This version of the form is not currently in use and is provided for reference only. Download this version of

Form 63-20P

for the current year.

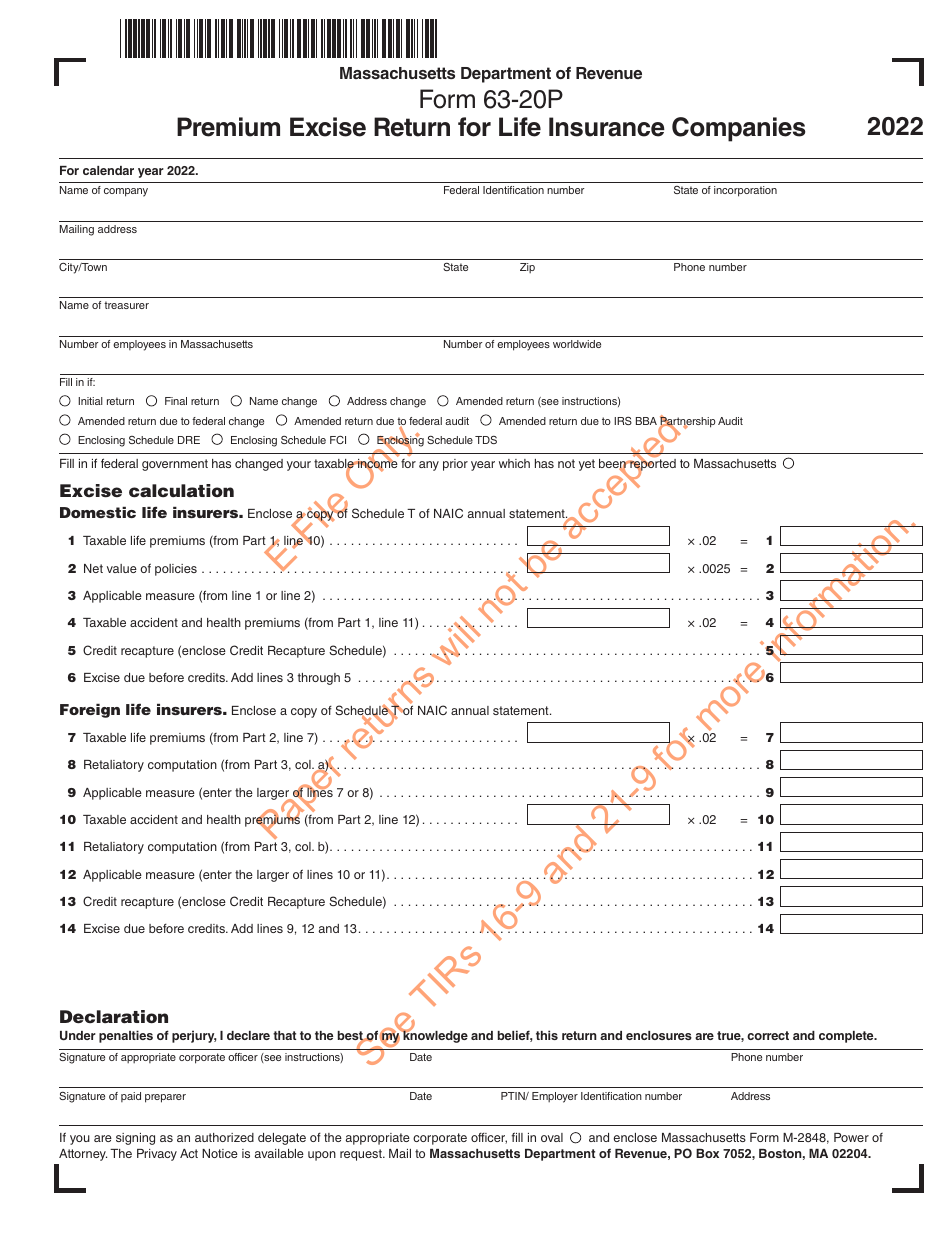

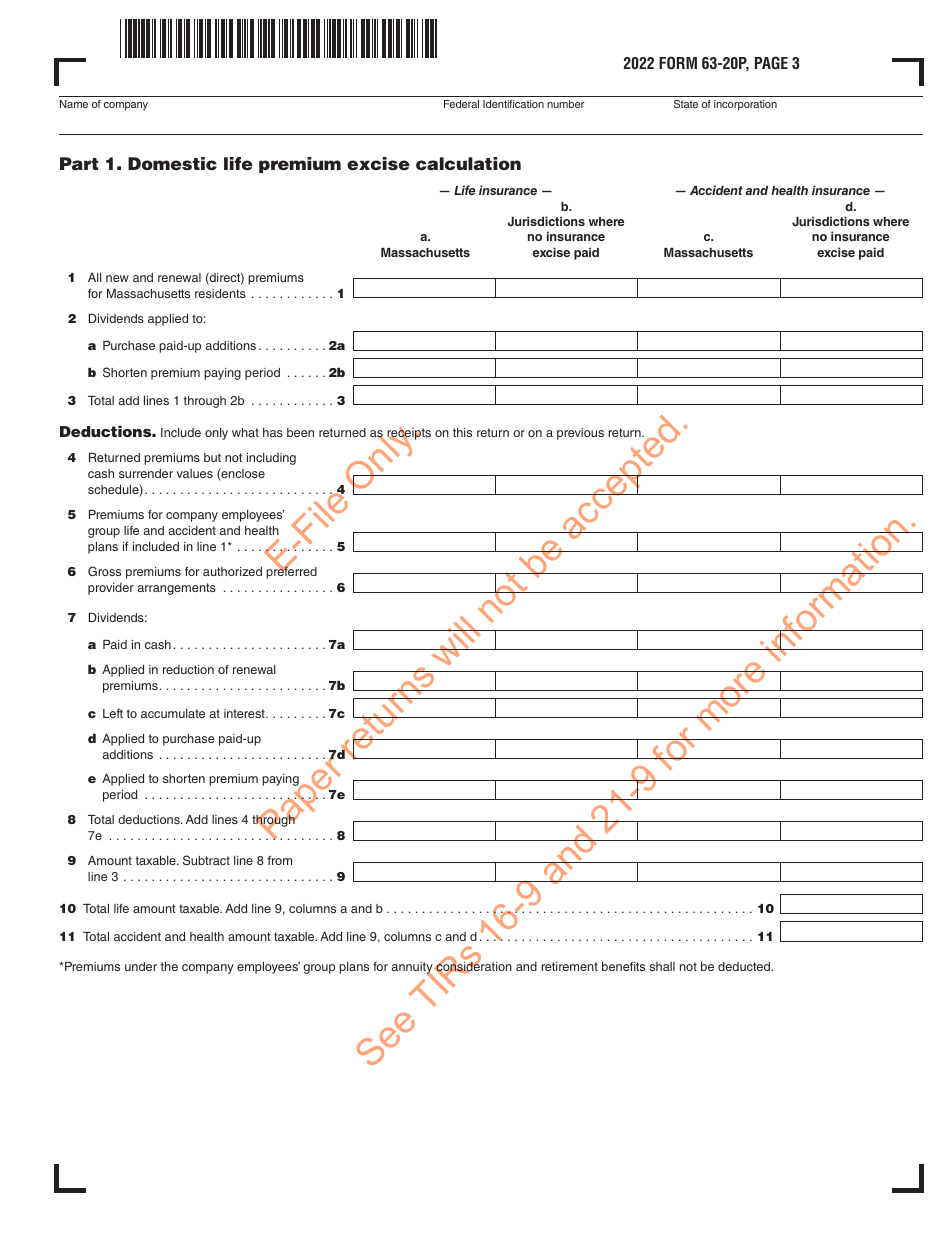

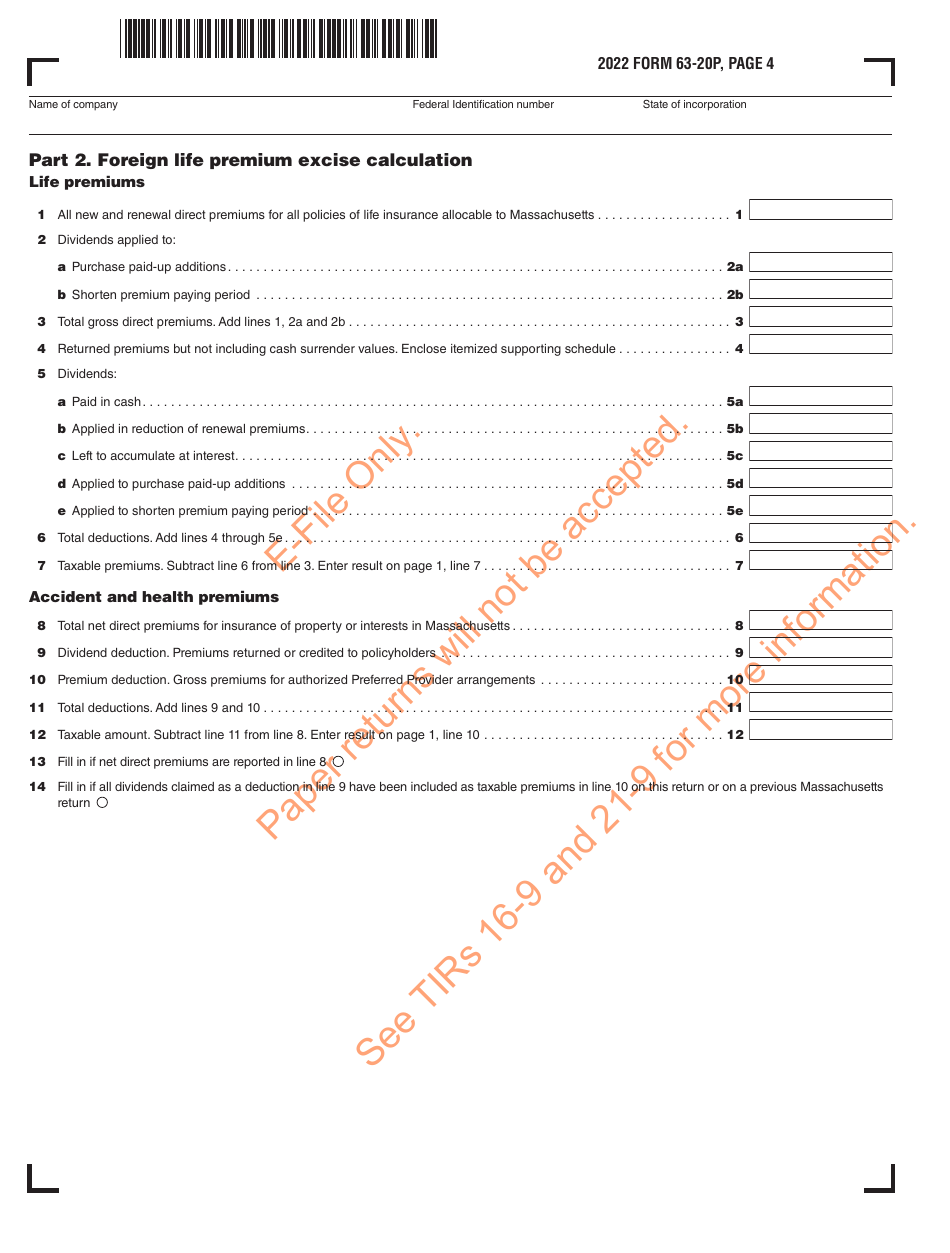

