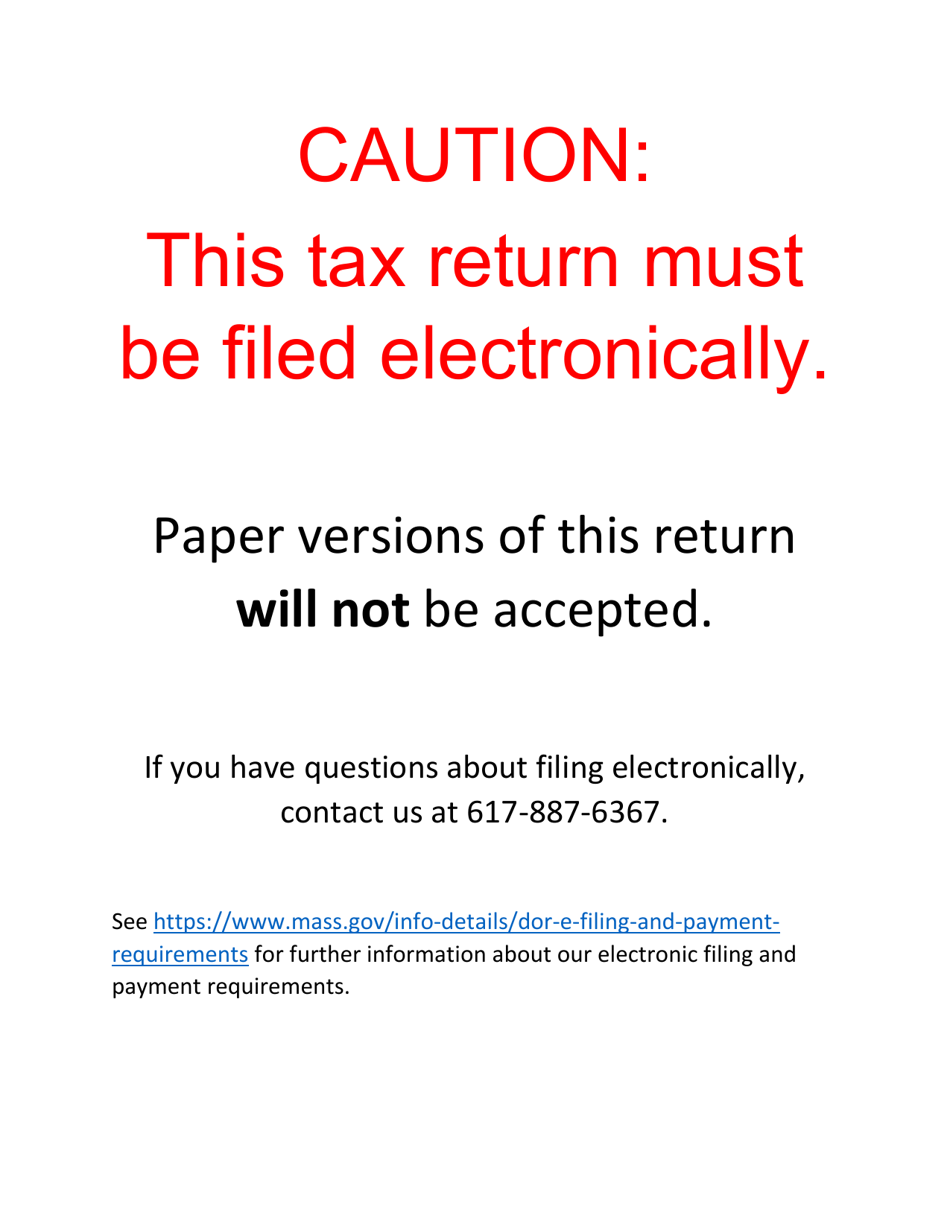

This version of the form is not currently in use and is provided for reference only. Download this version of

