium excise tax owed by insurance companies in Massachusetts.

Q: When is Form 63-23P due?

A: Form 63-23P is due by April 15th of each year.

Q: Are there any penalties for late filing of Form 63-23P?

A: Yes, there are penalties for late filing of Form 63-23P. It is best to file on time to avoid penalties.

Q: Is there a fee for filing Form 63-23P?

A: No, there is no fee for filing Form 63-23P.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 63-23P by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.