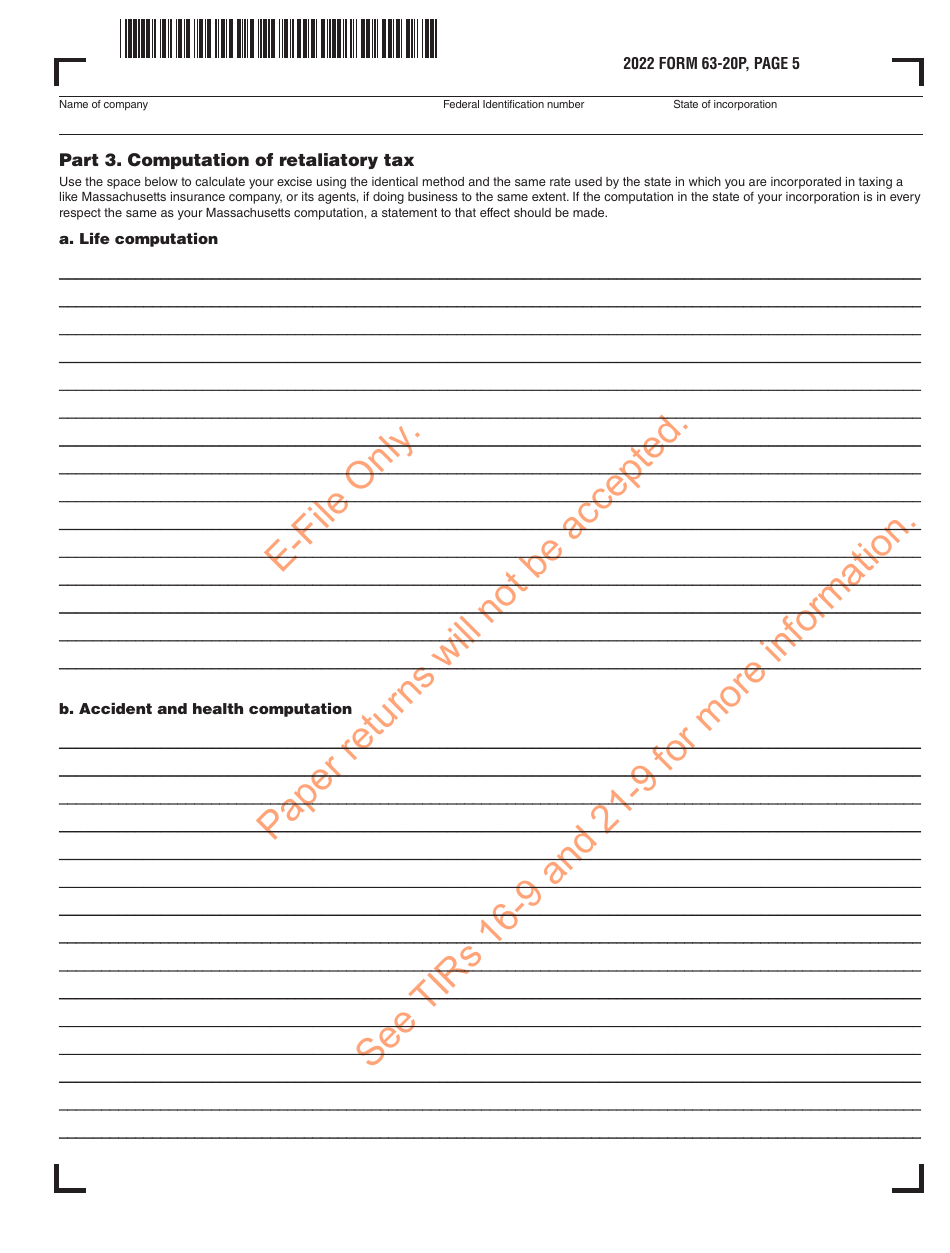

Form 63-20P Premium Excise Return for Life Insurance Companies - Massachusetts

What Is Form 63-20P?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. Check the official instructions before completing and submitting the form.

FAQ

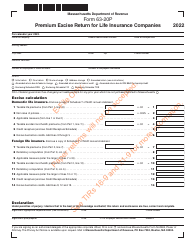

Q: What is Form 63-20P?

A: Form 63-20P is the Premium Excise Return for Life Insurance Companies in Massachusetts.

Q: Who needs to file Form 63-20P?

A: Life insurance companies operating in Massachusetts need to file Form 63-20P.

Q: What is the purpose of Form 63-20P?

A: Form 63-20P is used to calculate and report the excise tax owed by life insurance companies in Massachusetts.

Q: When is the deadline for filing Form 63-20P?