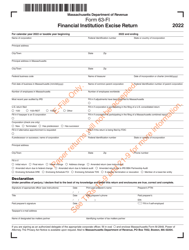

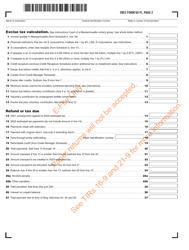

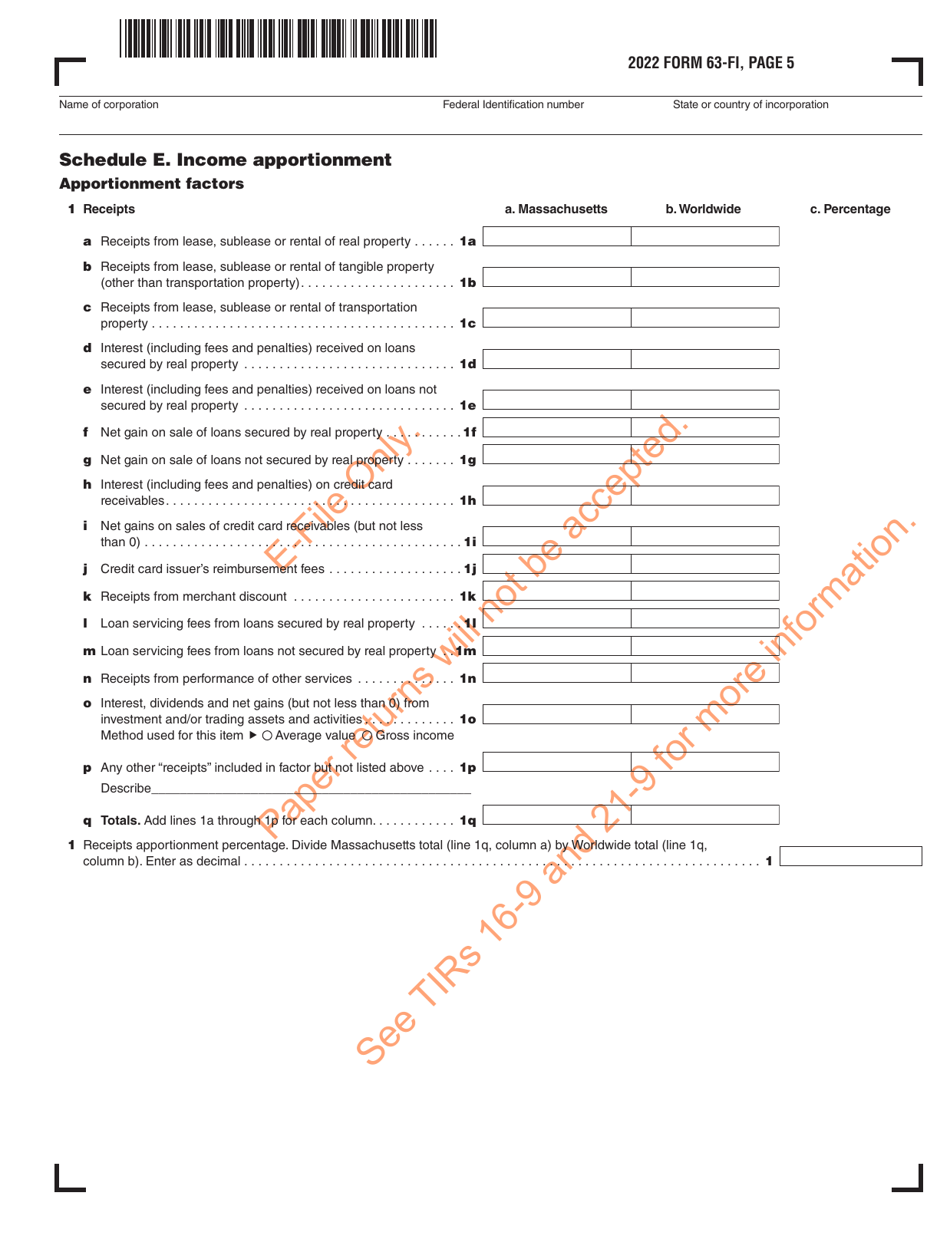

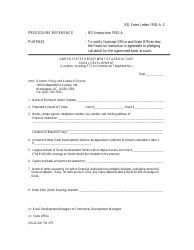

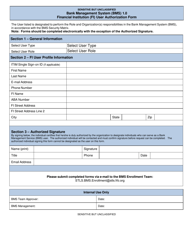

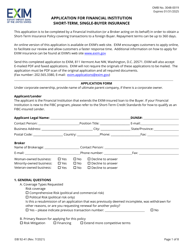

Form 63-FI

for the current year.

