This version of the form is not currently in use and is provided for reference only. Download this version of

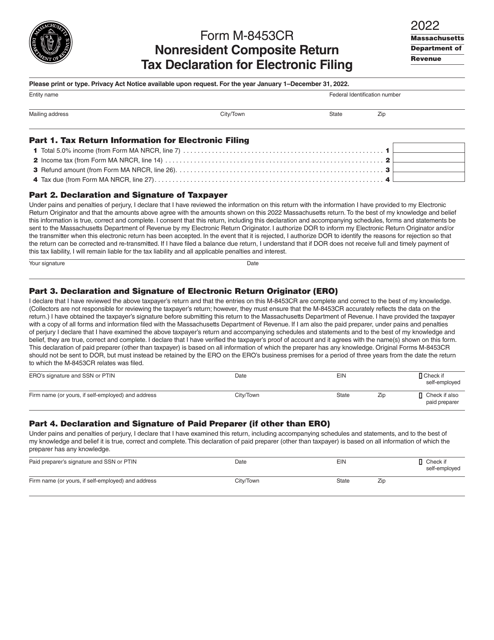

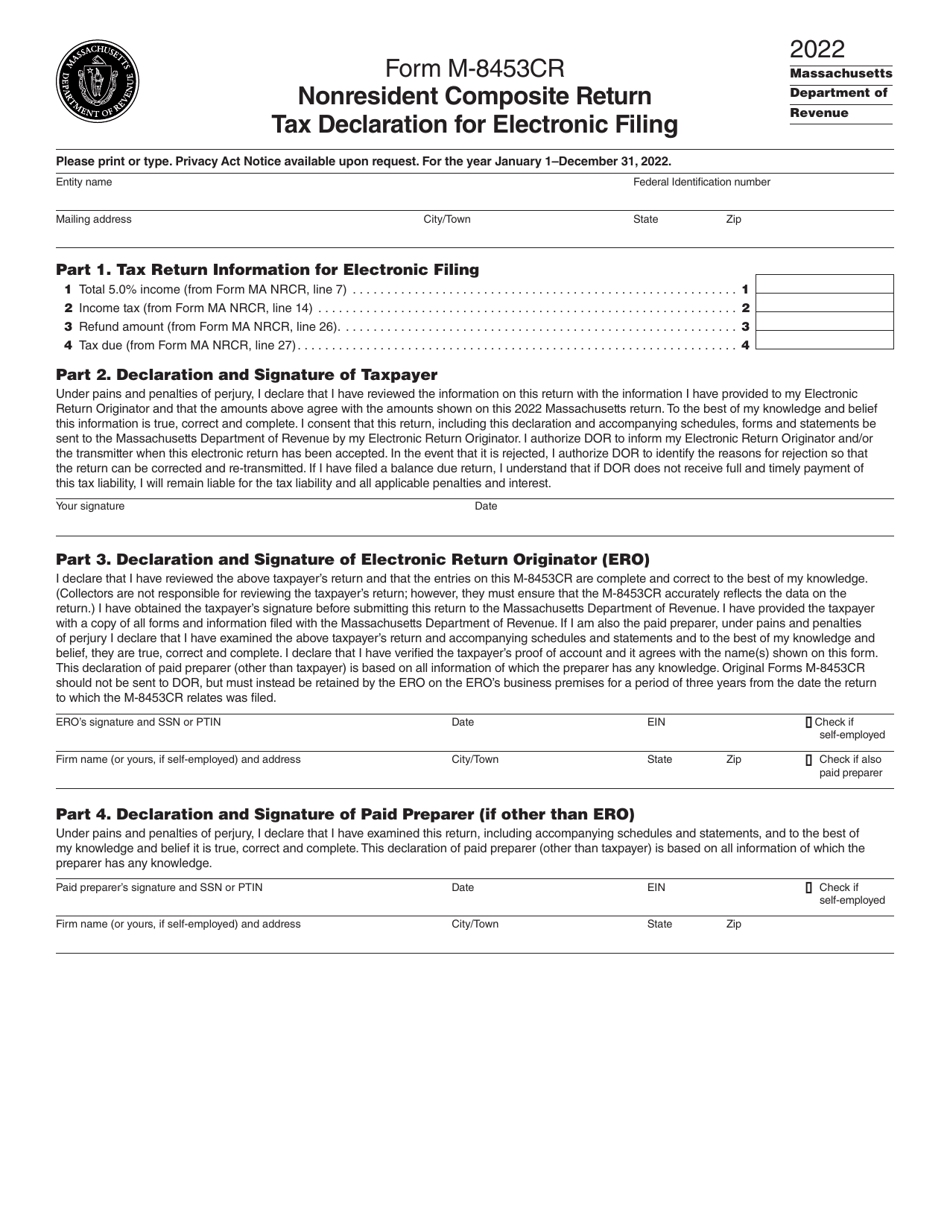

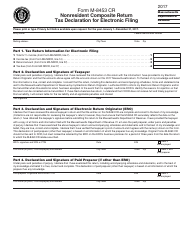

Form M-8453CR

for the current year.

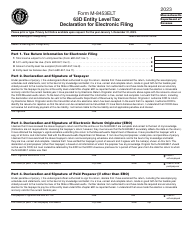

Form M-8453CR Nonresident Composite Return Tax Declaration for Electronic Filing - Massachusetts

What Is Form M-8453CR?

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-8453CR?

A: Form M-8453CR is the Nonresident Composite Return Tax Declaration for Electronic Filing in Massachusetts.

Q: Who should use Form M-8453CR?

A: Nonresident taxpayers in Massachusetts who wish to file a composite return electronically should use Form M-8453CR.

Q: What is a composite return?

A: A composite return is a tax return filed on behalf of multiple nonresident individuals by a designated agent or fiduciary.

Q: Why would someone file a composite return?

A: A composite return allows nonresident individuals to fulfill their tax obligations in Massachusetts without filing their own individual tax returns.

Q: Is Form M-8453CR only for nonresidents?

A: Yes, Form M-8453CR is specifically for nonresident taxpayers in Massachusetts.

Q: Can Form M-8453CR be filed electronically?

A: Yes, Form M-8453CR is specifically designed for electronic filing.

Q: Are there any other forms required to file a composite return?

A: Yes, along with Form M-8453CR, nonresident taxpayers must also file Form 3M.

Q: When is the deadline to file Form M-8453CR?

A: The deadline to file Form M-8453CR is the same as the deadline for filing individual tax returns in Massachusetts.

Q: Can I mail in Form M-8453CR instead of filing electronically?

A: No, Form M-8453CR is specifically for electronic filing and cannot be mailed in.

Form Details:

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form M-8453CR by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.