A: Form 63-20P must be filed by March 15th of each year.

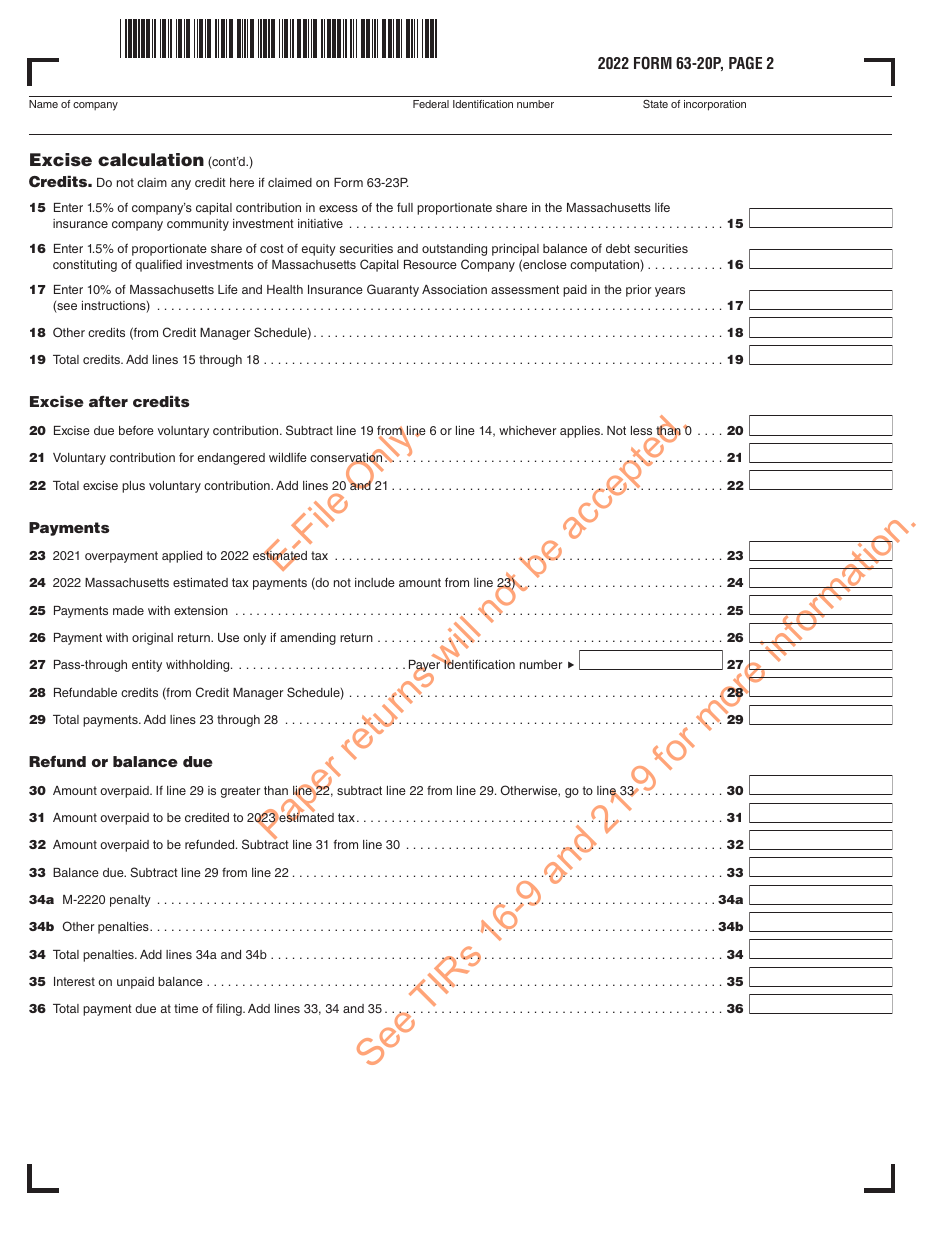

Q: Are there any penalties for late filing of Form 63-20P?

A: Yes, there are penalties for late filing of Form 63-20P. It is important to file the form on time to avoid penalties.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 63-20P by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.