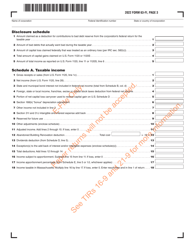

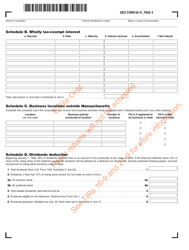

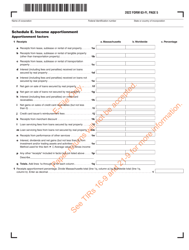

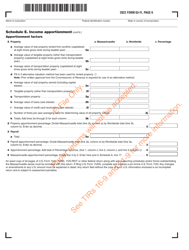

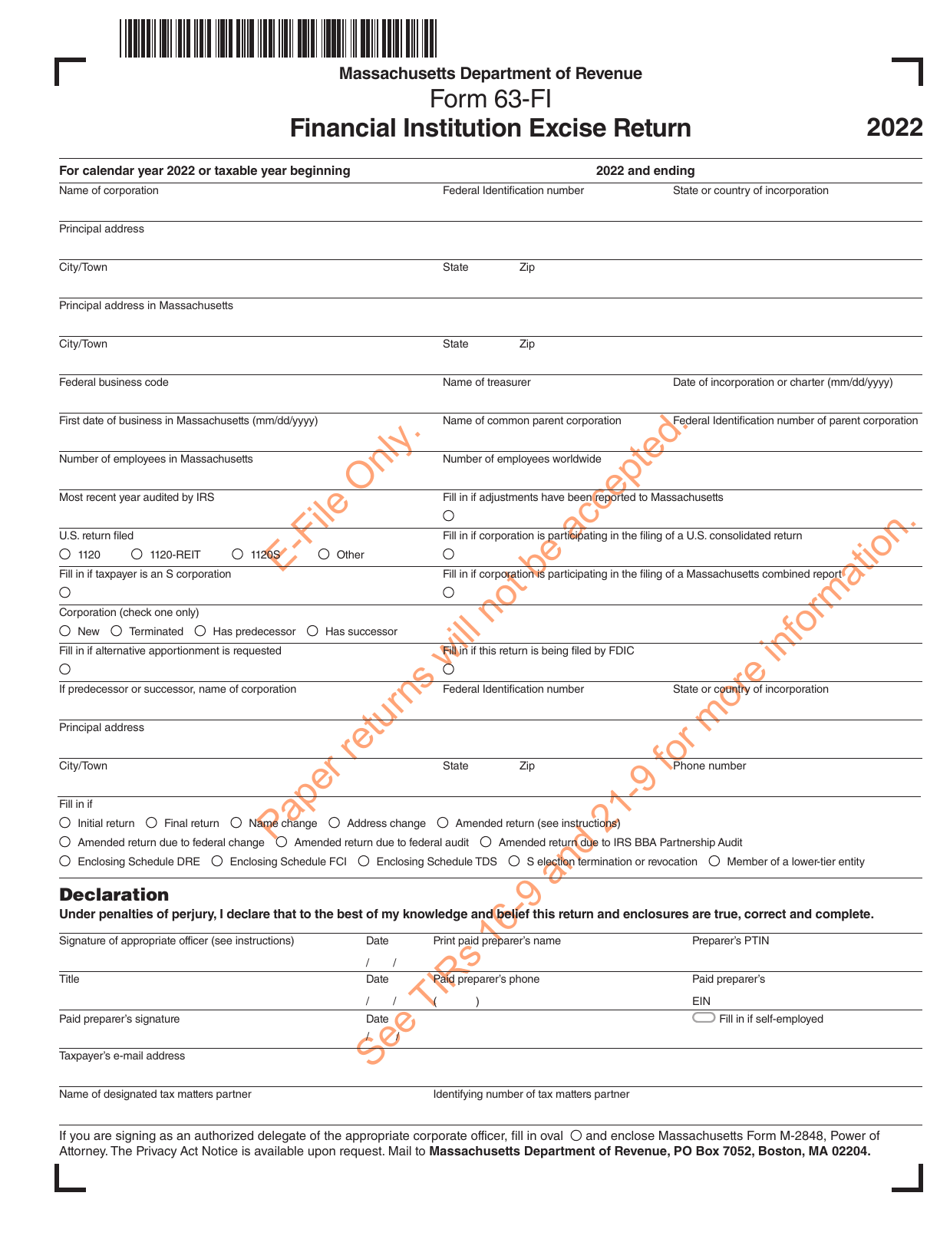

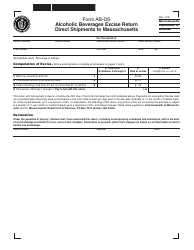

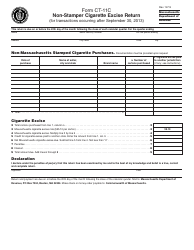

Form 63-FI Financial Institution Excise Return - Massachusetts

What Is Form 63-FI?

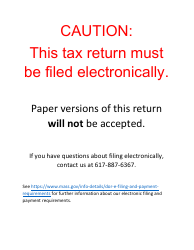

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

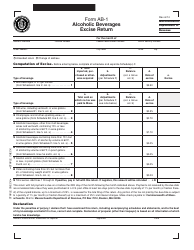

Q: What is Form 63-FI?

A: Form 63-FI is a financial institution excise return.

Q: Who needs to file Form 63-FI?

A: Financial institutions in Massachusetts need to file Form 63-FI.

Q: What is the purpose of Form 63-FI?

A: Form 63-FI is used to report and calculate the excise tax owed by financial institutions.

Q: How often do I need to file Form 63-FI?

A: Form 63-FI should be filed annually.

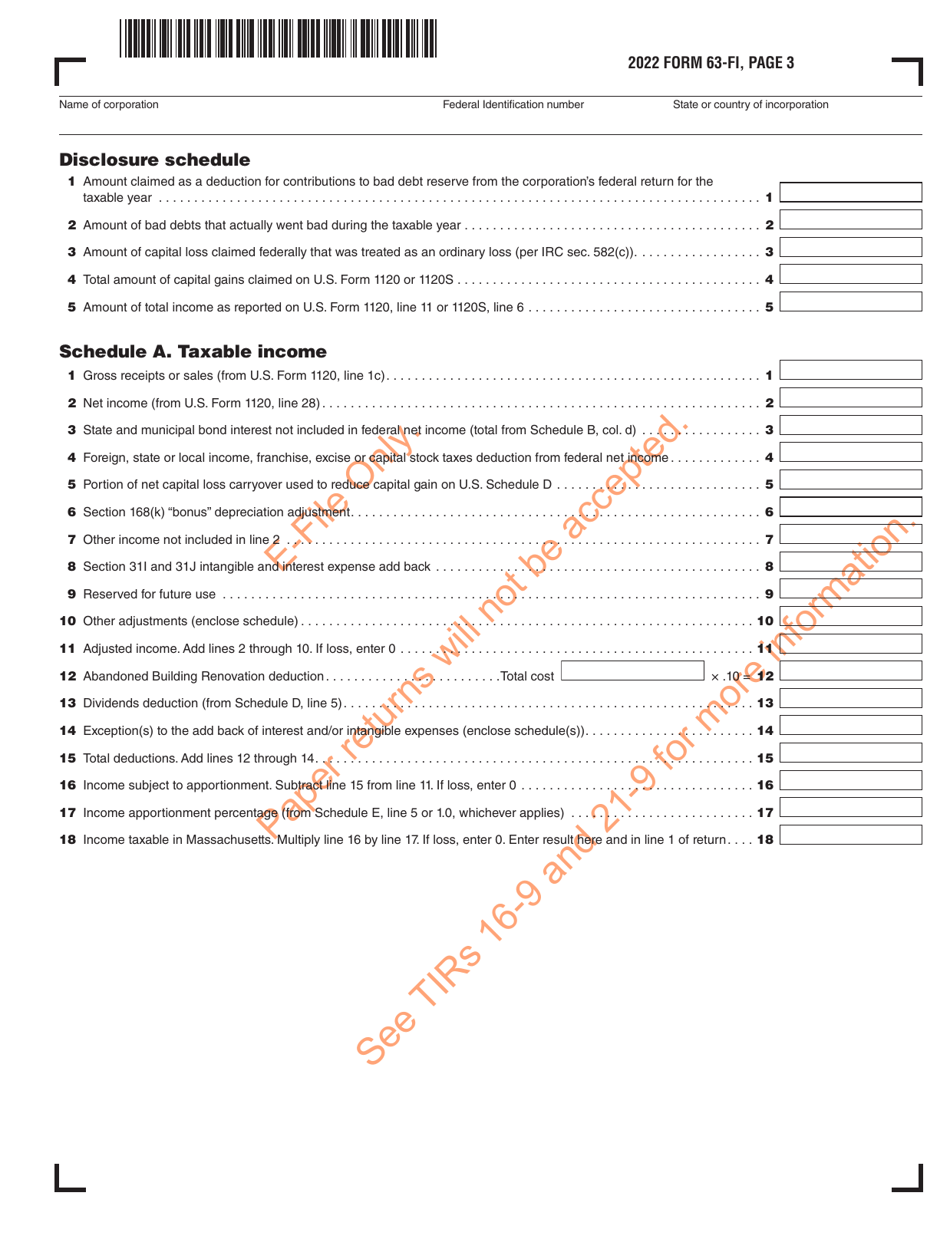

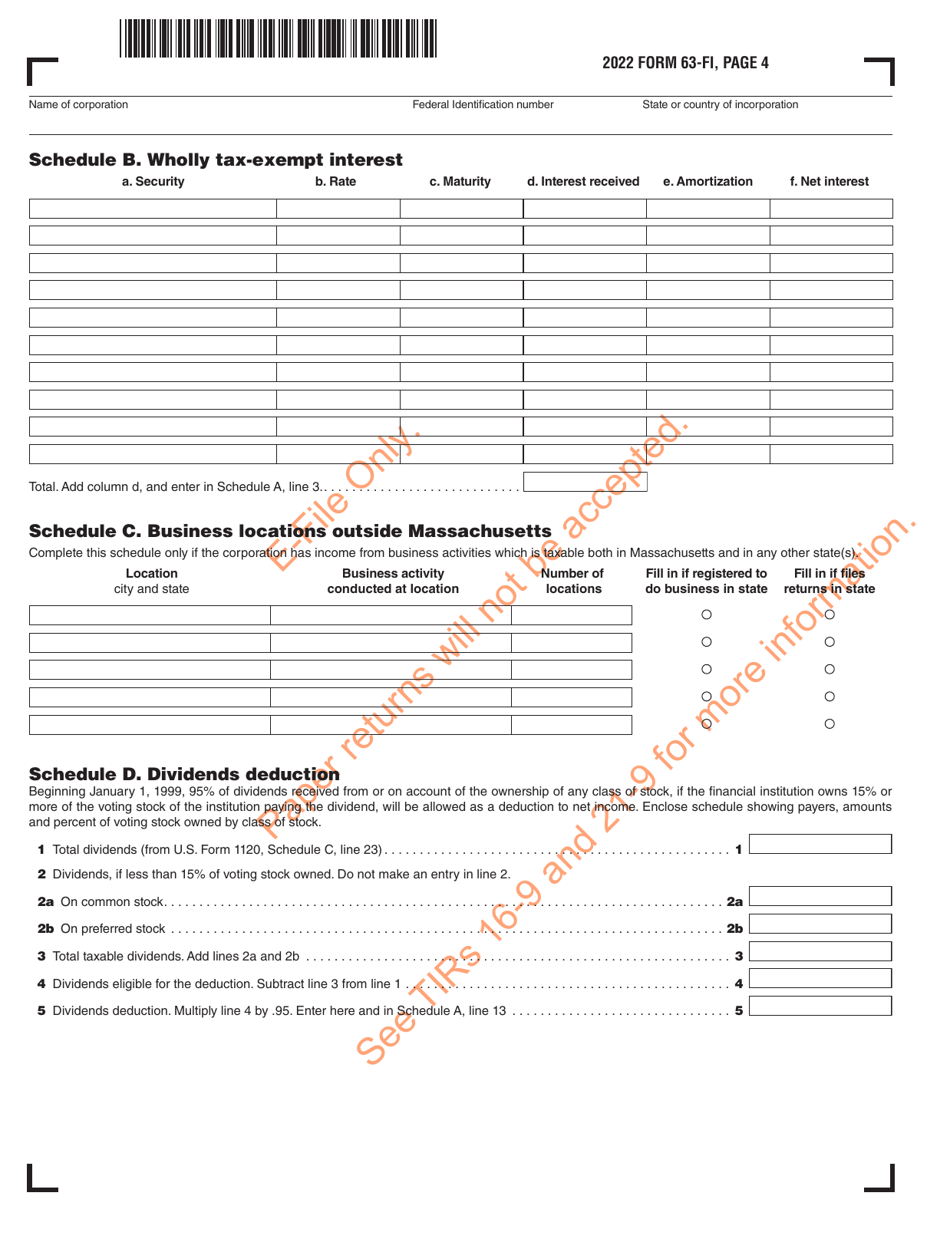

Q: What information is required on Form 63-FI?

A: Form 63-FI requires information about the financial institution's income, deductions, and tax liability.

Q: Is there a deadline for filing Form 63-FI?

A: Yes, the deadline for filing Form 63-FI is generally April 15th.

Q: Are there any penalties for late filing of Form 63-FI?

A: Yes, there may be penalties for late filing or underpayment of the excise tax.

Q: Are there any exceptions to filing Form 63-FI?

A: There may be exceptions for certain small financial institutions, but you should consult the instructions for Form 63-FI for specific details.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 63-FI by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.